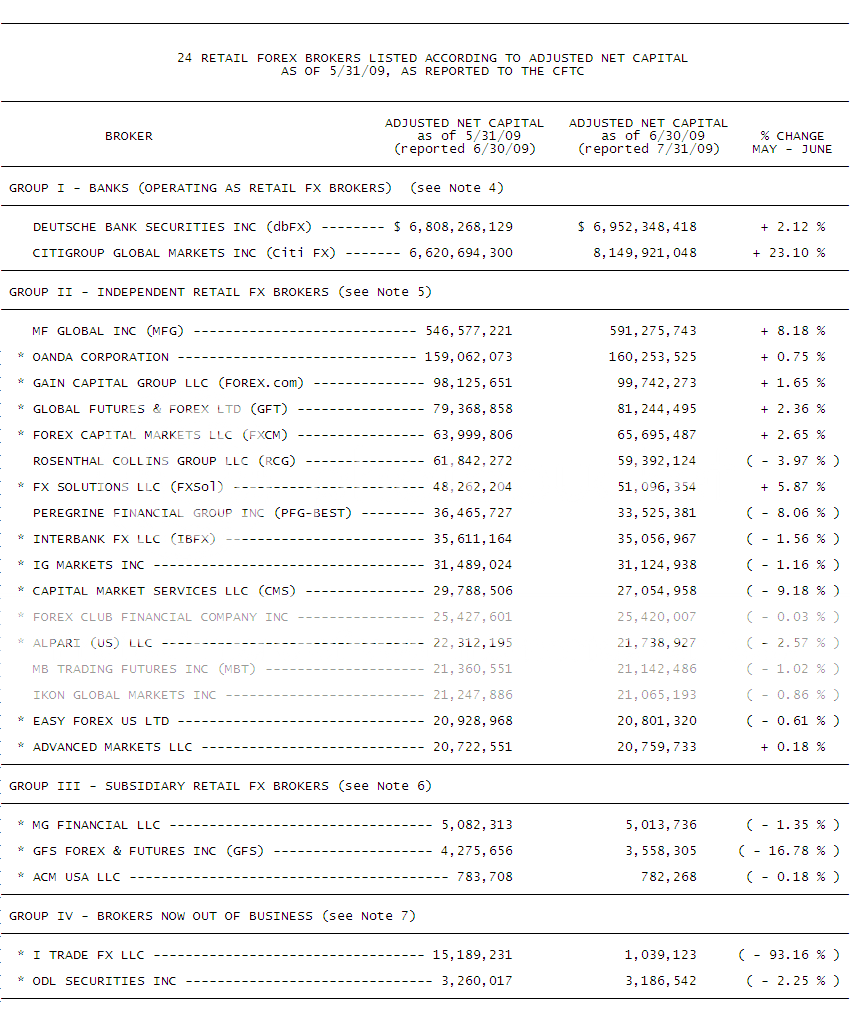

The latest CFTC report, Selected FCM Financial Data, was released on Friday, July 10. This report shows the capitalization of

forex brokers, commodity futures brokers, and certain futures clearing firms as of May 31, 2009.

This latest monthly report is the first to show the capital position of these firms since the CFTC raised the Net Capital Requirement for forex brokers to $20 million. There has been a lot of gossip and speculation about whether certain brokers would be able to meet the new capital requirements, which have been ratcheted up in $5 million steps since last July.

Here is a list of 22 survivors, plus 2 casualties. The Notes (which follow the list) explain the groupings.

NOTES:

B[/B] Brokers indicated with an asterisk (*) handle retail forex ONLY. Other listed brokers handle other securities in addition to retail forex, including one or more of the following: commodity futures, equities, and/or commercial banking.

(2) The CFTC report, Selected FCM Financial Data, is the source for the figures shown above. Here’s a link to the latest report:

http://www.cftc.gov/stellent/groups/public/@financialdataforfcms/documents/file/fcmdata0509.pdf

This report lists financial data for commodity futures brokers, certain futures clearing firms, institutional forex brokers, and retail forex brokers — all in one alphabetical listing.

I have pulled the retail forex brokers from this report and listed them in the table, above. All of these retail forex brokers are considered to be domiciled in the U.S., and are regulated by the CFTC and by the NFA (or other industry self-regulatory authority).

Foreign brokers, not regulated by the CFTC and not appearing in this table, include: Saxo Bank (Danish), Dukascopy (Swiss),

ACM (Swiss), and others.

B[/B] Regarding Adjusted Net Capital figures: In each case, these numbers represent the broker’s own funds AND the funds of all their customers, combined in one total. Unlike commodity futures brokers and stock brokers, forex brokers are NOT required to segregate customer funds. This should (and probably will) change in the future. In the meantime, there is no way to tell from the figures in the CFTC report how much customer money each broker has on deposit.

B[/B] Banks operating as retail FX brokers, listed in GROUP I, above, are separated from the rest of the broker list, because their very large capitalization, as banks, cannot be readily compared to the capitalization of non-bank brokers.

B[/B] Independent FX brokers, listed in Group II, above, are NOT subsidiaries of larger firms, and DO NOT rely on the capitalization of a parent firm to meet regulatory requirements.

These independent FX brokers (if they deal in forex only) must now meet the CFTC Net Capital Requirement of $20 million.

Independent FX brokers which also deal in commodity futures, or other securities, must meet higher capital requirements.

B[/B] Brokers in GROUP III are subsidiaries of parent firms, and rely on those parent firms to meet CFTC Net Capital Requirements. These brokers must have Net Capital of $500,000 in addition to the capital of their parent firms. Subsidiary relationships are as follows:

MG Financial LLC - subsidiary of Rosenthal Collins Group LLC (Chicago)

GFS Forex & Futures Inc - subsidiary of City Credit Capital Ltd (UK)

ACM USA LLC - subsidiary of Advanced Currency Markets SA (Switzerland)

B[/B] Group IV lists two brokers which have ceased forex operations in the U.S.: I Trade FX LLC, and ODL Securities (US) Inc.

Both of these firms have been acquired by FXCM.