This is a very common and difficult issue for many traders. It is also totally understandable!

It is clear that if we are interested in trading markets then we will also be very interested in learning about them and following their developments. But if we follow what is going on in these markets then we are naturally also going to form opinions and views on what is happening and what is likely to happen in the future. We are humans, therefore we have logical thought processes that have been deeply embedded in our thought mechanisms.

But we also know that our knowledge of factors affecting prices is incomplete and that others have different views, even opposite views.

If we place anything on our charts, whether it be indicators or various lines, then we have to accept that their only purpose is to tell us what the majority of other people are actually doing. Not what they are thinking but where they are actually placing their money. . And we need to remember that people don’t place trades because they think the price is right, rather because they think price should be somewhere else, either lower or higher.

So the sole purpose behind us engaging in Technical Analysis is to tell us what the majority is doing. And until that agrees with what we personally believe we have no justification for placing the trade. Otherwise we are just competing with our own TA, which is not very logical at all!

So, you are correct, it is fine, and even inevitable, that we decide what we want/expect to see, but we actually trade when we see it happening. The difficulty is in the patience and discipline and the strength to avoid the FOMO!

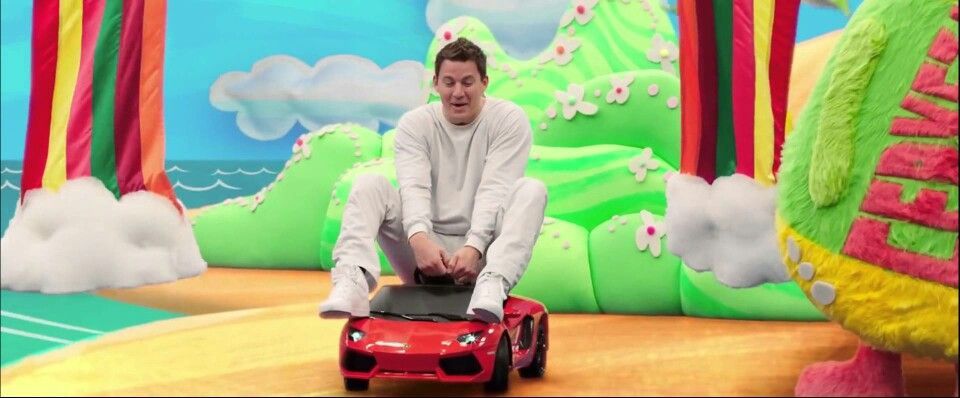

It is clear that most new traders lose money and seek the reasons for it in their strategy and therefore keep changing the strategy. But, as you have observed, the problem often lies in our own mindset regardless of what strategy we apply. And until we accept that and address the issues there (as you are doing!) we are not going to find the right strategy, unless it is a mechanical system that disconnects our brain from the action. I haven’t yet seen any retail trader that has successfully found such a system that works long term consistently (maybe it is out there somewhere, in which case I look forward to a nice pina colada with you on a hot beach somewhere discussing the various colour options for our Lambos  )

)