Thanks! I’m downloading those now. I was downloading the pro traders club youtube vids from the first post and started getting an error. You wouldn’t happen to have those?

You’re welcome. I have them all…I’ll zip em up and upload, might take a while though.

Hey guys, so i just wanted to share an observation i had today. Well, i basically observed myself and how my mindset and trade management are influenced after a loss. i got stopped out in LO, then when price traded up to key resistance before NYO, i was anticipating a reversal day forming. Sure enough, NY presented me with a nice OTE short on the Fiber. I entered at 1.3165. I was planning on holding for a while as reversal days tend to close below the opening price (for a reversal short) if I’m not mistaken. However, just before 18:00 GMT, price had moved down to the point where I had made up my loss from LO. When I looked at the charts I saw price starting to move up a bit. I was afraid that I would end the day without covering my previous loss, so I quickly closed the trade up about 2 pips up for the day.

Now, this went against my plan for where I would hopefully take profits, but my mindset was altered. Had I had a winning LO, I probably would’ve just left my SL and held for the daily close. Of course, right after I closed the trade, price moved down a nice 50 pips. Now I’m not lamenting a missed move here, just noticing how I approached the trade differently based off of the fact that my equity had dipped after the last trade. This is something I need to work on, and just thought I’d share this to see if anyone else has noticed a weakness like this, and hopefully how they’ve overcome this bad habit.

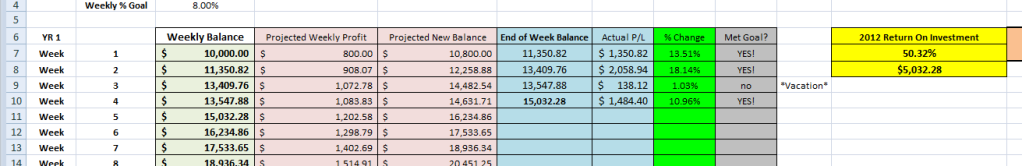

Anyways. Still hit my goal for the week and here’s my weekly account update. Sidelined til Monday.

Happy trading all!

Matty

Matty you’re a superstar. You probably made more ROI % than the man himself! Btw what broker do you use? I’m getting ready to start up a live account but can’t find a broker with decent reviews.

Well Matty, I know it’s never good to react to fear, but I don’t think there was anything terribly wrong with wanting to mitigate the loss and close up shop for the day. You seem well aware of your psychology, so I do trust you’ll react in your best interest next time around

You’re trading that account like a CHAMP. I get the feeling that $10,000 isn’t a lot of money to you… just based on how quickly you ramped up the capital base to 5 figs. By [U]conservative[/U] estimates, you’ll be a millionaire within 2 years.

Every week I worry that the rocket fuel might run out, but you come out swingin’ with another double digit gain!

Please keep it up (if you can), it’s inspirational stuff for people like me lol

Wow, Matty, I’d love to hear about your trading methodology. 10% a week is just mind-boggling.

My methodology is to try and do everything from the last 827 pages…especially the first page.

Thanks AK. I’ll definitely TRY to keep it up as long as I can. Just gotta make sure I don’t get in my own way. And I currently use IBFX mozdef.

Matty

I thought you were going to say that. It’s still pretty incredible.

Could someone point me to the video with the 4 am trade set up info. I have seemed to misplaced it and don’t for the life of me remember which one it was?

Thanks,

Its the truth : )

Take a look at Mark Douglas’ ‘Trading in the Zone’. It is not a heavy read, and most can be skimmed pretty quickly, but it will reinforce the fact that every trade is unique, and if you have objectively identified a new set up using your strict trading parameters, you shouldn’t be listening to the emotional ‘fear’ voice inside your head. The market doesn’t know and doesn’t care what happened on your last trade!

On a practical level, I had a similar experience (well a few actually) back in October, and I documented this on the thread. My analysis was correct, but my entry was wrong. I got back in soon after being stopped out, as my second entry was a valid Turtle Soup entry with all of the other analysis still in tact. The fear factor meant that I grabbed just enough to cover my losses, before seeing price move 150 pips up to where I had initially thought it would go. All I can say is that these experiences stay with you, and you will learn from them. You can even take revenge if you sit and wait patiently - a picture of this trade flashed into my mind on Wednesday at LC, and this time I held on to take 175 pips.

I called it ‘A lesson in trusting your instinct’ at the time, but I think ‘A lesson in trusting your analysis, and discounting your fear’ is probably more appropriate.

You’ve fulfilled your objectives for the week, so your objective for the weekend is to wrestle with the contradiction that all trades are unique, and should be viewed as such, but we can also learn from what happened in the past

Regards

Ali

We have head and shoulder pattern? 13120 lvl, and pivot just sitting above. I took it as a valid confluence and took the trade at 13114. Closed half at +30, left the rest to run.

