USD/JPY steadies near support. GBP/JPY rallies as BOE’s dovish cut fails to satisfy doves. Trump eyes shakeup at the Fed.

By : Matt Simpson, Market Analyst

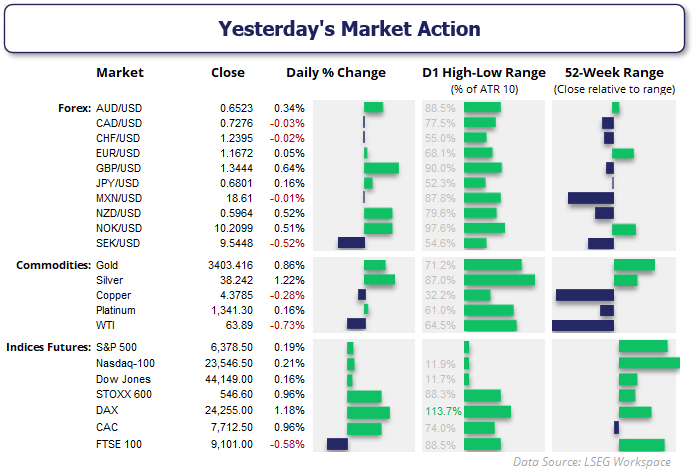

USD/JPY is consolidating after crashing below 150 on weak US jobs data, while GBP/JPY surged following a dovish 25bp rate cut from the Bank of England—though not dovish enough to satisfy rate cut doves. Meanwhile, Donald Trump’s move to nominate Fed critic Stephen Miran signals a potential shakeup at the US central bank. With both pairs near key resistance and support levels, traders are watching for technical confirmation of the next directional move.

View related analysis:

- GBP/USD and GBP/JPY Vulnerable to dovish BOE cut, USD Breaks Lower

- USD Selloff Stabilises Amid Mixed ISM, Trump’s Fed Pick

- AUD/USD Weekly Outlook: Fed Bets Boost Aussie as US Data Weakens

USD/JPY Holds Ground Despite Trump’s Pro-Trump Pick, GBP/JPY Rallies Into Resistance Post-BOE

President Trump is to nominate Stephen Miran to replace Adriana Kugler at the Federal Reserve, after she unexpectedly resigned from her post ahead – even though her term was due to expire on January 31. Miran has publicly called for a complete overhaul of the Fed and also argued for stronger presidential powers over the Fed board. Trump is also continuing to search for someone to serve a 14-year term from February while also looking for a replacement for Jerome Powell.

The Bank of England (BOE) cut their interest rate by 25bp as widely expected, though the delivery failed to appease doves seeking further cuts. Only 5 of the 4 MPC members voted to cut to show disagreement among the ranks. BOE governor Bailey said they must be careful not cut rates too quickly or by too much, and that the 50/50 market pricing reflects the ‘finely balanced’ decision for a future cut.

GBP/USD was the strongest FX major on Wednesday, with the British pound rising 0.6% against the US dollar, Swiss franc and 0.7% against the Canadian dollar. The FTSE 100 fell -0.7% on the realisation that the BOE may have reached their terminal rate at 4%.

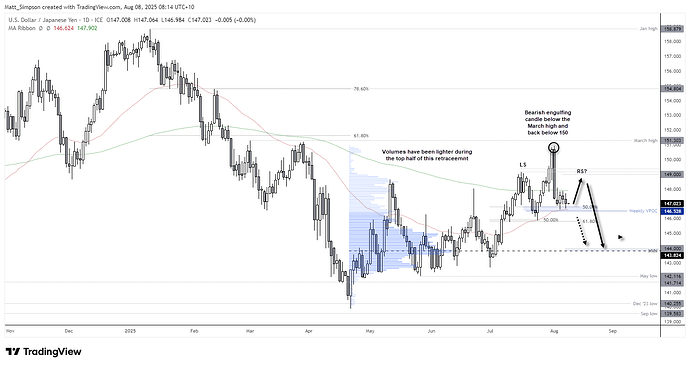

USD/JPY Technical Analysis: US Dollar vs Japanese Yen

Friday’s weak Nonfarm Payrolls (NFP) report saw USD/JPY crash below 150 during its worst performance since May 2024, potentially marking a major swing high. This suggests we could see the US dollar continue lower against the Japanese yen in the coming days or weeks.

