Morning guys,

I was looking back at my previous trades, and realized that the majority, if not ALL, of my losing trades have been through pending orders 15-30mins before the session starts. I started noticing this a couple weeks ago, but thought it was part of the losing streak. I took a pending order last night about 20 mins before LO, and lost yet again. I think the reason is because the market changes quite a bit just before the session which can greatly affect the market bias, sentiment, situation, etc. And to be not able to monitor it at such a crucial time is dangerous, as I have learned the hard way, giving up a big portion of my wins already.

I think from now on, what I’ll do is do the fundamental analysis maybe an hour or two before the session, as most the American and London markets are closed. And then I will do a quick technical analysis just prior to the session, perhaps 10-15mins before the session starts. Then I will have to sit patiently during the session instead of setting a pending order.

It’s just these small things that I am trying to overcome, as well as make sound technical decisions, and pulling the trigger when I have to. My money and risk management, in my opinion, is sound and I don’t really have much to worry about except to trade. Currently, I plan on continuing on trading my small live account until I am able to see more consistent gains again. And it’s good overall practise, creating habits of planning, recording all trades, notes, thoughts, and analysis. It also helps me emotionally and psychologically when trading like this, which is something I could never learn on a demo account. I’m hoping maybe starting August or September 1st, I am able to trade more consistently and deposit in what I think is a good sum to start off. Of course, that is only if I am confident in my abilities by that time.

Sitting back and thinking about my trading “career”, I feel that I need to keep things simple and not over complicate things. That’s the only I will be able to think logically about things. Of course, this is just a personal preference for myself. I think I have got a lot more patient over the past few months, but I feel like I need to be more selective about my trades, but I’m always afraid that I won’t be able to find a trade at all in the week. But I’m willing to give it a try though, it’s better than losing money!

This probably means nothing to most of you, and is just me trying to collect my thoughts in a more organized way.

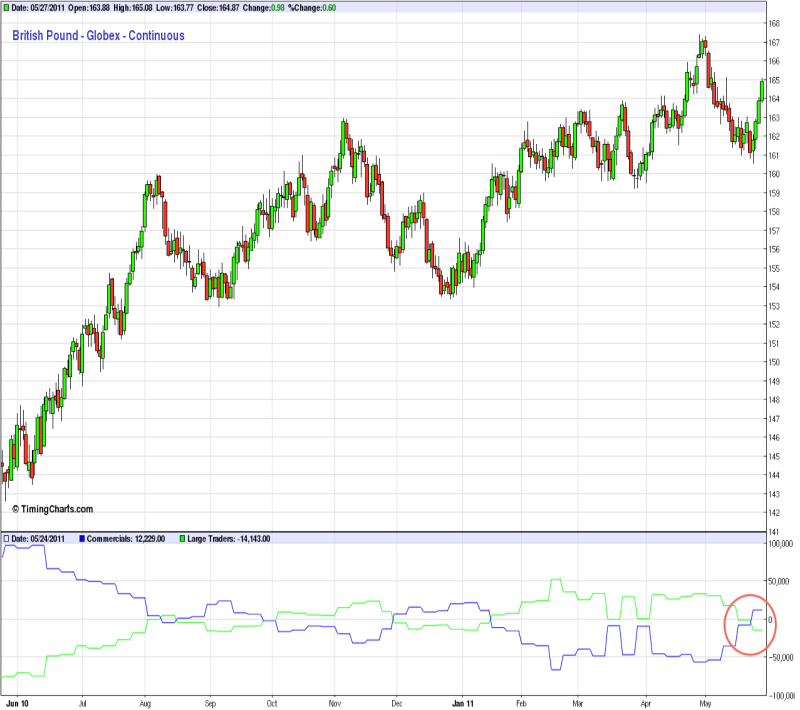

I will post my losing LO trade as soon as I can.

Regards,

Clark.