You’re welcome, I’m always happy to contribute a bit of time to discuss with those who are enthusiastic about learning. Don’t know if I would categorize my comments as “beautiful”, but I thank you for the compliment. ![]()

I understand your thinking around what a “high” is, but it is very subjective. Be careful when trying to describe one subjective term “high” by using other subjective terms like “turning point” because now we need a detailed, objective description of what a “turning point” is.

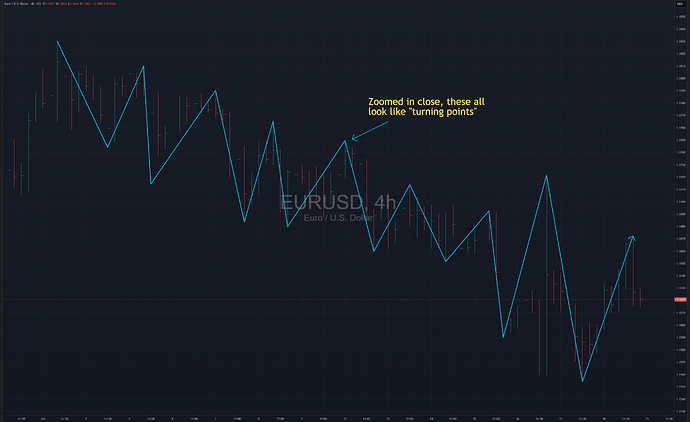

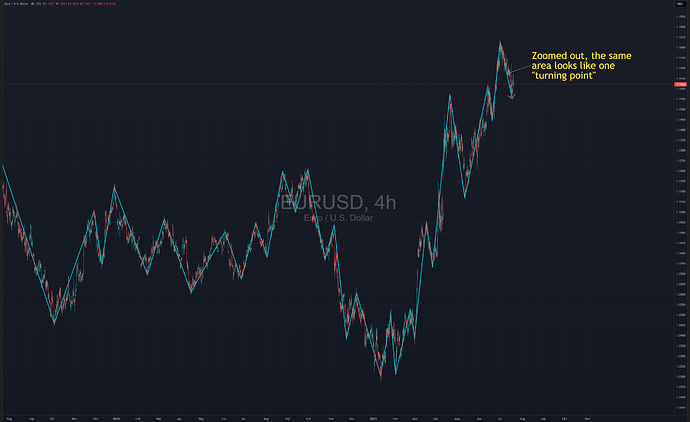

I’ll demonstrate this subjectivity with 2 charts below, they are the same 4H timeframe. We’re going to focus on the area where you placed your descending channel.

The first is zoomed in ![]()

And the other is zoomed out ![]()

Which of these 2 is more accurate? Is that area (where you put your descending channel) 1 turning point or several? How can a trader be certain of their analysis, if zooming in and out on the same chart / timeframe completely changes the picture?

This subjectivity causes confusion and uncertainty, which lead to me second guessing my strategy & trades, entering / exiting too early or too late. And this lead to me mistakenly believe that I just needed to find the “right” strategy among the 1000s out there. When I couldn’t make any of these strategies work, I thought something was wrong with my “trading psychology” and all other sorts of nonsense. Years of time, effort, blood, sweat and tears wasted!

Details matter and a trader that wants to succeed must remove subjectivity & bias from their analysis.

Edit: I just saw that I mentioned this same thing in your Elliott Wave thread. I can’t stress how important this is, it is the basis for nearly all technical analysis ![]()