Good Morning Journal !

Good morning Mike ! Come on in…talk to me. How the heck are ya?

I’m doing ok Journal, thanks. I mean, I’m feeling good, physically. You know, I just never want to take advantage of that fact. For what my body goes through at work, I’m forever thankful that nothing serious has plagued me yet, now that I’m getting much older. Whether it’s the knees, the back, or any kind of stupid injury. I mean, you just never know. I just want to make it to the day that I won’t be getting my hands dirty anymore. Oh, and the sweat also…man…it isn’t easy. 20 years working on cars is a long enough time to be doing something that isn’t quite you. But, thank God, I’m a worker. That will get me through it. Boy…and I can’t wait …till the day…that all of this, will pay off. Of all of the effort that I put into this. The experience that I need. The knowledge that I will need. The smarts that I need. Has to pay off. I mean, that day has to come.This all reminds me of what I plan on doing at the end of the year. I think I do that every years’ end anyway. That’s putting my entire trading career into perspective. You know, like where am I at. Where did I come from. Where am I going. And I should dig up the previous write-ups also. The end of the year is my anniversary, cause it all started in the week between Christmas and New Years, 2012, that I started my pursuit.

Yep, ok, that’s all nice and good Mike. We’ll get to that. But what’s going on now? How was your week? Did we learn anything?

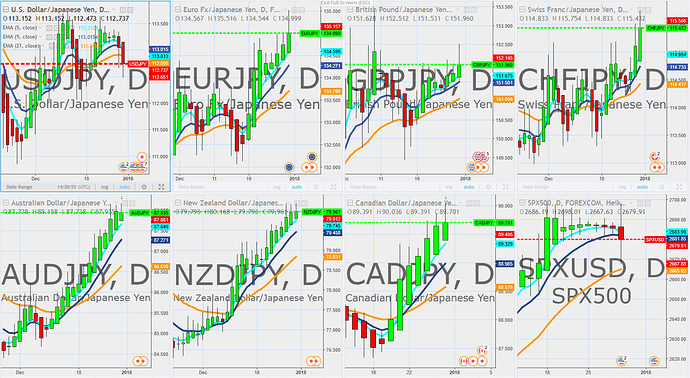

Well sure I did. I experienced something that we always hear about, but it’s kind of like my first time. See, I’m, generally speaking, usually in the market when it’s rolling, and running Yen strong. But lately, I’ve been realizing that I’m in the market just too much. And you know that I’ve been losing money that way. I’ve had 2 losing months now. So…you know…I’m gonna cool it some. And that’s what I did last weekend. I determined, pretty much, that everyone is not looking promising, after my diagnosing the higher time frames. Everyone except the NZD. Yeah, I did say that I should be ready to put on some more sizing with them if they started to fall. Other than them, all that was on my mind, at the open, was to get out. I had a 1k size open with all 7 pairs running last weekend at this time. So, I remember being scared. Boy, I can even show you what I wrote down on all of them. Basically, get out! The higher time frames (weekly, monthly) show Yen weakness. And I’m like, why am I in these trades??? It doesn’t make sense. Well, come the open, I jumped. The USD, EUR, GBP, CHF, & CAD. I took those trades off. But, I did stay in with the NZD, and AUD. I’ll remind you of what I determined last week, at this time.

The NZD.

And so, this is the result. Daily time frame. I stayed in. Added another 1k position size. Then jumped out. Was scared. Took the profits.

How about the AUD. This is last weekends determination.

Result.

I stayed in. Added another size. And then jumped. End of day Wed. Boy, I thought I did a good thing when Thursday came and went, cause it started rising. Actually, they had some big news come out right at that time. Man…I definitely thought I hit it at the bottom. Well, no. Look at Friday. Connnnnntinnnnnuuuuue, the trend.

