Geopolitical risks adding to the bullish context for GOLD.

There it is.

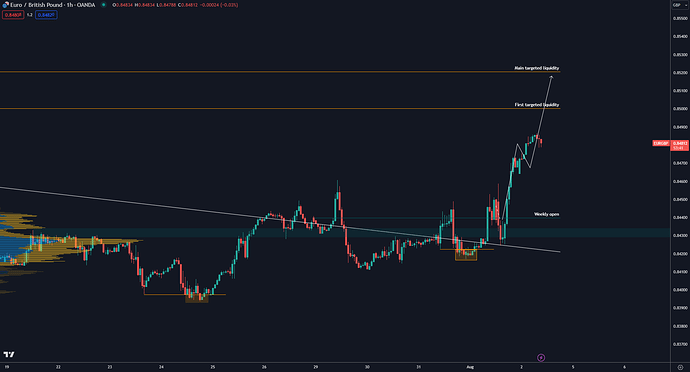

Long EURGBP.

Looking for a 25bps cut from the BoE later today which currently is only 65% priced in.

Which means if they deliver on it the Pound will drop 50 to 60 pips across the board.

Obviously if they don’t cut the opposite is true, but there’s a decent possibility they deliver on it.

Target 0.8520.

Still there.

We got that 25bps cut from the BoE earlier but fairly muted reaction.

Bailey’s presser also wasn’t dovish enough…

So not getting much fuel from the fundamental side of it.

But technicals are not too bad here, so…

Giving the trade a couple more hours to decide what it wants to do.

True, but it’s not a recession… until it is.

And the yield curve deinverted yesterday which is one of the most consistent, reliable, and accurate signals of an upcoming recession.

So that’s a scenario that needs to be factored in now.

Nothing actionable, but…

Seasonally the next two months are also the weakest part of the year for equities.

In other words…

Don’t hit that buy button too hard on equities like the S&P500, the NASDAQ, and such.

At least for a little while.

Just some thoughts.

This is NOT a recommendation to short.

Just one to be cautious about being long or about trying to buy the dip.

Keep an eye on the geopolitical headlines from the Middle East this week guys.

Feels off, and if something goes wrong, you know…

GOLD is where you want to be.

And…

Just saying.

Forgot to mention.

Seasonals also supportive of GOLD upside over the next couple of weeks:

Not an extremely consistent pattern.

But up 12 years out of 15 is statistically relevant.

Long EURGBP.

Technical setup on the chart with that break in market structure.

While being backed by the soft inflation prints in the UK.

Target 0.8640.

Still there.

But…

From a technical point of view looking for an hour candle close back above the weekly open within the next couple of hours.

If it doesn’t do that…

We can cut the trade.

Quick contextual macro update on GOLD guys.

China’s demand is back.

And that was the catalyst to get it above 2500.

Once again…

The whole context remains VERY bullish for the precious metal.

With 2500 done.

2600 is next and on its way.

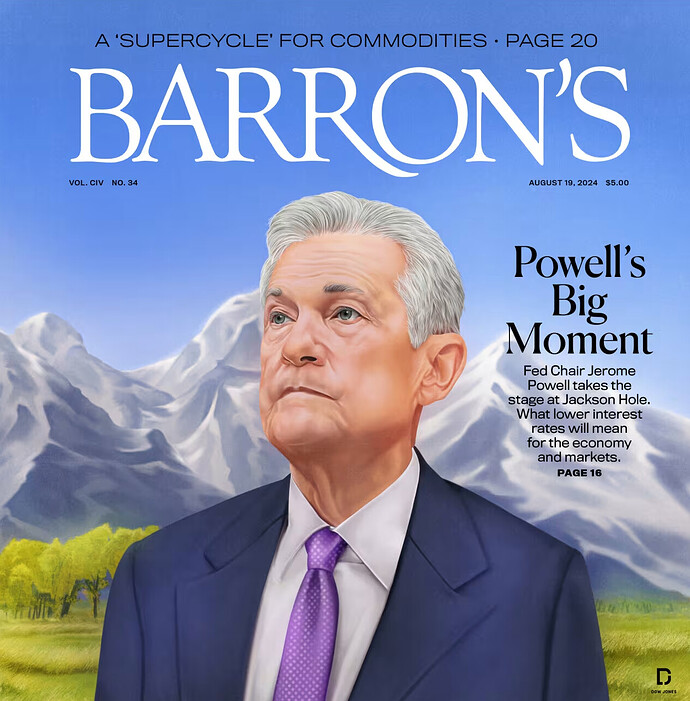

Keep in mind tomorrow guys there’s a VERY important speech from Powell at the Jackson Hole Symposium,

Honestly, with already more than 100bps of cuts priced in for the rest of the year the risk tomorrow is that Powell underdelivers on expectations.

