After re-reading, I’m not entirely sure that made sense. We can use the SMT at LC on Cable and Fiber, but my point is that the set-ups are few and far between, the kill zone is longer, and the potential for reward is less than LO. Is there something that could further act as a filter on the LC, just as market flow acts as a filter on LO? Maybe we already have it…maybe it is the ADR…I don’t know. What I do know is that last night was not the norm, and the monitoring of multiple pairs is usually a lot more relaxing than that.

Ali can you expand a little on your use of the Williams %R as I think I’ve got the wrong end of the stick (no sniggering at the back!). I’ve been using it with a daily setting on Sunday for my weekly Top down analysis (synoptic analysis) to guage market sentiment.

I see you use it as an intra trade tool, to some effect. Is this an ITC concept or an adaption?

Folks, Im not sure whether I understand correctly how ICT defines dealing range. Is it the distance between most recent support and resistance (e.g. fractals - maybe bodies only, not wicks)???

Once this dealing range is broken, you can expect retracement back into dealing range and then continuation in the direction of breakout. Am I right?

Just want to make something clear for myself…

EDIT: Or can be dealing range defined as higher fractal of 2 most recent upper fractals (for resistance) and lower fractal of 2 most recent lower fractals (for support). Once price close above/below this level, we have breakout and look for OTE…

Jaroon - having trouble posting my reply, but here goes for a fourth time!

ICT used the Williams%R with COT extremes, right? I am just playing around with it as a possible way of bumping up my 73% success rate to the 90% that he said was attainable on the LC. Basically I am using it to clarify entries and exits. On a long trade I will look for it to be oversold at key support, and hold the trade until it becomes oversold at key resistance. Vice versa for a short.

Hope that helps.

good question, i have also been wondering if i’ve been looking at this the correct way…this is the way i see dealing range/session breakouts and retest, i know its not a 100% perfect example but just a quick one i found when i opened the charts, can anyone let me know if im wrong!

Hey everyone,

I wish I could participate more frequently!!! Hopefully one day I can.

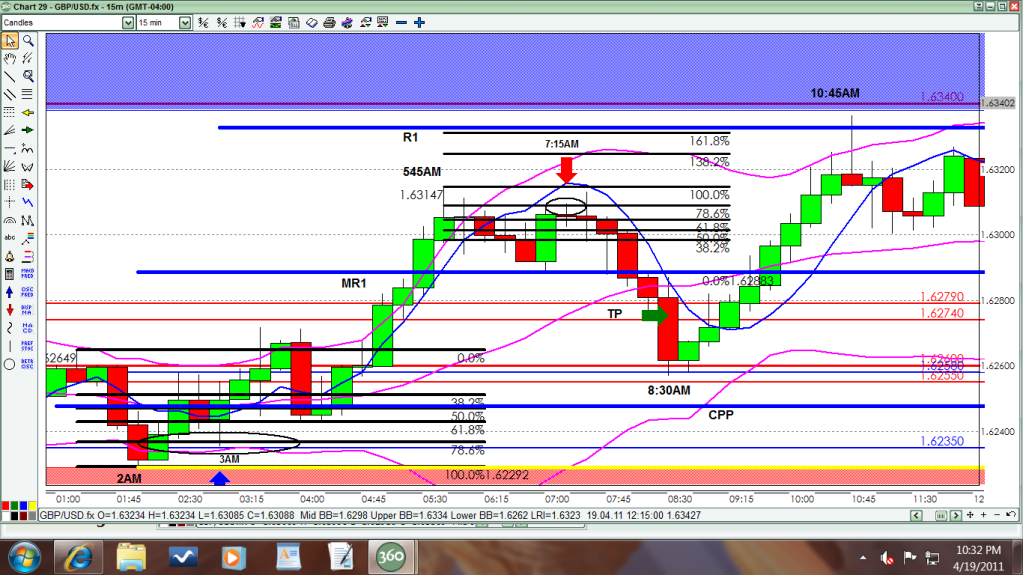

Demo trade from this morning. I did very little homework on this trade. My goal was to practice OTE trade at NY Open and build my confidence. Any comments feedback is appreciated.

Reasons for Trade - 1. NY Open target zone - 7am - 9am est. Sentiment is likely to change…PA had been going “long” since London Open on GU. 2. Price in the “sell zone” between MR1/R1 3. Fib on the most recent retrace 4. entered at the touch of the 78% fib.