You know, it hurts, when I look back at this chart and see my previous trades. We’re in a downtrend. And boy…you just do not know it when it’s presently happening. It started back in September! But, look up at the screen above that one. The weekly time frame (in the middle). It can be said that it’s in an uptrend. Well, honestly, last weekend, it did close below the 21 line. Is that the (hard) indication that the uptrend is over? Ok, what about to the left of that, monthly look. Tell me that doesn’t look like it’s climbing out of a big downtrend? I’ve pretty much always thought it was more accurate analyzing larger to smaller, time frames. Top down analysis. But, this seems to be changing the opposite way. Or, is there really is any correlation to be had in the first place. I don’t know.

But, this one really got to me. Let me show you the CAD. Last weeks analysis.

I was definitely scared of being in this one after seeing all of that. Look. Monthly - moving up and out. Weekly - moving up. Same with the daily, after a bit of rest.

So, what happened this week, you ask?

I updated the monthly, weekly, daily charts to the present.

Different ball game now huh. Well, that does teach me a lesson with the monthly time frame. It is very important to see the closing of the candle. We’re not even close for it to be closed. But, the candle for Oct is a bear candle. That is the last true bit of information on that chart. I admit, I was fooled by last weeks shot, on that time frame.

Look, as I said last week. You can paint a picture to say anything you want it to! But, what’s really accurate? I was scared to be in this trade anymore, because I thought all of these charts said, “we’re wanting to go up”. Of course, now I know, that’s not the case. Well, I should say, for this past week anyway. Look…I know the story is not over. It could still move on up to continue it’s long term breakout course for the longer time frames. But,to be honest, right now, I am wondering how much of a correlation the time frames really do have on each other. I think it’s actually the first time I’ve ever doubted this fact. I mean, Journal, you know me, I’m all about perspective. It’s definitely top/down analysis. Not small to big analysis. But, you just got to wonder… who’s leading who?

So…

Wait. I need more coffee.

Mmmmmmmm. Oh man…this baklava is so good. And it does go good with coffee.

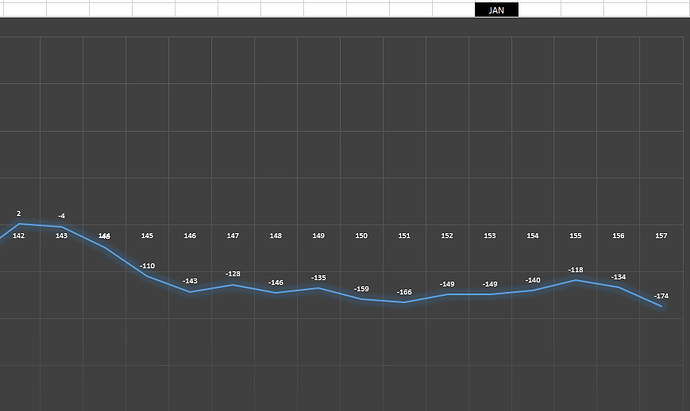

Ok, so I’m sitting here. Looking at the things that I wrote. Yeah, seeing myself complaining. Sorry about that. Well, let’s move on. I want to show you this chart. It’s my ‘currency relationship’ chart. You know it. But, this is the months tracking.

We have the Nov 1st monthly line-up (middle, bottom, one line). Above that is the weekly time frame standings. Then the daily time frames is the corners. I go top left, bottom left, then top right, then bottom right. Let’s pay attention to the Yen. What are some facts here? Every single weekend, so far, they have climbed up a notch. And it’s visible by what happened on the daily. Last week, they toggled between 3rd and 4th place. Then, this past week, they go from 3rd, to 4th, to 2nd, 2nd, FIRST. Ok, what does this mean again? They are trending higher than everyone else. Meaning, the JPY is trending above the 21 ema line, on the daily time frame, against everyone. It’s that line that separates who’s trending higher or lower, in my book. And the other thing that I find very interesting is the Comms. Just look at that. It has been the AUD, NZD at the bottom lately. But now, the CAD has joined them. I wonder if that correlation will stick. Man…you just never know if they are flowing together or not. Lately, no. They have tailed the USD more than the Comms. Geeeeezzz. Yeah, look at the USD. Maybe they are dropping off because the Dollar has. In any case, back to the Yen. Usually when they are on top, the Comms are at the bottom. It’s always been like that. So, another thing I want to point out. Let me show you, first, what last Aug looked like, when when had a good run.

