Thank you for sharing. Very good suggestions

Same technique here Donovan.

EURUSD, daily chart and just HMA. Had the exact same entry and exit prices as you did.

Hi, Nice to Hear from Tunisia…

How are you Guys?… Keep Safe

IGNORE WHAT EVERYONE IS SAYING.

YOU DONT NEED Blah Blah Blah… and more Blah Blah Blah…(That you already know).

Let Me Get To The Point:

It’s best to start with such a small account as Yours. £50 to £100

IT’S NOT THE ACCOUNT SIZE THAT MATTERs.

IT’S how good you are as a trader. (Remember I said Ignore everyone Else!)

Let me give you an example, often I start with 5 pounds account and take it over 50 pounds, and then I can open larger positions…

All in all I don’t get far, however I LEARN to capture lots of PIPS.

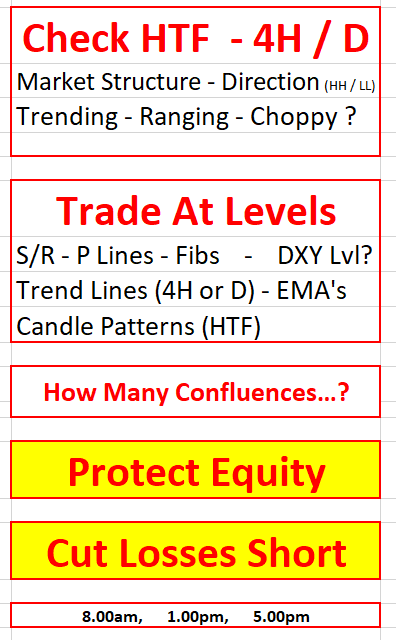

Before a strategy you need to have a plan in Forex.

FIRST STEPS

Get Tradingview account.

USE IC BROKER FOR ACCOUNT (I Have been through many, these guys I found best and offer almost Zero Spreads)… USE Australian as they still offer leverage 1to500, use Sharia compliant (Islamic) account which means you will not be charged overnight charges for holding positions.

Platform… Don’t use Meta Trader. (Remember I said Ignore everyone Else…. Just ignore them all….)

USE Ctrader… It’s far more user friendly and intuitive. Its Like Apple Iphone Vs Microsoft (Meta)

START ON DEMO FOR 3 MONTHS. (This is the right way of doing it)

But I know you must be eager to Enter the market, that’s understandable…. So Go Ahead….

WHEN YOU HAVE (With Certainty  ) blown your $75 account… don’t be UPSET…… Everyone Does…. And sometime the Market Teaches you Not to Mess with it. After Blowing then please refer back and start the process again.

) blown your $75 account… don’t be UPSET…… Everyone Does…. And sometime the Market Teaches you Not to Mess with it. After Blowing then please refer back and start the process again.

If you can last in the market over 90 days, chances are you will find the Treasure Eventually…(refer to Pic… always keep it in your mind)…maybe within a year… Don’t Give UP…. Insha Allah (God Willing) This will change your Life. (Keep ignoring everyone else…I mean if they discourage you and say its too difficult or you need lots of capital… No You need the SKILLS and a bit of guidance)

To The Point:

Plan… MAKE MONEY (I Said Ignore everyone…  …. We’re all here to make money)

…. We’re all here to make money)

HOW… Be a successful Trader.

