Commodity currencies gained ground as optimism over US–China trade talks lifted sentiment, pushing USD/CAD lower and supporting AUD/USD near range highs.

By : Matt Simpson, Market Analyst

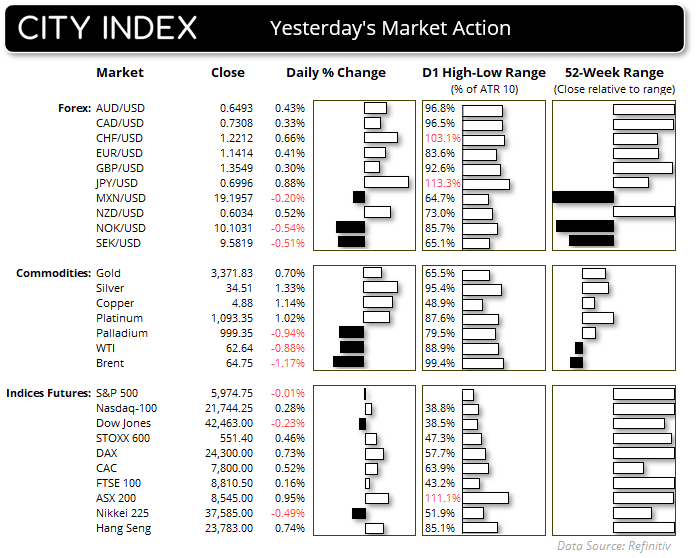

Sentiment was buoyant on Tuesday amid hopes for a breakthrough in US–China trade talks, which are expected to continue into Wednesday. According to US Commerce Secretary Howard Lutnick, negotiations are going “really, really well.” The Canadian dollar (CAD) and Australian dollar (AUD) led gains among majors, while the US dollar (USD) traded mixed. USD/CAD extended its decline, breaking below key technical levels, with further downside potential toward 1.36. AUD/USD continued to test the upper boundary of its 0.64–0.65 range, though stronger moves were seen in AUD/JPY amid broad risk-on appetite.

View related analysis:

- AUD/USD Outlook: Headwinds from China Data and RBA Policy

- US Dollar Outlook: Don’t Write Off the USD Just Yet

- ASX 200, Hang Seng, Nikkei 225 Futures: Bull Rallies Face Resistance

- Gold Outlook: Seasonal Weakness and Fading Momentum Hint at June Pullback

USD/CAD Drops, AUD/USD Pressures Resistance Amid Trade Deal Hopes

Softer-than-expected UK earnings and a rise in jobless claims point to a slowing UK economy, bolstering bets of a Bank of England (BOE) rate cut. Economists polled by Reuters still expect two cuts this year, with the UK economy seen benefiting from being the first to strike a trade deal with the US. The BOE is still favoured to hold rates steady next week, but cut by 25bp to 4% at their August monetary policy meeting.

Meanwhile, the World Bank slashed its global growth forecast to 1.4% for 2025 (down 0.9%), citing fallout from President Trump’s trade war. A further 0.4% downgrade is projected for 2026. While a global recession isn’t forecast, growth has been downgraded for 70% of economies—perhaps a contrarian indicator, but certainly a reflection of market uncertainty.

- Wall Street futures edged higher, with the Nasdaq 100 rising 0.6% to its highest level since late February. S&P 500 futures gained 0.5%, reaching their highest since early March.

- The S&P 500 cash index now trades just 1.8% below its record high.

- The positive lead from Wall Street helped SPI 200 (ASX 200 futures) reach a record high overnight.

- Gold prices were flat and remain effectively unchanged for the week, hovering around $3,350.

- WTI crude oil briefly hit a 3-month high before reversing near $66, suggesting some profit-taking ahead of key US inflation data.

