Hordane, I have a simple rule

look for new CBL

Hordane, I have a simple rule

look for new CBL

Great work IronHeart! You have confirmed that the 2 contract method works better in ranging markets and the multi-lot method works better in sustained trending markets. If we have a way to determine if a market is trending or ranging, we would know the optimum strategy to apply. For me, determining if a market is trending or ranging is very difficult to do in a consistent way. Perhaps some others will have some good input to this issue. Thanks for sharing your results  This really begins to clarify for me when I should be using which strategy.

This really begins to clarify for me when I should be using which strategy.

Thanks Graviton.

I think the idea of diversifying our trades by using 2 strategies at the same time is good, since it removes the need to predict which to use.

The less guesswork we have the better we can focus on executing our chosen strategy.

It’s not the most user-friendly or mainstream solution and doesn’t quite beat mastery in knowing which strategy to use at which time, but I will go ahead and try this out over the next week or two and report back on my findings.

DodgeV83 can you post your templates you show in your videos. I noticed you are using a template called cleanpivotbb. I also noticed some others in your videos and if at all possible could you post these for me. Thanks

I seem to remember, when I was little boy in the middle of this thread, our master, Tymen, we did draw CBL 3 candles …

So if you miss the entrance of the CBL early you still have to enter two candles, but beware of mid BB, a tilt of mid BB, and also has the tendency to a larger TF (4 to 6 times larger, Graviton dixit).

From there one can find his account, and our master, Tymen, admits he not use the CBL 2 candles as often as it deems necessary.

From there it seems to me, as I already said that everyone must do his views, his trading plan, include the fabulous advice Tymen and make a mix of all, working, testing and retesting, and improve.

We are fortunate to have two masters of the trade with us, and Tymen Graviton, let us listen, watch, search, and even rework OUR PLAN FOR TRADING !!!

Regards, Didier:)

:D! Well said Didier

We are really blessed here with the ongoing tutoring of both Tymen and Graviton! Babypips really is THE example of a great community i must say!

Amazed at all the ongoing improvement still going strong, will it ever end?

Looking forward to Macro and the new moneymanagement, maybe somemore on the cutting of the extreme candle? So much going on its easy to miss stuff:)!

Great weekend to you all!

IronHeart, I’m thinking about how this would work. I think the conclusion that the 2 contract method works better in ranging markets and the multi-lot works better in trending markets is valid and very important. I’m not clear though if there is a way to have our cake and eat it too.

As I see it, it would be the same as putting three lots on when we have a valid CBL, one for multi-lot and two for the two contract. The first lot would be taken off at TP1. The second lot would be moved to BE at TP1 for the 2nd of the 2 contract lots. The third lot would be moved to BE at +50 pips and a fourth lot put on with SL =50 pips for the multi lot. The second lot of the 2 contract strategy would be taken off with profit at TP2. The multi lot now with 3rd lot at BE and 4th lot with SL = 50 pips would continue to run with new lots put on and stops moved up every 50 pips. Is this how you see it, or did you have something else in mind?

Since testing has shown that risking less on entry improves profit, I’m hesitant to risk 3 lots Stop Loss on entry and I’m thinking there may be a way to accomplish this with less entry risk. I’m not sure if this is optimum, but I’ll await your response and that of others and the results of your testing to comment further.

Maybe we need to focus more on identifying a ranging market or a trend. Obviously news plays a big part in this, as well as, times of the day… What you reckon?

Hey all,

since tymen just gave a summary of the 4 types of trades i decided that now is a good moment to present some graphics i made for the final pdf.

Actually I wanted to present all the graphics only to tymen first so that he can tell me what needs to be changed, deleted or added. Thats why i haven’t posted any of the stuff i made so far.

But i think it doesn’t hurt if everybody can give his/her opinion.

So please tell me what you think about the style of these pictures.

Consider this:

Is it easy to see whats going on there? (understandable)

Is everything clearly visible? (no graphical issues)

Do you see typos or other errors? (lettering)

Especially:

Do you miss anything?

