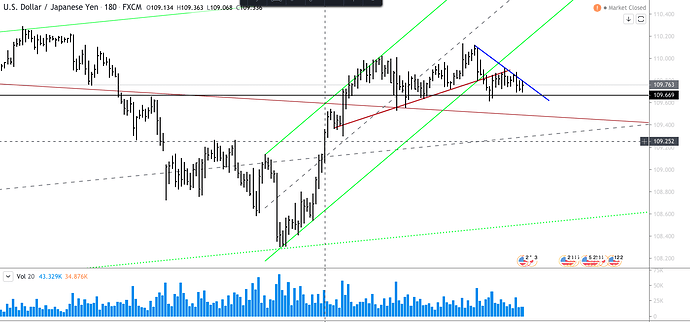

I’m also short USD/JPY. I got short when the low of the tine bar that kisses the blue line was taken out. I read this as a “no demand” bar in an area we would expect to see buyers. We have an attempt at a spring that resulting in 24 hours of closes grouped in a narrow range. Also note the behavior on the weekly chart during this last rally away from 105. The angle of ascent is low. It looks like a struggle.

This method is interesting, LVMexchange and sent an article about it and it is interesting.

It aims to act in line with the forces that move markets (supply and demand). It is not about predicting in which direction the market will go. It is just about attending to what these forces do and waiting for them to confirm a movement.

1 Like

Are you still using wyckoff techniques?

sorry but what does imbalances mean