Hello fellow FXers. Today I am creating a new journal which will show all my price action trades. I have moved further away from indicators and found my way to price action in the hopes of one day being able to make some consistent $crilla. I will post the trade once it is complete, so each trade gets one post once it has completed. There will be the statistics of the trade as well as the result and pictures of before/after.

I will only be risking 1% per trade. Maximum of 2 trades per a currency pair (USD, GBP, NZD, etc) unless it has been derisked. In that case i can add more up to 2 at risk. I will be putting 2 take profits, 1 will be large and 1 will be smaller. When the small one is hit the pair SL will be moved to break even.

I will be using chart patterns and the price action signals to make the decisions along with support/resistance, trendlines etc. I will be using the W, D and H4 charts. I will not be going below the H4 chart. I will be using all 28 pairs. This will also be on a small amount of real money, not fake. I think this makes it more serious as real emotions exist. Its a small amount so it isn’t that critical.

The goal of this is to gain some insight on things i may be doing wrong. Last time i used the 3 duck method but it was basically just me positing stuff on here. I never really got much feedback and didn’t really improve. I am hoping that there may be some price action traders that might be able to tell me right from wrong since price action seems to be a little more well known.

4 Likes

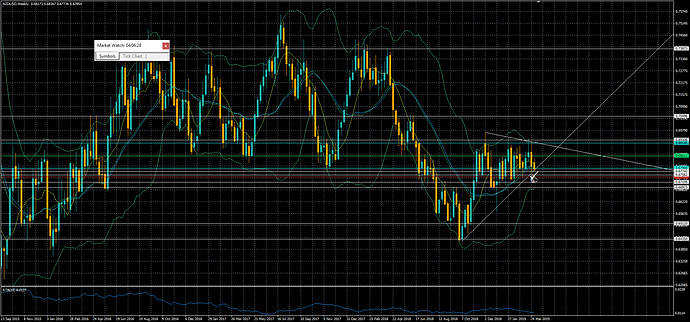

2019-04-02. One trade closed to report. Trade 2 was NZDUSD LONG which ended as a loss.

| Trade # |

2 |

| Session Set |

TOYOKO |

| Date Set |

2019-04-01 |

| Time Set |

6:00:00 PM |

| Session Triggered |

TOYOKO |

| Date Taken |

2019-04-01 |

| Time Taken |

6:00:00 PM |

| 1st TP Session End |

|

| 1st TP End Date |

|

| 1st TP Time End |

|

| 2nd TP Session End |

|

| 2nd TP End Date |

|

| 2nd TP Time End |

|

| SL End Session |

EURO US OVERLAP |

| SL End Date |

2019-04-02 |

| SL Time End |

7:16:00 AM |

| Pair |

NZDUSD |

| Long/Short |

LONG |

| Taken At Market |

YES |

| Type of Candle Pattern |

BULLISH PIN BAR |

| What Chart is Signal on? |

H4 |

| Trend or Range? |

RANGE |

| Support/Resistance? |

YES |

| Fib level? |

NO |

| 21 MA? |

YES |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

YES |

| Days Active |

#REF! |

| Pair |

NZDUSD |

| Daily Range |

53 |

| Pip SL |

42 |

| 1st PIP TP |

126 |

| R/R Ratio |

3.00 |

| SL % DR |

79.25% |

| Units |

895 |

| Half Units |

448 |

| Entry Price |

0.67900 |

| 1ST TP Price |

0.68511 |

| 2nd TP Price Set |

0.69145 |

| Actual 2nd Exit |

|

| 2nd TP TS or SL |

|

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

0.67465 |

| Level taken explanation |

Buying. Pair is ranging in an ascending triangle formation. Pair has fallen to the bottom of the RTL which is also a support level. Pair has made a H4 pin bar with a long wick and small body off the support level. Also a gap which has yet to fill. The W chart shows the pair against the 21 MA and the H4 shows the pair at the BB extreme. It think this pair should head higher in direction of the overall trend. |

| Sl Placement |

SL is below the RTL the S and the previous swing lows |

| TP Placement |

TP is midrange and at the top of the triangle. |

| Fundamental |

None |

| Risks |

|

| Updates |

|

| Account Balance |

500.00 |

| Amount Risked $ |

5.00 |

| Risked % |

1.00% |

| 1st TP |

0.00 |

| 2nd TP |

0.00 |

| SL |

-5.19 |

| $ Gained/Lost |

-5.19 |

| % Gained/Lost of trade |

-103.80% |

| Gained/Lost % of account |

-1.04% |

| Happened |

Pair was bought on a pin bar at a level of support & a RTL. Also a BB extreme. This was a range trade that was supposed to move higher. Pair failed and broke the support and ran to the SL however. |

| Improvements |

This trade was taken at what I think is an important level. There was factors of confluence (support, RTL, BB extreme, overall bullish uptrend). However the pair wanted to run lower instead. There was even a gap that didn’t fill. Looking at it I don’t think this trade was all that bad. One thing I guess I could have done was place the SL a bit lower to be under the other swing on the H4 chart. |

Two trades to report today 2019-04-02. Trade 1 EURAUD was a stopped out for a gain. Trade 3 CHFJPY was a loss after the AUD news caused a risk rally.

| Trade # |

1 |

| Session Set |

TOYOKO |

| Date Set |

2019-04-01 |

| Time Set |

5:47:00 PM |

| Session Triggered |

TOYOKO |

| Date Taken |

2019-04-01 |

| Time Taken |

5:47:00 PM |

| 1st TP Session End |

TOYOKO |

| 1st TP End Date |

2019-04-02 |

| 1st TP Time End |

5:35:00 PM |

| 2nd TP Session End |

|

| 2nd TP End Date |

|

| 2nd TP Time End |

|

| SL End Session |

|

| SL End Date |

|

| SL Time End |

|

| Pair |

EURAUD |

| Long/Short |

LONG |

| Taken At Market |

YES |

| Type of Candle Pattern |

BULLISH PIN BAR |

| What Chart is Signal on? |

H4 |

| Trend or Range? |

RANGE |

| Support/Resistance? |

YES |

| Fib level? |

NO |

| 21 MA? |

NO |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

YES |

| Days Active |

#REF! |

| Pair |

EURAUD |

| Daily Range |

85 |

| Pip SL |

55 |

| 1st PIP TP |

285 |

| R/R Ratio |

5.18 |

| SL % DR |

64.71% |

| Units |

960 |

| Half Units |

480 |

| Entry Price |

1.57596 |

| 1ST TP Price |

1.59145 |

| 2nd TP Price Set |

1.60511 |

| Actual 2nd Exit |

|

| 2nd TP TS or SL |

|

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

1.57067 |

| Level taken explanation |

Buying. Pair is ranging currently. Pair has fallen to the bottom of the range and has stalled at the support at 1.5776 area as well as the RTL. Pair has made a bullish pin bar off the support level. There is also several pin bars a few candles back. This area of support I think is strong. I think the pair will rally back to the channel top. Also think that the pin bar is well formed, he wick is more than double the body size. |

| Sl Placement |

SL is placed below the support and the RTL with a bit of room |

| TP Placement |

TP is midrange and also at the channel top. |

| Fundamental |

None |

| Risks |

|

| Updates |

|

| Account Balance |

500.00 |

| Amount Risked $ |

5.00 |

| Risked % |

1.00% |

| 1st TP |

5.21 |

| 2nd TP |

0.00 |

| SL |

0.00 |

| $ Gained/Lost |

5.21 |

| % Gained/Lost of trade |

104.20% |

| Gained/Lost % of account |

1.04% |

| Happened |

Pair was bought on a in bar at the RTL and the support. Pair had the AUD news occur which caused volatility an the pair came close to the SL. The pair then spiked higher I reduced risk to lock in the gains ahead of the AUD retail sales. Retail sales was good for AUD and the pair spiked lower into the ADJ SL for a gain. |

| Improvements |

Entry was at a good level I think. It was risky to buy before the news event, nonetheless I did without realizing the AUD news was upcoming. Good I derisked because the news really changed the direction of the pair. |