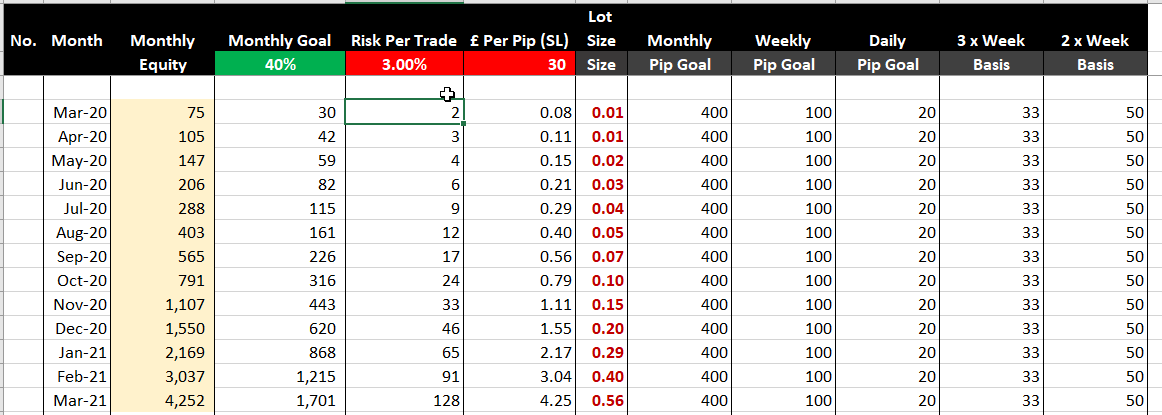

HOW… USE MONEY MANAGEMENT (See chart and replicate on excel and use it everyday)

HOW… WEEKLY GOAL TO GET 100 TO 200 PIPS

(Even Less is fine, but Trade with a Set Goal… refer to chart to understand why and how)

How … Using Forex Strategies to Achieve Target Pips Weekly (I will give more details…. So wait….)

What Pairs … Just stick with the Majors…. This will mean you have less to focus on, quicker to understand them and get better in predicting their movements.

Journal All Trades …. Use The TradingView Long/Short tool to mark positions so you can refer back to learn later. Also start spreadsheet for the Journal. Highly recommend taking snapshots of before & after for reference late.

Strategies & Quick Market Structure (Based on Day Trading/Short Swings)

Identifying the Trend of a Market i.e Long/Short is the Biggest Part Of Trading.

Always Trade in Direction of Trend (Counter Trends for Pros, or you will lose sooner)

Higher Highs & Higher Lows on 4H chart means UpTrend. And when top reached or Lower Lows start Forming and Lower Highs… That’s started a Down Trend.

Entries are Not Random. You have to calculate and work out where market moves are happening & Why.

On 4H chart, lets say AUDUSD…

Highlight Major S/R based on previous 3 months – 2 years Data .

Highlight Supply/Demand Zones Where market makes big moves from.

The Reason that The Market moved that 70 pips or so in 4Hrs is because Banks & Institutions traded at that point. So we want to trade with them. The Good Thing is, Often market repeats itself by reacting at those Levels.

Now wait for the Market to reach another Significant Level (zones Where big moves happen from), and look for entries.

Trade with Reward to Risk 2:1. E.g 30 Pip SL and 60 pip TP. 30 to 40 Pip SL for beginners is good, gives room for market to move. Eventually you can tweak this down.

Before Trading – Have a Checklist to tick Off. If Criteria Met, Then Enter. (See my check List attached)

When Trading – Trade with Confidence. You will Have Wins and Losses. Even if you have Less than 50% winnings, you can still be successful if you stick with R:R.

Use S/R, Trend Lines & Fibs etc . The More confluences, the Better Trade probability.

All The Indicators are useless (hopefully by now you are ignoring everyone else). Idicators are useless because they are lagging and they will tell you … ah… you could have entered here … duh… its too late now.

Learn to Master Support and Resistance, Supply & Demand Zones… think like a Banker… they will only BUY / Sell at certain levels, and they make the moves happen.

So look for say 4 or 5 trades a week. Good Quality Trades.

Wait for them. Execute with Precision.

Resources

You Tube: Learn the basics, go through lots of videos on

Support & Resistance, Candle Stick Patterns… learn what they are showing

Fibs, Trendlines, Market Structure.

Sorry I’ve Run Out Of Time… I Couldn’t get through everything… structure above isn’t so greate either… I didn’t plan to write so much…

Also just realised the system didnt let me post more attachments as promised above… so get in touch with me and i can forward by email…

If I get your response I’ll get back with more details.

Anyway good luck, keep safe from the Virus.

Naeem

!This Below Chart I can Say is the SINGLE MOST IMPORTANT thing that can make you successful and see the potential.

You Can start with a small account and work out how your account grows with compounding monthly. as & When you have a bit more cash available, you can add it and start trading bigger Position sizes.

