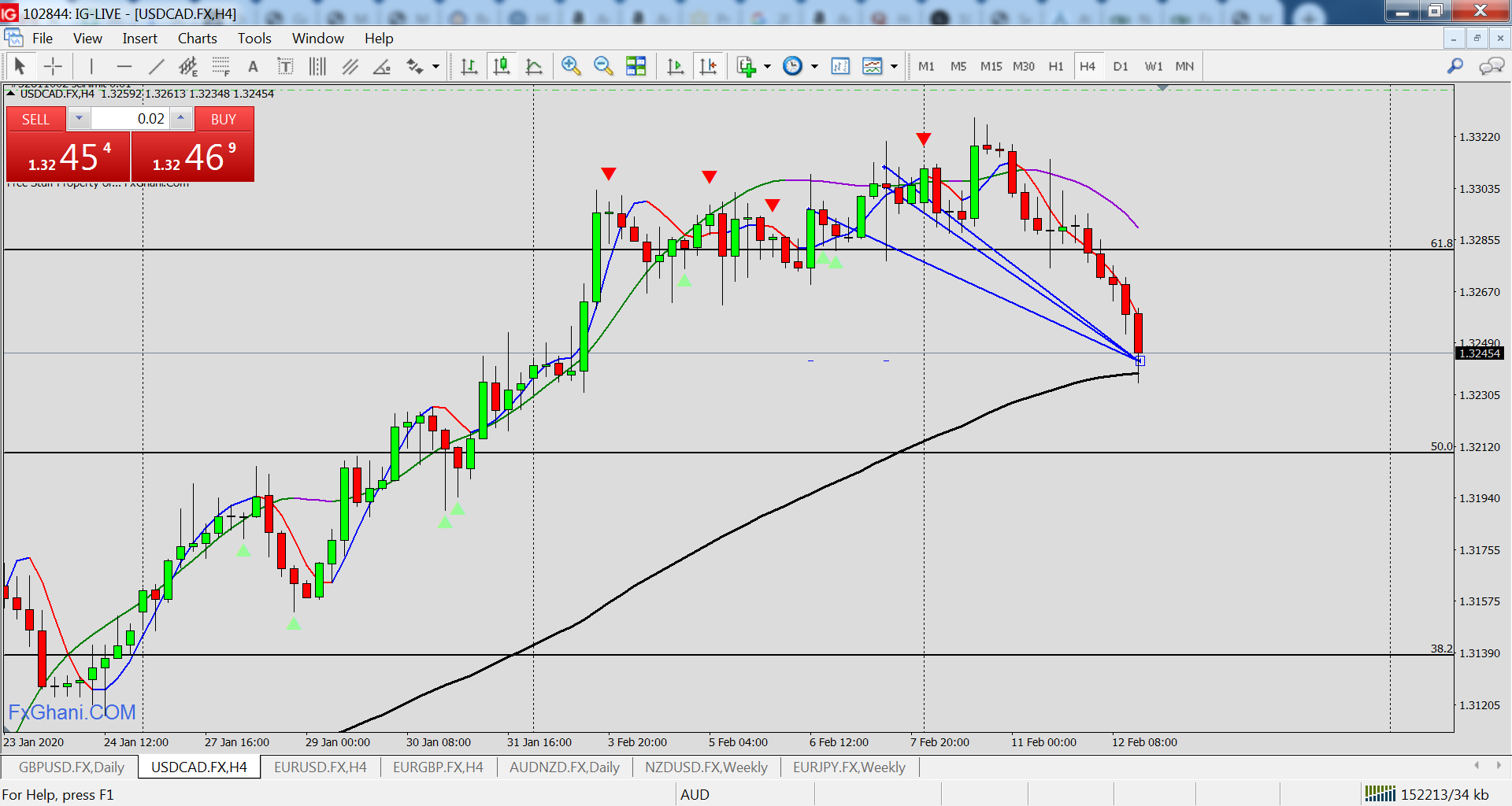

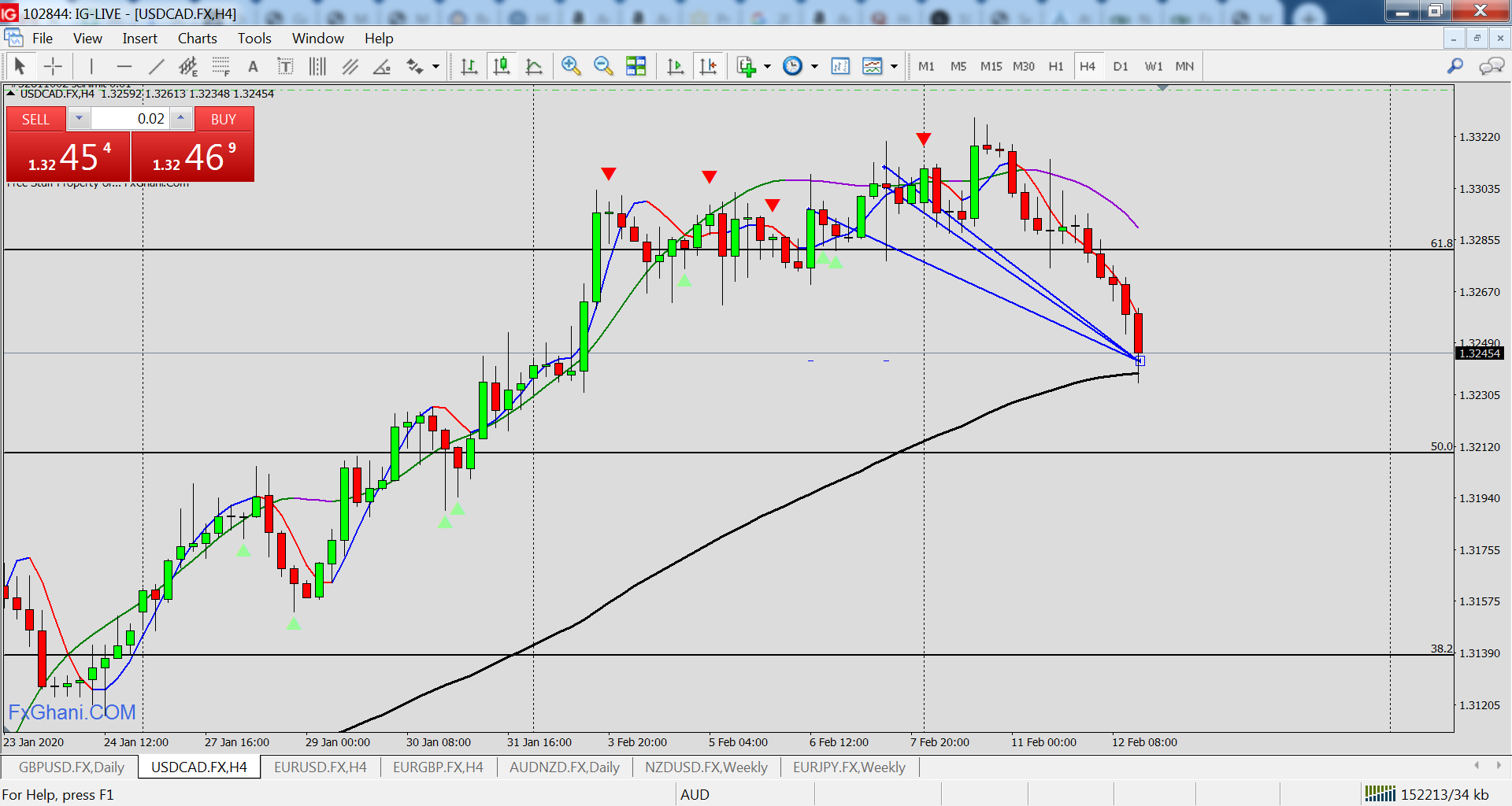

USD/CAD is on day 3 of consolidation in a 35 pip range at the top of a ~350 pip run up. I’m looking for a short setup, but it could be a break out of the channel/almost-triangle it’s in.

Baby_Girl is showing bearish divergence & falloff up to the 12hr chart.

https://www.tradingview.com/x/aZ8LjHuP/

Good rally on the USDCAD since the beginning of the year, but it has found some resistance around the 1.3300 level. In case of continuing higher, the 1.3325 zone may act as resistance. To the downside, the 76.4% Fibo at the 1.3239 zone may act as support in case of a pullback.

I’m expecting some type of pullback before it can climb higher. I have a short order at the 1.33260 level I see it’s struggled about the last 3 times it climbed to this region. I think it will reset before bulls try to get in at a better entry.

Canceled short orders about an hour before Friday’s close. There might be see some tricky price action go down at the open tomorrow. Rather wait it out and see if the breakout happens or if it’s a false breakout leaving longs abandoned and squeezed out.

Got my weekly percentage with the short on USD/CAD at 1.33260. Possibly looking to re-enter at another short position for another run down.

1 Like

I got in a little early on these shorts. Held over the weekend and my take profit hit today.

Good job that ceiling has been a hard one to crack for a while now.

Same for me. I’m staying in for a bit to see where it consolidates. Damn divergence did not want to break down on that one. Haha. End of a run is normally like that, all fuzzy, divergent, and pops off quickly.

