Hi @tomo22,

Reading his book, I will focus more on how he makes decision. I won’t follow his concept bluntly.

For example:

I will try to figure out how it is used on properly. You have to be careful when he describes the concept, pay attention to the example he uses. He uses more on stock, while we use CFD, it will be chicken talks to duck scenario.

Another example:

Look on how systematic his every concept. This is the most important thing from AI Brooks.

Last example:

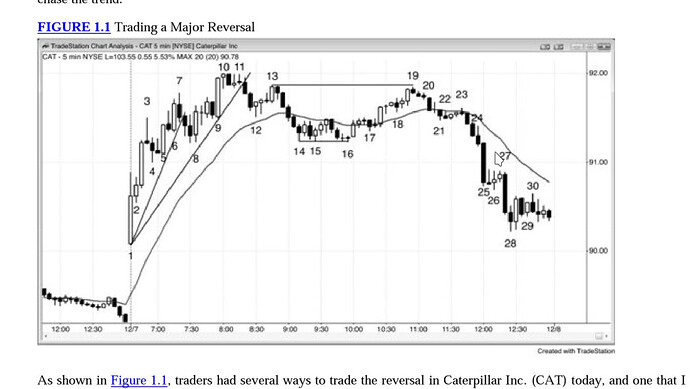

Can you see the similarity on how I plan my trade with his? But I can’t follow his rule at since he is using CAT (Stock Market).

For me, AI Brooks tells us how to analyze market systematically. He only gives you his method, for the purpose to show us the way he looks at market.

Like I told before, we need to have ability to see patterns. This is the patterns, something more fundamental, it’s not merely head and shoulder or tea cup with cookies. If we can breakdown the real message behind every AI brooks’ trading idea, we will have the essence on how to trader properly.

Many fund manager, I met, trades this way, almost half of them. The rest will be based on indicator or time based trading.

So adopting PA will let you adopt the skill of 40% of fund manager I met.