Eventually You want to Reduce The Risk Per Trade to 1%… which means you will have to lose 100 times consistently to Blow your account. If That happens, GO & Do Something Else…

No… i’m joking… Try Again… Refer To that treasure picture I’ve Shared…

Just a note - this is just to start you off with some of the common strategies.

Use this in conjuction with the Supply/Deman S/R Zones. If all Stars Aligned, Take The Trade.

Never Regret… Theres a 50/50 chance of getting it right

My brother read margin level lessons, you will know why starting with a $50 account is like donating your money to any body in need. If you plan to start trading with $50, you better look for a job.

However, when you decide to demo trade please start with the money you intend to deposit on the live account. This will built confidence once you double it three times on the demo, then you can go live.

Strategies will depend on your personality. First identify a time frame that suit you, second try to get a pair that you fully understand in terms of its daily range. Control your emotions and avoid being greedy in this business of Forex. Never compete with anybody if you want to be a successful trader. Risk only 1% per trade and avoid over trading and revenge.

NB:Trading seems deception ally easy but its not. Practice, practice and practice until you identify your own style and strategy.

When setting your daily goals focus on pips not dollars. That’s to say 200- 250 pips per week but ensure you set realistic goals.

Demo trade for a year before you go live trading and have a desire to learn you will one day be a successful trader.

Number 8 and 9 are very wise words ! I’ve learned the hard way,blowed up a live account 2 times(minimum deposit was €200).So i lost the hard earned €400 within 3 months of opening a live account with minimal to nihil trading experience.Some of the people i know that are trading forex did pay some “mentor” all through they have been succesful,i didn’t want to pay someone for the same “basic” information.Through a podcast i’ve listened i discovered babypips and thank god. I’ve already learned so much and i still do.I keep a diary with summary’s from the stuff i learned at babypips,which helps a lot.I’m currently trading with a demo account and i plan to do this until i get a good understanding of charts reading before going to a live account again.

that is a good start mate. i remember the first time i am trading real money only 5 usd. it was 10 years ago. trade only with money you can afford to lose and always withdraw your profits.

if you can’t make consistent profit with small balance, don’t try trade with big account size.

This is important information

Glad to hear your eating good from forex brother. Much success to you

Hi,

I hope you are doing well. You have a really good question there.

It’ possible to grow your account, but the odds are against you. That’s why you need to ask yourself if losing this money is an option, since 70-80% of the traders are losing money, with or without experience.

If the pain of losing 10, 20, or your entire account is too high, don’t do it for now. But if this is more an experiment, it may be worth doing it after a few weeks of tests (why not try with fake money than going directly to the real?)

Also, don’t forget about the costs of sending money, how will you withdrawn your profits and how much will cost? Many brokers will send by bank wire and will charge for small withdraws, so this may cost a chunk of the profits.

What concerns me most is that you don’t have margin to leave some trades run. Let’s say each microlot needs at least 1 daily ATR, let’s say 100-200 pips. So you cannot do long term or swing trades, you will then depend entirely on scalping and luck.

Try to work some daily strategies using channels. I use Linda Raschke’s version of Keltner channels for some very specific trades ( when more then 5 conditions are meet, from Taylor techniques to my own analysis) and it’s working amazingly.

But then you need to go and find your style, be very very careful with drawdowns (how much you can lose in one trade or one day), and test it.

Good luck!

Let me reply directly to the OP because I don’t know if all the replies will be read.

Let me make this short.

Can it be done? Yes.

Can you do it? I don’t know.

Everyone has their own opinion based on their own experiences. Myself included.

Facts would be these.

- It’s possible to trade with ANY amount. Leverage helps here.

- If you have ZERO experience you can still get lucky.

- If you’re going off luck, it will run out. And you may get hit hard.

As I said in the other thread. I’ve seen someone read the market wrong but win because of movement due to news. So while everyone else was losing he was winning. Until the markets calmed down.

Some of the users posted good advice, but take everything and learn from it. Make your own style. Some of the things posted by @NQ seem good, but I wouldn’t discard MT4. My reason for that would be the available plugins/indicators/EAs. I personaly use those to make my life easier - things like daily high/low instead of manually going on and marking those on the charts each day. Tedious. cTrader is a great platform, and the tutorials they have on YouTube are awesome, but there’s something about experience that you can’t go around - you have to go through.