Click the website link below to read our exclusive Guide to AUD/USD trading in Q2 2025

https://www.cityindex.com/en-au/market-outlooks-2025/q2-aud-usd-outlook/

Commodity FX Embrace Positive Trade Outcome

The British pound (GBP) and Japanese yen (JPY) were the weakest FX majors, while the commodity FX currencies Canadian dollar (CAD) and Australian dollar (AUD) were the strongest on Tuesday. The US dollar (USD) finished centre of the pack.

USD/CAD Technical Analysis: US Dollar vs Canadian Dollar

The weekly chart shows that USD/CAD has invalidated a longer-term trendline from the 2021 low. It also appears to be ain a fifth wave lower which could see USD/CAD print new cycle lows before a retracement higher unfolds.

The next level of potential support on this timeframe could be the 1.3585 high-volume node (HVN) which is ~90 pips below current prices. The weekly RSI (14) is confirming the move lower and remains elevated above its oversold zone. That said, the weekly RSI (2) has formed a small bullish divergence in the oversold zone to warn of a near-term inflection point.

The daily chart shows Tuesday’s high perfectly respected the broken trendline, which shows the trendline’s significance remains in play despite it technically being invalidated. The near-term bias is therefore bearish while prices remain beneath Tuesday’s high (1.3728) with last week’s low (1.3645) and the 1.36 handle potentially in focus for bears.

Click the website link below to read our exclusive Guide to USD/JPY trading in Q2 2025

https://www.cityindex.com/en-au/market-outlooks-2025/q2-usd-jpy-outlook/

AUD/JPY Technical Analysis: Australian Dollar vs Japanese Yen

While AUD/USD remains confined to its familiar 0.64–0.65 range, it continues to benefit from improved sentiment around US–China trade relations. That said, there’s little new to add regarding this well-established range, with price once again testing its upper boundary.

In contrast, AUD/JPY continues to trend higher, in line with a bullish technical structure and broader risk-on tone. The support zone around ¥92 held firmly, propelling the pair 3.2% higher from its May low, including a 2.2% rally over the past three sessions. With momentum intact, a push toward ¥95 looks increasingly likely—unless optimism around US–China trade talks fades.

The 1-hour chart shows AUD/JPY holding within a well-defined bullish trend, with price action consolidating just beneath recent highs. This tight range suggests a potential continuation move, especially with dips toward 94 likely to attract buyers.

If support near ¥94 holds, bulls may look to target the 95.00 handle, followed by the April high at 95.30 as the next key resistance.

Economic Events in Focus (AEST / GMT+10)

- 08:45: NZD External & Long-Term Migration, Visitor Arrivals (Apr) (NZD/USD, AUD/NZD)

- 09:50: JPY PPI (May) (USD/JPY, EUR/JPY, Nikkei 225)

- 13:15: EUR ECB President Lagarde Speaks (EUR/USD, EUR/GBP, EUR/JPY)

- 19:00: EUR German Buba VP Buch Speaks (EUR/USD, EUR/GBP)

- 19:30: EUR German 10-Year Bund Auction, ECB’s Lane Speaks (EUR/USD, EUR/GBP, DAX)

- 21:00: USD MBA Mortgage Data: 30-Year Rate, Applications, Purchase, Refinance Indexes (USD, S&P 500, Nasdaq 100, Dow Jones)

- 22:30: USD CPI, Core CPI, Real Earnings (May) (USD, Gold, S&P 500, Nasdaq 100, Dow Jones)

- 22:30: CAD Building Permits (Apr) (USD/CAD, CAD/JPY, TSX)

- Thursday, June 12, 2025

- 00:30: USD Crude Oil Inventories, Refinery Runs, Gasoline & Distillate Data (WTI Crude Oil, Brent Crude Oil, USD)

- 01:00: USD Cleveland CPI (May), Thomson Reuters IPSOS PCSI (Jun) (USD, S&P 500, Nasdaq 100)

View the full economic calendar

– Written by Matt Simpson

Follow Matt on Twitter u/cLeverEdge

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.