1 more winner and results for the day so far

Looks like my data hasn’t updated since 9/27 on myfxbook so I emailed them to see what the deal is.

Right now I’m using 1.42% of buying power and the weekly performance is below. This equates to 1.17% gross return for the week.

I checked out Myfxbook and it looks like your account only exist from January to early March of this year. Have you been keeping it up-to-date?

You may be looking at one links I provided earlier in the thread from when I needed to run two seperate accounts. See this link for the most recent/relevant info:

https://www.myfxbook.com/members/bronztrader/bronzhedgetrader/1632319

Thanks for reading my thread!

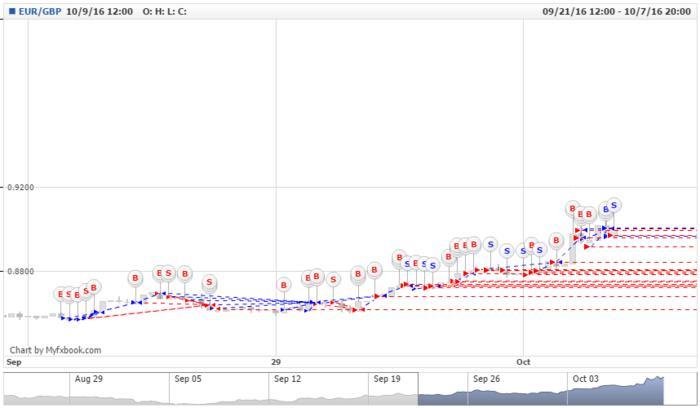

Wow! Some crazy markets out there!! I wish I was able to watch the markets moe closely today cause I missed a ton of action especially in GBPUSD. Finally getting some real volatility in he markets and I was hoping we could get some soon so that I could get more stress testing in. Here is my current drawdown. Looks to be about 3.1%. Comments welcome!

G’day bro.

So remember this statement a few weeks ago. Concerned cause looks like you could be in a world of pain at the moment.

So whats the contingency plan bro?

Mr. Billibob Back in action!

The contingency plan is to keep trading (as is with any move). Despite how those charts look, I have managed to stay very small still. I am only using 4.6% of total capital. Here is my current PL which shows I am only down about 4.04% on total capital.

I am bummed that I couldnt trade through that massive move in the EURGBP and GBPUSD because they were followed with very fast reversals. Would have been some very nice gains

On a more philosophical note and in response to your original comment, I totally understand the risk here with a strategy like this. You are constantly exposed and a large enough move will blow up the account. But to be honest I have reviewed the charts going back as far as I can and I can’t find a move that large (not saying that there might not be one at some point). Ultimately, due to that, I think this is a strategy where you keep pulling money off the table. It is for sure a money making strategy ( and it is very straight forward and simple, “any mug punter could do it” as you say ( and I think that is an advantage!))but there is a very small possibility that you could get blown out.

You need to look at a strategy like this in two ways: 1) here is a simple strategy in which you can start making money right away with but with a very small probability that the account may blow and just start with a very small account and just start pulling gains off the table or 2) continue on the ever lasting hunt through non sense strategies on countless forums and potentially waste years trying to find something that may work (of which I have done). The choice is yours…

Just took one of my biggest positions. Ended up being a small loser but took a ton of risk off the table. Was a winner when I started taking it off but was in a fast moving market.

Is there a closing point for this position? What’s the floating P/L? o_O

Hello,

Sorry for the delay in my response. Been away from the forums for a while, but the max drawdown on this position ranged from about $4-5k. Price ended up coming around and I took some profits out of it. I am still trading this account. Here is a link to Myfxbook account:

BronzHedgeTrader System by bronztrader | Myfxbook

Current profitability is about 31% gains so far this year. Not bad at all since middle of May 2016 inception.

If anyone else has any question, please let me know. I will try to be more active on here.

Happy Thanksgiving!

The worst lies are the ones we tell ourselves. Tell the truth bro and be happy to admit that you got lucky with the US elections. Nothing to do with good trade management.

Anyhow, even though it’s a demo account, glad that things worked out in this case.

Hahah! Billibob back in action!

Well the fact that you are bringing up some sort of outside influence on price shows how different we are in investment philosophy (fair enough). I have accepted that the markets are random (sounds like you haven’t) and my goal is to create strategies that can accommodate for market randomness.

As for luck, there’s no luck involved here. I have simply created a strategy and position sizing that can withstand certain market movements. The market could have gone WAY lower and the strategy still would have been fine. I still had a ton of buying power left. Any time the markets go my way isn’t because of luck, it is because my position sizing was correct to begin with.

On a separate note, I am curious: Even though this is demo, is anyone else showing stats like this on the forums? You really can’t pout at 30% returns over a 6 month period using a completely mechanical strategy. c’mon!

You just keep telling yourself that bro.

So the next question is since your the one putting out challenges, when do you go live?

As soon as I can (as I have previously stated). Secondly, I believe the jury is still out on some stats for you. How have your accounts been performing this year?

you simply cant compare a demo account to a real accoun. im not trying to offend you or put your achivements down or anything thelike; but trust me, comparing real account to demo makes no sense.

its like comparing Grand Theft Auto video game to really driving a car.

How about 40% in 9days?

100% spot on. We can all play with Monopoly money, same as these guys getting great results in competitions.

Its good that you’re doing well, but it really isn’t quite the same when you go live