Hi, Nice to Hear from Tunisia…

How are you Guys?… Keep Safe

IGNORE WHAT EVERYONE IS SAYING.

YOU DONT NEED Blah Blah Blah… and more Blah Blah Blah…(That you already know).

Let Me Get To The Point:

It’s best to start with such a small account as Yours. £50 to £100

IT’S NOT THE ACCOUNT SIZE THAT MATTERs.

IT’S how good you are as a trader. (Remember I said Ignore everyone Else!)

Let me give you an example, often I start with 5 pounds account and take it over 50 pounds, and then I can open larger positions…

All in all I don’t get far, however I LEARN to capture lots of PIPS.

Before a strategy you need to have a plan in Forex.

FIRST STEPS

Get Tradingview account.

USE IC BROKER FOR ACCOUNT (I Have been through many, these guys I found best and offer almost Zero Spreads)… USE Australian as they still offer leverage 1to500, use Sharia compliant (Islamic) account which means you will not be charged overnight charges for holding positions.

Platform… Don’t use Meta Trader. (Remember I said Ignore everyone Else…. Just ignore them all….)

USE Ctrader… It’s far more user friendly and intuitive. Its Like Apple Iphone Vs Microsoft (Meta)

START ON DEMO FOR 3 MONTHS. (This is the right way of doing it)

But I know you must be eager to Enter the market, that’s understandable…. So Go Ahead….

WHEN YOU HAVE (With Certainty  ) blown your $75 account… don’t be UPSET…… Everyone Does…. And sometime the Market Teaches you Not to Mess with it. After Blowing then please refer back and start the process again.

) blown your $75 account… don’t be UPSET…… Everyone Does…. And sometime the Market Teaches you Not to Mess with it. After Blowing then please refer back and start the process again.

If you can last in the market over 90 days, chances are you will find the Treasure Eventually…(refer to Pic… always keep it in your mind)…maybe within a year… Don’t Give UP…. Insha Allah (God Willing) This will change your Life. (Keep ignoring everyone else…I mean if they discourage you and say its too difficult or you need lots of capital… No You need the SKILLS and a bit of guidance)

To The Point:

Plan… MAKE MONEY (I Said Ignore everyone…  …. We’re all here to make money)

…. We’re all here to make money)

HOW… Be a successful Trader.

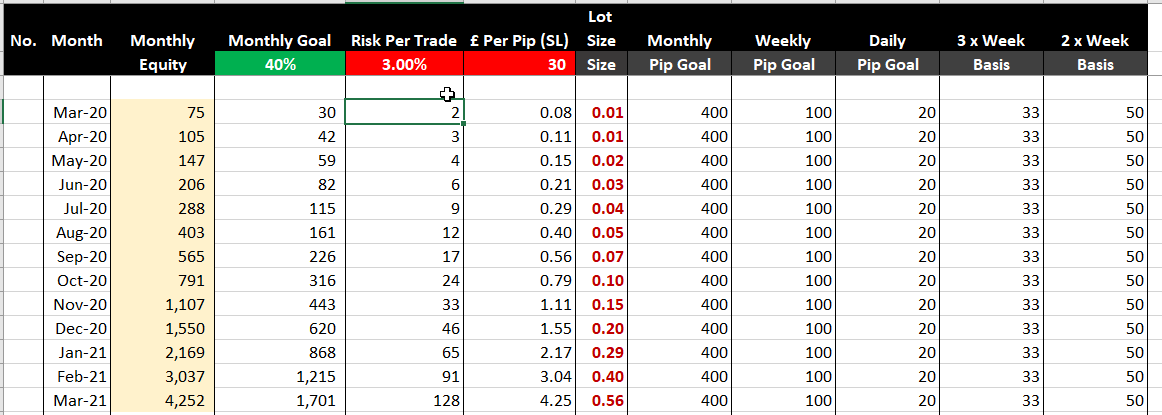

HOW… USE MONEY MANAGEMENT (See chart and replicate on excel and use it everyday)

HOW… WEEKLY GOAL TO GET 100 TO 200 PIPS

(Even Less is fine, but Trade with a Set Goal… refer to chart to understand why and how)

How … Using Forex Strategies to Achieve Target Pips Weekly (I will give more details…. So wait….)