I’m good for 155 pips so far this week. Riding out USD/JPY to see if it’ll break like USD/CAD did or recover. I’m tied up for 20 pips on that short so far. My stoppie is normally set at 100 pips & 2% risk. So, if she turns my way… Saul Goodman. If not, the dude abides.

Cool I have a short again on USD/CAD something tells me it’s going to run back down towards the 1.32 range but I also diversified and got a long on CAD/JPY and just exited from a GBP/JPY long at the 142.200 range literally a few minutes ago.

The GBPCAD nuke candle got me this morning on a short

Brexit is throwing us some crazy volatility on GBP and EUR pairs… scalpers are either eating or crying. I need to widen my trails a bit and lean out positioning to ladder in more when these 130 pip 4hr candles decide to show up.

With GBP trades I give it enough room to fluctuate 200-300 pips normally but have even widened it due to the Brexit volatility. I’ve bought at the lower 141 handle a few times and taken the trade sky high up. EUR is getting clamored nicely as well and I’m possibly looking to take a short term trade.

1 Like

Good point! I’ll backtest the 200-300 trail and see how that works over the past month or so.

(CAD/JPY)

Closed an excellent buy from 82.700 to 84. Was an excellent trade just had to allow it to run its course.

(USD/CAD)

Still have my short open but getting tired of watching it barely moving any pips and more importantly so much volatility from other pairs I might as well look at another trade set-up. Still favoring pro loonie and pro USD on other pairs.

Interesting spot now with USD pairs today. I’m noticing correlation between the S&P and USD value (for obvious reasons). S&P has been shaky and throwing divergence for the past year+, looks like today was the day.

So far so good on these short-term moves