Follow it like you can’t change it. How many times do we get sucked into a chart and it has this hold on you, you actually have to get up and walk away and talk to yourself and then your realize man what was I doing! My worst trades were the trades where I had been siting there too long holding on to this trade idea I had 2 hours ago and not realizing what was staring at me in the face. more money=limit chart time to 2 hours lol

well, that was quick. So much for my theory that price would head back down from 1.31 for the intermediate term.

Ake, dont know if you have a Proper Trading Plan, but if you dont, make one immediately, learn every word and letter of it and stick to the damn plan all the time, every time. This is your surviving guide in the jungle called ‘‘Markets’’.

I was very sceptical about it, but once i made one (still work in progress thought), my approach about whole trading started to change. The biggest portion of the plan is about risk management, bigger than the entry rules and techniques even. Also, I keep adjusting risk management part almost daily everytime I see a flow, loophole that would give me (other me) chance to go around any of the rules. Have a rule saying: if you brake any part of this plan you stop trading immediately, pack up and go out for the day, etc.

I’m looking at it from this perspective: Real, cool headed me, makes a strict set of rules to control the other half-brained idiot sitting behind the trade station and wasting my money.

here, I’m attaching a simple guide+template for building personalized trading plan.

Hope this helps.

T2W_Trading_Plan_Template_2005.pdf (160 KB)

Ongoing work: some manual backtesting on LO to begin with. A dirty job but it’s got to be done :47:

Mechanically taking each OTE on Fiber (hard right edge) that is at least 40 pips, started no earlier than the Asian session, and posts a high/low during LO. Looking at T1 only at 30 pips. For Jan and Feb 2011: 14 no trades, 20 winners, 8 losers. Need to check this, almost too good to be true (20/28 or 34/42 win%). Some no-trades missed the entry by a couple of pips; they did hit the 50%. Those tend to be big winners.

Anybody else who has any data about this ?

So just some thoughts using indicators (hopefully like the pros).

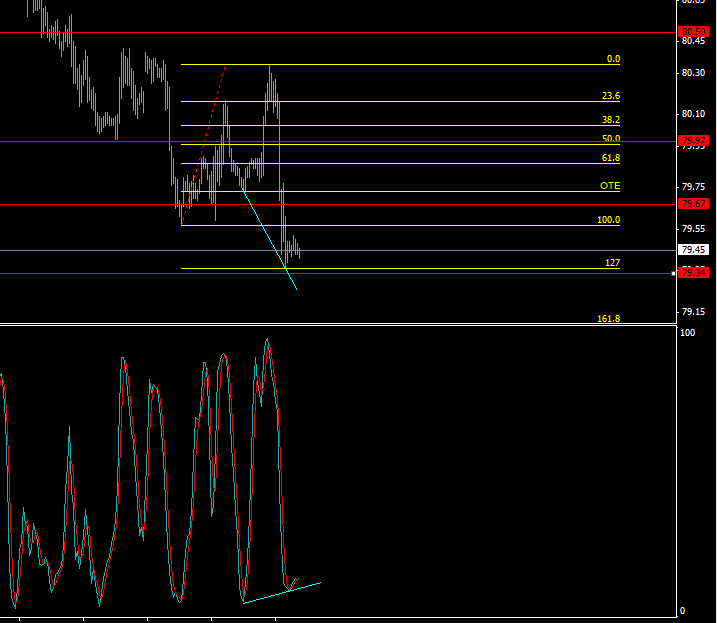

USDX showing bullish divergence at a key S/R level, as well as the 127% extension of recent swing:

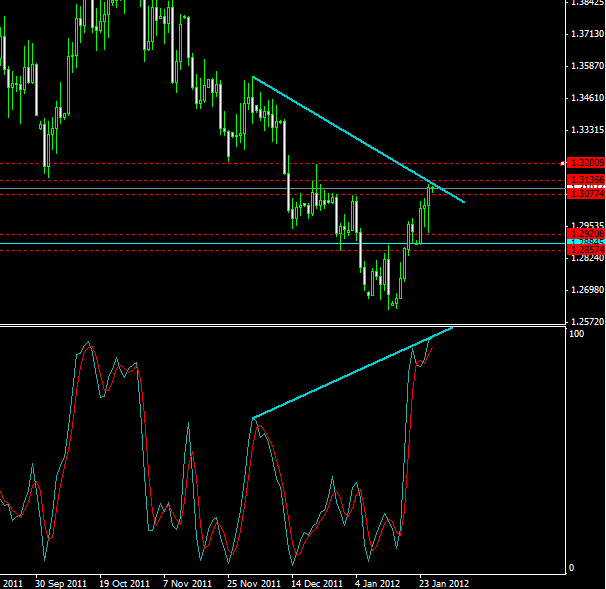

And Fiber is just below key resistance like Michael was talking about, and there is trend following divergence (I believe) on the daily from all the way back in November:

What are your guys’ thoughts on this? I know Michael was done for the week…but are we primed for a nice move down soon (tomorrow)?

