Another one that you can take is GBPAUD where you can look for the same buy setup here. Just don’t forget to put your SL after putting an entry.

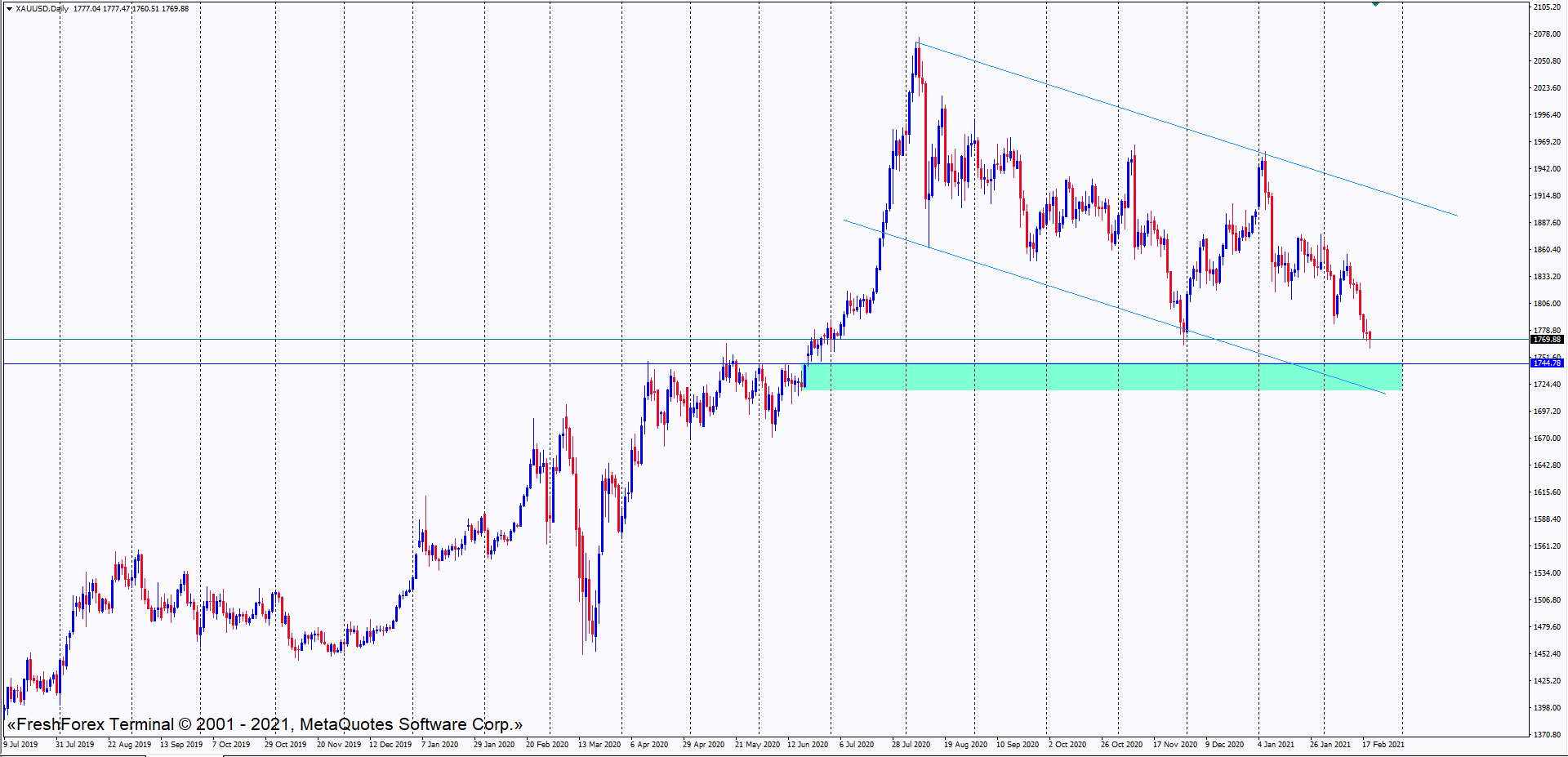

Let’s see what Gold has to offer as the price currently in a strong downtrend. Better to look for reselling setup next week till the price hit this demand area later on.

