There was some panic selling over the weekend.

I think its a lot more solid now than it was and lots of institutional investors. The masses are panicking i can’t imagine they are

Retail flows don’t really drive prices anymore. It’s more institutional flows and derivatives.

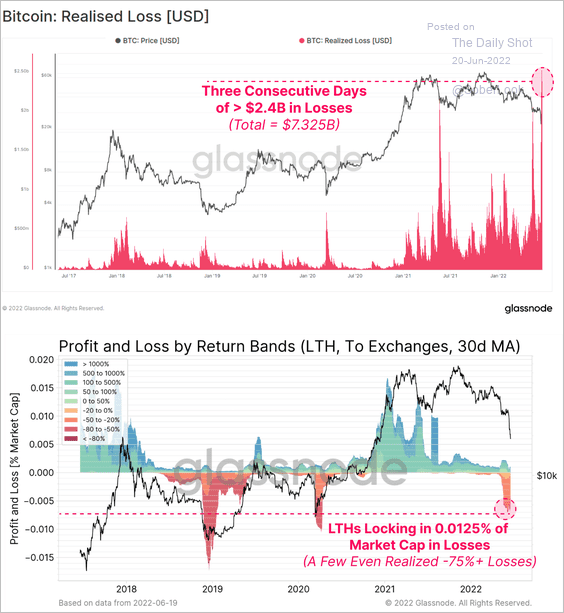

Bitcoin network has shown the biggest realized loss according to Network Realized Profit Loss metric.

What is it? NPL metric computes the average profit or loss of all coins that change addresses daily. For each coin that moves onchain, NPL takes the price at which it was last moved and assumes this to be its acquisition price. Once it changes addresses again, NPL assumes the coin was sold.

In fact, the loss we see above is a large value aggregated from a few subsequent days of loss in Bitcoin network. We can see it on a zoomed in chart:

So how would you read that figure, where there’s the down-spike in blue to $5k?

Is anyone asking “wen bottom?” just like when they were asking “wen moon”?

Wondering if we’ll see $10k BTC…

Getting closer perhaps.

Hard to say though. There are still many things working behind the scenes that we aren’t party to. The coming weeks will tell us who else is going bust.

When/if it happens will you be buying?

1 Like

Definitely, long term i think it is going to be around for years to come

I don’t think selling is a good option now. Let’s just hope for the best. I still believe this is not the end and we will be witnessing a hike soon.

Bullish and bearish signs for bitcoin this past week:

One metric gives a bullish signal:

Bias for exchange outflows.

Four metrics give bearish signals:

ETF outflows.

Futures open interest and perpetual funding rates plunge.

Reduced profitability of the coin supply, the market moves into a state of unrealized losses (NUPL < 0), and a bias for realized losses on-chain.

Hash rate and miner revenue are decreasing.

Don’t panic because the entire crypto is down. Please invest in strong fundamental crypto like bitcoin. Matic and sandbox.

Fundamentals don’t matter if there are large forced liquidations happening.

This cycle has happened 4 times before.

More pain in the short term is what I think.

Not good signs either.

After throwing lifelines to troubled digital currency exchanges BlockFi and Voyager Digital, Sam Bankman-Fried, the 30-year-old billionaire founder of FTX, warns that many crypto exchanges will soon fail.

This doesn’t help either. And I hope there isn’t more unravelling behind the scenes. But it could still take weeks and months to feel some of this impact.

More collateral damage from the Luna/UST collapse. Some big players have stepped up with find to keep the market contagion from spreading, but it’s not completely clear what other companies might still be at risk of defaulting.

Well, this is frightening. People don’t realize that this is the nature of the market.