| Trade # |

3 |

| Session Set |

TOYOKO |

| Date Set |

2019-04-01 |

| Time Set |

6:39:00 PM |

| Session Triggered |

TOYOKO |

| Date Taken |

2019-04-01 |

| Time Taken |

6:39:00 PM |

| 1st TP Session End |

|

| 1st TP End Date |

|

| 1st TP Time End |

|

| 2nd TP Session End |

|

| 2nd TP End Date |

|

| 2nd TP Time End |

|

| SL End Session |

EURO US OVERLAP |

| SL End Date |

2019-04-02 |

| SL Time End |

6:48:00 PM |

| Pair |

CHFJPY |

| Long/Short |

SHORT |

| Taken At Market |

YES |

| Type of Candle Pattern |

BEARISH TWEEZERS |

| What Chart is Signal on? |

H4 |

| Trend or Range? |

RANGE |

| Support/Resistance? |

YES |

| Fib level? |

NO |

| 21 MA? |

YES |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

YES |

| Days Active |

#REF! |

| Pair |

CHFJPY |

| Daily Range |

57 |

| Pip SL |

45 |

| 1st PIP TP |

100 |

| R/R Ratio |

2.22 |

| SL % DR |

78.95% |

| Units |

928 |

| Half Units |

464 |

| Entry Price |

111.38500 |

| 1ST TP Price |

110.85700 |

| 2nd TP Price Set |

110.38500 |

| Actual 2nd Exit |

|

| 2nd TP TS or SL |

|

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

111.83500 |

| Level taken explanation |

Buying. Pair has rallied and stalled at the resistance and the FTL. Pair made a bearish tweezer pattern on the H4 and fell back below the FTL. Pair is ranging and at the top of the range but the FTL shows a long term bearish downtrend. The W shows the pair touching the 21 MA and the H4 shows the BB extreme acting as resistance for the tweezers. |

| Sl Placement |

SL is above the candle stick swing and the FTL and the resistance |

| TP Placement |

TP is mid range and then at the support |

| Fundamental |

None |

| Risks |

|

| Updates |

|

| Account Balance |

500.00 |

| Amount Risked $ |

5.00 |

| Risked % |

1.00% |

| 1st TP |

0.00 |

| 2nd TP |

0.00 |

| SL |

-4.99 |

| $ Gained/Lost |

-4.99 |

| % Gained/Lost of trade |

-99.80% |

| Gained/Lost % of account |

-1.00% |

| Happened |

Pair was sold after seeing the H4 tweezers off the resistance and the FTL. Pair moved a bit lower but then rallied on a risk rally from the AUD retail news. Pair hit the Sl. |

| Improvements |

I think this trade was good. The pair was ranging and had approved the 111.728 resistance level. There was confluence from the FTL and the resistance. Pair made a good signal which showed a bearish move was ready but in the end it was the news event which was totally not related to the AUD anyways that did this trade in. I guess I could have set my SL higher maybe above the 111.954 level but I don’t think this was all that bad. |

2019-04-04 report. One closed trade # 12 AUDCHF which got stopped out.

| Trade # |

12 |

| Session Set |

EURO US OVERLAP |

| Date Set |

2019-04-03 |

| Time Set |

6:17:00 AM |

| Session Triggered |

EURO US OVERLAP |

| Date Taken |

2019-04-03 |

| Time Taken |

6:17:00 AM |

| 1st TP Session End |

|

| 1st TP End Date |

|

| 1st TP Time End |

|

| 2nd TP Session End |

|

| 2nd TP End Date |

|

| 2nd TP Time End |

|

| SL End Session |

EURO US OVERLAP |

| SL End Date |

2019-04-04 |

| SL Time End |

7:58:00 AM |

| Pair |

AUDCHF |

| Long/Short |

SHORT |

| Taken At Market |

YES |

| Type of Candle Pattern |

BEARISH PIN BAR |

| What Chart is Signal on? |

H4 |

| Trend or Range? |

RANGE |

| Support/Resistance? |

YES |

| Fib level? |

NO |

| 21 MA? |

YES |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

NO |

| Days Active |

#REF! |

| Pair |

AUDCHF |

| Daily Range |

49 |

| Pip SL |

25 |

| 1st PIP TP |

126 |

| R/R Ratio |

5.04 |

| SL % DR |

51.02% |

| Units |

1496 |

| Half Units |

748 |

| Entry Price |

0.70879 |

| 1ST TP Price |

0.70473 |

| 2nd TP Price Set |

0.69619 |

| Actual 2nd Exit |

|

| 2nd TP TS or SL |

|

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

0.71129 |

| Level taken explanation |

Selling. Pair is in a range and has approached the .7104 resistance, there is also a FTL at this level. Pair made a bearish pin bar that has a long wick off the resistance levels. Pair then made a inside bar on H4 and is breaking lower. This is a bearish signal. Overall trend is lower so there is a bearish bias to this pair. Thinking that selling at this level will see a higher probability of prices to fall in direction of the trend. The D chart has a 21 MA that is acting as resistance. |

| Sl Placement |

SL is above the resistance and the FTL |

| TP Placement |

TP is at the swing support, 2nd TP is ambitious and much lower at support from January |

| Fundamental |

|

| Risks |

|

| Updates |

|

| Account Balance |

500.65 |

| Amount Risked $ |

5.00 |

| Risked % |

1.00% |

| 1st TP |

0.00 |

| 2nd TP |

0.00 |

| SL |

-4.99 |

| $ Gained/Lost |

-4.99 |

| % Gained/Lost of trade |

-99.80% |

| Gained/Lost % of account |

-1.00% |

| Happened |

Sold the pair on the pin bar that formed at the .7104 level and the FTL. Pair hesitated but then ran higher and hit the SL and stayed above the .7104 resistance level. |

| Improvements |

I think the pin bar was a good signal. The wick was long on it and it occurred at a good level. The overall trend was down as can be seen by the FTL and price staying underneath it since the beginning of February. I really don’t think this was a bad trade. |

2019-04-05 results. Several trades were closed today. Trade 6 GBPUSD had the 1st TP hit but then ended up reversing and hitting the BE. Trade 10 NZDUSD was a full loss. Trade 9 NZDCHF was closed before the full SL could be hit. Trade 14 GBPJPY was stopped out. Trade 4 GBPCAD was a partial gain and then stopped at BE.

| Trade # |

6 |

| Session Set |

EURO US OVERLAP |

| Date Set |

2019-04-02 |

| Time Set |

6:34:00 AM |

| Session Triggered |

EURO US OVERLAP |

| Date Taken |

2019-04-02 |

| Time Taken |

6:34:00 AM |

| 1st TP Session End |

NEW YORK |

| 1st TP End Date |

2019-04-02 |

| 1st TP Time End |

1:23:00 PM |

| 2nd TP Session End |

EURO US OVERLAP |

| 2nd TP End Date |

2019-04-05 |

| 2nd TP Time End |

5:42:00 AM |

| SL End Session |

|

| SL End Date |

|

| SL Time End |

|

| Pair |

GBPUSD |

| Long/Short |

LONG |

| Taken At Market |

YES |

| Type of Candle Pattern |

INSIDE BAR BREAKOUT |

| What Chart is Signal on? |

H4 |

| Trend or Range? |

RANGE |

| Support/Resistance? |

YES |

| Fib level? |

NO |

| 21 MA? |

NO |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

YES |

| Days Active |

#REF! |

| Pair |

GBPUSD |

| Daily Range |

126 |

| Pip SL |

75 |

| 1st PIP TP |

270 |

| R/R Ratio |

3.60 |

| SL % DR |

59.52% |

| Units |

500 |

| Half Units |

250 |

| Entry Price |

1.30429 |

| 1ST TP Price |

1.31438 |

| 2nd TP Price Set |

1.33116 |

| Actual 2nd Exit |

|

| 2nd TP TS or SL |

|

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

1.29666 |

| Level taken explanation |

Buying. Pair is in a long term uptrend as seen by the D chart following the RTL. Pair has fallen to the support at 1.3 and the RTL and has stalled. Pair made a inside bar breakout at the beginning of the week that I missed. Pair has now retraced to that level again where I am buying, The H4 short shows some long wicks at the level showing some good support. The pair seems to be following the RTL higher. Pair is also at the BB extreme after the fall so thinking that it is oversold and ready to return to the top of the range |

| Sl Placement |

SL is below the Support at 1.3 and the RTL and the candle stick swing support |

| TP Placement |

TP is at the high of the week and then the top of the range |

| Fundamental |

|

| Risks |

|

| Updates |

|

| Account Balance |

500.00 |

| Amount Risked $ |

5.00 |

| Risked % |

1.00% |

| 1st TP |

3.36 |

| 2nd TP |

0.00 |

| SL |

0.00 |

| $ Gained/Lost |

3.36 |

| % Gained/Lost of trade |

67.20% |

| Gained/Lost % of account |

0.67% |

| Happened |

Bought there pair on a stale signal from the beginning of the week that price returned to. Pair moved higher and hit the 1st and I reduced risk. Pair then fell and hit the ADJ SL on NFP volatility. |

| Improvements |

The signal was stale but it was a good price on the chart with the support and the RTL in the way of SL. This was a range trade with a bullish bias that was in line with the direction of the market and trade results reflect that. It’s a shame that the pair didn’t get a push higher from the NFP but nothing can be done, derisking after the 1st TP was the correct move I think. |