I’ve had the cTrader videos saved on my phone and listened to them when I drive or when I’m not working. And over time I keep reviewing them as I learn more. I then realize that simple statements have much weight to them. Patience. Greed. Fear. Three words that you don’t understand what they mean until you’ve been in this for some time.

I agree with @NQ that it’s not the account size. I’ve taken a nearly blown account when I was learning - from $14.08 back to $80+ within a week. I’ve taken $100 to over $1,200 in two weeks. Gains are always possible. But big gains are high risk with small accounts.

If you can’t afford to lose your $50, you need to practice first on demo. Find or develop a strategy that works for you on demo then transfer to live. As a rule I personally believe that a minimum of 3 months should be taken to determine if a system is viable.

Let me give you an example of a system to test out on demo. DO NOT DO THIS ON LIVE.

- Check the direction on H4/D1. Do this by using a 20 EMA on the D1. Switch to Heiken Ashi (HA). If price is above the EMA and the last HA candle is green then it’s most likely going up. If it’s below the EMA and the HA candle is red, it’s most likely going down. This assumes RED candles are bearish and GREEN candles are bullish.

- Following the above initial trend rules, if you have a bullish candle under the EMA or bearish above the EMA - there is no trade. Wait for the condition to be present.

- After verifying the trend direction on D1, switch to the H4. Change chart style to line. Zoom out and draw horizontal lines in areas where the peaks are. These will represent your general zones close to your entries.

- Identify the highest and lowest point on the H4 chart.

Now I’ve opened MT4 and opened the EURGBP as an example pair for this with half of the rules above. Based on that price seems to have started a down trend.

- Wait for price to get back to a higher point or zone you drew on the chart to then sell.

Based on this I would sell if price:

- Gets to one of the zones drawn.

- Gets to an even number near one of the zones drawn.

- Gets close to the high but does not break it and is turning again.

With all of that you should have an established amount of cash you’re willing to lose per trade. This is your money management and risk management.

There’s so much more, but it’s hard to place it all in one post. But that’s an example of trading with very few indicators. We could go further into looking for patterns, using fibs, etc, etc. But start simple. Find something that works. Stick to it. Once you’ve mastered it - refine it.

Just a note - this is just to start you off with some of the common strategies.

Use this in conjuction with the Supply/Deman S/R Zones. If all Stars Aligned, Take The Trade.

Never Regret… Theres a 50/50 chance of getting it right

What did you mean by half profit?

Hey there @roytagl

I’m going to start from the bottom up… To go down your list of priorities/risk/capital/feelings and your ultimate goal, as I see it, reading through the lines.

College student

I presume you are under 20 years of age? Doesn’t matter what age you are of course.

It’s embarrassing  taking money off Mum & Dad…

taking money off Mum & Dad…

Okay, is it really? That embarrassing? I would say no it’s not at all, and that’s just your young male ego playing tricks on you. No offence, I remember the very same.

You want to be your own man, I get it. We ALL get it. (I was out the house, left school, got a job, and a sh!t-hole apartment when I was sixteen years old)

You are a student and I’m SURE you’re Mum and Dad are VERY, very PROUD of you.

Trying paying bills, rent, mortgage, feeding yourself, getting to work, ironing, cleaning etc etc. It’s not that much fun man.

Cover my needs… Take $[10-20] DAILY profits.

Frankly, that would be cancerous to your ultimate aim. You will blow your 50 bucks in 3 and a half minutes, if you’ve not already.

Forgive me, but I kinda ‘hope’ you have already blown your money with your head in your hands to learn your lesson. I don’t say that to be negative or nasty, at all.

I hope you understand.

Of course I hope you have not, and taken ‘some’ advise within this thread and forums.

But given that scenario… You would then HAVE TO LEARN patience.

-COMPLETE ALL OF…

School of Pipsology

Pay special attention to risk management, position sizing, leverage and getting margin calls. Fully understand these, so you don’t blow up.

Course 10 of 11

Undergraduate - Senior

…BEFORE DOING ANYTHING ELSE…

I’ve completed every single excersise but I show 326 of 336 complete, the remaining ten courses I’ve kept “Not Complete” to go back again, and again, and again to grasp.

