I am still trying to simplify my trading I still use some moving averages to help me with entry and exit timing. My trading style is a simple idea I just want to try jump into existing moves that offer at least a 1:1 and ride till where I think next s/s areas are.

I will defiantly let you know how I get on with testing your tool with my trading ideas.

Thanks

That’s undeniably a commendable, logical and sensible “general objective”, however you look at it.

Personally, I prefer to try to do that by price-action parameters alone, without using indicators; but I don’t for a moment suggest that it can’t also be done with indicators. (With some of my methods, I’m even willing to take some trades that offer a little less than a 1:1, provided they’re collectively well proven to have a [I]very[/I] high win-rate.)

Good luck!

G’day tick and PA lovers. Time to update my thread and where my work is taking me. Exciting times.

First, the normal disclaimer. This is not an education thread, I am no teacher. You won’t make money overnight following my methodologies. It is a third party-place where I document some of the key stages of my systems development for future reference. All comments are welcome and I will endeavor to answer to the best of my ability any questions asked. But those wanting to p\i\s\s in my pockets I have no time for.

So the problem with PA trading lies within its very definition. From the second post 301 Moved Permanently I defined PA as

literally everything a securities price does in relationship to time. It is purely subjective and no two speculators will interpret price action the same.

Subjective - based on or influenced by personal feelings, beliefs or opinions. Reality is, not a very good way to trade as it is hard to define rules. But, never the less, a serious proportion of speculators swear by it as a valid method. It also works for me.

But, I’ve also longed for a way to mathematically express my subjective based decisions. Why, because I can’t always be based in front of a screen trading waiting for the right trade. But I can build a bot that can when I’m not. Well, I think I’ve found the solution in a process called [B]Binary Rule Based Approximation [/B]based on [B]Rough Set theory[/B] first described by Polish computer scientist [I]Pawlak, Zdzisław (1982). “Rough sets”. International Journal of Parallel Programming. [/I]and [B]Binary Relations.[/B]

Sounds pretty daunting and it’s definitely out of my league. But research a few papers and the principle is pretty simple (the way I like it) and easily applied and just as easy to program -kinda.

So first a bit about rough set theory. As first described by Pawlak, [B]rough set[/B] is formal approximation of a [B]crisp set[/B] of data by expressing the [B]upper [/B]and [B]lower approximation [/B]of the [B]original set[/B]. In layman terms, a [B]set/B is a collection of distinct numbers considered as a number in it’s own right. So the numbers 1, 2, 3, 4, 5 are numbers in their own right but together can be considered a single set of size 5, expressed as {1,2,3,4,5}. As a rough set it would be expressed as {5,1}, giving the upper and lower valves.

My boxes are nothing more than a crisp set of data that has been collected over a period of time that meets a criteria. The upper and lower boundaries of the box correspond to the upper and lower approximation. As a rough set a box can be expressed as such {high,low}.

[B]Binary relations[/B] is mathematically, a modeling concept where the relationship between two sets of data is expressed a a binary number. The simplest example would be to replace the expressions [I]greater than, less than [/I]or [I]equal to[/I] with [I]“00”, “01” or “10”. [/I][B]We’ll use these expression in the examples below.

[/B]Together, they are applied in the process of [B]Binary Rule-Based Approximation (BRA)[/B]. BRA is implemented in two stages. First stage is use of a [B]Specification Rule Engine (SRE).[/B] The [B]SRE [/B]is a process where a series of rules are applied to express the relationship of our rough sets as a binary number. To keep it as simple as possible, lets consider two consecutive candles, the candles are our crisp set of data. The high/low and open/close price can be considered our rough set. There are many combinations of relationships that know can be expressed as rule. Is the candle a bull, bear or doji (open vs close of each candle). Is the high of the second candle higher, lower or equal to the first. Now the lows. Is there a gap between candles ie, is the open of the second candle greater than, lower than or equal to the close of the first. Is the candle body formed above the candle midpoint, straddles or below? And so on.

The second stage is the [B]Knowledge Representation Module (KRM).[/B] At this stage we use our already existing knowledge base to organize our binary relations into binary code to express the candlestick patterns.Lets look at the following candlestick pattern - the bullish engulfing

First condition to be meet is a bear candle followed by a bull candle. Our open/close rough set binary relation would express as “10” and “00” combining as “1000”. Second condition is the open of the second bar is less than the close of the first and the close of second bar is greater than the first. Again using the open/close rough set we return “10” and “00”. Our binary code has now expanded to “10001000”. Our final condition is the high of the second bar must be greater than that of the first and the low must be less than. Using the high/low rough set we return “00” and "10.