Entered at 1.6305 Target 30 pips 1.6275 SL 1.6323

I circled my entry point at 7:15am and green arrow at exit

A dealing range is a consolidated area between support and resistance

where the banks are trading with each other until some stimulus

moves price out of that range. After another leg up/down then another

range of consolidation, then it breaks out, another leg up/down, then another

consolidated range, etc. Price spends most of it’s time in consolidated ranges.

The upper/lower points of the ranges are primary reference points the banks

use as they try to keep price moving their way and as these levels are retested

then S becomes R and R becomes S.

Well said flabberdous! I will definately be writing that 1000 times on the chalkboard!

Regards,

Clark.

It’s called accumulation.

Well Ali, your results speak for themselves. You have certain circumstances and clearly you’ve adapted well. I just think in a general sense, that new traders will find great advances in their consistency by shedding the unneccessary burden of watching more than 2 pairs, and simply let days or even weeks go by without getting into the market. So many new traders have overtrading as a problem, I just worry that that foundation is getting lost as the thread goes on.

It’s pretty hard to critique a winning method Ali, but if you ever find consistency starting to be a problem, I’d highly recommend cutting back some of that burden even if it gets a tad on the ‘dry’ side. But honestly best of luck, you might be surprised to know what I’m pretty impressed with the clarity of some of those LC trades you guys pull off! I of course can’t trade them because of my dayjob, so I understand the frustration of being limited to one kill zone, but I look forward to the day that I get to have a crack at them

Hey Jack B. Some of the other guys have the ITC principles down to a much higher degree than me but from a noobs POV.

The OTE was well executed but the swing your using is too small at 20 pips and I guess might be catergorised as [I]noise[/I] ICT recommends a swing of 40 pips minimum to look for an OTE.

You mention Price was on the rise in the session but it’s a great help to just check the 1 hour, 4 hour and daily market flow and at a minimum always try to trade with the 4 hour flow following a correction, this will great increase your success percentage.

Lastly I’m used to MT4 so it could be me but I find your chart a bit busy, I’d used smaller candles and have a bigger picture on screen, but you may have zoomed in for the screen shot.

The OTE was good, sell zone, S/R and kill zone all covered and a profitable trade so looking good on the whole:)

Interesting stuff about ICT, thanks.

Thanks - This is the kind of feedback I was looking for

Took a London Open trade last night with the Cable, I tried it with a pending order, it worked quite well, grabbed 60 pips, with a 30 pip SL, price had dropped right through my entry with the railroad tracks, but then bounced up to my TP in a couple hours. Not really an ideal ICT trade, but was profitable nonetheless, allowed me to make back my losses from last week, and a little bit more.

I had also placed a pending order for the Fiber as well, but it was never triggered, unfortunately.

Now, London Close is starting and watching patiently at the channel that the Fiber formed this morning. I’m also looking for a retracement on the Cable where I placed a pending order to go short at 1.64137.

Alishijo, your Kill Zone starts and ends 1 hour before mine, correct? Mine are set at 15:00-18:00GMT, so I didn’t catch the USDCHF, I may try making my LC Kill Zone 14:00-18:00GMT. (4 Hours)

Edit: I realize I haven’t posted many trades lately, or pictures, so I will try to do that more often, it feel it allows me to explain my thoughts too. I just created a Trade Journal Template so I can record my trades easier and quicker. I’ve attached it if anybody else would like to use it, it’s really quite simple, and not too complicated. I feel the simpler it is, the bigger chances that I will actually go back to them and analyse my trade.

Babypips Attachments isn’t working for me, so here’s the link:

MEGAUPLOAD - The leading online storage and file delivery service

Regards,

Clark.

Starts at 3pm GMT. Ends at 6pm GMT. Watching your Cable trade now but standing aside. GLGT!

I closed the trade about an hour ago during my final exam… Haha. +18 pips.

I won’t be able to make it to the Chat room for ICT’s Asian session appearance today. If someone would be awesome enough to post a recap of what’s covered I would be forever grateful. Doubly so if a screenshot or two are posted.

edit: Also, netted 30 pips off of a New York session trade today on the EU - just a simple OTE from a bounce off of resistance. Felt good to finally get myself back in the habit of actually entering the trades I see.

Chat room keeps crashing on me and wont permit me to join chat. Is this occurring for anyone else?

I was just able to sign in