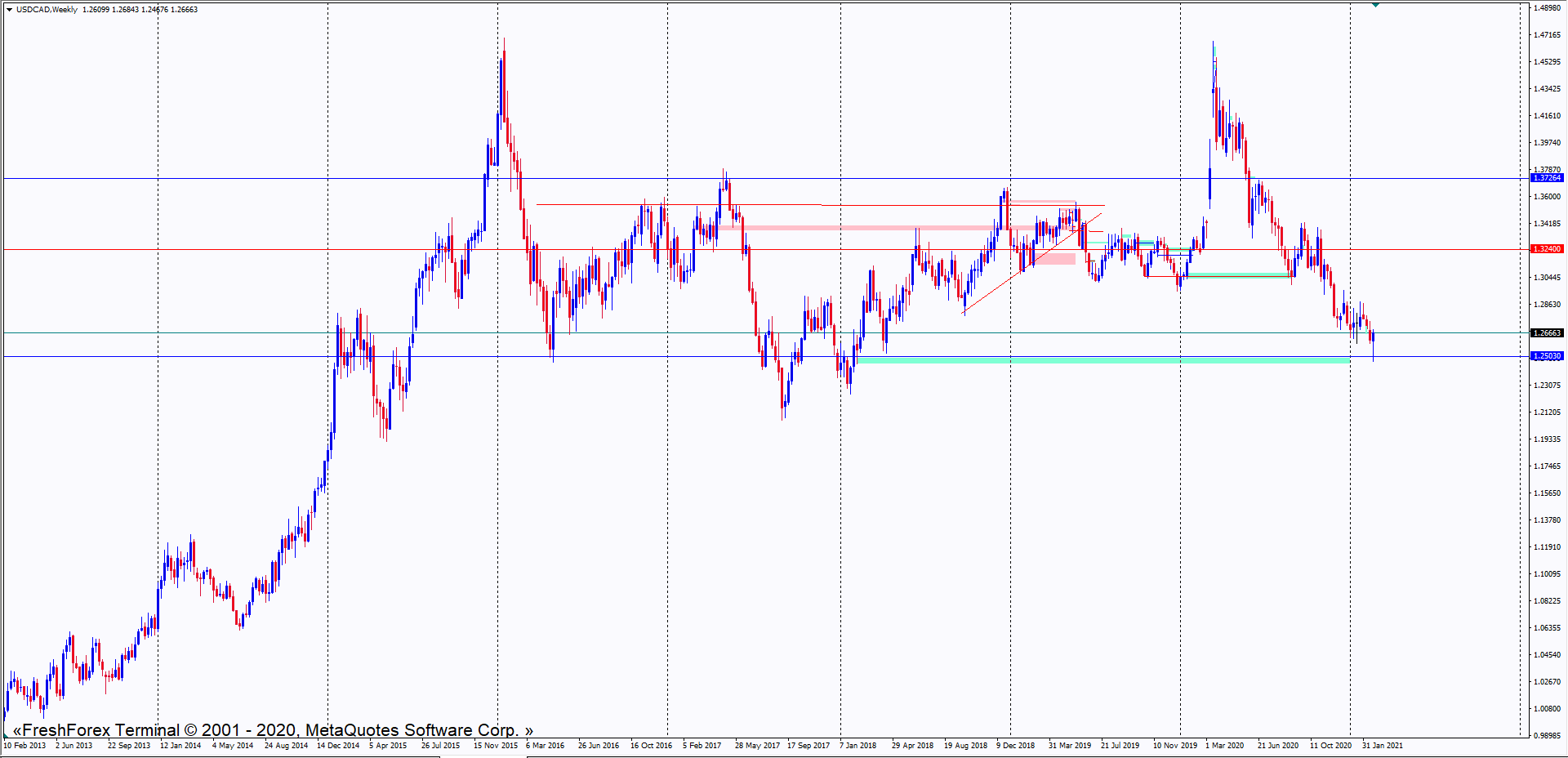

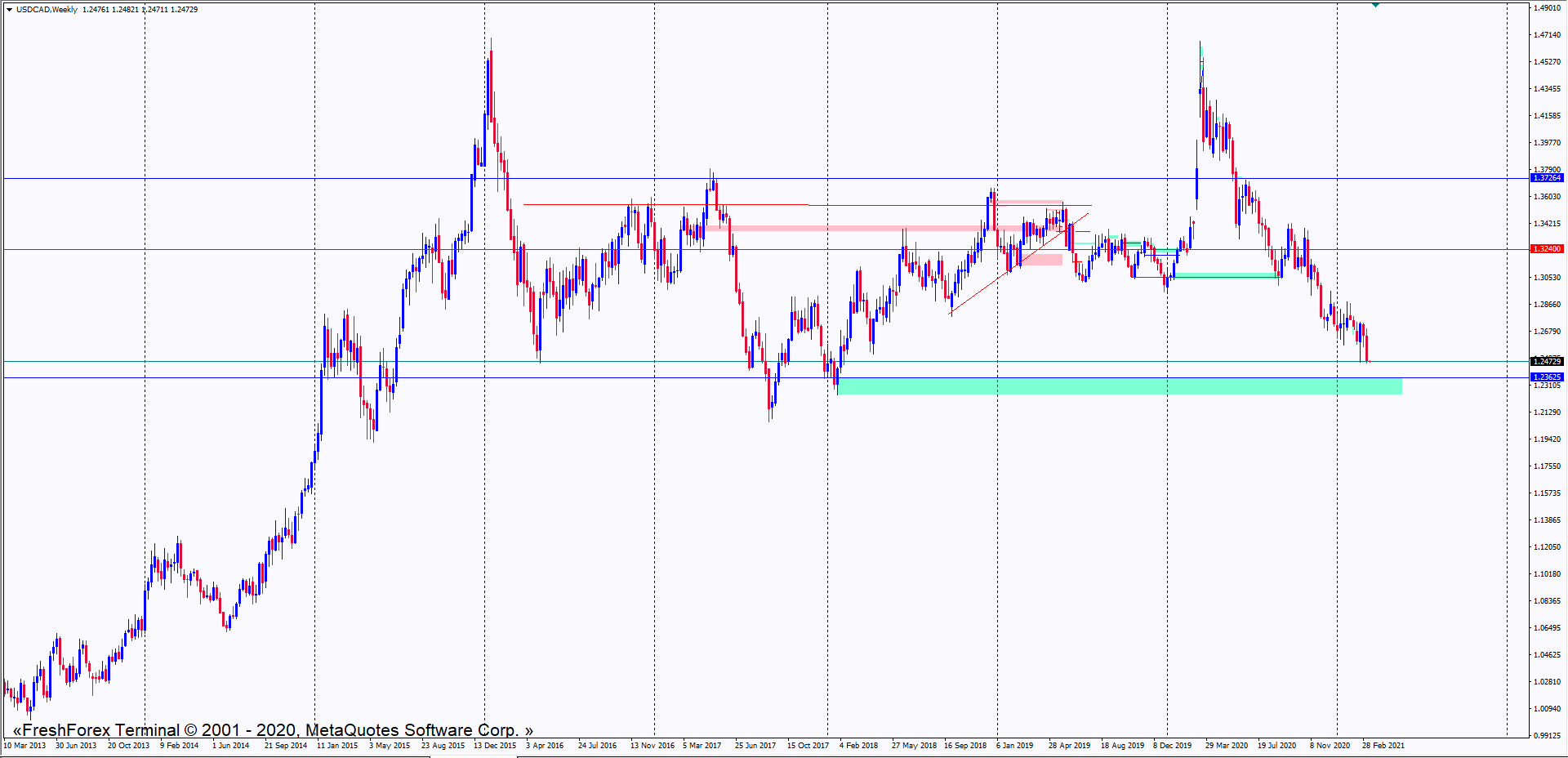

Looks like the USD is going to be strong next week at the beginning of March. Let’s take a look at few charts on major pairs. First of, USDCAD where we can spot a pinbar.

Another one spotted on GBPUSD. Some may be a bit aggressive trying to put a sell limit on such area. But let’s just wait for further confirmation later on.

Another one on NZDUSD. Wait for the price making a new low on lower timeframe. Then, find the selling opportunity.

