Selling CAD/JPY - anyone else buying Yen?

I think one thing that will be different about this correction, is that there is a very large amount of “new money” that bought at the highs. People with little to no trading experience- and, when they see spikes in volatility the first thing they think is to panic sell. How long it lasts, and how deep it goes, is anyone’s guess.

The RUT is already down 2.5% before lunch. I’m feeling some pain there as I put on a M2K/MES pairs trade (long 5 M2K, short 3MES). I tried to offload some of that through some put spreads on the big boy RTY. Very engaged and ready for this volatility right now.

Long VIX

Long GME

Long GLD

Short SPY

Short RTY

Short JPY crosses

Short Swissie

Also seeing yields get whacked- so this is the correction folks! Everything behaving how it should.

Risk off, gold up, yields down. Flight to safety.

Looking at CAD/JPY now. Very nice! A little surprised GME is in there! Will be watching that one, too!

@ponponwei I used today’s volatility to exit about 50% of my positions. Corrections have been compressing in size and duration, and, this one could have the makings of a trap written all over it. The risk-on trade is clearly over-extended and in the face of a big intraday sell off, many could take the position that this is the beginning of something much larger. I’m not 100% convinced yet seeing how things closed…

So, I exited my VIX, SPY, RTY, JPY, and Swissie trades. Call me lucky, because each booked a profit.

The VIX was up 12% at one point, and closed up only 7%

The 10Y dropped 2.5%

SPY Qs Diamonds all down .7% (modest)

Volatility got crushed again. Rallied up to that floor @ 19 and then sold off EOD.

To me, it’s more likely that we go sideways from here, or, even crazier that the “pain trade higher” continues.

I think the market is taking all their queues from the Fed still. As long as the liquidity is there, it’s risk-on.

That move in CAD/JPY was significant and you can’t downplay that.

And, the Euro is coming up on some key technical resistance around 1.20.

This could have just been a mini-correction.

As for GME- going to reserve my comments for now haha…Just will say that coming off the heels of BTC selling off, and real volatility hitting global equities, you would have expected to say GME down BIG - 10, 20, 30% - if it truly is one of the riskier plays out there. We’re still making higher lows, and I think that another push to 280 is in the works-- impossible to time when though.

Oh wow that was quick. How long were you holding those trades?

Did you by any chance… also snag some DOGE lol. It is 4/20 hahaha

VIX and SPY < 24 hrs. I got very lucky timing the sell-off today; there have been a few false starts where I was able to manage a scratch or small loss, but today made up for that! My philosophy is- don’t be greedy. No one ever lost their shirt taking profits. I know this is arbitrary, but, there is some objectivity to it. 1 good rule is- if you make 25% of your max profit overnight, book the trade, free up the buying power, and move on. VIX was just straight up calls expy on 4/28 against the index, SPY was too- because implied volatility is so low, I’m fine dishing out the premium and getting aggressively directional.

RTY was an intraday scalp / hedge against my MES/M2K pairs trade. Saw the Russell getting hammered early and had to pick up some short deltas. Was only in that trade for 3, maybe 4 hours. /RTY was pretty aggressive too- there I routed the 2215/2220 put spread for a debit of 2.60 and sold it for 3.60 4 hours later.

On the FX front: Sold 30K CAD/JPY @ 86.19 around 10:50 AM EST then bought it all back @ 85.79 around 2PM EST. I started selling the Swissie last WED - my avg was around .9220, started buying that back today around .9140. Completely flat here now. I think there’s going to be some choppiness over the next few days, and, I’d rather free up the capital to deploy on earnings trades. I’m not quite sure where the dollar moves next either. So, watch the dollar, and watch global appetite for risk.

For GME…hahah, funny you should ask about DOGE. I did open up a Kraken account- but when I saw that I had to wire cash and there was a waiting period, I said F it - not worth my time. I don’t think it’s a bad idea to allocate 1-10% of your portfolio to crypto, fully knowing it’s just gambling.

Any catalysts you’re on the lookout for?

Yeah I haven’t gotten around to doing that. A friend told me Polkadot is now THE altcoin of the day because of its easy staking. I wish I had bought DOGE just for kicks back in the day. I thought I was being smart not falling for that meme crap lol. I could have like you said, just gambled! Ah well. Too late.

Wow, 25%. You’re not lying about not being greedy!

I think you have to be watching correlations and macro moves as to where money is moving.

The best trades right now I feel are going to occur at extremes, where everyone can clearly mark a key level on the chart.

Need to always be watching: Oil, 10Y rates, FX (EURUSD + JPY crosses), global equity indices, VIX, and commodities.

On the equities side, there are some med/longer term interesting plays- VALE/RIO/BHP (iron ore / inflation trade - if you believe in that. VALE chart looks the best to me), NFLX bouncing off 200MA after earnings, I like ERIC in 5G space. We need to see how the tape plays out @ market open, but I’m sure there will be some opportunities today.

VIX is back up around 19, 10Y yields rising pre-market. Futures down slightly.

Did you get in on this?

I did not. Got distracted w/ way too many other opportunities. The stock has done nothing since, which would have actually played perfectly to the trade I’d normal put on (selling a strangle or straddle). The product is big though, and trading w/ undefined risk on a $500+ stock eats up a massive chunk of buying power. The premium just isn’t their either. Implied volatility is at annual lows, so I’d really have to be stretching to make a trade here. Watching the big FAANG stocks though is important as they make up something like 25-30% of the S&P.

I’ve been very busy over the last 8 or so trading sessions as volatility has come back into the market, exposing some opportunities. I’ve posted a few here and there if you check my activity.