Get 100% on every single quiz.

Keep studying, and do your level best to fully understand the topics without memorising the right answers.

Then start demo trading, not with the default $100,000 demo account, create a new demo account with a micro amount. (Honestly, I’ve not tried to do that myself, not sure if it’s possible)

Forget about going to brokers with [1000]:1 leverage, that’s ridiculous advice.

brokerchooser [dot] com > pull down list for Tunisia.

Or look on here for broker reviews.

AND, PLEASE stop with a dollar money amount, and even thinking you can take anything out until you reach maybe $600, and FOCUS ON % gains as others have said.

If you can, don’t take anything out, at all. Compound your profits. Forget about daily living. Mum and Dad will take care of that… As much as that may annoy you.

Get to €155/$ equivalent and then do the FTMO[dot]com challenge but go through a couple of free trails beforehand. Then after passing verification and evaluation, start trading their capital with €8,000 / $10,000 for €155 buy-in. Then reinvest profits, to trade at $100,000 with a further evaluation and verification 2nd account for $650 buy in.

Make profits, and collect. Then make real profits, complete your studies at college. Day trade for a living. If that is indeed your ultimate aim.

I wish you the very best in your journey…

In closing I do hope and trust I have not said anything offensive, or uncomfortable for you… If I have, I apologise but at the same time, analysise yourself.

I completely get you wanting to stand on your own feet, and be your own man… We all want that freedom.

Self analysis is key here… Ask yourself the hard questions.

Take care but be bold.

Best regards,

ThriveTrader

Let’s take your conservative goal to put into perspective how unrealistic this is. You have $50 and your looking to make $10 a day, a day!! So first let’s move this into percentages so we can calculate compound growth… you’re looking to make 20% a day, let’s see how much you will have in Just 10 weeks. (I’ll even round down the math)

$60 day 1

$70 day 2

$80 day 3

$90 day 4

$100 day 5

So you doubled your account in 1 week! So:

$100 week 1

$200 week 2

$400 week 3

$800 week 4

$1600 week 5

$3200 week 6

$6400 week 7

$12,500 week 8

$25,000 week 9

$50,000 week 10

So you’ve gone from $50 to $50,000 in 10 weeks. Some advice would be (and many would consider this a realistic sustainable goal) to aim for 5% growth per month. This will allow you survive the losing streaks and many beginner mistakes you’ll make in the first year.

Whatever you do, use a demo account First! Set a financial goal: go from $100 - $200 5 Consecutive times in a row, once you do that you’ve proven to yourself that you’ve got a system which makes money consistently. then take it to the real market.

Be careful with who’s advice you take, sure people will tell you how they started with $50 3 months ago and now they have $1000. Good for them. If I told you to jump off a cliff into shark infested water and swim to shore because I did the same thing and survived, it doesn’t make it a good idea. Ask them in another 1, 2 or 5 years how they got on in the forex market trading that fast and I could almost guarantee that they would have all blown up by then. To play the long game you need to play safe. Good luck!

(No Offence intended to above guy… However)

This is What I Mean by Blah blah blah… (Stuff you already Know)…

The Person Writing, spent 10 mins, the person reading spent 5 mins to Realise… I already know that same useless info…

Thats why I said Ignore them all.

When Looking for Gold, You have to Sift through all the rubbish…

So You have to Sift through Tonnes of Useless Information… Which Takes so much of your time…and wish someone just got to the point and told you how to Trade… and take the first steps…

Go Back to My Reply… Some Golden Nuggets There… I promise you it gets better…

Its not as easy as you think if you don’t understand the process

firstly $50 to $75 is small for a newbies to breathe well in the forex market.

Secondly, which i think is the most important is how you understand the process to be profitable consistently.

Always guide your emotions, if not you won’t stay longer in trading.

He is not looking at compounding as you have put it. He wants to make $10 a day from starting with a $50 account. If he has a reasonable strategy and he has good money management I can assure he will be successful. I have done it countless times and will do it over again. If greed it out of the way and he is not scared of loses or trades faking out then patience will be his best friend on his way to success.