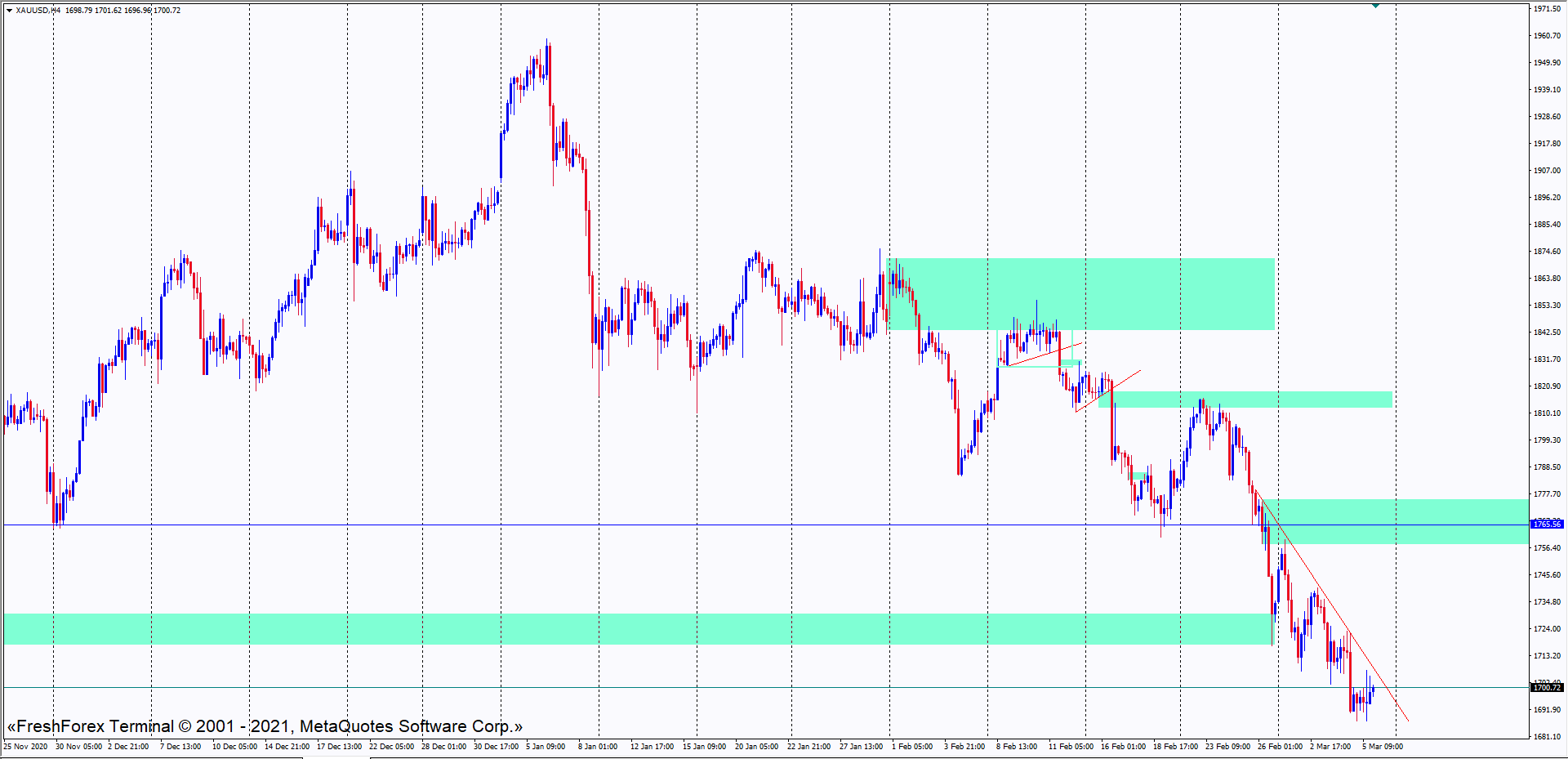

Gold acts a bit different but still on the same track. Just touched a demand area but I’ve seen a good area with significant support resistance. If the retracement is slower than the bearish, you may sell on that area.

FreshForex congratulates those who are taking early selling setups last week. Now it is time to move forward to the next setups on major pairs.

Just wait for GBPUSD to break the trendline after hitting one of the two areas on top of the current price. We will see it this week.

Another one to wait is AUDUSD where you can expect a retracement to hit the supply area and break the trendline. Just wait and see.

NZDUSD created a new low but it might takes us a bit longer for the retracement. Just be patient for a setup to be formed while retracing to this supply area.

I didn’t expect the retracement on Gold happened on Monday. But either way, congrats to those wo took the sell.

Now let’s move on to new fresh maps for these weekdays. First is Gold which I assume would be moving up right after the price broke the trendline. You can look for buying opportunities since the supply target is still far away.

But on the other side, USDCAD is still looking for a strong demand area to reverse the current trend. Keep on lookout on this one.

USDCHF is changing the main trend. Just look for a retracement for another buying opportunities later on.

And as for GBPUSD, the price is looking for higher supply area before continuing to make another low of the month. Watch the price when it hits this area later.

I have seen the price on USDJPY has stopped rallying on this supply area, meaning that the price is giving a hint for a retracement. You can look for a short term sell and I already marked the retracement target.

On another pair, USDCAD finally hit the supply area on weekly timeframe. So far I am still looking for a buying confirmation on lower timeframes. As simple as a trendline break would do the trick.

Never put an order on a moving trend, better to look for a retracement and look for a continuation pattern. GBPUSD is on a strong bearish and I will wait till the price hit this area and making a retracement for another selling opportunity.

You can also learn these simple ideas I’m giving on this thread on FreshForex’s weekly webinar. Stay tune on their website for what is coming up this week.