Trade 38 - 09/12/2010

Pair: Gold Spot

Timeframe: 1 Hour

Went long early this morning at 1385.31 after price had pulled back a little from the overnight move up and seemed to be holding at the 23.6% Fib measured off the recent major decline. Entered with 1 mini lot and stop was placed at 1382.31.

Price rose up my way for a while before it started to come back just a short while ago and USD gained across the board. Decided to pull the plug early on this one and take a quick profit to bring me up to just over my weekly target. Will try to monitor this today for further entries as long term I think Gold and Silver are headed back up but I don’t want to enter just now as there’s a considerable chance that JPM and algos might push this down some more until Buyers of Size resurface.

P1: +25 pips

Total Account Risk: 1.63%

R/R: 0.83

Account Balance: +1.36%

Overall Account Balance: +86.63%

Trade 39 - 09/12/2010

Pair: Gold Spot

Timeframe: 1 Hour

Went long at 1383.0 after it appeared that the ST trend line on the 1H chart was holding up during the day. My guess is that the JPM and Buyers of Size aren’t really active in the market today and it’s mostly speculators and algos which can make TA more relevant than other days to this market.

Price rose up right after my entry but seemed to be stalling out around the 1386 level for a while. USDX was holding well over 80 and was a bit worried that this would keep the algos ticking gold down so I exited manually at 1386.5. Unfortunately this was a bit premature on my part as price rose up some more as USDX started to fall back a bit. In retrospect the smarter option would have been just leave my stop at B/E and see if I could hit that upper trendline but the call of giving myself some breathing room for the rest of the week with my weekly target proved a bit much.

P1: +35 pips

Total Account Risk: 1.61%

R/R: 1.17

Account Balance: +1.88%

Overall Account Balance: +90.13%

Trade 40 - 10/12/2010

Pair: Gold Spot

Timeframe: 1 Hour

Was way, way too hungover to contemplate doing any trading until late this afternoon. After finally logging on saw Gold had been getting a bit of a beating again throughout the day and was starting to come back. Entered with 1 mini lot at 1380.0 with stop placed $3 below that. Just the same tactic I’ve tried for most of the week - buy the dip.

The comeback continued after entry and was up $5 not long after entry. Seemed to be stalling out and what with the weekend coming and the recent propensity of a certain large financial institution to raid the market after the Globex close and shove price down sharply I figured I’d just take my profit and be happy.

P1: +50 pips

Total Account Risk: 1.58%

R/R: 1.67

Account Balance: +2.63%

Overall Account Balance: +95.13%

Trade 41 - 13/12/2010

Pair: EUR/USD

Timeframe: 1 Hour

I’d gone short yesterday with 1 mini lot at 1.3316 after price appeared to be holding up at the descending parallel channel line. This was a bad reading of the direction of the market though and price rose up strongly after a little dip. In the end I gave up on this trade at 1.3366 and closed it out. In retrospect should’ve taken more account of how little downward momentum there was and that there seemed to be some big money behind the move up. Also, once the channel line was conclusively broken I should’ve closed out earlier than I did. Had a good run lately but this was definitely a bad call all round.

P1: -50 pips

Total Account Risk: 2.56%

R/R: -1.00

Account Balance: -2.56%

Overall Account Balance: +90.12%

Trade 42 - 03/01/2011

Pair: GBP/USD

Timeframe: 1 Hour

Went for a Boll DNA trade to start my year after taking a break over Christmas completely. Went long as price went back up through the CBL in the chart above with 2 mini lots. At the time of entry the Bollinger Bands were flat and the entry looked valid.

Unfortunately price turned around not long after entry and started to head back down again. Decided to jump out early as I didn’t like the look of the way things were developing. I was a bit hasty with the entry in this case I think - should’ve been more careful about scanning across the rest of the timeframes as the 4H and Daily didn’t look good for a long entry.