Final result, applying [B]BRA [/B]analysis we can produce the following algorithm binary code to represent the bullish engulfing pattern “100010000010”. Interesting fact, there are 729 individual candle patterns that can be detected using the above set of rules. Indeed if we wanted to identify patterns like a hanging man or morning stars we would need one more set of rules defining the relationship between the body and candle midpoint making a total of 6561 different patterns combinations. However of these patterns maybe only 0.1% are trade-able and even then only in the right market conditions. Love those two words, market conditions. A very subjective term used by most when they can’t explain what went wrong! eg there is nothing wrong with my strategy, I just applied it in the wrong market conditions.

But my work isn’t candlestick patterns. I trade PA specifically boxes. The two are not the same. Normally I would share my work cause I know how hard it is to duplicate. However through personal experience and by being active on this forum I have noticed a censoring of opinions policy has been implemented over the past few months. This I do not agree to and I believe (my opinion) has been brought on through commercial interest with the site owners/administrators. Please remember at the end of the day this site is a commercial business whose purpose is to generate a return on the investment made by the owner. At this stage in my journey, personally, I don’t care. But I’m not going to disclose my work to this commercial interest.

What I have discovered is that by applying the principles of [B]BRA [/B]to my boxes using a simple rule set, there are 216 individual box patterns that can be analysis for 3 consecutive boxes increasing 6 fold for each consecutive box pattern (1296 patterns over 4 boxes, 7776 patterns over 5). There are more [B]SRE [/B]that can be applied and of cause many pairs to investigate.

But this project is simply too big and too complex for my skill set. By myself, it will take years to develop. I know however, there are some very talented people that lurk in the background. If this is you and you would like to become involved please contact me. Particularly I’m looking for a skilled programmer with experience in [B]BRA[/B]and a system developer that can help bring this system alive.

In the mean time, happy trading all and remember - think outside the box (pun intended).

Bob

G’day tick lovers. Time for an update. After an extensive couple of weeks work think I’m finally in a position to share some results. All references here on will be to the EURUSD and I have veered away from tick charts to one minute charts. Although not happy about this the reality is one can not back test ticks on MT4. The next best option, 1 minute charts. Luckily the same price action forms all time frames and I’m able to achieve the desired outcomes.

So using [B]BRA [/B]I have identified 18 individual trade-able patterns that repeat on a regular basis. Better still when they appear at a certain time of day, day of week they have the ability to identify high probability set-ups i.e greater than 70% probability they will produce a desired outcome using my trade management set-up. Which is nothing more than achieving a 1:1 RR ratio.

With my very limited coding ability, I have smashed together a bot to automate my trading. I have opened a second small account ($515) and started forward testing and linked up with myfxbook, made public for all to see https://www.myfxbook.com/members/forexbob70/brab-v50/1762501

I’ve made a couple of changes to the bots logic (mainly related to how it detects my boxes) but hopefully can now leave alone to run it’s due course. The forward test has been running now for almost 4 weeks and here are the current results.

Fist couple of weeks was a bit disheartening, but has since bounced back. But then during back testing I discovered that the beginning of September saw some draw down and that was reflective in my live results. So now its a process of let run and see where it goes. Hopefully up up and away. Time will tell.

Next, going to bling bling the bot a bit. Have to add in a screenshot feature so I can document and review trades it takes. This will also allow me to publish some of them here. Also want to add a market panel to give an overview of current conditions. More for my benefit. And it’s also time to look at other pairs maybe even an index or two.

So that’s about that for now, happy trading and my the pips come your way.

Bob

So, what I like about the markets is how willing she is to make you pay for silly mistakes. And it didn’t get any sillier than mine.

After getting smashed late last week I went searching for answers. I have two bots, one for testing one for trading. I have but one filter, time. In my testing bot I had reference time as TimeGMT, my test data was formated to GMT. However, for some silly reason I reference TimeCurrent in my trading bot. And the rest is history.

So the test is on hold for the moment. Resetting and testing my data again. Should be up and running again in a day or two.

Well, looks like the mods are hard at work modifying my thread without my permission.

Just another reason why it might be time to leave. I hate censorship as much as marketers. So this idiot member “Bearish” (I’ll call him out), posted some pointless, irrelevant, mumbo jumbo, jibber jabber that he normal spews forth on my thread. In a tone most controlled for myself, I told him to begone. Yet the mod’s in their exalted position, have deemed necessary to remove these posts. Well, I’m a big boy, and am more than capable to deal with such nonsense. So please don’t!