| Trade # |

10 |

| Session Set |

TOYOKO |

| Date Set |

2019-04-02 |

| Time Set |

6:21:00 PM |

| Session Triggered |

TOYOKO |

| Date Taken |

2019-04-02 |

| Time Taken |

6:21:00 PM |

| 1st TP Session End |

|

| 1st TP End Date |

|

| 1st TP Time End |

|

| 2nd TP Session End |

|

| 2nd TP End Date |

|

| 2nd TP Time End |

|

| SL End Session |

EURO US OVERLAP |

| SL End Date |

2019-04-05 |

| SL Time End |

5:42:00 AM |

| Pair |

NZDUSD |

| Long/Short |

LONG |

| Taken At Market |

YES |

| Type of Candle Pattern |

INSIDE BAR BREAKOUT |

| What Chart is Signal on? |

H4 |

| Trend or Range? |

RANGE |

| Support/Resistance? |

YES |

| Fib level? |

NO |

| 21 MA? |

NO |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

YES |

| Days Active |

#REF! |

| Pair |

NZDUSD |

| Daily Range |

54 |

| Pip SL |

35 |

| 1st PIP TP |

150 |

| R/R Ratio |

4.29 |

| SL % DR |

64.81% |

| Units |

1071 |

| Half Units |

536 |

| Entry Price |

0.67659 |

| 1ST TP Price |

0.68341 |

| 2nd TP Price Set |

0.69142 |

| Actual 2nd Exit |

|

| 2nd TP TS or SL |

|

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

0.67292 |

| Level taken explanation |

Buying. Pair is ranging. Pair has fallen to the Support at .6750 which is also the RTL showing a bullish bias. Pair fell sharply last week on bad NZD news but has made a H4 inside bar breakout off the support and the RTL. Pair is being aided by the AUD retail news being positive and I think the AUD’s bullish push will rub off on the NZD. Pair is also against the BB extreme indicating pair might bounce |

| Sl Placement |

SL is below the Support and the RTL and the swing support |

| TP Placement |

TP is at the last swing lower high and at the resistance from the range. |

| Fundamental |

|

| Risks |

|

| Updates |

|

| Account Balance |

503.16 |

| Amount Risked $ |

5.00 |

| Risked % |

0.99% |

| 1st TP |

0.00 |

| 2nd TP |

0.00 |

| SL |

-5.29 |

| $ Gained/Lost |

-5.29 |

| % Gained/Lost of trade |

-105.80% |

| Gained/Lost % of account |

-1.05% |

| Happened |

Pair was bought on the inside breakout. Pair moved higher but stalled before the 1st TP. Then price fell and hesitated at the RTL and the support level. Then the NFP news came out and shoved the pair below the supports and hit the SL. |

| Improvements |

Entry was at a good level of confluence. There was a support and a RTL and the BB extreme. Pair made a good reversal signal. Just wasn’t able to get to the 1st before another swing lower occurred. I don’t think the entry was all that bad since it was inline with the main direction of the pair and was at a good level. The news event could have easily gone the other way. |

| Trade # |

9 |

| Session Set |

TOYOKO |

| Date Set |

2019-04-02 |

| Time Set |

6:07:00 PM |

| Session Triggered |

TOYOKO |

| Date Taken |

2019-04-02 |

| Time Taken |

6:07:00 PM |

| 1st TP Session End |

|

| 1st TP End Date |

|

| 1st TP Time End |

|

| 2nd TP Session End |

|

| 2nd TP End Date |

|

| 2nd TP Time End |

|

| SL End Session |

EURO US OVERLAP |

| SL End Date |

2019-04-05 |

| SL Time End |

6:42:00 AM |

| Pair |

NZDCHF |

| Long/Short |

LONG |

| Taken At Market |

YES |

| Type of Candle Pattern |

INSIDE BAR BREAKOUT |

| What Chart is Signal on? |

H4 |

| Trend or Range? |

RANGE |

| Support/Resistance? |

YES |

| Fib level? |

NO |

| 21 MA? |

YES |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

YES |

| Days Active |

#REF! |

| Pair |

NZDCHF |

| Daily Range |

51 |

| Pip SL |

35 |

| 1st PIP TP |

150 |

| R/R Ratio |

4.29 |

| SL % DR |

68.63% |

| Units |

1069 |

| Half Units |

535 |

| Entry Price |

0.67497 |

| 1ST TP Price |

0.68195 |

| 2nd TP Price Set |

0.68970 |

| Actual 2nd Exit |

|

| 2nd TP TS or SL |

|

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

0.67120 |

| Level taken explanation |

Buying. Pair is in range as can be seen by the D chart. The bottom of the range is the .6739 support which price has fallen to. There is also a RTL at this level indicating a bullish bias. Pair is making a double bottom from late last week and has made a inside bar breakout on the H4. Pair is against the BB extreme. The AUD news is out of the way and was positive for the AUD so I think there will be spill over on the NZD from it. |

| Sl Placement |

SL is below the Support and the RTL and the swing support |

| TP Placement |

TP is mid range and at the top of the channel |

| Fundamental |

|

| Risks |

|

| Updates |

|

| Account Balance |

503.16 |

| Amount Risked $ |

5.00 |

| Risked % |

0.99% |

| 1st TP |

0.00 |

| 2nd TP |

0.00 |

| SL |

-3.81 |

| $ Gained/Lost |

-3.81 |

| % Gained/Lost of trade |

-76.20% |

| Gained/Lost % of account |

-0.76% |

| Happened |

Pair was bought after seeing price fall to the range support and bounce off the support an d the RTL. Pair moved a bit higher on the Inside bar breakout that occurred on the H4 but then reversed and broke the support and the RTL. I closed after the NFP did not help price and price was remaining under the support and RTL. Figured the trade did not work out and it was best to save the remaining pips from a full loss. |

| Improvements |

Entry was good I think. Pair was ranging and price was at a important level, there were factors of confluence on the side of my trade. Not all trades work out but looking back at this trade I think the logic was good on it and I would take this one again. |

| Trade # |

14 |

| Session Set |

TOYOKO |

| Date Set |

2019-04-04 |

| Time Set |

5:27:00 PM |

| Session Triggered |

TOYOKO |

| Date Taken |

2019-04-04 |

| Time Taken |

5:27:00 PM |

| 1st TP Session End |

|

| 1st TP End Date |

|

| 1st TP Time End |

|

| 2nd TP Session End |

|

| 2nd TP End Date |

|

| 2nd TP Time End |

|

| SL End Session |

EURO US OVERLAP |

| SL End Date |

2019-04-05 |

| SL Time End |

6:40:00 AM |

| Pair |

GBPJPY |

| Long/Short |

LONG |

| Taken At Market |

YES |

| Type of Candle Pattern |

INSIDE BAR BREAKOUT |

| What Chart is Signal on? |

H4 |

| Trend or Range? |

TREND |

| Support/Resistance? |

YES |

| Fib level? |

YES |

| 21 MA? |

YES |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

NO |

| Days Active |

#REF! |

| Pair |

GBPJPY |

| Daily Range |

140 |

| Pip SL |

70 |

| 1st PIP TP |

230 |

| R/R Ratio |

3.29 |

| SL % DR |

50.00% |

| Units |

597 |

| Half Units |

299 |

| Entry Price |

597.00000 |

| 1ST TP Price |

146.98000 |

| 2nd TP Price Set |

148.50000 |

| Actual 2nd Exit |

|

| 2nd TP TS or SL |

|

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

145.45100 |

| Level taken explanation |

Buying. Pair overall has a bullish bias as seen by the D chart and the RTL that price has been following, pair has broken above the FTL that can be seen on the D chart. Pair entered into consolidation on the D chart for all of March but found support at 144.559 which coincides with the FTL. pair has moved strongly off this level and has created a new H4 uptrend which I believe will last till the top of the D resistance. Pair has made consecutive higher lows and higher highs. Pair has made a significant retracement to the 61 fib, the 21 MA and also a RTL that has formed. I think this is a high probability set up |

| Sl Placement |

SL is below the swing support and the RTL |

| TP Placement |

TP is at the last swing high and the 2nd TP is at the D resistance. |

| Fundamental |

|

| Risks |

|

| Updates |

|

| Account Balance |

498.22 |

| Amount Risked $ |

5.00 |

| Risked % |

1.00% |

| 1st TP |

0.00 |

| 2nd TP |

0.00 |

| SL |

-5.21 |

| $ Gained/Lost |

-5.21 |

| % Gained/Lost of trade |

-104.20% |

| Gained/Lost % of account |

-1.05% |

| Happened |

Pair was bought after seeing the pair find a bottom at the range support, then a bounce and then H4 make two swings higher. Pair made a 61 retracement and the trade lined up with the fib, the RTL, the 21 MA and made a good signal. Pair went a bit higher but then over the EURO and the US session JPY rallied and this pair hit the SL. |