However, bears have so far failed to push USD/JPY significantly lower this week, with prices consolidating within a tight range between the 50-day EMA (146.6) and 200-day EMA (147.9). Given that prices are also holding above the 50% retracement level (146.8) and weekly VPOC (146.55), a cheeky swing low may be forming in the near term.

While the 200-day EMA could technically invalidate a bearish breakout, it has already acted as both support and resistance several times in recent weeks. A break above 148 opens the door for a run to 149, at which point I would reassess the potential for USD/JPY to form a swing high.

I would then be looking for a move towards 144, near the high-volume node (HVN) of the current retracement. Incidentally, a lower high on the daily timeframe could also confirm a head and shoulders top pattern.

Chart analysis by Matt Simpson - data source: TradingView USD/JPY

Click the website link below to read our exclusive Guide to USD/JPY trading in Q2 2025

https://www.cityindex.com/en-au/market-outlooks-2025/q2-usd-jpy-outlook/

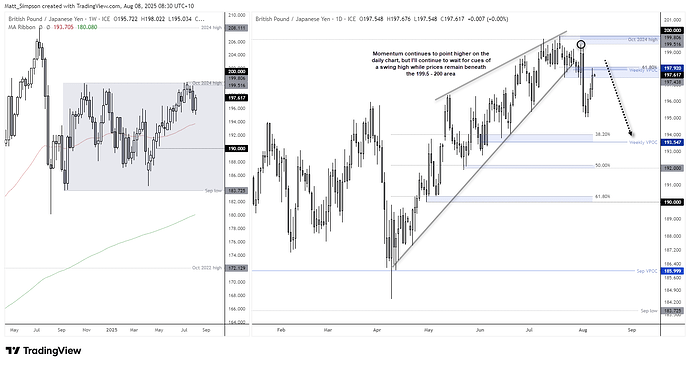

GBP/JPY Technical Analysis: British Pound vs Japanese Yen

I noted yesterday that I have a bearish bias on the GBP/JPY weekly chart, though bullish momentum on the daily chart is still pointing higher. The less-dovish-than-expected BOE meeting helped GBP/JPY rise for a third straight day, and there are no immediate signs of a top on the daily chart. We may need to wait until today’s close—or potentially next week—for any bearish reversal patterns to emerge below 199.

It is interesting to note that today’s high stalled precisely at the weekly VPOC (197.92). If a swing high forms below the 199.56 lower high, bears may look to increase their potential reward-to-risk, with 194 in view while prices remain below 200.

I don’t know what the trigger for such a move might be, but until 200 is broken, the assumption is that the weekly chart remains in a broader sideways range—one that could potentially reward bears on the daily timeframe near the range highs.

Chart analysis by Matt Simpson - data source: TradingView GBP/JPY

Key Economic Events for Traders (AEST / GMT+10)

09:30 JPY Household Spending, Household Spending (YoY) (USD/JPY, EUR/JPY, Nikkei 225)

09:50 JPY Adjusted Current Account, Bank Lending, BoJ Summary of Opinions, Current Account n.s.a. (USD/JPY, AUD/JPY, Nikkei 225)

15:00 JPY Economy Watchers Current Index (USD/JPY, EUR/JPY, Nikkei 225)

17:00 CHF SECO Consumer Climate (Q3) (USD/CHF, EUR/CHF, SMI)

21:15 GBP BoE MPC Member Pill Speaks (GBP/USD, EUR/GBP, GBP/JPY)

22:30 CAD Average Hourly Wages Permanent Employees, Employment Change, Full Employment Change,

03:00 USD Baker Hughes Oil Rig Count, Total Rig Count (WTI Crude, S&P 500, USD/JPY)

View the full economic calendar

– Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.