So back to the forward test. I have reset my data and bot to trade off server time, re-calibrated and reloaded. So we are live testing on the EURUSD pair again. I have also re-adjusted myfxbook to reflect the new start date.

I am still concern about this time alignment. After speaking to my broker the change in daylight saving comes at the end of October here. My test data is set for the beginning of October. So I could be in for a world of pain again. Time of day is the most critical part of this bot and the only filter for trades. If it is mis-aligned then it will destroy all this hard work again. [B]So if anyone has any experience in aligning time in historical data to time server I would be most grateful if you can share your experience or solutions.

And now a tune for the lords of the underworld

[/B]<strong>

Hey Bob,

Great thread here, I found it searching for info regarding tick trading.

I downloaded your gift zip that you posted on there, thanks. I’ve added the market overview indicator to my charts and using it in conjunction to a scalping strategy I’ve developed it’s working really well as a filter, very impressed with the improved results.

Although it seems to be working for me in the way I’m using it, I’m not totally sure what it is I’m actually looking at! Sounds strange but also kind of in line with your way of thinking… do it your own way/find what works for you etc… Having said that I’d be really grateful if you could explain in a bit more detail how the indicator works and how you use it also.

Cheers

Oli

So glad you found a use for this indicator bro. Haven’t got much time but I’ll touch base now and explain what you are looking at.

They say a picture paints a 1000 words but here on BP is more like 250 because of quality, so I apologize first for the poor quality of the picture I will reference against

So, to start, inputs are just the one, inpPeriod. This is simply the number of bars the indicator will look back over. There are 4 buffers. Buffer 0 and 1 (which I have highlighted green and red) measure sentiment over this period. Green being bull, red being bear. The formula measures percentage wise each bar over this period comparing the body of the candle to the range (high/low) Then averages them out over the period. When bulls have control sentiment will be < 50%, when bears take over it will rise above 50%.

Buffer 2 and 3 (again lime green for bulls, magenta for bears) measure buying power. It simply’s measures the body of each candle (bulls and bears separate), sums them up over the look back period and them expresses it as a percentage of the total sum of all bodies over the period.

So how to use. Well its a trend finding indicator. In a strong bull trend, buffer 2 will be greater than buffer 0 which will be greater than 50%. In a bear run, buffer 3 will be greater than buffer 1 which in turn will be greater than 50%. I use it to determine when a trend will start.

Part of the theme of this thread is that we are trying to detect when market negotiations have stall. We will see price stall and trade in a narrow range. This indicator detects that because the buffers start intertwining themselves around the 50% line - as depleted in the picture. When the market breaks the buffers will break in the same direction. So in a bull run, you’ll first see buffer 2 break greater than 52% followed by buffer 0. The bear buffers will natural break below 48%. You then use what-ever method you are using to confirm the break and enter.

Now my work is on ticks and the 1 min chart so this is what the indicator has been developed for. The theory should hold true but for higher time frames. Also think of it as combined rsi/stoch indicator when you use it on your charts.

I hope that has helped, always here and happy to answer questions if you need more specific details.

Thanks for filling in the blanks for me Bob! Really helpful.

I use it on a 1 minute chart in conjunction with an indicator that shows volume increases by colouring the candles red or green when there is a significant increase. I look for a retraces to the 50 EMA coupled with a high volume candle close to the top/bottom of the retrace depending if I’m going short or long respectively. By analysing the buffers on your indicator I can get a much better idea if the trade is a good one or not.

If I’m going long the criteria is 0 and 2 pointing up, above the 50 mark but below 58 is the highest probability trade. With just 2 pointing up that would be one step down but still valid. If they are flat, pointing down or not both between 50 and 58 levels this invalidates the trade.

G’day bro’s and bro’ets. Being running my mouth as usual so time for an update where I’m at.

So a couple of live forward test showed how greedy I can get. Greed and speculating don’t mix. So I analysed my results, went back to the drawing board and started afresh. First thing I did was eliminate the pattern types I was looking for. Now I’m concentrating of 6 key patterns as illustrated below.

I redefined my binary rules to describe the relationships of each box and updated the knowledge base to reflect the specific patterns I’m searching for. I recompiled my test data back until Jan 2011 and ran my tests over that period (effectively double the back test period). I redefined my active trading hours to only allow trading only when the following conditions where met, a) less than 10 trades taken - 70% win rate, 10-20 trades 65%, >20 trades 60%.