| Improvements |

The entry I think was good, I had lots of confluence on my side, it could have been the NFP which caused the pair to hit the SL but this trade could easily have gone the other way also. I still think there is a overall bullish bias on the pair. Only way I can see this could have improved would be to not take the day before the NFP even though it was not a USD pair. |

| Trade # |

4 |

| Session Set |

TOYOKO |

| Date Set |

2019-04-01 |

| Time Set |

6:49:00 PM |

| Session Triggered |

TOYOKO |

| Date Taken |

2019-04-01 |

| Time Taken |

6:49:00 PM |

| 1st TP Session End |

NEW YORK |

| 1st TP End Date |

2019-04-03 |

| 1st TP Time End |

12:00:00 AM |

| 2nd TP Session End |

|

| 2nd TP End Date |

|

| 2nd TP Time End |

|

| SL End Session |

|

| SL End Date |

|

| SL Time End |

|

| Pair |

GBPCAD |

| Long/Short |

LONG |

| Taken At Market |

YES |

| Type of Candle Pattern |

BULLISH PIN BAR |

| What Chart is Signal on? |

H4 |

| Trend or Range? |

RANGE |

| Support/Resistance? |

YES |

| Fib level? |

NO |

| 21 MA? |

YES |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

NO |

| Days Active |

#REF! |

| Pair |

GBPCAD |

| Daily Range |

170 |

| Pip SL |

150 |

| 1st PIP TP |

300 |

| R/R Ratio |

2.00 |

| SL % DR |

88.24% |

| Units |

334 |

| Half Units |

167 |

| Entry Price |

1.73947 |

| 1ST TP Price |

1.75434 |

| 2nd TP Price Set |

1.76932 |

| Actual 2nd Exit |

|

| 2nd TP TS or SL |

|

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

1.72411 |

| Level taken explanation |

Buying. Pair has fallen to the support at 1.7380 and bounced. Pair then fell again and made a bullish pin bar. Good wick on it also. This is a double bottom and it lines up with the 50% retracement from the last major swing higher. Pair is in a overall bullish uptrend and I think it will not be able to break the 1.73349 support. |

| Sl Placement |

SL is below the double bottom and the support level at 1.733 and also the 1.7261 support |

| TP Placement |

TP is at the last swing high and the range top |

| Fundamental |

None |

| Risks |

|

| Updates |

|

| Account Balance |

500.00 |

| Amount Risked $ |

5.00 |

| Risked % |

1.00% |

| 1st TP |

2.49 |

| 2nd TP |

-0.02 |

| SL |

0.00 |

| $ Gained/Lost |

2.47 |

| % Gained/Lost of trade |

49.40% |

| Gained/Lost % of account |

0.49% |

| Happened |

Pair was bought at the level of support mid channel. Pair made a large pin bar that I bought immediately. Pair fell move but ended up jumping higher and hit the 1st TP. I then reduced risk to 0 and the pair gradually fell to the entry point where it was stopped at BE. |

| Improvements |

Looking back the entry level was a area of support for sure, pair had struggled with that area multiple times. The signal from the pin bar was strong, it had a long wick and was at an important level so that is good. The overall bullish bias as seen by the D chart was in play so this trade was well aligned with the underlying direction. All in all a solid trade since the level held and my SL was not too greedy. 1st TP was a good hit and it is unfortunate that the pair didn’t keep moving higher but that is the way it is sometimes. |

Week 1 review. This week saw more losses than gains and a loss of nearly 3%. The trades that remain have a floating gain but what happened with them remains to be seen. Looking back at the 9 trades, I think a trade like #3 CHFJPY could have used a larger SL. However my trades all appear to be at key levels. I was aware of the news events throughout the week and was careful not to take positions ahead of them and to adjust the risk. I did not over leverage and was careful to only be have 2% at risk on a particular currency. The weakest trade this week was probably # 12 AUDCHF. Maybe my SL was too tight on this one as the pair ended up falling back down. Maybe the signal was not close enough to the FTL or the resistance level. Most of these trades I think were good though, shame that they didn’t all work out.

| Week |

Start |

End |

Change |

Change % |

Trades set |

Trades Taken |

Trades Closed |

| 1 |

500 |

486.27 |

-$13.73 |

-2.75% |

17 |

17 |

9 |

2019-04-08 review. Two trades were closed today. Trade 11 USDCAD was a partial gain and a partial BE. Trade # 16 CADCHF was a loss on the risk rally that occurred in the comdolls today.

| Trade # |

11 |

| Session Set |

EURO US OVERLAP |

| Date Set |

2019-04-03 |

| Time Set |

6:00:00 AM |

| Session Triggered |

EURO US OVERLAP |

| Date Taken |

2019-04-03 |

| Time Taken |

6:00:00 AM |

| 1st TP Session End |

EURO US OVERLAP |

| 1st TP End Date |

2019-04-03 |

| 1st TP Time End |

12:50:00 PM |

| 2nd TP Session End |

EURO US OVERLAP |

| 2nd TP End Date |

2019-04-08 |

| 2nd TP Time End |

7:27:00 AM |

| SL End Session |

|

| SL End Date |

|

| SL Time End |

|

| Pair |

USDCAD |

| Long/Short |

LONG |

| Taken At Market |

YES |

| Type of Candle Pattern |

BULLISH ENGULFING |

| What Chart is Signal on? |

H4 |

| Trend or Range? |

RANGE |

| Support/Resistance? |

YES |

| Fib level? |

NO |

| 21 MA? |

NO |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

YES |

| Days Active |

#REF! |

| Pair |

USDCAD |

| Daily Range |

73 |

| Pip SL |

30 |

| 1st PIP TP |

120 |

| R/R Ratio |

4.00 |

| SL % DR |

41.10% |

| Units |

1666 |

| Half Units |

833 |

| Entry Price |

1.33198 |

| 1ST TP Price |

1.33693 |

| 2nd TP Price Set |

1.34380 |

| Actual 2nd Exit |

1.33197 |

| 2nd TP TS or SL |

SL |

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

1.3288 |

| Level taken explanation |

Buying. Pair is in a range and has fallen to the 1.3298 level and bounced. This level is support and a double bottom. Pair has made a bullish engulfing off the support and looks to be ready to return to the top of the range. Factors of confluence, are the support, the double bottom, the BB extreme, the weekly uptrend and the signal is the engulfing |

| Sl Placement |

SL is below the support, double bottom and the candlestick |

| TP Placement |

TP is at the last swing high and the range top |

| Fundamental |

|

| Risks |

|

| Updates |

|

| Account Balance |

500.65 |

| Amount Risked $ |

5.00 |

| Risked % |

1.00% |

| 1st TP |

3.18 |

| 2nd TP |

-0.01 |

| SL |

0.00 |

| $ Gained/Lost |

3.17 |

| % Gained/Lost of trade |

63.40% |

| Gained/Lost % of account |

0.63% |

| Happened |

Pair was bought on a engulfing and a double bottom in direction of the underlying trend. Pair rallied and the 1st half was closed at a gain. The 2nd was derisked and a risk rally in the comdolls saw this pair fall and hit the ADJ SL. |

| Improvements |

Entry was good, it was at a level of confluence (support, double bottom, bb extreme, H4 engulfing signal, overall direction of trend). The 1st TP was set well and it was good I reduced the risk to 0 on the 2nd half as the NFP occurred. Shame with the end result but still good overall. |

| Trade # |

16 |

| Session Set |

EURO US OVERLAP |

| Date Set |

2019-04-05 |

| Time Set |

6:15:00 AM |

| Session Triggered |

EURO US OVERLAP |

| Date Taken |

2019-04-05 |

| Time Taken |

6:15:00 AM |

| 1st TP Session End |

|

| 1st TP End Date |

|

| 1st TP Time End |

|

| 2nd TP Session End |

|

| 2nd TP End Date |

|

| 2nd TP Time End |

|

| SL End Session |

EURO US OVERLAP |

| SL End Date |

2019-04-08 |

| SL Time End |

7:33:00 AM |

| Pair |

CADCHF |

| Long/Short |

SHORT |

| Taken At Market |

YES |

| Type of Candle Pattern |

BEARISH ENGULFING |

| What Chart is Signal on? |

H4 |

| Trend or Range? |

TREND |

| Support/Resistance? |

YES |

| Fib level? |

YES |

| 21 MA? |

YES |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

NO |

| Days Active |

#REF! |

| Pair |

CADCHF |

| Daily Range |

48 |

| Pip SL |

30 |

| 1st PIP TP |

85 |

| R/R Ratio |

2.83 |

| SL % DR |

62.50% |

| Units |

1245 |

| Half Units |

623 |

| Entry Price |

0.74690 |

| 1ST TP Price |

0.74216 |

| 2nd TP Price Set |

0.73834 |

| Actual 2nd Exit |

|

| 2nd TP TS or SL |

|

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

0.74984 |

| Level taken explanation |

Selling. Pair is in a bearish downtrend as can be seen from the FTL that is on the D chart. Pair has made a rally after the last low and stalled at the FTL. This coincidence with the 61 fib and the D 21 MA. Pair made a engulfing off the resistance on the H4 and currently looks to be wanting to break out of the descending triangle the H4 price is in. I think the NFP and the bad CAD em0plyoment news is going to push this pair lower in direction of the bearish bias. |