Basically they were the top dog for most of the month, on the daily time frame. But, look at where they were on the weekly time frame, during that time. They were no better than 5th place the entire time! And on the monthly, Aug 1st, they sat 5th. So, you would think that they would’ve been placed higher on the weekly time frame. But, nope. And it is interesting that the Comms were above the Yen on the weekly time frame, during that time. That is interesting to me. Sure, it does bode correctly on the daily, where the Comms are down low compared to the Yen. And also, see, the CAD, did ride with the other 2 Comms, well, until the end of the month. Then they separated.

So, back to my point. Look at the present (previous chart). The JPY has never been this high on the weekly time frame, since I’ve been tracking these this way (June I started this). Does this give more credence to the fact of them getting stronger? Sure…I know…only time will tell. After the fact, I think, it only tells how strongly and how long will the Yen trend strong. (Man…this is making me want to go back and get the rest of this year mapped out.) And the question is…is there a direct correlation? Also…which is following which? (monthly - weekly - daily or daily - weekly - monthly) ? Top down? Or bottom up?

I know there are no answers to these questions. I just have to spell them out, that’s all. But, I do have to conclude, presently, that the Yen is getting stronger. Man…I remember keeping track of these currencies on a daily basis. Surely all you have to do is go back a couple years, and you’ll see some of my work. But, I remember seeing how strong the Yen can get. I mean, they can dominate like no other. Can’t remember exactly what year. Maybe 2016. They tore apart everyone in the beginning of the year, for months! So, I know the possibility of their strength. And of course, their weakness. Surely, anyone who’s been around knows they can be the butt end of a trade. Easy money.

Ok Journal. I’m done talking. I want to get back to work. I’ve been compiling past data to my new ‘ema relationship’ table. I’ve been working on the 3rd quarter of this year. Surely, present data is being compiled. I’m just working my way back. I should show you what it looks like so far. It is a daunting task. But, I’m enjoying it.

Btw…I’m gonna try and get back into the market. I think last Friday was the beginning of something big. Don’t worry, I’ll start off small, and if it turns out correct, gonna add some sizing.

I believe this will help me to get closer to automating my trading. It’s data, that I will be able to use. Each block is comprised of the 4 lines. Price (red), 21 ema trend line (tan), my crossover lines of the 5 ema (light blue) & 9 ema (dark blue). There is an extra square in the block for the crossover point (half light blue, dark blue). And so, the more data I can get, the better I can see what chances are best for me to pick of when I should be getting in and out of trades. And I should get a better idea of whether or not the correlation with the weekly & monthly time frames hold true or not. Should I consider that? Or not? And also whether there’s correlation laterally, between the currencies. You know, divergences that occur over time. Especially between the Comms and Majors. But, when the time comes, it’ll all be about asking the right questions. Like…what are the better chances…being in a trade that matches the weekly time frame standings, or not? How about the fact that your not necessarily making money even though it’s trending high? So therefore, is there any better places (indications) to be getting out? Ok, so what will be the best triggers? I can go on and on. But, that’s the idea. I need to find what the market will tell me, when exactly, has the best chances to be getting in and out are. (I know people go back years and years for backtesting a strategy. But, patterns happen all the time. This will just be a continual update.I track of the present time, the daily progression of it, and will keep chomping at the quarterly time periods of the past.

Will keep you up on it all Journal.

Mike

gives me adrenaline rush recently im off of that for some time now

gives me adrenaline rush recently im off of that for some time now