Hello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of XLV , published in members area of the website. As our members know, XLV is another instrument that we have been trading lately. The price is showing Impulsive sequences in the cycle from the March low (73.86) . The price structure of XLV has been calling for further rally. Consequently, we advised members to avoid selling XLV and keep on buying the dips in the sequences of 3,7,or 11 swings whenever get chance. In further text we’re going to explain Elliott Wave Forecast and trading strategy.

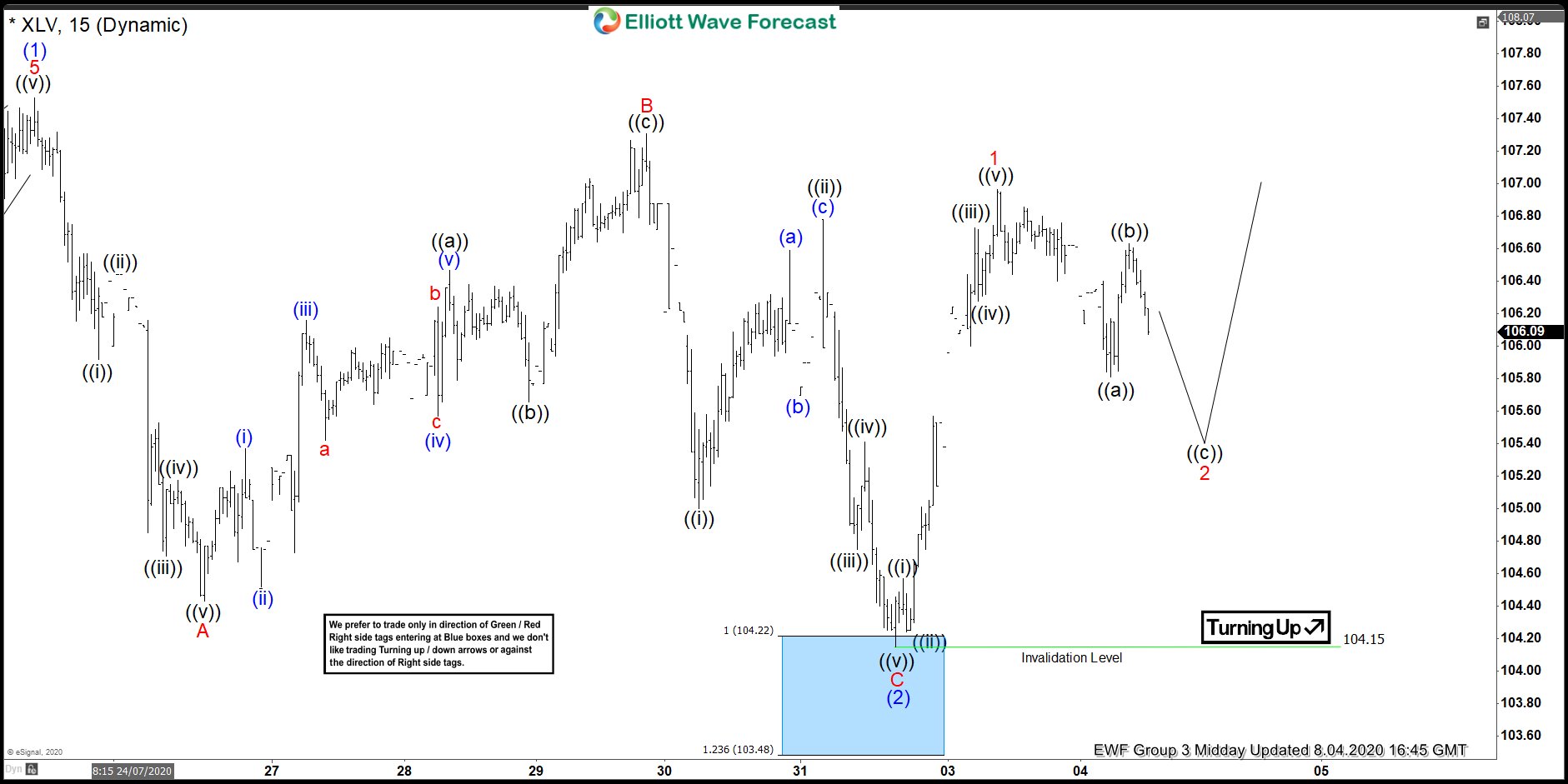

XLV 1 Hour Elliott Wave Analysis 7.31.2020

Wave (2) blue pull back is unfolding as Elliott Wave Zig Zag and still looks incomplete at the moment. The price is reaching equal legs area at 104.22-103.49 (buyers zone). As our members know, Blue Boxes are no enemy areas , giving us 85% chance to get a bounce. We don’t recommend selling it against the main trend in any proposed pull back. We favor the long side from the marked blue box area. As the main trend is bullish, we expect to see 3 waves bounce at least from the mentioned zone. As soon as the price reach 50 Fibonacci Retracement against the B red peak, we should make long positions Risk Free ( put SL at BE).