So watch for a potential squeeze higher on USDCHF and USDJPY after his speech.

Why?

Because if he doesn’t deliver on the dovish expectations then US yields will reprice higher, and that will attract funds back into carry trades like. USDCHF and USDJPY longs.

If I see a decent trigger to get long one of these two I will share the details with a chart and all, as usual.

No trigger here as Powell on Friday turned out to be quite dovish.

Basically, his words pointed to a new phase for the FED where inflation is NOT the key variable anymore and instead now the labor market is the priority…

That’s nothing really new to be honest.

But certainly doesn’t help the Dollar anyway.

So no trigger there, yet.

Short NZDUSD setting up.

Testing the water for a Dollar reversal this week, why?

Couple of reasons…

Seasonality is bearish risk and bullish USD in September.

The market has overpriced FED’s easing expectations a bit.

And we’ve got a small failed breakout of multiple important highs of the year on the chart.

With that in mind tho…

Small position as it’s a counter trend trade.

Target 0.5980.

Stopped out.

Picked the wrong Dollar pair.

EURUSD would have been better.

Long USD again.

This time on USDCHF.

Same logic behind the USD longs earlier this week.

Seasonality ahead is bullish for the Dollar and FED’s expectations for the September meeting are too dovish with still some chances of a 50bps cut priced in.

And on top of that…

Technically most USD pairs are reacting and faking out from very important higher timeframe levels:

So that triggers me into Dollar longs again.

Target 0.8750.

DXY has pulled far enough away from its 50DMA to soon revert back up to it but there’s a chance that DXY first wants to test the psychological 100 level before that happens. For USDCHF, that could mean price first taking out the recent low (marked in your chart) before heading up.

Let’s hope I’m wrong and this trade works out. If not you’ll get another crack at in a few days ![]()

Whether DXY / USD bottomed a few days ago or will bottom in a few days from now it looks like it wants to head upwards up until around the September FOMC before rolling over into the next leg down. Could be a good short term opportunity either way. Let’s see how it plays out! ![]()

Having said that T-bonds and future rate expectations are pointing to a secular USD decline for a whole host of reasons I suspect (JPY fiscal time bomb, spreading bank contagion from fallout of JPY carry trade unwind, US fiscal dominance, onset of a global recession, sovereign and household debt levels in G7 and some G20 economies forcing dovish central bank policies and potentially various forms of stealthy QE etc etc etc).

Thank you Gavin for your insights.

I’ll take this ![]()

Also NFP next week so that will be an important variable in this.

Great point about NFP.

I actually have a small (unleveraged) short position @0.9125 (when price made a lower high end of May) which I’m planning to ride down for as long as my thesis holds. But if price takes out that recent low, I’ll join you on the ride up until around FOMC then add to the short position for the next leg down. ![]()

For context, my thesis is that I’m long term (several years in the future) bullish:

- CHF - I believe it will be the most stable major economy/currency

- AUD - we entered a commodities bull market in 2020

- NZD - same as AUD

- Brazilian Real and the Brazilian economy - undervalued commodity based economy

(note: even though CAD is also a commodity currency, Canada has one of the highest levels of sovereign and household debt, which will probably force the BoC to ease / QE during a commodity boom over the coming years) - XAU - all of the above and below

- XAG, XPT - I believe these are the 2 most undervalued assets on the planet

- XPD - undervalued asset that will do well in the commodities bull

Long Term Bearish:

- JPY - At 264% debt to GDP, I believe it’s on the verge of a fiscal crisis

- USD - At 122% debt to GDP, $35 TUSD in debt is costing $1TUSD /yr in interest payments alone, making it the single highest government outlay (unsustainable). JPY will also force a USD devaluation to ease the pressure of the JP fiscal situation

- EUR - Several European countries are weighed down by very high levels of sovereign and/or household debt which will end up tying the ECBs hands for any rate hikes

I’m also in many other non-FX commodity related investments which I won’t muddle this thread with. ![]()

Disclaimer: none of my opinions should be taken as financial advice. Do not take investment advice from anonymous internet tards like myself, please do your own DD.