Matty

we are also at the 262 extension of last weeks broken TT on the fiber, and past 200 on the cable. Type I divergences on both the pairs on the 1 hr chart. A lot of stops were put into play with the late day run up in price. There are more stops at the 1.5780 level, but they may be leaving those to run at a later time for future liquidity needs. My thought is they have enough liquidity at the moment to make a move down, but I have been bearish all week. Hopefully I’m not being blinded by my bias.

bearish market structure was broken today on the daily. I believe it was Sladha who made reference to a swing point a couple weeks ago, and this may be a good place for a swing high for a marker on the chart. Although I’m currently bearish, I’m going to try to keep my eyes peeled for a bullish move

I was at work when you posted this, but I’m glad I remembered it when I got home.

Started watching the video, and I gotta say it got my attention pretty quick, haha!

Excellent insight in the first 15 minutes there… extremely relevant to the problems I’m having now.

It made me kind of sad though, because it showed me that I really have taken some steps back in the most important areas of my trading… namely patience and discipline. I really did have these ideas grappled last spring, but I lost that somewhere along the way.

Perhaps I got caught up in all the new material – simply overwhelmed by its potential, and I think now would be a really great time to take a step back and reconnect with the me from a year ago and get back to that focus on taking LESS trades and having the discipline to wait for the [U]clear[/U] setups.

anyways, thanks for pointing that out to me

edit:

@kubio

thanks for sharing that trading plan template. I have taken your advice to heart and instead of trying to chase BE for the rest of the week, I’m going to relax a bit and write out a trading guide that should be ready for next week.

It will be geared towards giving me reasons to trade LESS often…

Last Friday’s Cable review on Livestream was only partially recorded. Here’s my recording of the full version for dl:

CableReviewJan20.mp4 - 4shared.com - online file sharing and storage - download

Hi Lazydogs,

Correct me if I am wrong but my broken TT shows fiber only just above the 162 fib extension. Is my chart wrong?

sorry to question your analysis.

Many Thanks Pippy

Great ! You’re very welcome.

I have my tradingplan based on Lance Beggs’ material (yourtradingcoach dot com) with some other bits and bobs. Includes checklists to go through on a D/W/M basis.

And then there’s the lure of the mouse button… Clicking a mouse button should be the result of a comprehensive analysis, including self-analysis. And that includes stepping outside oneself to evaluate what transpired and what has been overlooked. Sounds easy - there’s a part in me which is very chaotic that still thinks it isn’t. I need to quiet that part.

Just watched the short-term trading video. Gonna have to watch it a few more times, but #%$*+! genius.

Sigh, I need to get an android phone, I miss out on such awesome trades during work hours and I have no means of opening positions  Curse you Nokia!!!

Curse you Nokia!!!

Working my way up through the thread I came across this post: 301 Moved Permanently

Apart from the beautiful pictures, that might be of help too

I was lucky enough to catch a good swing/day trade this week going long with fiber. I had to re-enter after getting stopped out once. I entered (the second time) at 1.2947, stop at 1.2920 and had targets of +30 pips, the 127 fib and the 200 fib. There was strong s/r around 1.2950.

The reason why I’m posting is because ICT has said that swings often hit the 200 fib and this is a great example. I was really tempted to exit earlier but let the last portion ride and the 200 fib was hit almost exactly. That is so cool.

Finished watching PTC 03-14-11.

[I]The more I see, the more I’m convinced it’s worth my time.[/I]

I know it’s been said before again and again - and it can’t be said often enough imho so here goes:

[B]I highly recommend reading this thread from the beginning and to watch ALL the PTC videos.[/B]

That said, by all means - skip them in case you think you know it all. Rest assured your money will end up in good hands (mine :7:).

Spoken like a true champion

Let there be no misunderstanding about this:

I have the deepest respect for those who have done everything they thought they ever could, only to find out that that was NOT enough, hence challenged their own limiting beliefs one by one in order to achieve what they wanted to achieve.

Trading is a Game of Champions. A mediocre mindset won’t fly.