You can learn more about Zig Zag Elliott Wave Patterns at our Free Elliott Wave Educational Web Page .

XLV 1 Hour Elliott Wave Analysis 8.04.2020

XLV found buyers at 104.22-103.49 , the Blue Box area. We got nice rally from there, when wave (2) pull back completed at 104.15 low. All longs from the blue box should be risk free at this stage. As far as the pivot at 104.15 low holds , we expect XLV to keep trading higher as proposed on the charts. We don’t recommend selling it, and favor staying long from the blue box in risk free positions.

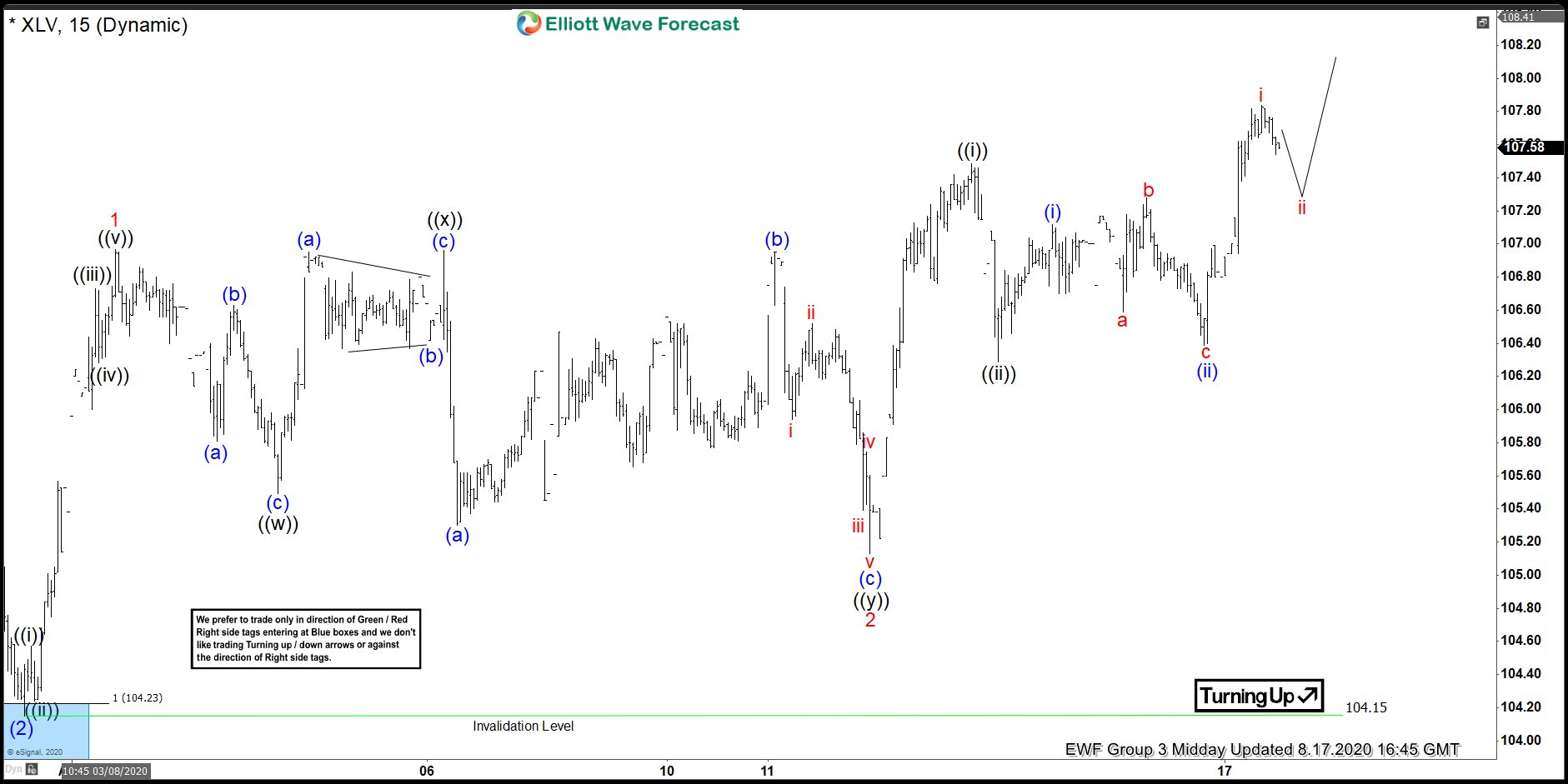

XLV 1 Hour Elliott Wave Analysis 8.17.2020

After sideways consolidation we got another leg down and wave 2 red pull back completed. 104.15 pivot held nicely during wave 2 pull back. We got further rally after 2 red completed.

You can check most recent charts in the membership area of the site. Keep in mind not every chart is trading recommendation. The best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room .

Elliott Wave Forecast