Pip, is IST India Standard Time? I just wanted check so I can follow along with the past trades on my charts, thanks

IST is India Standard Time I think. I work off GMT myself. And I think my MT4 demo account is GMT+1 (Interbank had some reason for this which I forget now).

Trade 80 - 17/09/2010

Pair: EUR/USD

Timeframe: 1 Hour

Had gone short in this pair yesterday morning after price had gotten up to the 3.3 dev after a few bars of expansion. Pretty often that can be your best exit point and I thought 1.31 would be a good level to try and catch a retracement as it had seemed a bit of a struggle to get over it. After this week starting to think I should rename the thread to DNA and 3.3 dev reversal thread. Anyway, entered with 2 positions of 2 mini lots each. Stop was placed at 1.3130.

Caught a decent retracement and exited with a limit order for the first position on a test of the 1.2950 level. PA moved around then for a number of hours and by the end of last night it seemed to me that the 1.31 was holding up so let it run overnight. Obviously the wrong choice as Asia markets climbed during the night and I got stopped out on 2nd position.

Total P&L: +19 pips

Total Account Risk: 0.78%

R/R: 0.32

Account Balance: +0.25%

Overall Account Balance: +54.79%

Trade 81 - 17/09/2010

Pair: USD/CAD

Timeframe: 1 Hour

Missed the blindingly obvious EUR/USD and GBP/USD short trades as was in some meetings and away from the desk. Got back just in time to catch the USD/CAD long setting up on the 4 hour charts. Having retraced from the low I went long once PA pierced the CBL. Entered with 2 positions of 2 mini lots each. Stop was placed a little below the recent low.

PA dropped a little after entry but started to head up pretty soon after that as USD began to be bought. Closed out TP1 with a limit order for +29 pips after spread. PA continued my way and eventually rose up pretty sharply to the 3.3 dev area where looking back I probably should’ve closed. Being a Friday I was going to be closing anyway in the next few hours and didn’t look like the markets were collapsing or anything. Guess greed got the better of me and I ended up closing out once price started dropping back down towards the Outer BB.

P1: +29 pips

P2: +89 pips

Total Account Risk: 0.59%

R/R: 2.41

Account Balance: +1.43%

Overall Account Balance: +57.01%

The charts you’re posting indicate that they are IST… or does the IST after the time (in the chart’s header) indicate something else? I guess I’m just confused if they are in IST or GMT. My apologies for getting stuck on this.

Oh yeah… never noticed that there. Did a little googling just now. Must stand for Irish Standard Time seeing as I’m from Ireland. Irish Standard Time and India Standard Time both use IST as an abbreviation it seems. We don’t really use the term IST here in Ireland as far as I know but mystery solved. IST must be GMT+1 during the summer hours and will revert to GMT in October once the clocks go back.

Ah! Thanks, that makes sense

Trade 82 - 20/09/2010

Pair: EUR/CHF

Timeframe: 1 Hour

Went long as price went up through the CBL. Were in a squeeze and seemed to be heading up towards the Mid BB. European stock markets and US futures were up and things seemed ok for this trade to work out. Entered with 2 positions of 2 mini lots each. Stop was placed a little below the extreme candle low.

PA reversed course however. Looks like debt concerns maybe coupled with an improved KOF Swiss forecast. Was a bit slow to shut this trade down and ended up seeing it go all the way to my stop loss.