What Pairs … Just stick with the Majors…. This will mean you have less to focus on, quicker to understand them and get better in predicting their movements.

Journal All Trades …. Use The TradingView Long/Short tool to mark positions so you can refer back to learn later. Also start spreadsheet for the Journal. Highly recommend taking snapshots of before & after for reference late.

Strategies & Quick Market Structure (Based on Day Trading/Short Swings)

Identifying the Trend of a Market i.e Long/Short is the Biggest Part Of Trading.

Always Trade in Direction of Trend (Counter Trends for Pros, or you will lose sooner)

Higher Highs & Higher Lows on 4H chart means UpTrend. And when top reached or Lower Lows start Forming and Lower Highs… That’s started a Down Trend.

Entries are Not Random. You have to calculate and work out where market moves are happening & Why.

On 4H chart, lets say AUDUSD…

Highlight Major S/R based on previous 3 months – 2 years Data .

Highlight Supply/Demand Zones Where market makes big moves from.

The Reason that The Market moved that 70 pips or so in 4Hrs is because Banks & Institutions traded at that point. So we want to trade with them. The Good Thing is, Often market repeats itself by reacting at those Levels.

Now wait for the Market to reach another Significant Level (zones Where big moves happen from), and look for entries.

Trade with Reward to Risk 2:1. E.g 30 Pip SL and 60 pip TP. 30 to 40 Pip SL for beginners is good, gives room for market to move. Eventually you can tweak this down.

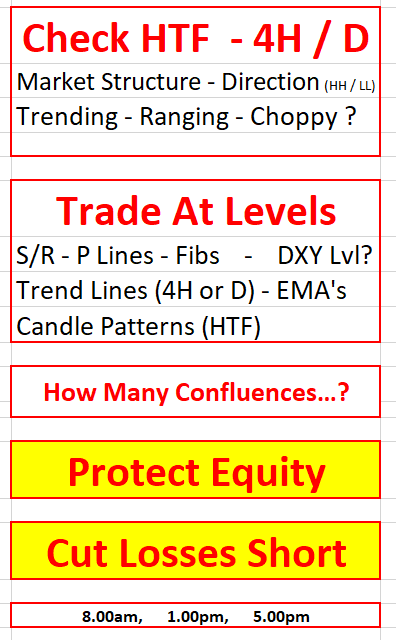

Before Trading – Have a Checklist to tick Off. If Criteria Met, Then Enter. (See my check List attached)

When Trading – Trade with Confidence. You will Have Wins and Losses. Even if you have Less than 50% winnings, you can still be successful if you stick with R:R.

Use S/R, Trend Lines & Fibs etc . The More confluences, the Better Trade probability.

All The Indicators are useless (hopefully by now you are ignoring everyone else). Idicators are useless because they are lagging and they will tell you … ah… you could have entered here … duh… its too late now.

Learn to Master Support and Resistance, Supply & Demand Zones… think like a Banker… they will only BUY / Sell at certain levels, and they make the moves happen.

So look for say 4 or 5 trades a week. Good Quality Trades.

Wait for them. Execute with Precision.

Resources

You Tube: Learn the basics, go through lots of videos on

Support & Resistance, Candle Stick Patterns… learn what they are showing

Fibs, Trendlines, Market Structure.

Sorry I’ve Run Out Of Time… I Couldn’t get through everything… structure above isn’t so greate either… I didn’t plan to write so much…

Also just realised the system didnt let me post more attachments as promised above… so get in touch with me and i can forward by email…

If I get your response I’ll get back with more details.

Anyway good luck, keep safe from the Virus.

Naeem

!

taking money off Mum & Dad…

taking money off Mum & Dad…