| Sl Placement |

SL is above the FTL at the fib and the candlestick resistance |

| TP Placement |

TP is mid range and then at the last swing support |

| Fundamental |

|

| Risks |

|

| Updates |

|

| Account Balance |

495.52 |

| Amount Risked $ |

5.00 |

| Risked % |

1.01% |

| 1st TP |

0.00 |

| 2nd TP |

0.00 |

| SL |

-5.00 |

| $ Gained/Lost |

-5.00 |

| % Gained/Lost of trade |

-100.00% |

| Gained/Lost % of account |

-1.01% |

| Happened |

Pair was sold after the NFP report was out of the way, pair was in a overall downtrend and below the FTL. Pair moved a bit lower but reversed on a risk rally and hit the SL. |

| Improvements |

Pair had made a good retracement to the 61 fib and made a engulfing signal. The small descending triangle had a higher probability of breaking lower. There was the fib, the overall bearish trend, the FTL, the candle signal, the descending triangle chart pattern all aligned with the trade. I really don’t think this was a bad signal or a bad trade, I suppose it was a bit risky selling before the triangle broke down but it had a higher probability of breaking lower. |

2019-04-09. Two trades to report closed out. Trade #15 AUDUSD was stopped. Trade # 17 AUDCHF was also stopped out. No idea where the strength in the AUD came from but it came nonetheless.

| Trade # |

15 |

| Session Set |

EURO US OVERLAP |

| Date Set |

2019-04-05 |

| Time Set |

5:43:00 AM |

| Session Triggered |

EURO US OVERLAP |

| Date Taken |

2019-04-05 |

| Time Taken |

5:43:00 AM |

| 1st TP Session End |

|

| 1st TP End Date |

|

| 1st TP Time End |

|

| 2nd TP Session End |

|

| 2nd TP End Date |

|

| 2nd TP Time End |

|

| SL End Session |

TOYOKO |

| SL End Date |

2019-04-08 |

| SL Time End |

9:06:00 PM |

| Pair |

AUDUSD |

| Long/Short |

SHORT |

| Taken At Market |

YES |

| Type of Candle Pattern |

BEARISH ENGULFING |

| What Chart is Signal on? |

H4 |

| Trend or Range? |

RANGE |

| Support/Resistance? |

YES |

| Fib level? |

NO |

| 21 MA? |

YES |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

NO |

| Days Active |

#REF! |

| Pair |

AUDUSD |

| Daily Range |

52 |

| Pip SL |

25 |

| 1st PIP TP |

100 |

| R/R Ratio |

4.00 |

| SL % DR |

48.08% |

| Units |

1049 |

| Half Units |

525 |

| Entry Price |

0.71114 |

| 1ST TP Price |

0.70596 |

| 2nd TP Price Set |

0.70114 |

| Actual 2nd Exit |

|

| 2nd TP TS or SL |

|

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

0.71364 |

| Level taken explanation |

Selling. Pair is in a range that the top appears to be .7128. This level there is also a FTL. Pair has made a bearish engulfing off that level after the NFP report finished and caused the USD to move lower then higher. Pair is being sold with the thought that at the fundamental push will cause pair to head back lower rather than higher past the resistances. Pair is in a long term downtrend as can be seen from the D chart and the FTL That price has been following. |

| Sl Placement |

SL is above the .7128 resistance and also the FTL. |

| TP Placement |

TP is mid range and also at the .7 support. |

| Fundamental |

|

| Risks |

|

| Updates |

|

| Account Balance |

495.52 |

| Amount Risked $ |

5.00 |

| Risked % |

1.01% |

| 1st TP |

0.00 |

| 2nd TP |

0.00 |

| SL |

-5.07 |

| $ Gained/Lost |

-5.07 |

| % Gained/Lost of trade |

-101.40% |

| Gained/Lost % of account |

-1.02% |

| Happened |

Pair was sold after the NFP report was over. Pair was at resistance near the .7128 and the FTL. Pair made a strong move lower after the report was over which I sold. Pair continued a bit lower but then risk taking and a comdolls rally saw the pair break the resistances and hit the SL |

| Improvements |

Well the level sold was good, it was in a range and at the top after a rejection at the resistance and the FTL. This was a good level to sell. I waited till after the report which was good so that meant less risk. I am not sure where the comdolls rally came from but I still am finding it unexpected and surprised the price broke the FTL and the resistance, there was just too much AUD strength. Id probably take this trade again. |

| Trade # |

17 |

| Session Set |

EURO US OVERLAP |

| Date Set |

2019-04-05 |

| Time Set |

6:45:00 AM |

| Session Triggered |

EURO US OVERLAP |

| Date Taken |

2019-04-05 |

| Time Taken |

6:45:00 AM |

| 1st TP Session End |

|

| 1st TP End Date |

|

| 1st TP Time End |

|

| 2nd TP Session End |

|

| 2nd TP End Date |

|

| 2nd TP Time End |

|

| SL End Session |

TOYOKO |

| SL End Date |

2019-04-08 |

| SL Time End |

11:36:00 PM |

| Pair |

AUDCHF |

| Long/Short |

SHORT |

| Taken At Market |

YES |

| Type of Candle Pattern |

INSIDE BAR BREAKOUT |

| What Chart is Signal on? |

H4 |

| Trend or Range? |

RANGE |

| Support/Resistance? |

YES |

| Fib level? |

NO |

| 21 MA? |

NO |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

NO |

| Days Active |

#REF! |

| Pair |

AUDCHF |

| Daily Range |

48 |

| Pip SL |

35 |

| 1st PIP TP |

135 |

| R/R Ratio |

3.86 |

| SL % DR |

72.92% |

| Units |

1067 |

| Half Units |

534 |

| Entry Price |

0.70998 |

| 1ST TP Price |

0.70473 |

| 2nd TP Price Set |

0.69648 |

| Actual 2nd Exit |

|

| 2nd TP TS or SL |

|

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

0.71348 |

| Level taken explanation |

Selling. Pair is in a bearish downtrend as seen by the D chart. Pair has rallied and stalled at the .7127 resistance as well as the FTL. Pair made a H4 inside bar that broke down after the NFP news event. Pair is now making a strong move lower in direction of the overall trend. |

| Sl Placement |

SL is above the resistance the FTL and the candlestick resistance |

| TP Placement |

TP is at the mid support and then an ambitious distance past last swing |

| Fundamental |

|

| Risks |

|

| Updates |

|

| Account Balance |

486.52 |

| Amount Risked $ |

5.00 |

| Risked % |

1.03% |

| 1st TP |

0.00 |

| 2nd TP |

0.00 |

| SL |

-4.98 |

| $ Gained/Lost |

-4.98 |

| % Gained/Lost of trade |

-99.60% |

| Gained/Lost % of account |

-1.02% |

| Happened |

Pair was sold after the NFP report had ended and the p[air moved sharply from the .7127 resistance and the FTL that was acting as confluence. Pair moved lower and came close to the 1st TP but then reversed on a risk rally as the comdolls strengthened and the pair hit the SL. |

| Improvements |

The level sold was good, pair was ranging and was against the resistance and the FTL, it was good I waited till after the news event because that meant less risk. I do not know where the AUD strength really came from but I am surprised it was able to break the resistance that were in front of the SL. Its a shame it didn’t hit the 1st TP. |

2019-04-10. Lots of volatility today. The AUD Showed strength again. Trade # 8 AUDNZD was a gain. Trade 24 AUDCAD was a loss on the AUD strength. Trade 25 AUDUSD was a loss. Trade 26 USDCAD was a loss. Trade 5 EURCHF was a gain. Trade 22 EURCHF was a gain.