P1: -35 pips

P2: -35 pips

Total Account Risk: 0.89%

R/R: -1.00

Account Balance: -0.89%

Overall Account Balance: +55.61%

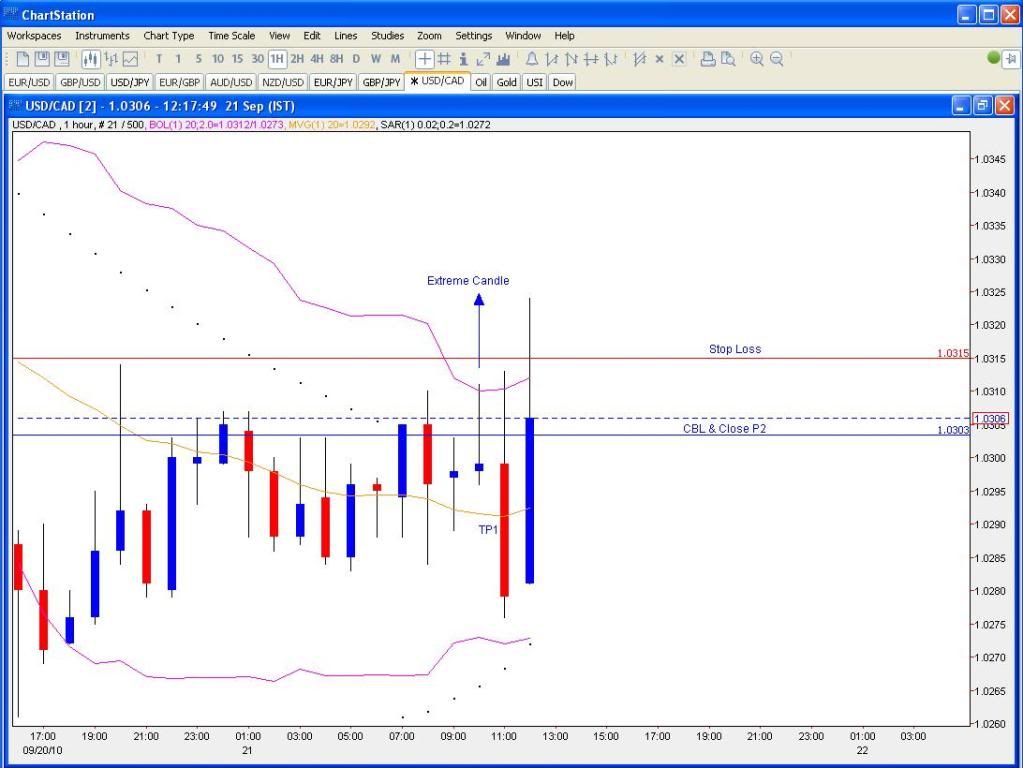

Trade 83 - 20/09/2010

Pair: USD/CAD

Timeframe: 1 Hour

Went long the candle after the extreme candle as PA went up through the CBL. Entered with 2 positions of 2 mini lots each. Stop was placed just below the low of the extreme candle.

TP1 was hit fairly early on for a small gain after spread. As USD strengthened all over during the morning and afternoon PA rose up to the Outer BB and TP2 was closed with a limit order.

P1: +9 pips

P2: +31 pips

Total Account Risk: 0.59%

R/R: 0.87

Account Balance: +0.51%

Overall Account Balance: +56.41%

Hmm pipbandit what broker are you using, I see your BB and it is showing the PA in a squeeze when my broker is showing the close of the bubble and would like to see which broker you use.

In work I don’t have access to any broker package (but I can access my spreadbetting provider funnily enough) so I use the Netdania Chartstation java client. I’ve noticed reasonably big differences sometimes between it and the MT4 demo account I have at home but I’m stuck using it for now.

Trade 84 - 21/09/2010

Pair: USD/CAD

Timeframe: 1 Hour

Went short after PA had gone down through the CBL. Cheated a little in that the candle after the one I had designated the extreme candle was a couple of pips higher but watching the PA it looked like the momentum was going that way so I went ahead and entered anyway. Also there was some CAD news coming up that I thought might lead to more CAD strength. Entered with 2 positions of 2 mini lots each. Stop was placed a little above the high of the extreme candle.

TP1 was hit quickly for +9 pips and continued to drop before the news. However some weaker than expected inflation data turned this around and P2 was closed out at breakeven.

P1: +9 pips

P2: +0 pips

Total Account Risk: 0.31%

R/R: 0.37

Account Balance: +0.12%

Overall Account Balance: +56.59%

In your original post, you said you are using orthodox method for drawing your CBLs. By this, do you refer to the 1CBL (with longer presiding candle), 2CBL (with shorter presiding candle before extreme one) or the Cut into half of an extreme candle that touches the mid BB?

I enter during BB squeezes and use 1 CBL usually. If the extreme candle is very large I’ll cut it in two. If the extreme candle high / low is very close to the Outer BB I’ll then use 2 CBL.