Would you like to have something included in such a graphic?

Well yeah, basically what i need to know now is: Do you like the style?

Remember, that it must be a useful graphic for an instrucional pdf/book.

These graphics should act as visual support to tymens excellent explanations.

Of course I’m especially interedsted in your oppinion Tymen, since its your method. ^^

Feel free to tell me what you would like to be changed.

(Well, actually all of you: please feel free to do so)

There is much more but i think i’ll present it bit by bit. When im finished with most of the needed graphics (in my oppinion) i’ll contact you tymen. : - D

Happy to get feedback.

NForex

3,417 replies

187,341 views

mother, the greatest thread of all time !!!

[B]Consider this:[/B]

Is it easy to see whats going on there? (understandable)

Is everything clearly visible? (no graphical issues)

Do you see typos or other errors? (lettering)

[B]Especially:[/B]

Do you miss anything?

Would you like to have something included in such a graphic?

Well yeah, basically what i need to know now is: [I]Do you like the style? [/I]

Remember, that it must be a [I]useful [/I]graphic for an instrucional pdf/book.

These graphics should act as visual support to tymens excellent explanations.

Of course I’m especially interedsted in your oppinion [B]Tymen[/B], since its your method. ^^

Feel free to tell me what you would like to be changed.

(Well, actually all of you: please feel free to do so)

There is much more but i think i’ll present it bit by bit. When im finished with most of the needed graphics (in my oppinion) i’ll contact you tymen. : - D

Happy to get feedback.

NForex[/QUOTE]

Nforex, as usual you amaze us by your style airy, clear and concise.

The only important thing is to have the advice and approval of Tymen, for he alone is the Head of this thread and will eventually detect some possible mistakes.

Congratulations, Didier.

Yes, we could approach it from that direction. We could introduce additional indicators, like the ADX, to generate a rule about whether a market is trending or ranging, but I don’t think that’s necessary. I believe one can tell a ranging market from a trending market just by looking at price action and the mid BB 20SMA at the moment of entry. If the SMA is tilted up more than 2 o’clock or down more than 4 o’clock, we could call it a trending market, if the SMA is flat, we could call it a ranging market. But, looking at the higher TF mid BB at the moment of entry might give a much better indication. Just an idea to think over. Does anyone else have a comment on this?

I’ve made some diagrams that explain my plan a little better. I pre-emptively apologise to Tymen if I’m steering discussions off course.

Over the past few weeks, I have followed both Tymen’s rules and Graviton’s wisdom to carry out multi-timeframe analysis and make entries based on Tymen’s CBL method.

From my experiences so far, it has been very difficult to ride a trend out properly and make large pips due to the short term price fluctuations that occur before price decides to make a determined move up or down.

A large percentage of the time, my analysis is correct - BUT, even if I make a good CBL entry, I have no guarantee about future price action.

The largest issue thus far has been the middle Bollinger Band - a large percentage of the time, price will hit the mid-line and retrace. If my entry is too close to the mid-BB, my 2-lot strategy makes only TP1 before my SL at the entry line is hit.

On these trades, the multi-lot technique works better, since its SL isn’t moved until PA is a reasonable distance away from the mid-BB.

On the flip-side, if my entry is a far distance away from the mid-BB, the retrace often takes out the multi-lot strategy, whereas the 2-lot strategy performs better, since its SL is further away.

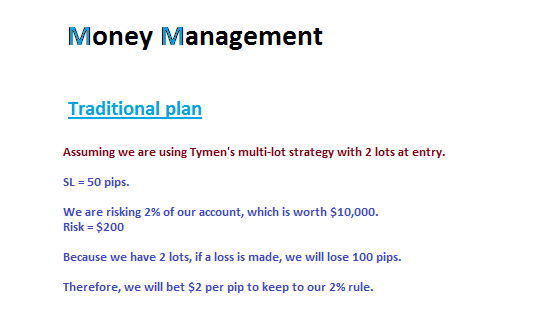

Here is a trade on the EURJPY 4H using Tymen’s multiple-lot entry strategy, which uses 2 lots to enter and exits 1 lot at the first milestone, which I have selected as +50 pips. Pyramiding begins at +100 pips, which is where another lot is added and the SL is adjusted accordingly to only risk 50 pips.

