06.15.2020 Kitty Lesson: Dawwk horse trades

As kitty promised, I made a post discussing “Dawwk horse trades” on the KittyMoku System

A dark horse is defined by Oxford as follows:

In the tradin’ world, a “dawwk horse trade” is samtin out of the ordinary and is not nowwmally expected.

My mentor befoww expressly forbid these “Dark horse trades” because he kitty said they were difficult and low probability.

So what is a dawwk horse trade?

A dark horse trade is samtin that is pegged on mean reversion. The “usual” course for our trades would be trend following. Trend following is revered as the “kitty holy grail” of trading and is advocated by most of the leading traders out there.

Dark horse trades follow spotting “divergences” on a trend and inclinations towards “mean reversion”. To illustrate, we have (1) a hilty trend that usually looks ‘stretched’ or ‘overextended’, then (2) we start to see divergences and (3) we see a follow through in the form of a correction where we make latsa manni.

What made my mentor issue a decree banning dark horse trades?

Divergences aren’t always an indication that the current trade will reverse. Divergences can be resoved in 2 kitty ways: (1) Price corrects / undergoes a ‘mean reversion’ where price goes back to where it “should be”. (2) Price consolidates to ‘shake off’ selling pressure/ buying pressure before resuming the previous trend.

On the concept of “Risk vs. Return”, mean reversion looks pawesome at first glance. Afterall, people love to predict “tops” and “bottoms” and they be seen as the “Oracle of Ooh-mah-heart” but more often than not, people highlight the “return” side of mean reversion trades with a skewed “risk” side.

The “bottom” from which we anchor the “risk” side and achieve that incwedible 1:10 RR ratio is founded on the presumption that the “bottom” is rock solid. What is cheap could become cheaper: what is expensive could become more expensive. No one can outrightly and accurately pick tops and bottoms. You can only call tops or bottoms in hindsight (lookin’ back to da past).

As my mentor often warned us, “BOTTOM PICKERS OFTEN BECOME BOTTOM DWELLERS”

Such a wise old cat that mentor of mine is. Hihi…

The KittyMoku system has its own method for these dawwk horse trades. This is mainly due to the concept of EQUILIBRIUM which is central to the KittyMoku System. The KittyMoku system, apart from providing bias, trend, and signal, also asks: Is price in equilibrium or not? Is price going where it “should be” or izzit gonna consolidate / correct?

The parts of the KittyMoku system focused on this concept of determining equilibrium or disequilibrium are: the (1) Kijun Sen and the (2) Senkou Span B.

When you see them FLATTENING, it means that price has reached a state of DISEQUILIBRIUM (price is NOT in equilibrium)

*Pawesome note: If BOTH Kijun Sen and Senkou Span B tells you price is at a disequilibrium and should correct to levels (preferably the same or close to each other) far away from where it is right now, the bias for that dawwk horse trade is stronger.

A state of disequilibrium is comparable to the concept of “DIVERGENCE” in oscillators and other indicators.

It simply states that PRICE has gone a wee bit of distance from where it “should be” aka from its VALUE.

From hewwe, price can either

(1) CONSOLIDATE to shake off buying/ selling pressure OR

(2) CORRECT to re-establish equilibrium

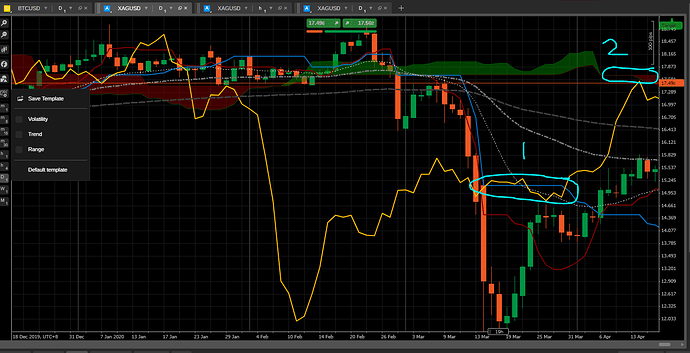

Hewwe is an example of a dawwk horse trade.

You can see multiple times that the Kijun Sen exerted a “magnetic force” calling price to correct and re-establish equilibrium. (1) Overextended move, (2) Disequilibrium, and (3) Correction.

P.S. This DOES NOT happen always coz there is a chance the disequilibrium is corrected by consolidation

So the miwwion dollar question is: Does it work? Yes! Correction to re-establish equilibrium is pawesome! Signals complementing the concept of a correction to re-establish equilibrium is pawesomer!

Did you see my last post on a trade I did with GBP/USD on 06.08.2020? Yep, that was a signal trade and at the same time a dark horse trade!

I was betting on the correction to re-establish equilibrium on the Senkou Span B (Bottom part of a bullish Kumo). A correction bias + signals trade. As you can see, price did not “touch” the “EQUILIBRIUM LEVEL” where the Senkou Span B was but just the same, you can see the “attraction” or “magnetization” happen!

As you can see, the power of the KittyMoku system is that it keeps you out of bad trades. It wont call absolute tops and bottoms for you to get in at once. You’ll get in slightly late. You’ll give up some pips to get confirmation.

That is the tradeoff. You won’t get to the absolute bottom or absolute top on mean reversion trades so you can’t maximize the RRR. But being kept out of uncertain trades until the disequilibrium / divergence is strong enough to warrant a probable mean reversion is good enaff.

There is the pawesome Dawwk horse!

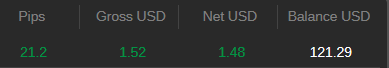

Although it would really take a lot of time and patience to profit from a small account

Although it would really take a lot of time and patience to profit from a small account  And who knows, right? $21 might already be a big help to some people.

And who knows, right? $21 might already be a big help to some people.