A carry trade unwind due to an emerging risk off environment means JP investors are covering JPY shorts, not accumulating JPY.

Short answer, no. Rate hikes usually happen slowly and don’t often surprise investors. Risk off events usually come as a surprise and happen suddenly.

Rate hikes usually take place during prolonged economic expansion (=risk on) or in order to protect purchasing power of a currency. Current BoJ hike has more to do with the BoJ looking like they’re trying to protect purchasing power due to consumer price inflation. In reality, the JP govt—much like the US govt—needs a much weaker JPY to reduce the debt burden.

You have to understand what the carry trade is. It is essentially a build up of JPY borrowing (=short positioning). The unwind is a short squeeze on the JPY carry traders (=borrowers), often resulting in a cascade of margin calls making the unwind fast and violent.

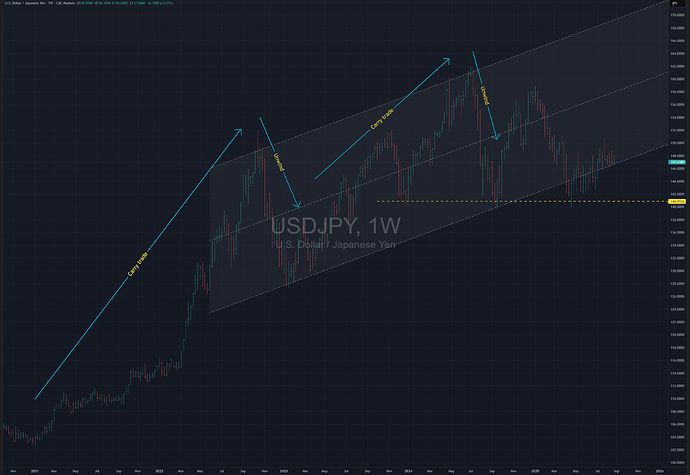

In this USDJPY chart below, I try to show the gradual buildup of the carry trade and the fast unwind. ![]()

There has to be a carry trade first before you can have an unwind. At the moment there is no carry trade happening, it was unwound last year.

The point I was trying to make in my previous post was that the capital flow driving currency movements is complex and just looking at CB overnight rate policies in isolation won’t give you an accurate picture of what’s happening.

Having said that, the technical picture above is suggesting continued downside due to foreign capital exiting US assets.