| Trade # |

8 |

| Session Set |

TOYOKO |

| Date Set |

2019-04-02 |

| Time Set |

6:00:00 PM |

| Session Triggered |

TOYOKO |

| Date Taken |

2019-04-02 |

| Time Taken |

6:00:00 PM |

| 1st TP Session End |

TOYOKO |

| 1st TP End Date |

2019-04-04 |

| 1st TP Time End |

8:38:00 PM |

| 2nd TP Session End |

TOYOKO |

| 2nd TP End Date |

2019-04-09 |

| 2nd TP Time End |

6:29:00 PM |

| SL End Session |

|

| SL End Date |

|

| SL Time End |

|

| Pair |

AUDNZD |

| Long/Short |

LONG |

| Taken At Market |

YES |

| Type of Candle Pattern |

BULLISH ENGULFING |

| What Chart is Signal on? |

H4 |

| Trend or Range? |

TREND |

| Support/Resistance? |

YES |

| Fib level? |

NO |

| 21 MA? |

YES |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

NO |

| Days Active |

#REF! |

| Pair |

AUDNZD |

| Daily Range |

51 |

| Pip SL |

50 |

| 1st PIP TP |

130 |

| R/R Ratio |

2.60 |

| SL % DR |

98.04% |

| Units |

1110 |

| Half Units |

555 |

| Entry Price |

1.04866 |

| 1ST TP Price |

1.05426 |

| 2nd TP Price Set |

1.06135 |

| Actual 2nd Exit |

1.05495 |

| 2nd TP TS or SL |

SL |

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

1.04335 |

| Level taken explanation |

Buying. Pair has started what I think is a new uptrend. Pair made a huge move higher on NZD weakness last week and then this week it broke the FTL. Pair then retested the FTL and the support at 1.044 and made a engulfing off that level from the AUD retail news being positive. There is at he 21 MA at this level also. With the FTL being broken and holding above I think a new trend has begun. |

| Sl Placement |

Sl is below the FTL and the support at 1.044 and also the candlestick support form the AUD news event |

| TP Placement |

TP is at some resistance from February and the 2nd TP is at area of congestion from January and November |

| Fundamental |

|

| Risks |

|

| Updates |

|

| Account Balance |

503.16 |

| Amount Risked $ |

5.00 |

| Risked % |

0.99% |

| 1st TP |

2.66 |

| 2nd TP |

3.14 |

| SL |

0.00 |

| $ Gained/Lost |

5.80 |

| % Gained/Lost of trade |

116.00% |

| Gained/Lost % of account |

1.15% |

| Happened |

Pair was bought after seeing the price break the FTL from last year. Pair moved sharply higher and broke the resistance levels then retraced back to them which acted as support. Pair made a engulfing higher and I bought. 1st TP was hit and I locked in gains for the 2nd which was hit. Pair was looking overstretched. |

| Improvements |

Good I noticed the direction change. Once the pair had broken that resistance and retested the bearish bias needed to be flipped into bullish. It was good I identified this. The 1st TP was good, the 2nd might have been a bit much. Overall good job catching a new trend on this pair. |

| Trade # |

24 |

| Session Set |

EURO US OVERLAP |

| Date Set |

2019-04-09 |

| Time Set |

6:37:00 AM |

| Session Triggered |

EURO US OVERLAP |

| Date Taken |

2019-04-09 |

| Time Taken |

6:37:00 AM |

| 1st TP Session End |

|

| 1st TP End Date |

|

| 1st TP Time End |

|

| 2nd TP Session End |

|

| 2nd TP End Date |

|

| 2nd TP Time End |

|

| SL End Session |

NEW YORK |

| SL End Date |

2019-04-10 |

| SL Time End |

8:33:00 AM |

| Pair |

AUDCAD |

| Long/Short |

SHORT |

| Taken At Market |

YES |

| Type of Candle Pattern |

BEARISH PIN BAR |

| What Chart is Signal on? |

D |

| Trend or Range? |

RANGE |

| Support/Resistance? |

YES |

| Fib level? |

NO |

| 21 MA? |

NO |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

YES |

| Days Active |

#REF! |

| Pair |

AUDCAD |

| Daily Range |

54 |

| Pip SL |

50 |

| 1st PIP TP |

175 |

| R/R Ratio |

3.50 |

| SL % DR |

92.59% |

| Units |

940 |

| Half Units |

470 |

| Entry Price |

0.95065 |

| 1ST TP Price |

0.94133 |

| 2nd TP Price Set |

0.93315 |

| Actual 2nd Exit |

|

| 2nd TP TS or SL |

|

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

0.95565 |

| Level taken explanation |

Selling. Pair is in a long term downtrend and is staying below the FTL resistance since the beginning of 2018. Pair is currently ranging and has stalled at the resistance at .95665 and the FTL. Pair made a huge bearish pin bar on the D chart which is at the resistance the FTL and the BB extreme. This is a strong signal pair is going to head lower. Signal is a bit stale but still a good price level |

| Sl Placement |

SL is above the pin bar and the FTL |

| TP Placement |

TP is at the last swing lower and then the next level down. |

| Fundamental |

|

| Risks |

|

| Updates |

|

| Account Balance |

473.01 |

| Amount Risked $ |

4.73 |

| Risked % |

1.00% |

| 1st TP |

0.00 |

| 2nd TP |

0.00 |

| SL |

-4.70 |

| $ Gained/Lost |

-4.70 |

| % Gained/Lost of trade |

-99.37% |

| Gained/Lost % of account |

-0.99% |

| Happened |

pair was sold a bit late after seeing the large bearish pin bar at the FTL and the .9566 resistance. Pair spiked higher on a heavy comdolls rally and hit the SL. |

| Improvements |

I think the D pin bar was a strong signal. It was a bit late but still a good price level. The FTL and the .95665 resistance were important resistance levels and the pin bar was at that important level. I had figured that pair would be unable to breach the strong resistance levels but the market proved me wrong. I would probably take this trade again because that pin bar occurred at important levels and the overall trend was lower. |

| Trade # |

25 |

| Session Set |

TOYOKO |

| Date Set |

2019-04-09 |

| Time Set |

7:05:00 PM |

| Session Triggered |

TOYOKO |

| Date Taken |

2019-04-09 |

| Time Taken |

7:05:00 PM |

| 1st TP Session End |

|

| 1st TP End Date |

|

| 1st TP Time End |

|

| 2nd TP Session End |

|

| 2nd TP End Date |

|

| 2nd TP Time End |

|

| SL End Session |

NEW YORK |

| SL End Date |

2019-04-10 |

| SL Time End |

8:33:00 AM |

| Pair |

AUDUSD |

| Long/Short |

SHORT |

| Taken At Market |

YES |

| Type of Candle Pattern |

BEARISH PIN BAR |

| What Chart is Signal on? |

D |

| Trend or Range? |

RANGE |

| Support/Resistance? |

YES |

| Fib level? |

NO |

| 21 MA? |

YES |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

YES |

| Days Active |

#REF! |

| Pair |

AUDUSD |

| Daily Range |

45 |

| Pip SL |

45 |

| 1st PIP TP |

100 |

| R/R Ratio |

2.22 |

| SL % DR |

100.00% |

| Units |

833 |

| Half Units |

417 |

| Entry Price |

0.71139 |

| 1ST TP Price |

0.70596 |

| 2nd TP Price Set |

0.70114 |

| Actual 2nd Exit |

|

| 2nd TP TS or SL |

|

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

0.71589 |

| Level taken explanation |

Selling. Pair is in a long term downtrend as seen by the W chart. Pair is below the FTL which has been acting as resistance since the beginning of 2018. On the W chart pair is against the 21 MA. Pair is currently ranging. And has approached the top of the range which is the .7149 level. This coincides with the FTL and the BB extreme. Pair made a bearish pin bar with a good wick and small body. This is a strong sell signal at an important price level. Pair has a good probability of heading lower. |

| Sl Placement |

SL is above the FTL and the two levels of resistance indicated on the chart. Also above the candlestick pin bar. |

| TP Placement |

|

| Fundamental |

|

| Risks |

|

| Updates |

|

| Account Balance |

476.05 |

| Amount Risked $ |

5.00 |

| Risked % |

1.05% |

| 1st TP |

0.00 |

| 2nd TP |

0.00 |

| SL |

-5.00 |

| $ Gained/Lost |

-5.00 |

| % Gained/Lost of trade |

-100.00% |

| Gained/Lost % of account |

-1.05% |

| Happened |

Pair was sold near the top of the range which I deemed to be .7128. Pair made a huge bearish pin bar on the D which was a strong sell signal. Pair rallied into the SL, |

| Improvements |

The overall trend was down. There was a large FTL that price was under on the D chart. Pair was in a range though on a smaller time frame and had approached the resistance and made a strong signal to sell. I do not feel going short at this area was the wrong thing to do. Pair was clear ranging and had a long term bearish bias. Not sure where the strength on the AUD came from but I think this was a good trade. The SL was placed above the range and the FTL. |