Notice on the above chart that after price reaches +100 (at which point the SL is changed to the +50 point), a retrace occurs and takes the trade out.

In this case, the total profit is +50 pips.

It’s unfortunate that we are no longer in this trade, which carries on going in our desired direction.

Now notice the same trade with the 2-lot strategy.

I’m not saying one strategy is better than the other, their performance over the long term seems to be similar across a reasonable number of currencies.

What I am proposing is to attempt using the multi-lot strategy with the 2-lot strategy as a backup.

Here is some glorified text, explaining how it would be done:

Sorry about the long post.

I will continue doing my research/testing and report back on my findings over the next couple weeks.

[B]Ironheart,[/B]

I was about to propose a similar optimization myself! Would it be possible to stipulate that:

[ul]

We use the Standard 2 Lot strategy when our CBL is drawn from an extreme candle that is close to, or intersects the outer Bollinger Band.

[/ul]

[ul]

We use the Pyramiding Technique when our CBL is drawn from a candle which is close to the middle Bollinger Band, since it will better withstand price fluctuations

[/ul]

Cheers,

xXTrizzleXx

That’s about as simple a set of rules as we could hope for.

Tymen, your thoughts?

I have a question for the some of you relating to the below chart:

I traded this twice on Friday one was a failed trade where I managed to Sell at the low and then just get stopped out.

The new extreme candle formed so i thought i would have another attempt. I went in with 4 mini contracts. Took profit of 2 contracts at TP1, as price continued to fall i had a gut feeling i was going to see my first walk. On touching TP2 i decided to close 1 contract and keep the 2nd contract available for a BB walk. I also moved the last Stop to the mid BB to lock in more profit.

My question resolves around the fact i only had a gut feeling that price would walk the BB after the close of the 2nd candle i obviously had much greater confidence. Basically, how do most of you assess the situation and decide you will wait for a BB walk or take your profit at TP2 and leave the rest?

By the way i got out early as i was going to bed and US unemployment rate was coming out soon after.

Just another side note, this is only demo trade

OK IronHeart, thanks for going to so much trouble to explain this.

Of course, a 50 pip profit on a high win loss strategy isn’t a bad proposition.

This reminds me of the question Tymen asked us long ago, would you rather have a high win loss strategy with a low reward to risk ratio, or would you rather have a lower win loss strategy with a higher reward to risk ratio?

Maybe the best thing we can do is look for an optimum trade off between initial trade risk, win loss ratio and reward risk ratio.

I’m anxiously awaiting Tymen’s contribution. His improvement may be the optimal trade-off we so desire.

Cheers,

xXTrizzleXx

I believed in one of tymen’s video regarding stop loss, he would tell us to take note of the midd BB and outter BB.

As i can see in your diagram, the outter BB and opp BB is expanding still, and is not yet ready for a contraction. Thus we have a probability of a bubble forming and the PA would continue on a BB walk.

What’s more is that the mid BB is tilting down towards our direction of trade.

Do check out the video on it, I’m sure it can better answer your question

Just my 2 cents

Hi Ironheart

I think this graph speaks for itself

Graviton When we discussed his method for adding lots I do not understand why he adds lots of 20 pips instead of lots of 40 or 50 …

I think the answer is here, plus lots starting at 2 to 20 p, the risk is much smaller than 2 lots to 50 p. …

The EA has provided us that Dodge can easily manage the business with the addition of lots.

This is only my humble opinion, but in this case, numbers, and the results speak.

Reviews appreciated, as always …

Regards, Didier.