I don’t fully understand the fundamental reasons behind the market’s extreme volatility in both directions, but from a technical perspective, January was a good month.

AUDJPY +170 pips

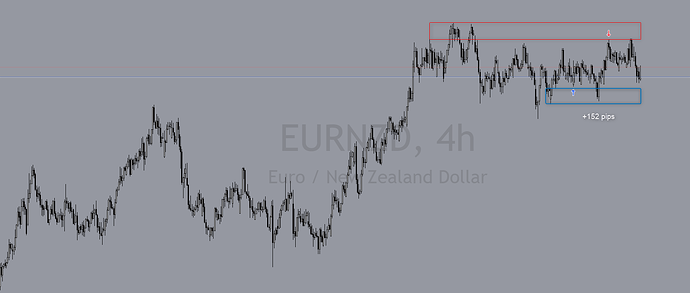

EURNZD +152 pips

NZDUSD +85 pips

GBPJPY +100 pips - TP2 @ 196 pips

AUDCHF +30 pips - TP 2 @ 62 pips

AUDUSD -30 pips

CADJPY -60 pips

EURAUD -52 pips

GBPCAD -85 pips

Gold was the big winner in January, following the uptrend of the 50 day average to new all-time highs

Long term, if you held through the 4-year range-bound market of 2020 to 2024 , you are being well rewarded for your patients. Holding gold is part of my wealth building strategy

you are being well rewarded

Dennis, may I please ask you what kind of initial stop (or, exit point) you prefer to use with your Strong-Weak Analysis? Thank you.

A simple strategy would be a 100 pip stop, then take profits on half your position at 100 pips, then put a breakeven stop on the remaining position and let it run

Yen continues to kick but

CHF/JPY short became our top trade on January 29th and is now up nearly 400 pips

Hi Dennis, thanks for the thread! Would that be kind of “for all pairs” or an average, or would you vary it according to their ATRs or anything like that?

Some pairs move more in a day than others, for example, GBP/JPY, it would be hard to play this one with just a 100 pips stop unless there was some price support to protect your stop

Yen is still in control

One of the slowest days you will ever see in stocks, especially after a three day weekend

Yen shows no sign of ending this run