P1: -14.5 pips

P2: -14.5 pips

Total Account Risk: 1.79%

R/R: -0.85

Account Balance: -1.52%

Overall Account Balance: +87.52%

Trade 43 - 04/01/2011

Pair: Gold

Timeframe: 4 Hour

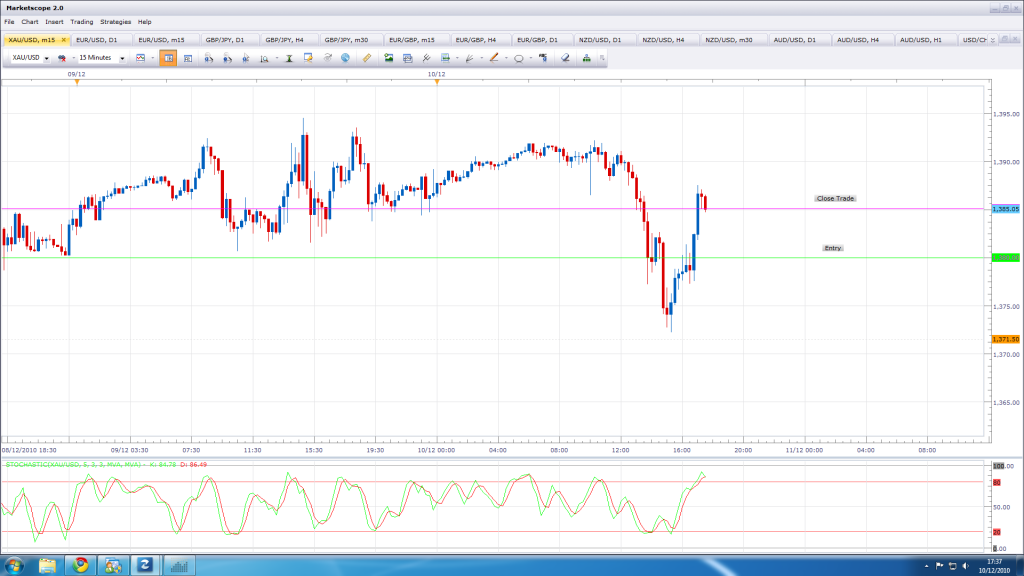

Went long at 1405.5 after price had hit the purple ST rising trendline on the 4H chart. Entered with 1 mini lot and the stop was placed $2 below entry point. Figured this would just be a very quick trade as JPM could well be up for another raid on gold today after they tried it twice yesterday (including after the Globex close in thin trading conditions).

Price went my way pretty much straight after entry and was +30 pips for a while before it fell away again getting down back towards my entry point. Price then rallied up again a bit and I decided to close out as it’s only about an hour away from the usual time that paper short trades begin. FOMC minutes are out later today and my guess is that the big players will not want Gold to be up near it’s highs today. We’ll see how it plays out today though and if we get an aggressive move down I’ll look to buy the dip with a couple of mini lots.

P1: +20 pips

Total Account Risk: 1.07%

R/R: 1.00

Account Balance: +1.07%

Overall Account Balance: +89.35%

And this was what I was just talking about. A quick raid at the usual time by JPM designed to drive down the price of Gold and Silver. Below’s a 1 minute Gold chart which shows >$10 disappearing off the price in 10 minutes:

There was no particular reason for a 100 pip move. No news release, no nothing except one or two large financial institutions hell bent on manipulating the PM markets by flooding them with massive paper shorts in a desperate attempt to try and dampen down price moving up and overwhelming their already huge paper short positions. Just another example of how the PM market is completely rigged in favour of the big guy. I don’t like to play the short side raids though as if these raids don’t come I’d prefer to not be on the end of a jump up as, in my opinion, this is where the price of gold is going medium to long-term. They do give good long entries though every time they go in for these manipulations and buyers of size in Asia and elsewhere are falling over themselves in delight at being able to buy physical gold for delivery at cheaper prices than they would otherwise. Time to buy the dip methinks…

Well all in all it’s been about 3 months trading excluding the x-mas break and I’m thinking to take stock of things for a little while after reviewing my trades. It’s become pretty clear to me that I’m not judging the FX markets well at all due to the fact that I’m being way too haphazard about picking entries and exits. If it wasn’t for buying gold on dips I wouldn’t be at +90% that’s for sure.

I don’t want to be dependent on the PM markets for trades so I’m starting work now on finding a system that works for my trading style and the time I have to trade in. Tymen’s system is useful but I don’t find many valid entries and the 2 lot entry combined with the stop loss required can be a bit rich for my trading account given that I spreadbet and can only bet mini lots or higher.

Given that I’ve been looking at ICT’s thread and, for me, the framework applied in it looks very useful to a forex noob like myself who only has a 15 months experience. I haven’t really done a proper analysis of S&R lines across the timeframes, pivots, etc. to determine my entry and exit points. So for the next little while I’ll probably demo the points laid out in his thread to familiarize with the routine and then try to apply to my live trading when more comfortable with it all. I might throw up some of the demo trades as live examples showing the top-down analysis from start to finish.