USD failed at the 2025 downtrend with a break of support risking further losses into the close of the month. Battle lines drawn on the DXY short-term technical charts.

By : Michael Boutros, Sr. Technical Strategist

US Dollar Index Technical Outlook: USD Short-term Trade Levels

- US Dollar April rally fails into yearly downtrend- plunges nearly 2.6% off monthly high

- USD near-term rebound vulnerable while below weekly high- U.S. Core inflation data on tap into monthly close

- Resistance 100.35, 100.65 (key), 100.98- Support 99.40/47, 98.79, 97.71-98.39 (key)

The US Dollar Index rallied more than 4% off confluent support with the recovery failing at the yearly downtrend this month. The decline is responding to initial support late in the week with the near-term recovery may be vulnerable as we head into the close of the month. Battles lines drawn for the bulls on the DXY short-term technical charts.

US Dollar Index Price Chart – USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; DXY on TradingView

Technical Outlook: In my last US Dollar Short-term Outlook we noted that the recovery off downtrend support was threatening a larger recovery with key resistance / bearish invalidation at, “the September high / high-day close (HDC) at 101.77/92- look for a larger reaction there IF reached with a breach / close above needed to suggest a more significant low was registered last month / a larger reversal is underway.” The index briefly registered an intraday high at 101.98 the following week before reversing sharply with price breaking below the April uptrend this week. A rebounded off support yesterday remains in focus with the broader risk still weighted to the downside while within the February downtrend.

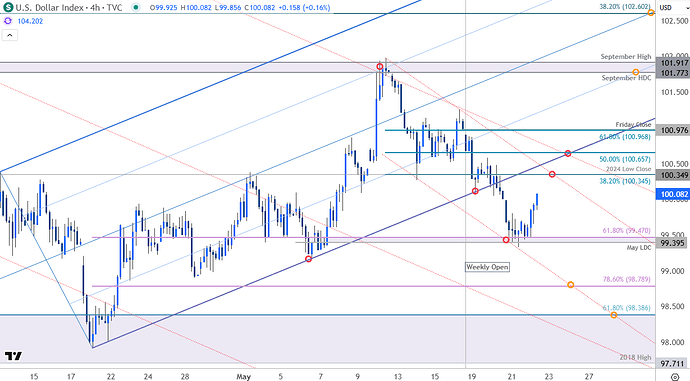

US Dollar Index Price Chart – USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; DXY on TradingView

Notes: A closer look at USD price action shows the index rebounding off support today at 99.40/47- a region defined by the 61.8% retracement of the April rally and the May low-day close (LDC). Initial resistance is eyed at the 38.2% retracement of the recent decline / 2024 low-close at 100.35 with key resistance around the 50% retracement at 100.65- note that the April trendline converges on this threshold over the next few days. Ultimately, a breach above the Friday close / 61.8% retracement at 100.97 is needed to suggest a more significant low was registered last month / validate a breakout of the yearly downtrend.

A break below the weekly lows would threaten resumption of the broader downtrend towards subsequent objectives seen at the 78.6% retracement at 98.79 and key support at 97.71-98.39- a region defined by the 2018 swing high, the 2025 swing low, and the 61.8% retracement of the 2018 advance. Look for a larger reaction there IF reached.

Click the website link below to read our Guide to central banks and interest rates in Q2 2025

https://www.cityindex.com/en-au/market-outlooks-2025/q2-central-banks-outlook/

Bottom line: The U.S. Dollar has broken below a multi-week uptrend with the bulls now attempting to mark resumption of the yearly downtrend. From a trading standpoint, rallies would need to be limited to 100.65 IF the index is heading lower on this stretch with a close below 99.40 needed to fuel the next leg of the decline.

Keep in mind we get the release of key U.S. inflation data next week with core personal consumption expenditures (PCE) on tap into the close of the month. Stay nimble into the release and watch the weekly closes here for guidance. Review my latest US Dollar Weekly Forecast for a closer look at the longer-term DXY technical trade levels.

Key US Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- British Pound Short-term Outlook: GBP/USD Threatens Major Breakout

- Australian Dollar Short-term Outlook: AUD/USD Breakout Imminent

- Gold Short-term Outlook: XAU/USD Bulls Defend Make-or-Break Support

- Canadian Dollar Short-term Outlook: USD/CAD Breakout Looms

- Euro Short-term Outlook: EUR/USD Recovery Stalls at Trend Resistance

- Swiss Franc Short-term Outlook: USD/CHF Bulls Tested at Resistance

- Japanese Yen Short-term Outlook: USD/JPY Rejected at Trend Resistance

Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.