@ponponwei Also, as far as the JPY crosses are concerned-- I’ve stayed away from this brutal sell-off on JPY. AUDJPY looks interesting, but, I think that’s more of an AUD strength story than a JPY weakness as it looks like it’s trying to breakout. I’m not really convinced though that the crosses are firing an “all systems go” for risk appetite just yet. You’d need to see the JPY sell of more and some significant breakouts across the board. I don’t know what the catalyst for that is though.

If rates go higher (violently) we’ll probably see risk aversion again and everything get taken down.

https://forums.babypips.com/t/zn-us10y-rates-are-going-higher/534057/2

I’m long rates (synthetically through 10Y treasury future put options)

I also don’t trust the BTC rally.

https://forums.babypips.com/t/btcusd-crypto-analysis-thu-apr-22/531528/3

Long DOGE - it’ll either be a new vehicle for BTC sellers, or, it’ll get taken down too.

There are major signs of inflation everywhere.

https://forums.babypips.com/t/fxc-hg-copper-breakout-freeport-mcmoran/534065/2

I’m long anything in the copper space

Corn and Beans basically just melted up over the last few days…absolute insanity.

Rates are moving higher, while the VIX is slightly lower, and equities are flat.

To me, it seems like there’s some hesitation to see where rates settle after this current sell off and that’s where traders will get their next queue from.

They are pricey. Are you holding any of the FAANG stocks?

Maaaan. I’d like to join the party but I feel I’m too late.

OOH thoughts on lumber???

No- I rarely ever have pure stock plays in my trading account. Maybe 1 out of every 20 trades is a covered call position, but even then I’m only looking to take the money and run.

Check out the term structure of the futures- major backwardation. Actually, the most pronounced of all the commodities I’d say. This is what the FED is queuing on- that the inflation we’re saying is “transitory”. Who knows. Lumber might pause for now, because I think the USD is moving higher! Making a separate post about that so check it out.

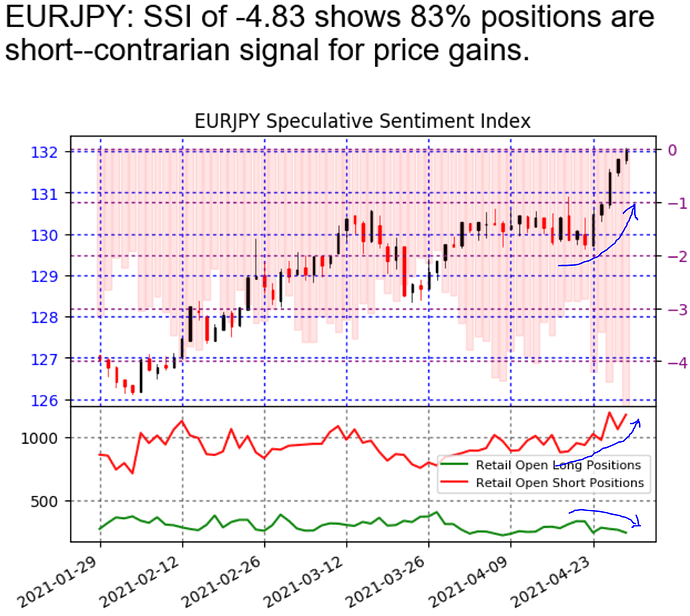

Retail sellers continue to sell heavily into this rally / breakout.

Most sell-side order flow from retail we’ve seen all year as we print new highs.

Short order flow is up something like 50% since last week.

I’m trading this breakout. Look at all the other JPY crosses- is risk back on?

Maybe the single-most important chart right now. Going to write about this in a separate post…

Keeping an eye on risk appetite though the JPY crosses.

Mostly all pairs have either broken out, or, are on the verge of breaking out.

I’m still long EURJPY, playing the momentum trade.

There are some individual stories at play here

USD and CAD massive strength in the last few sessions.

AHA THERES THAT SSI! Ok now for some actual googling lol

Think we might be in for some JPY strength.

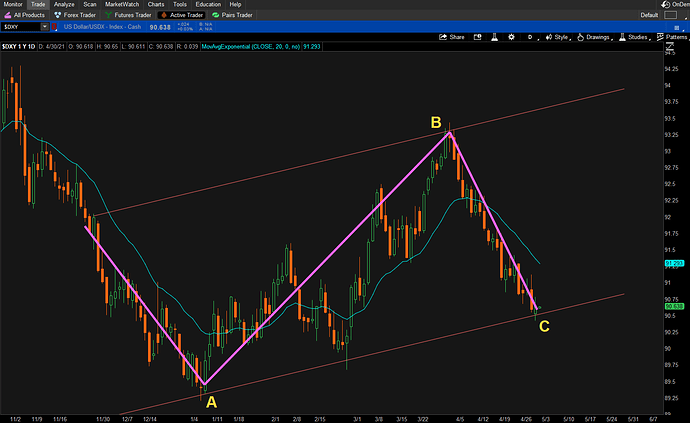

1- Impulse leg up

2- Correction

3- New high

4- Impulse selling, taking out the low that printed the most recent high (KEY)

5- Multiple failed attempt to rally above (2) shoulder, failing @ FIB level

The leg (4) sell-off shows the strength of the sell side here. Buyers were unable to hold the lows put in @ swing (2) and printed a new lower low. The rally from point 4 to 5 then failed. This is a strong head and shoulders reversal pattern.

Retail continues to press long-USD bets and I think they’re really trapped right now.

I had plans of investing in CAD/JPY and so, I came here. But now I think that I am not ready for it because it can get complex with time and it’s not worth the risk. Will keep trading other pairs and will come back here.

That’s more of a surprise! Looks like newbies entering the market are making an impact. I had some other plans but will have to change them now.