I’ve also added in bounces of these levels. Where as traditional I look for breaks, many of these breaks can be fakeys and simply reverse. Here is the current trade on picking a top at the end of a bull run on the UJ

and closed in profit

Might as well take advantage of this fact. Final trick, limited the pairs to just 2, my beloved EU and added in the UJ.

And the bot is up and running again for just over a week. As usual here’s the fxbook link BRAB JailBreak System by forexbob70 | Myfxbook and results

So far so good. Been interesting watching it in action over the past couple of weeks. As we know there is a level of inverse correlation with this two pairs. And the market hours and direction are matching up according. So hopefully that’s a good sign. I’ve got the risk set at 1%. But that’s because of the small capital assigned to this live test. Also because of this small size it doesn’t allow for proper MM to be used. Even though risk is set at 1%, trades can range from 0.75% to near 2% in range because of the small pip movement I am chasing. This can greatly distort the profit factor at the end of the day.

So much more work to be done still. Currently resetting my data back to Jan 2005 for back testing. First I want to see if the system can hold true over a much larger period of time. I suspect it won’t.

The theory I’m implying is that even though the market scum and educators would like us to believe the markets are 24 hours, the reality is it’s not. From what I understand 80% of the markets participants ( ie the banks) conducted their business within the first hour of business local time. Not server time from our broker, not GMT. Which goes back to one of my original beliefs, the same players, play the same markets at the same time leaving evidence of PA on our charts. This evidence is probably (my opinion) more valid in the past 5 years with the advent of more automated trading. At least 75% of all transactions are computer generated these days. And since banks trade to balance inventory (cash) not speculate we can use this fact more to our advantage than 5 or 10 years ago - evolving to market conditions.

So thats about all I have to dribble on about now. I see the bot has just said that could well be the end of that little pullback, lets see if I can lose that money just made with a long order.

We’ll see in a few minutes!

Happy pip hunting all

Bob

Oh how good does it feel to be home. Duckin fantastic.

Hello tick chart traders and lovers of pure price action. Seems like we have a population of pantie wearing want-a-be’s polluting the forum at the moment so time to step things up. Also good to know who your friends are.

First an update. Still haven’t automatized the system yet but it has evolved as a discretionary system. Also, thanks to @Lexys, I have studied Ross Hook patterns and added them to my arsenal of tool. Which is what I wish to share with you all today.

Now remember, this is all designed to work off tick charts. But, it will also work on a 1min, 5min, 30min and daily charts. Of course I can’t be bothered pissng around with them when I can be in and out of a tick chart leaving me with plenty of time to play golf, kick the kids and upset pantie wearing conservatives here on babypips.

So what have we got. First up is a Bot. Its what’s called a Trade Panel or Dashboard. When trading manually and discretionary on tick charts you don’t have a lot of time to make decisions. One needs all the information to make ones trade decisions at hand. Thanks to the good people over at fx1.net they have release some freeware called mt4gui. A graphic user interface allowing one to turn MT4 into a more powerful tool. Actually I only like their buttons and check boxes but the freeware has one more powerful feature. It produces ticks internally allow the user to turn MT4 strategy tester into a manual trade environment. Much better than paper testing or ForexTester.

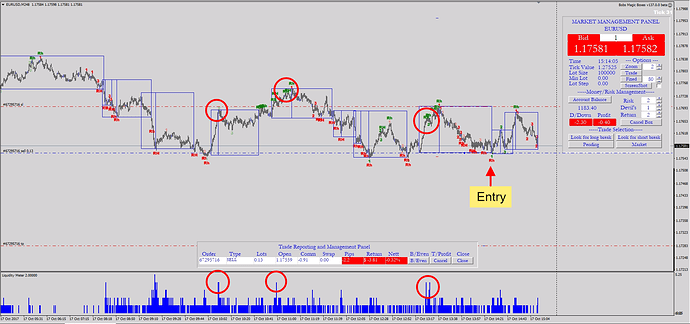

This is what it looks like up and running

First panel on the far right is my market management panel. It gathers all the details and information I need to place and enter a trade. Once a trade is entered, a second panel pops up. This panel gathers all the information I need to actively manage a trade. The bot also draws my beloved boxes.

Just on these boxes. while researching I discovered a gentleman called Nicolas Darvas. He loved his boxes as well but used them in a very different but well documented way. Do take the time yourself to research him.