Hi All, Just here to bare my soul for the week,

Not trading today so thought I’d update my performance for this week.

Took a beating in the markets this week. That darned gremlin Mr. Be-right crept into my head on Monday & Tuesday and persuaded me to take more risky trades against my rules and guess what? that’s right made big losses. My biggest loss was Tuesday when I entered short on EU, price rebounded on me and I was nursing a big loss. Stop loss? who needs stop losses when you have Mr Be-right in your head telling you the market will come back and you will make profits? hah. I ended up allowing the losing trade to go on all night, after all the Asian range normally reverses the NY anyhow, doesn’t it?

Wednesday morning came and my loss was almost exactly where it left off the previous night, phew! it could just as easily took off further away. Anyhow Sense & Sensibility took over, I manned up, took the hit and closed the trade. Ironically though I re-entered a short just a little higher than my previous losing trade to make back some of my losses, but glad I took the hit as there are no guarantees in this business. It wasn’t the tools that was wrong, no, it was the tool sitting in front of the computer pressing the buttons at fault (me).

From now on I have put Mr. Be-right in his cage and am going to throw the key into the deepest ocean, never for him to emerge again. No, I am now going to spend more time with little Here & Now who sees the market as it is, buy when flows are up and sell when flows are down. I am going to re-learn ICT’s money management rules along with re-visiting early videos.

Enough of my rant, here are my stats;

Total Trades 9, Wins 4, Losses 4, B/Even 1. Start Balance £906.67, End Balance £758.02, £148.65 loss 16% decrease!

Now for the Good news, Over the last 3 weeks since I’ve been trading and learning ICT’s methods I have grown the start balance of £732.27 to the princely sum of £758.02, which is an increase of 3.5%. Now this may not seem much to many, but I compare it to the bank’s interest rates and in the UK the best ones at present are about 3% per annum. I have beaten this in just 3 weeks despite my losses!

I also agree totally with Pippy’s recent posts stating newbies like me should work through this thread from the beginning. This is what I am doing in real time, only one year from the original start time. I know I have cheated in that I am using the Traders Trinity, but this is actually helping me with Key S&R Levels, Buy & Sell Zones and gives me possible targets for price along with higher time frame market flows, Totally genius thanks ICT.

For the next month I will be concentrating on LO trades only, cutting down on my trades to 3 per week (hopefully) only trading Tuesday, Wednesday and Thursday with a weekly pip count of about 60 or so ( oh how I dream). I will also be doing the exercise of targeting Daily & Weekly Highs & Lows and demo trading them when price gets there with 20 pip SL and 20 pip TP as prescribed by ICT early on, just to go through the process properly.

Sorry for the lengthy post, I just hope it helps newbies not make the mistakes I just have.

As always GLGT to all for next week.

That’s my new goal, Matty.

US Dollar index making new lows, EUR and GBP failing to make new highs.

Short EUR/USD at 1.3150.

wow Matty this is very inspiring!

have you been following this thread since the very beginning? In other words: how long did it take you to put the material shared here into the very core of your head, and to use it to create such extraordinary returns?

keep it up and thanks for the inspiration;) I wonder how long it will take for me to even set my goals that high;)

I have a question to you, ICT:

You repeatedly stated that we should not spend too much time on the charts (such as trying to trade too many sessions during a day) And I fully understand where you are going with this statement, and I agree!

BUT, as I’m just starting out, I feel that 10-15 hours of chart time everyday (the same amount of time I would spend at a day job…) could be beneficial to earn experience of price behavior and such… or would you disagree with this?

I do make sure to still spend enough time on quality family time and rest, I also try to take a 3-4 days weekend each week to make up for the time spend on charts;) but I just feel so thirsty to gain as much experience as possible at any given period of time…

And by chart time I do not mean “overtrading”… So far I don’t feel rushed to enter trades… but just watching price instead, and hope that eventually the price charts will be talking to me fluently - rather than me asking the charts all those questions;)

Since you have so many years of experience in trading AND in balancing the time for your family and trading, I would really appreciate if you could just tell me, if I should stop spending around 12 hours a day (monday to thursday) behind the screens;)

Sincerely Fredy

yes,was thinking about saving PCTs lately too,cause we never know what can happen with tube or babipips,anything can happen and that would be disastrous loss

woudl b great

Mark Douglas has also done a video about trading psychology (over 1 hour) and one may also be able to find the Mind over Markets video and perhaps other stuff that I’m not aware off. Search for “mark douglas trading psychology video” or something like that

if ofc you will help me. So first divergence between Euro and USD. Is it a divergence at all? If not, why not? If yes, what does it say?

if ofc you will help me. So first divergence between Euro and USD. Is it a divergence at all? If not, why not? If yes, what does it say?