so u don t use vol, u just use weis wave? i have bought the indi a while back, displays also the vol of each wave in numbers but i ended up not using it.cool stuff. how do u know it s accumulation and not distribution using weis wave?

I used to look at both waves and the volume on individual bars but I struggled. Especially on intraday timeframes, it’s hard to tell what is high volume etc because volume trends throughout the day. I find that I can see more clearly using the Weis Wave on multiple time frames. Instead of looking for a “no supply” bar, I look for a “no supply wave”. Generally, the spread of the bar, the quality of a move, the grouping of closes and the angle of ascent tell me more than I was getting from the volume on individual bars.

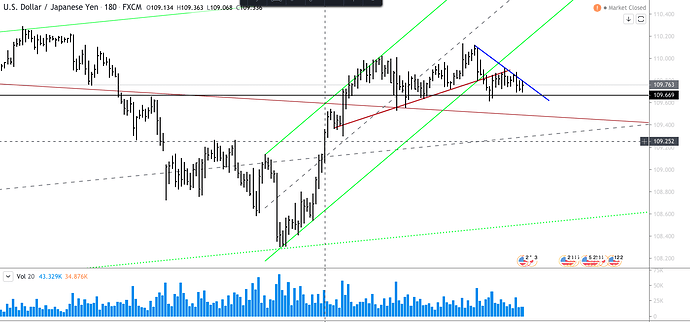

This shows the trading range the pair is currently in after the extended move up. Notice the quality of the move down on all the bars highlighted with arrows. These bars show what David Weis would call “ease of movement”. Compare that with some of the grinding up moves.

In Wyckoff’s original course there were no springs and upthrusts. He references only one pattern, the hinge. We can see a hinge forming on this timeframe. Price is coiling between a supply and demand line. Wyckoff expected a strong move out of the center of the hinge.

Given that overbought, exhausted look of the higher timeframe and the ease of movement downward within this trading range, I’m looking for a short coming out of the hinge formation.

I’m out of this trade with nearly 150 pips. I know I struggle taking profit when I see a strong up move like this that I’m in. We are running into a pretty logical resistance area and we are showing the biggest buying wave anywhere on the chart by a pretty large factor.

This may be the fuel me need to move higher but a correct to test is likely.

We didn’t get a strong move out of the hinge but we leaked out to the downside. We had our first two closes back in the trend channel and our steep demand line has been broken. We also had the highest selling wave anywhere on the chart.

I have orders in to go short but if if we break back above the trend channel I’ll re-evaluate. We are currently in a tight trading range and could continue to drift sideways. If price moves back to the middle of the range, I may look for an upthrust to enter.

I got short prematurely here. I was looking for a classic upthrust. This is when price moves strongly above a clearly defined trading range, then reverses back in the range. Aggressive longs will buy these breakouts. When price starts moving in the other direction, they get trapped. If sellers can push price through the other side of the range, a lot of these traders will sell their long positions, adding more fuel to the fire.

There was a ton of selling during the last down wave but very little progress. The current up move looks strong, with good easy of movement. If there is no follow through then it’s more likely there is a supply imbalance and we are going down.

“Successful tape reading is a study of Force; it requires ability to judge which side has the greatest pulling power and one must have the courage to go with that side. There are critical points which occur in each swing, just as in the life of a business or individual. At these junctures it seems as though a feather’s weight on either side would determine the immediate trend. Anyone who can spot these points has much to win and little to lose.” (Studies In Tape Reading, R.D. Wyckoff p. 95 - borrowed from David Weis)

Springs and upthrusts are my favorite entries in this method because the risk to reward is so good. You don’t want to have to pay a lot to find out you are wrong.

highest vol of the day closing well off the highs, but like u said u need the confirmation of the upthrust closing back in the range. that is usually markin the end of distribution. climactic vol, bearish react, start of the range (distribution possible) and again selling of the highs with vol increase confirms so far, if this candle closes inside the range i d consider sellin(not to be takin as trading advice, just my opinion)

Still not sure its ready to go. I’ve moved my stop to 1.3310.

well, it s getting late, volume starts to die off after 16 gmt, asia usually offers a retracement, or in this case some absorbtion of longs if there are still people trying to buy UC, but i doubt that, they ussually do the fake break after they ve finished accumulating or distributing in this case. since tommorow is NFP, we might see it move then. but my money is on short for now unless something changes volume wise.

from a 5m stand point for example, i would ve preffred that high vol to be at the top, the probabilities are way higher when 1hr and 5 or 15m show same thing regarding vol, but even so we see an increase, and then the high vol, but the result is still bearish candles on lower vol. i don t think it s gonna move till tomm nfp but who knows, if wasn t so close to asia i would ve considered takin a short, 10 pips stop above the high to allow for some small fakes and wait for the news tomm, but i won t trade it till monday or maybe tomm after the nfp an oportunity will present itself using the news as catalyst. cheers

I exited my short at breakeven last night. I’m having issues with thinkorswim right now so no charts.

I’ve limited myself to 5 forex pairs. My main trading chart is the 3 hour but I start my analysis of each pair off the weekly. The five pairs are:

USD/JPY

AUD/USD

USD/CAD

GBP/USD

AUD/NZD

I picked these five because they are somewhat uncorrelated (as best I could manage) and “look good” to me - meaning I can draw lines that make sense and seem to be respected. Here are my weekly charts

I got short the AUD/USD after we took out the low of this bar. I haven’t seen the downside follow through I was hoping for. So far the supply line has been well respected.

I’m also short USD/JPY. I got short when the low of the tine bar that kisses the blue line was taken out. I read this as a “no demand” bar in an area we would expect to see buyers. We have an attempt at a spring that resulting in 24 hours of closes grouped in a narrow range. Also note the behavior on the weekly chart during this last rally away from 105. The angle of ascent is low. It looks like a struggle.

This method is interesting, LVMexchange and sent an article about it and it is interesting.

It aims to act in line with the forces that move markets (supply and demand). It is not about predicting in which direction the market will go. It is just about attending to what these forces do and waiting for them to confirm a movement.

Are you still using wyckoff techniques?

sorry but what does imbalances mean