Welcome to a brand new trading week! If you’re looking for a quick read on what to expect from the forex market in the coming days, here’s Forex Gump’s weekly forex outlook.

In the meantime, we want to know:

What’s the one thing you’d like to focus on this week?

As always, this could be trading-related or something completely different. Maybe you want to focus on a particular pair, a particular news event, or maybe making time for certain things in your life like a hobby or your family?

Tell us!

With the Huawei restriction from US. I expect the US dollar to be bullish on the 4 majors, but specially against the Japanese Yen.

Funny thing I’m sitting on technically 5 long positions when USD/JPY had hit 109.500 last week. This week I’m close to ready to close out my position but I feel like I could try to see if it’ll test 111 levels this week.

China/US (will China retaliate against US for Huawei / and if so how? Will it also go after technology companies? )

FOMC minutes (I’m expecting to still hear bullish news on US economy since the labor market is still performing under tight constrictions but tariff uncertainty, global uncertainty with possible slowdowns could slightly damper news. Also rising corporate debt & the struggles with getting their projected inflations at the levels they deem part of their policy mandate.)

PMI (Want to see what it’s looking like across the board for the major economies and how much effect of this global slowdown is being felt)

1 Like

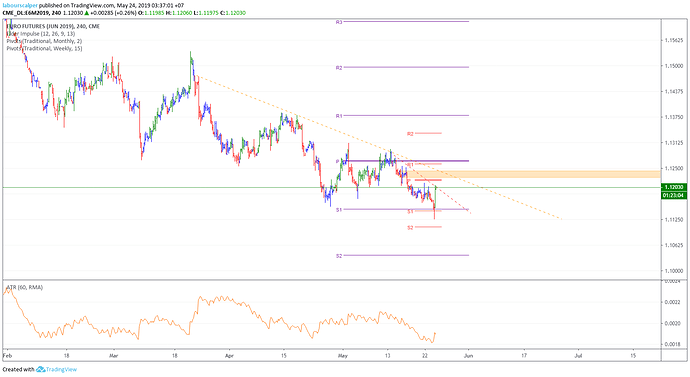

Dollar index in resistance zone

Nice trade with the USDJPY longs from last week - I had 110.65 as an area of rejection, I hope you managed to get out! I suppose the timing of equities moving sharply to the downside helped with that downside move though.

So long as uncertainty with trade war issue, as you’ve stated, continues, I see JPY being brought and general mid term economic slow down. I think the FED meeting yesterday was all about the fact they DIDNT mention rate cuts that much, but with the meeting being held prior to Trumps trade war, I think that view may change and the market kind didn’t really react too much. I do feel thought that this trade war could certainly push the FED into lowering rates this calendar year.

It looks like Europe is still struggling also, based on todays data. trade war already causing a problem? I’m sure that’s the excuse this time…

Me personally, I was short AUDJPY off the back of the green shoot from Aussie elections, with ongoing trade war issues also causing risk pairs to melt (mentioned above). EURCHF was a good short also, USD CHF approaching strong resistance area and (before today) EURUSD creeping lower. I also liked the idea that Italian 10Y would start to rise off the back of EU election.

I got rid of the one position that I had at 110.700. Felt that was too high but let the other ones still run as I bought them all in the 109 levels. I’ll keep the buck still - might get lucky and catch another buy at 109 but I didn’t like the faulty PMI numbers and housing shows consumers are still waiting on the sideline and we will bear the brunt of tariff fiasco. I feel the dollar would be able to shoot up against most currencies since economically wise it’s one of the more sound at this current moment especially during all this headwind. I’ve been looking at the AUDJPY, I’m looking at potential shorts on GBP though just waiting for a trigger. I wish I would’ve kept my short GBPUSD position when I had it back at 1.30.