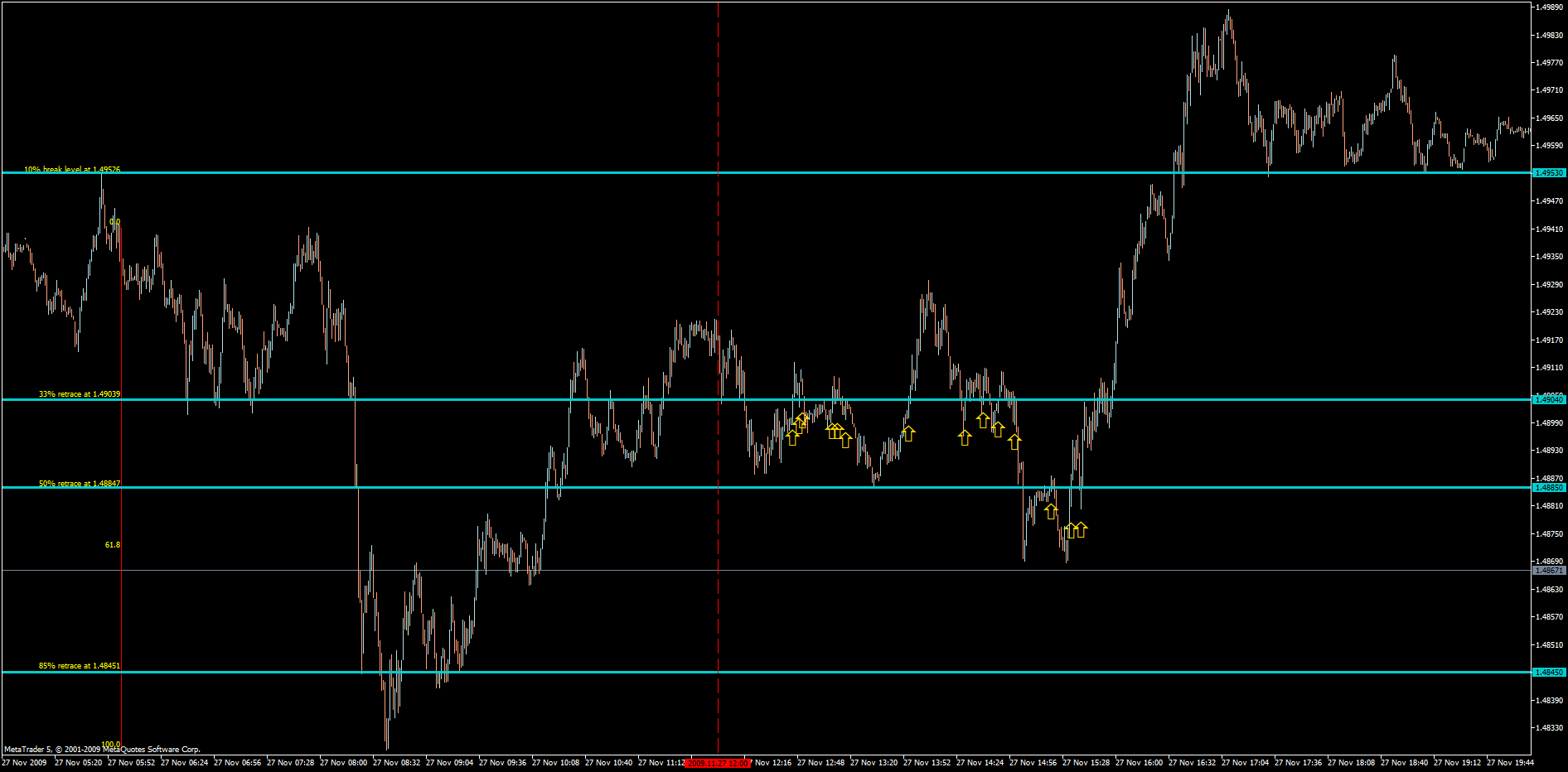

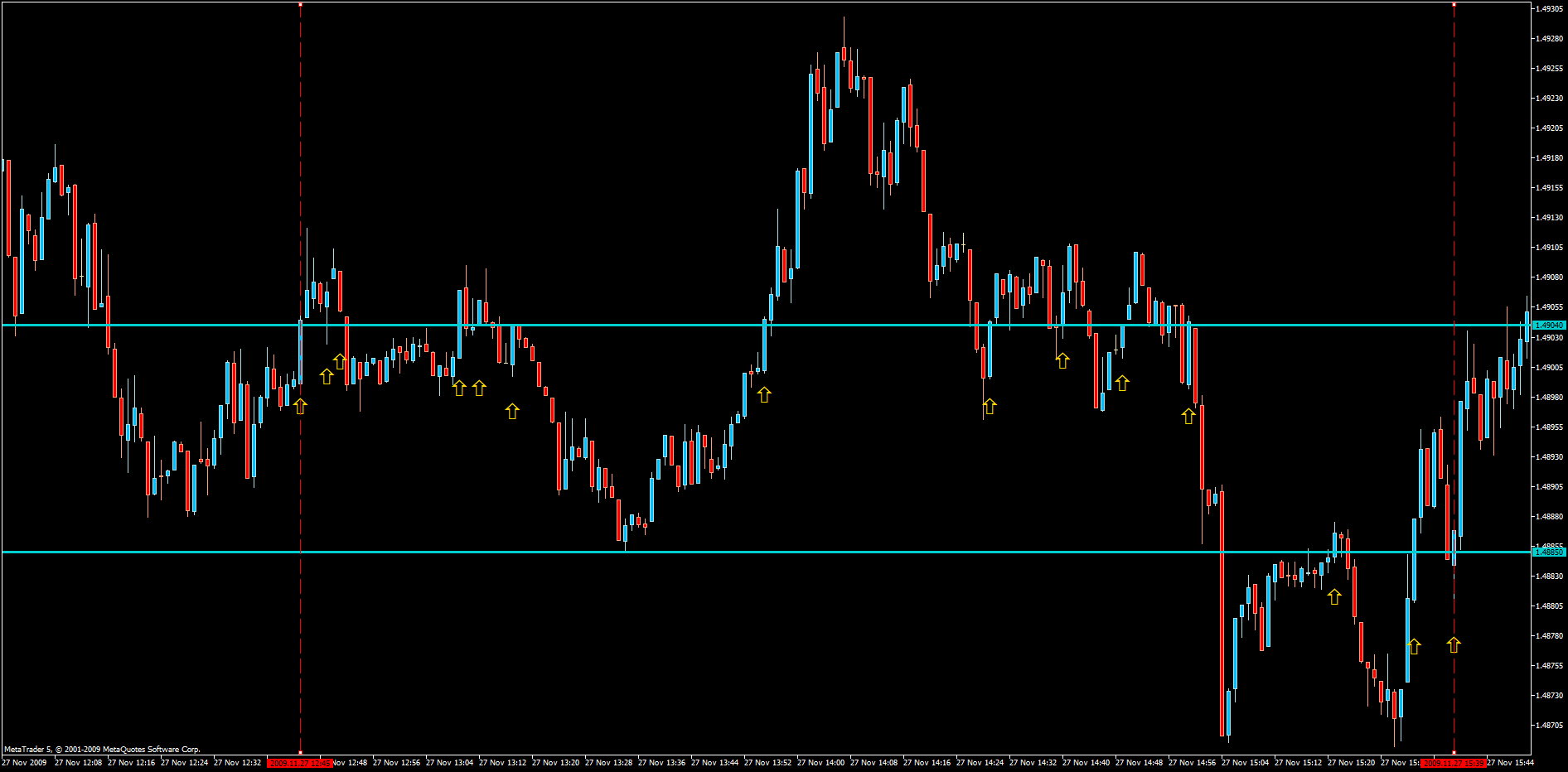

First of all, sorry about the huge chart but I really want it to be possible to scrutinize it closely. I hate charts where you can’t quite make out the text you want to read etc.

All right. I’ve saved this chart using MT5. That’s why the currency pair and time frame doesn’t show in the upper left corner like it would normally.

This is a 6H chart of EURUSD. I’ve tweaked the fib tool with the help of the tip I posted a while back. I’ve marked the 10% extension above the pin bar as a break level and also the 33%, 50% and 85% retrace levels of the pin bar.

It’s a 6H pin bar reversing back into the trend direction and rejecting the 1.4850 short/medium term PPZ. Good quality pin bar shape in my opinion.

Now what?

OK, we know for a fact that almost all pin bars do break, this is true also for those pin bars that later fail. Therefor I’m not waiting for the pin bar to be confirmed by a break. I put my faith in the high probability setup I’ve identified and go to work immediately.

I’m looking to try to enter at any of these LITS levels: 10% break level, 33% retrace and 50% retrace.

(Another possibility is to change the 10% extension simply for the close of the pin bar.)

If the pair starts by breaking the 10% extension and then moves down to hit the 33% retrace, that means that I start trading the LITS entry strategy here instead and if it moves further down to the 50% retrace then I’ll trade LITS there instead.

If the pair for instance doesn’t break but moves directly down to the 33% retrace, no difference - I apply LITS entry method same as above.

If I manage to enter at the 50% retrace I do not try to add when price again reaches the 33% retrace or the 10% extension, although pyramiding like that may be a future thing to study.

Stop Loss used in this example will be 3pips including spread, which on Oanda roughly means 0.9 pip spread + 2.1 pips leeway. Every pip will be worth 0.1% That makes our risk, R, 0.3% per entry attempt.

