Here is a link an MT5 link

Free download of the 'IBS' indicator by 'GODZILLA' for MetaTrader 5 in the MQL5 Code Base, 2012.02.03.

I personally prefer the manual computation of the IBS on the specific daily signal bar to the indicator as the calculation is relatively simple.

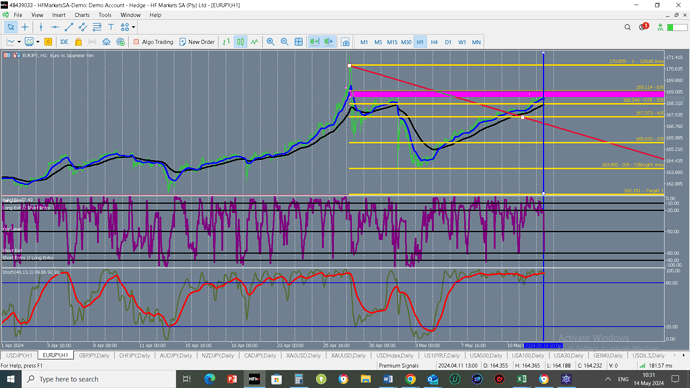

I have dropped the time frame to H1. There is confluence of a key level with Fibs at 156.00-156.20 zone, EMA 13/48 are about to cross down. Williams %R and Stochastics also confirm the overbought condition.

Okay, thanks, but not a chart that I understand, I will stick to RSI when I need to use an oscillator.

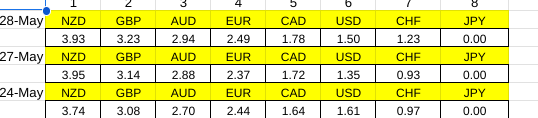

The last time NZD was number one was back in February

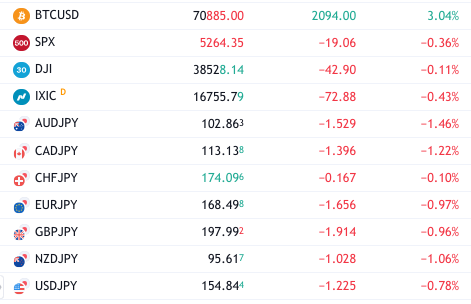

Staying short the Yen was the play of the week.

Note, that I will be traveling for the next few days, my next post will be on Wednesday

Pretty much the same, I wonder if the USD spike weaker on news will rebound in the coming weeks, anybody?

The AUD and NZD have a firm grip on #1 spot, however.

On reflection: the so called BoJ intervention can hardly be seen on the JPY.

Not much has changed while I was away

Note: My NZD numbers for Thursday were incorrect, the numbers below are correct ( maybe ![]() )

)

For a few years now, the partner of a friend I occasionally visit has asked me what is my top tip for the forex market, as he shows me in through the front door. He’s an ex-business owner but knows nothing of forex.

For years I have been saying while passing him in the hall, “Just keep selling the Yen.”

US markets closed today, no change in rank order

No change, market is in a slow crawl upward

DOW leads markets lower, but relative strength continues to be in the NASDAQ , that tells us this market remains in Risk-On mode

Stocks down, but all Yen pairs are up for the week, CHF made the biggest

a sea of red but look at Bitcoin, back above 70K