EUR/USD pulls back ahead of the August high (1.1743) to register a fresh weekly low (1.1613).

By : David Song, Strategist

US Dollar Forecast: EUR/USD

EUR/USD pulls back ahead of the August high (1.1743) to register a fresh weekly low (1.1613), but the weakness in the exchange rate may turn out to be temporary should it continue to track the positive slope in the 50-Day SMA (1.1665).

US Dollar Forecast: EUR/USD Pulls Back Ahead of August High

EUR/USD fails to retain the advance from the start of the week even though the Euro Area’s Consumer Price Index (CPI) shows the core reading for inflation holding steady at 2.3% in August, and a pickup in market participation may lead to increased volatility in the exchange rate as US traders return from a holiday weekend.

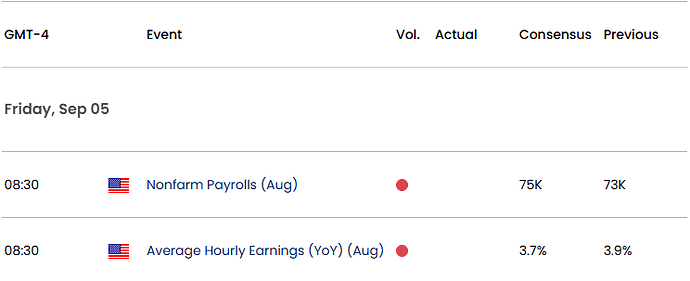

US Economic Calendar

At the same time, data prints coming out of the US may sway foreign exchange markets as Federal Reserve Chairman Jerome Powell warns that ‘the shifting balance of risks may warrant adjusting our policy stance,’ but the US Non-Farm Payrolls (NFP) report may encourage the Fed to further combat inflation as the economy is expected to add 75K jobs in August.

Join David Song for the Weekly Fundamental Market Outlook webinar.

In turn, a further expansion in employment may generate a bullish reaction in the Greenback as it raises the Federal Open Market Committee’s (FOMC) scope to keep US interest rates higher for longer, but a weaker-than-expected NFP report may curb the recent decline in EUR/USD as it fuels speculation for a Fed rate cut.

With that said, EUR/USD may stage further attempts to test the August high (1.1743) as the FOMC appears to be on course to further unwind its restrictive policy, but the exchange rate may reestablish the bullish trend from earlier this year as the 50-Day SMA (1.1665) continues to reflect a positive slope.

EUR/USD Chart – Daily

Chart Prepared by David Song, Senior Strategist; EUR/USD on TradingView

- EUR/USD pulls back ahead of the August high (1.1743) to snap the series of higher highs and lows from last week, and a move/close above 1.1560 (100% Fibonacci extension) may push the exchange rate toward the August low (1.1392).

- Failure to hold above the 1.1390 (78/6% Fibonacci extension) to 1.1440 (61.8% Fibonacci extension) region may lead to a test of the June low (1.1347), with the next area of interest coming in around 1.1260 (61.8% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement).

- Need a move/close above the 1.1690 (78.6% Fibonacci extension) to 1.1750 (78.6% Fibonacci retracement) zone to bring the July high (1.1830) on the radar, with the next region of interest coming in around the September 2021 high (1.1909).

— Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong

Click the website link below to read our Guide to central banks and interest rates in Q2 2025

https://www.cityindex.com/en-uk/market-outlooks-2025/q2-central-banks-outlook/

StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information purposes only and it does not take into account your personal circumstances or objectives. This material has been prepared using the thoughts and opinions of the author and these may change. However, City Index does not plan to provide further updates to any material once published and it is not under any obligation to keep this material up to date. This material is short term in nature and may only relate to facts and circumstances existing at a specific time or day. Nothing in this material is (or should be considered to be) financial, investment, legal, tax or other advice and no reliance should be placed on it.

No opinion given in this material constitutes a recommendation by City Index or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although City Index is not specifically prevented from dealing before providing this material, City Index does not seek to take advantage of the material prior to its dissemination. This material is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For further details see our full non-independent research disclaimer and quarterly summary.