Can you see what will happen? The end result will be an entry at the 50% retrace and at the close of the first 6H bar of the current week we’re up by roughly 190 pips.

That’s 190 x 0.1% = 19%

Our account growth can be expressed as:

19% - number_of_failed_entries x 0.3%

At no one time has our risk been greater than 0.3% (losses do add up continually however).

And do notice that the super cool trader that managed to hold on to the trade had the chance to get all the way to 250 pips profit at the second bar from the right, maybe he’s still holding it for even higher prices to come…

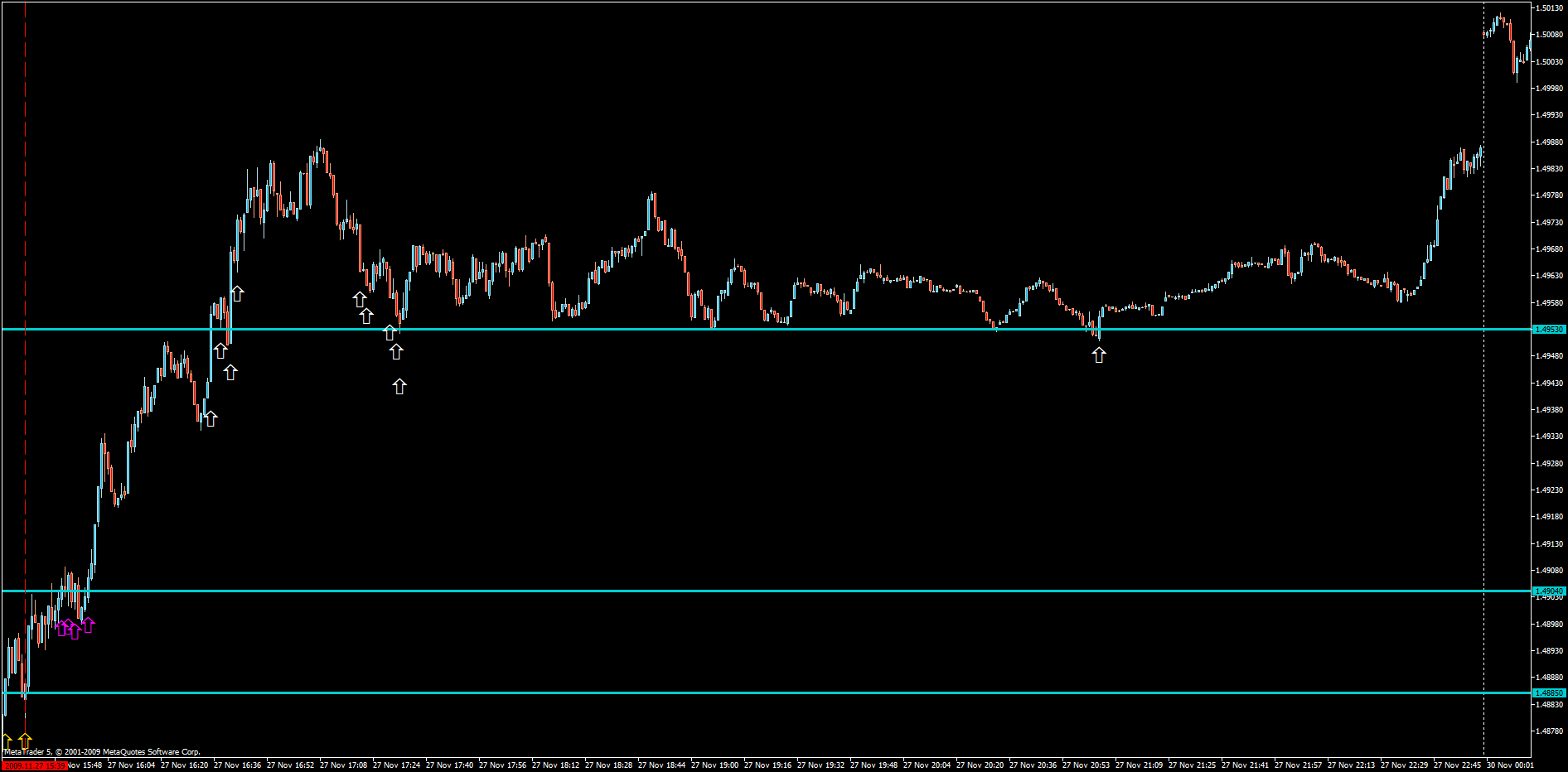

Next post will display 1min charts showing how many number_of_failed_entries we have during price’s path through the different levels before the trade starts running.

What we do know is this: 19/0.3 = 63.3

We have room for a couple of losers… (However, we want a reasonable drawdown right?, so 63 losers wouldn’t be that attractive to put it very modestly)

Next post may have to wait until tomorrow.