Next up the first of two indicators. This is one I built myself and is a liquidity indicator. IT WILL ONLY WORK ON A TICK CHART. Price movement on your chart between levels “usually” (used very loosely) starts with and finishes with increased market activity i.e. increased liquidity. We also need a liquid market to ensure our order gets filled at the price we want and to ensure the price will move sufficient to generate a return.Looks a little something like this

Now also on this image is the Ross Hook indicator. This indicator was built by fxdaytrader over at forexfactory as freeware. I have modified the code to the extent that I have removed the alerts. I find the indicator fantastic on a tick chart as it not only provides confirmation for entries off boxes but provides a general trend direction as well. For those unfamiliar with Ross Hook patterns I have also included a very detail PDF explaining the pattern.

Please note Candlestick traders, the Ross Hook is a price action pattern. Blow your candlesticks out your wa-zoo.

So here’s the package.

Bobs Magic Boxes.zip (3.7 MB)

I have organized it so extraction into the appropriate folders is self explanatory.

And thats about that. We’ll see if we can fire off a few trades during the week.

Love price action. Love tick charts. Love those boxes. Hate candlestick traders that call it PA trading.

Here we go first trade of the day.

Nothing really specific to report here except I recognize this price action on a Monday morning at Singapore Open.

The only thing I don’t like about this trade is that it has to break through the 1.18 level. Not to worry. It’s moved in my favor, stop loss has been moved to break even and liquidity is on the sell side. Batter up!

So closed this one out. Price bounced of the 1.18 level. Made a nice little 1.19% of it. Live to trade another day.

Make a bit, add a bit, wash, rinse, repeat.

Ok so second trade for the day. Broken the 1.18 level. Liquidity seems to be bearish. Plenty of room for the price to continue south. I’m reentering short. Risking 2% on a 1:2 risk/reward. Coming up to London open so have to watch for a fakey.

Well got that one wrong. But maybe it was me showing off.

Post trade analysis shows a few mistakes. First big one, trading around a round number ie 1.1800. Next low volatility on a Monday. Third, beating my chest here. Forth time in trade. There could also be a dumb placement of the stop loss but time will tell on that one.

Now, I could have gotton out six times from this trade. Being Monday I probably should have recognized the first finishing volume demonstrated in the liquidity indicator and exited. Then the market gave 4 more exit points to break even at. Finally a reversal signal.

Somehow I feel that this might turn into a low volatility Monday or at least during my waking hours. So I’ll stay out for the rest of the day. Own my decision, accept, learn, move on.

Now who can I go upset!

Great to see you showing your box trades here, Bob. I know these are very dear to your heart and that you have put an incredible amount of work into these.

Obviously, tick trading is not for everyone, and each has to find what works for them. (As you know, I am moving out into the other direction towards daily charts). But I really hope this works out as it is something quite different to the usual stuff we see about trading forex.

I also always appreciate people showing their honesty by putting up the losers as well as the winners!

Although I don’t normally look to trade Monday mornings at all, there is sometimes some immediate follow-through from the Asian session and, like you, I tested the downside. But after a period of total non-movement decided to close it and made a humongously huge 2 pip profit to start the week! Is there anyone more simple than Simon, I have to ask!

Can’t all be winners my friend. The first sign of a charlatan especially here on babypips is you only see post trade analysis of winners. I plan (like in the rest of my thread) to post all my trades this week for documentation purposes. Then, like the revolving door of babypips members probably drift away into obscurity.

Why do people fail at trading, well, they follow the herd and do what everybody else is doing. Never been a follower.

It was a very quite Monday. 39 pip range straddling a round number. No good for the cash machine. Lets hope for a more trending Tuesday.

Here we go folks. Bit of a delay between when I took this trade but you get that. First my bias is bearish on the EURUSD. If I had not been so greedy an thought about my stoploss a bit more yesterday then my loser would of been a winner.

Next, this pair has slipped into a tight range over the past 5 hrs of 21 pips. However it keeps testing the lower range and doesn’t seem to be able to recover to form a higher high. So I’ve entered short on a box break.

Again what looks like a tight stop just follows my rules. If the trade fails I’ll look to re-enter but I will need a confirmation signal. At this time of day one has to remember that USD borrowers become active for the next 2 hours and these dollars have to be converted to the mother currency. If so I will get stopped out but it should also mean I’ll get a better entry and risk reward ratio if my bias is correct.

Time to sit back and enjoy the ride. Now where’s that abandon baby with their hammer.