| Trade # |

26 |

| Session Set |

EURO US OVERLAP |

| Date Set |

2019-04-10 |

| Time Set |

5:36:00 AM |

| Session Triggered |

EURO US OVERLAP |

| Date Taken |

2019-04-10 |

| Time Taken |

5:36:00 AM |

| 1st TP Session End |

|

| 1st TP End Date |

|

| 1st TP Time End |

|

| 2nd TP Session End |

|

| 2nd TP End Date |

|

| 2nd TP Time End |

|

| SL End Session |

NEW YORK |

| SL End Date |

2019-04-10 |

| SL Time End |

9:31:00 AM |

| Pair |

USDCAD |

| Long/Short |

LONG |

| Taken At Market |

YES |

| Type of Candle Pattern |

BULLISH ENGULFING |

| What Chart is Signal on? |

H4 |

| Trend or Range? |

RANGE |

| Support/Resistance? |

YES |

| Fib level? |

NO |

| 21 MA? |

NO |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

YES |

| Days Active |

#REF! |

| Pair |

USDCAD |

| Daily Range |

60 |

| Pip SL |

30 |

| 1st PIP TP |

100 |

| R/R Ratio |

3.33 |

| SL % DR |

50.00% |

| Units |

1600 |

| Half Units |

800 |

| Entry Price |

1.33447 |

| 1ST TP Price |

1.33927 |

| 2nd TP Price Set |

1.34428 |

| Actual 2nd Exit |

|

| 2nd TP TS or SL |

|

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

1.33128 |

| Level taken explanation |

Buying. Pair has found support at the 1.3298 level and made a engulfing off if it. Pair is ranging and I wanted to buy but needed the US news event to get out of way. US event occurred and created a engulfing which I bought. Think price will return to the highs of the range |

| Sl Placement |

SL is below the engulfing candle that has been created from the news event |

| TP Placement |

TP is mid range at the last swing high and then at the channel top |

| Fundamental |

|

| Risks |

|

| Updates |

|

| Account Balance |

476.05 |

| Amount Risked $ |

4.80 |

| Risked % |

1.01% |

| 1st TP |

0.00 |

| 2nd TP |

0.00 |

| SL |

-5.12 |

| $ Gained/Lost |

-5.12 |

| % Gained/Lost of trade |

-106.67% |

| Gained/Lost % of account |

-1.08% |

| Happened |

Bought the pair after the USD news event had ended on the engulfing bullish candle. Pair fell sharply lower and hit the SL. |

| Improvements |

I think the overall bias on the trade was bullish as the pair has been moving in an ascending channel for two years. Pair had fallen and found support at 1.3298 level where it bounced. I had waited for the news event to pass which was good. The signal was a bit away from the support level but still was a good sized engulfing candle. The Comdolls seemed to have a large rally unfortunately which caused this trade to be a loss. I guess a way of improving it would have been to place the SL below the 1.3298 level, this would have got me |

| Trade # |

5 |

| Session Set |

TOYOKO |

| Date Set |

2019-04-01 |

| Time Set |

6:58:00 PM |

| Session Triggered |

TOYOKO |

| Date Taken |

2019-04-01 |

| Time Taken |

6:58:00 PM |

| 1st TP Session End |

NEW YORK |

| 1st TP End Date |

2019-04-08 |

| 1st TP Time End |

11:04:00 AM |

| 2nd TP Session End |

EURO US OVERLAP |

| 2nd TP End Date |

2019-04-10 |

| 2nd TP Time End |

6:06:00 AM |

| SL End Session |

|

| SL End Date |

|

| SL Time End |

|

| Pair |

EURCHF |

| Long/Short |

LONG |

| Taken At Market |

YES |

| Type of Candle Pattern |

INSIDE BAR BREAKOUT |

| What Chart is Signal on? |

H4 |

| Trend or Range? |

RANGE |

| Support/Resistance? |

YES |

| Fib level? |

NO |

| 21 MA? |

NO |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

YES |

| Days Active |

#REF! |

| Pair |

EURCHF |

| Daily Range |

40 |

| Pip SL |

45 |

| 1st PIP TP |

150 |

| R/R Ratio |

3.33 |

| SL % DR |

112.50% |

| Units |

834 |

| Half Units |

417 |

| Entry Price |

1.11955 |

| 1ST TP Price |

1.12664 |

| 2nd TP Price Set |

1.13485 |

| Actual 2nd Exit |

|

| 2nd TP TS or SL |

|

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

1.11486 |

| Level taken explanation |

Buying. Pair is ranging and has fallen to the bottom of the range created on the D chart. Pair has made a inside bar on H4 and broke out at the start of the new week. This level is a level of support form the previous D swings. Pair is also at the BB extreme on the H4. I am buying thinking that the pair is ready to move back to the middle of the range zone. The D Chart is showing a strong move higher off the support level in the new week. |

| Sl Placement |

SL is below the swing support |

| TP Placement |

TP is at the midrange and then also near top of the range |

| Fundamental |

None |

| Risks |

|

| Updates |

|

| Account Balance |

500.00 |

| Amount Risked $ |

5.00 |

| Risked % |

1.00% |

| 1st TP |

2.99 |

| 2nd TP |

3.91 |

| SL |

0.00 |

| $ Gained/Lost |

6.90 |

| % Gained/Lost of trade |

138.00% |

| Gained/Lost % of account |

1.38% |

| Happened |

Pair was bought at the inside bar breakout on the H4. Pair was at a important support level at 1.1158 and bounced. Pair then began to move higher and I closed out for a gain for the 1st. The 2nd part of the position I closed out after the EURO and US news events began pushing pair lower. Pair then spiked even higher,. |

| Improvements |

I think the entry was good and at a good level. Pair had fallen sharply and was oversold at an important price level. The new trend started and the 1st TP was at a good level. I don’t think closing the 2nd where I did was so wrong, I guess to make it better I could have placed the SL below the RTL that had started on the H4. This might have allowed me to ride the trend higher for longer although the pair did look stretched out and the news events were causing a huge sell off. |

| Trade # |

22 |

| Session Set |

EURO US OVERLAP |

| Date Set |

2019-04-09 |

| Time Set |

6:20:00 AM |

| Session Triggered |

EURO US OVERLAP |

| Date Taken |

2019-04-09 |

| Time Taken |

6:20:00 AM |

| 1st TP Session End |

|

| 1st TP End Date |

|

| 1st TP Time End |

|

| 2nd TP Session End |

|

| 2nd TP End Date |

|

| 2nd TP Time End |

|

| SL End Session |

EURO US OVERLAP |

| SL End Date |

2019-04-10 |

| SL Time End |

5:30:00 AM |

| Pair |

USDCHF |

| Long/Short |

LONG |

| Taken At Market |

YES |

| Type of Candle Pattern |

BULLISH ENGULFING |

| What Chart is Signal on? |

H4 |

| Trend or Range? |

TREND |

| Support/Resistance? |

YES |

| Fib level? |

YES |

| 21 MA? |

NO |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

NO |

| Days Active |

#REF! |

| Pair |

USDCHF |

| Daily Range |

39 |

| Pip SL |

25 |

| 1st PIP TP |

60 |

| R/R Ratio |

2.40 |

| SL % DR |

64.10% |

| Units |

1420 |

| Half Units |

710 |

| Entry Price |

0.99875 |

| 1ST TP Price |

1.00160 |

| 2nd TP Price Set |

1.00456 |

| Actual 2nd Exit |

|

| 2nd TP TS or SL |

|

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

0.99606 |

| Level taken explanation |

Buying. Pair is in a bullish H4 trend. Pair has made consecutive higher highs and higher lows. Pair has made 61 fib retracement since the last swing higher and is now above the RTL and the support at .99826. Pair made a engulfing candle off of this level and I think price will move higher in direction of the overall trend. |

| Sl Placement |

SL is below the RTL and the support level. |

| TP Placement |

TP is at the last swing resistance and the 2nd TP is at next level of resistance |

| Fundamental |

|

| Risks |

|

| Updates |

|

| Account Balance |

473.01 |

| Amount Risked $ |

4.73 |

| Risked % |

1.00% |

| 1st TP |

0.00 |

| 2nd TP |

0.00 |

| SL |

-0.04 |

| $ Gained/Lost |

-0.04 |

| % Gained/Lost of trade |

-0.85% |

| Gained/Lost % of account |

-0.01% |

| Happened |

Pair was bought after seeing the engulfing candle on the H4 chart at the .9982 support level. Pair was against the RTL and the Support level. Pair moved higher and I derisked ahead of the US news. The news event caused a spike lower which caused the SL to get hit only to see the price move back higher. |

| Improvements |

Entry was good on this, the pair had started a new H4 trend. The pair was moving higher in line with the overall trend. Pair made a good signal at a good level and buying the signal was the correct move. The derisking ahead of the news event was because in all my USD trades I had open the exposure was overall long, the derisking was to reduced that. It is unfortunate that the pair hit the SL before moving higher but you can never really know what is going to happen. |

2019-04-13. Several trades ended up being closed.