Well, enough of the demo trades I think. Time to move into live. Only problem is I’ve €1,000 to invest and minimum bet with spreadbetting provider is €1. Not exactly conducive for proper risk management. Can’t access FX brokers in work to make use of smaller lot sizes and if I did manage to make money I’d rather not have to explain to work why they need to factor that into working out tax, etc. Work for one of the big financial companies and there’s all sorts of forms to fill out about investments.

So anyway, this could go completely wrong with the minimum wager size but so be it. I can’t really be bothered waiting x number of months to build it up and stay demoing. Need some live trading practice so off we go. Prepare to see some stupid mistakes coming your way soon probably…

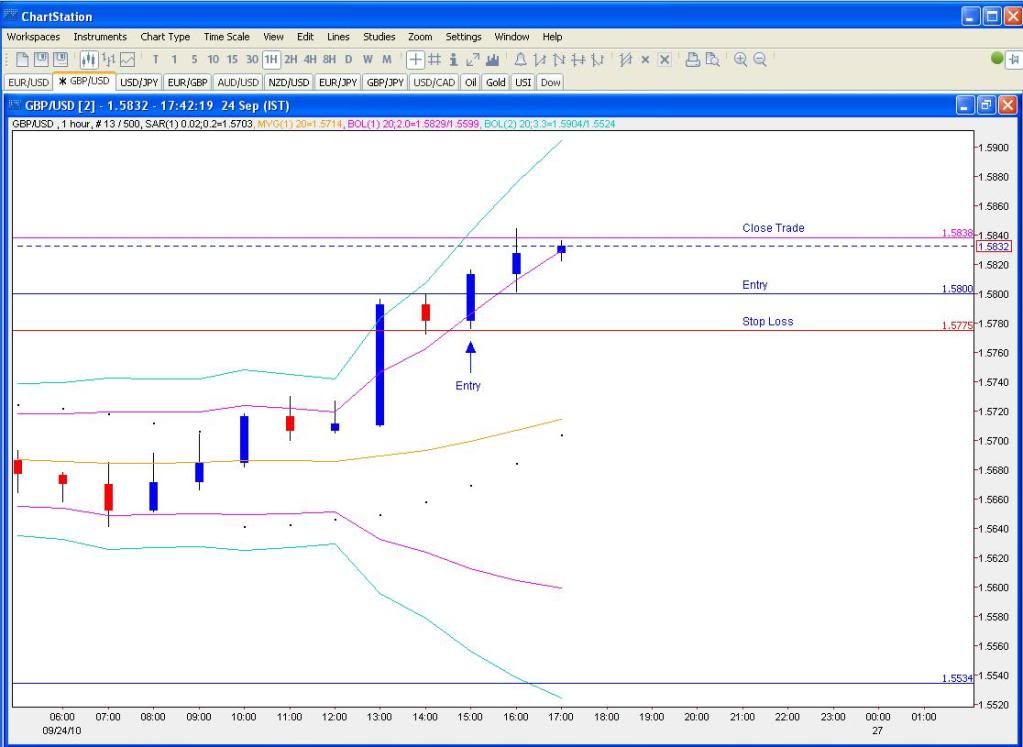

Trade 1 - 24/09/2010

Pair: GBP/USD

Timeframe: 1 Hour

Was busy in work all day so didn’t get to look at anything until this afternoon. GBP has been rocketing up lately and once it got to the 1.58 level for the second time I went ahead with a long trade as that’s where the momentum seemed to be going. Entered with one position of 2 mini lots. Stop was placed at the low of the candle before it.

After the US data was released price continued to grind it’s way upward and with the end of my day approaching I closed out at 1.5838. Don’t want to get caught with an open position over the weekend.

P1: +38 pips

Total Account Risk: 5.00%

R/R: 1.52

Account Balance: +7.60%

Overall Account Balance: +7.60%

hey pipbandit.

Great to see you going live!

I’m sure no silly mistakes will come our way if you keep doing what you have done

As always, your success is inspiring.

Regards,

Nathan

So you went live, huh. Sweet.

Hope you’ll get the same results you got with your demoing. You’re a beast.

Great your trading live.

subscribing.!

just curious, whats your basis for that entry? it’s not based on the bb dna method isnt

That last one was just watching the price action and momentum. Retracements were pretty small and slow. PA was going long far more convincingly so just followed the trend for a bit.