| Trade # |

7 |

| Session Set |

EURO US OVERLAP |

| Date Set |

2019-04-02 |

| Time Set |

6:45:00 AM |

| Session Triggered |

EURO US OVERLAP |

| Date Taken |

2019-04-02 |

| Time Taken |

6:45:00 AM |

| 1st TP Session End |

|

| 1st TP End Date |

|

| 1st TP Time End |

|

| 2nd TP Session End |

|

| 2nd TP End Date |

|

| 2nd TP Time End |

|

| SL End Session |

NEW YORK |

| SL End Date |

2019-04-12 |

| SL Time End |

1:59:00 PM |

| Pair |

CADJPY |

| Long/Short |

SHORT |

| Taken At Market |

YES |

| Type of Candle Pattern |

BEARISH ENGULFING |

| What Chart is Signal on? |

H4 |

| Trend or Range? |

TREND |

| Support/Resistance? |

YES |

| Fib level? |

NO |

| 21 MA? |

YES |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

NO |

| Days Active |

#REF! |

| Pair |

CADJPY |

| Daily Range |

66 |

| Pip SL |

60 |

| 1st PIP TP |

180 |

| R/R Ratio |

3.00 |

| SL % DR |

90.91% |

| Units |

696 |

| Half Units |

348 |

| Entry Price |

83.51100 |

| 1ST TP Price |

82.92500 |

| 2nd TP Price Set |

81.71100 |

| Actual 2nd Exit |

|

| 2nd TP TS or SL |

|

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

84.17500 |

| Level taken explanation |

Selling. Pair is in a bearish downtrend which can bee seen from the D chart. Pair is making LHs & HLs. Pair has rallied and stalled at a FTL which is showing a bearish engulfing as well as bearish pin bars, Pair has made a decent sized retracement from the last swing low. pair is against the 21 MA on the W chart as added confluence. |

| Sl Placement |

SL is above the swing high, the FTL and the resistance at 84 |

| TP Placement |

TP is at the last swing low and the bottom of the last large swing |

| Fundamental |

|

| Risks |

|

| Updates |

|

| Account Balance |

500.00 |

| Amount Risked $ |

5.00 |

| Risked % |

1.00% |

| 1st TP |

0.00 |

| 2nd TP |

0.00 |

| SL |

-5.02 |

| $ Gained/Lost |

-5.02 |

| % Gained/Lost of trade |

-100.40% |

| Gained/Lost % of account |

-1.00% |

| Happened |

Sold the pair at the move to the FTL that had been active since Oct 2018. Pair made a bearish engulfing off the FTL level. The overall trend was lower as seen by the D and H4 chart. Pair was retracing and was at the level to make another swing lower. Pair instead mostly went sideways for 2 weeks but then spiked higher at the end of the week on general risk taking in the market. |

| Improvements |

Well the pair was in a downtrend and had made a good retracement to an important level. I guess the bearish engulfing signal was fine as price did fall after I sold. Its just that there was too much risk taking that went on. I suppose to make this trade strong I could have avoided this trade due to no other factors of confluence other than the weekly 21 MA. |

| Trade # |

31 |

| Session Set |

TOYOKO |

| Date Set |

2019-04-11 |

| Time Set |

5:14:00 PM |

| Session Triggered |

TOYOKO |

| Date Taken |

2019-04-11 |

| Time Taken |

5:14:00 PM |

| 1st TP Session End |

|

| 1st TP End Date |

|

| 1st TP Time End |

|

| 2nd TP Session End |

|

| 2nd TP End Date |

|

| 2nd TP Time End |

|

| SL End Session |

EUROPEAN |

| SL End Date |

2019-04-12 |

| SL Time End |

3:09:00 AM |

| Pair |

AUDUSD |

| Long/Short |

SHORT |

| Taken At Market |

YES |

| Type of Candle Pattern |

BEARISH TWEEZERS |

| What Chart is Signal on? |

D |

| Trend or Range? |

RANGE |

| Support/Resistance? |

YES |

| Fib level? |

NO |

| 21 MA? |

YES |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

YES |

| Days Active |

#REF! |

| Pair |

AUDUSD |

| Daily Range |

47 |

| Pip SL |

50 |

| 1st PIP TP |

104 |

| R/R Ratio |

2.08 |

| SL % DR |

106.38% |

| Units |

690 |

| Half Units |

345 |

| Entry Price |

0.71175 |

| 1ST TP Price |

0.70596 |

| 2nd TP Price Set |

0.70139 |

| Actual 2nd Exit |

|

| 2nd TP TS or SL |

|

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

0.71659 |

| Level taken explanation |

Selling. Pair is ranging right now but in an overall bearish downtrend as seen by the D FTL that price has been following since the beginning of 2018. Pair has reached the FTL and the resistance has noted on the chart. This coincides with the bb extreme. pair made a bearish tweezer at this important level and it looks like the FTL rejected price on a fakeout. The W chart shows the price at the 21MA. I think this pair is finally ready to fall in direction of the trend,. |

| Sl Placement |

SL is above the FTL and the two levels of resistance indicated on the chart. Also above the candlestick pin bar. |

| TP Placement |

TP is at the near support and then then .7 support |

| Fundamental |

|

| Risks |

|

| Updates |

|

| Account Balance |

460.87 |

| Amount Risked $ |

4.60 |

| Risked % |

1.00% |

| 1st TP |

0.00 |

| 2nd TP |

0.00 |

| SL |

-4.61 |

| $ Gained/Lost |

-4.61 |

| % Gained/Lost of trade |

-100.22% |

| Gained/Lost % of account |

-1.00% |

| Happened |

Sold the pair after seeing the bearish tweezers at the FTL and the resistance levels on the D chart. Pair instead moved higher and hit the SL. |

| Improvements |

I would totally take this trade again. That was a strong signal on the D chart at the FTL and the resistance levels. I could not have predicted the Chinese data causing the AUD to jump nor was it scheduled as a big release. Only thing id do differently would be to put the SL above the candlestick pattern. Still would have been a loss though. |

| Trade # |

21 |

| Session Set |

TOYOKO |

| Date Set |

2019-04-08 |

| Time Set |

6:07:00 PM |

| Session Triggered |

TOYOKO |

| Date Taken |

2019-04-08 |

| Time Taken |

6:07:00 PM |

| 1st TP Session End |

|

| 1st TP End Date |

|

| 1st TP Time End |

|

| 2nd TP Session End |

|

| 2nd TP End Date |

|

| 2nd TP Time End |

|

| SL End Session |

EUROPEAN |

| SL End Date |

2019-04-12 |

| SL Time End |

1:35:00 AM |

| Pair |

EURUSD |

| Long/Short |

SHORT |

| Taken At Market |

YES |

| Type of Candle Pattern |

BEARISH ENGULFING |

| What Chart is Signal on? |

H4 |

| Trend or Range? |

TREND |

| Support/Resistance? |

YES |

| Fib level? |

YES |

| 21 MA? |

YES |

| Multiple Time Frame Analysis? |

YES |

| Boillinger Band? |

NO |

| Days Active |

#REF! |

| Pair |

EURUSD |

| Daily Range |

51 |

| Pip SL |

46 |

| 1st PIP TP |

75 |

| R/R Ratio |

1.63 |

| SL % DR |

90.20% |

| Units |

816 |

| Half Units |

408 |

| Entry Price |

1.12587 |

| 1ST TP Price |

1.12203 |

| 2nd TP Price Set |

1.11864 |

| Actual 2nd Exit |

|

| 2nd TP TS or SL |

|

| TS Used |

|

| TS as % of DR |

0.00000 |

| SL Price |

1.13047 |

| Level taken explanation |

Selling. Pair is in a long term downtrend. Pair has retraced and stalled at the 61 fib which coincides with the D 21 MA. Pair made a engulfing candle off the resistance level at 1.1269 and the fib. I think this is a strong enough signal to sell. |

| Sl Placement |

SL is above the resistance and the 61 fib, also took DR into consideration. |

| TP Placement |

TP is and the last swing support and then the large support at 1.1181 |

| Fundamental |

|

| Risks |

|

| Updates |

|

| Account Balance |

483.09 |

| Amount Risked $ |

5.00 |

| Risked % |

1.04% |

| 1st TP |

0.00 |

| 2nd TP |

0.00 |

| SL |

-5.01 |

| $ Gained/Lost |

-5.01 |

| % Gained/Lost of trade |

-100.20% |

| Gained/Lost % of account |

-1.04% |

| Happened |

Pair was sold after seeing a H4 engulfing off 1.1269 resistance and the 61 fib in a downtrend. Pair moved sideways before spiking higher at the end of the week. |

| Improvements |

The pair had an overall bearish bias as seen by the D chart. Not sure why there was no USD strength. I guess the level I sold at could have been better though, It would have been more prudent to wait till the price was interacting with the 1.1288 resistance and the FTL. That would have made the trade stronger I think. |

| Trade # |

23 |

| Session Set |

EURO US OVERLAP |

| Date Set |

2019-04-09 |

| Time Set |

6:29:00 AM |

| Session Triggered |

EURO US OVERLAP |