[U]Markets[/U]

Several currency pairs are chosen to increase the probability of detecting trades:

-EUR/USD

-GBP/USD

-AUD/USD

-NZD/USD

-GBP/JPY

-EUR/JPY

-USD/JPY

-USD/CHF

-USD/CAD

-EUR/GBP

-GBP/CHF

[U]Position Sizing[/U]

2 contracts will be used for all trades. At this point, I have not yet taken into account money management as determining the win:loss % remains my priority. When I have determined this figure and deemed it acceptable, I will demo with a brand new account with proper money management, risking not more than 2% of my account for each trade.

[U]Time Frame[/U]

The 4 Hours Timeframe will be traded. This saves me time spent in front of the computer all day and lets my eyes get a break. :o

[U]Entries[/U]

I only use one set of Bollinger Bands with default standard deviation set to 2.0.

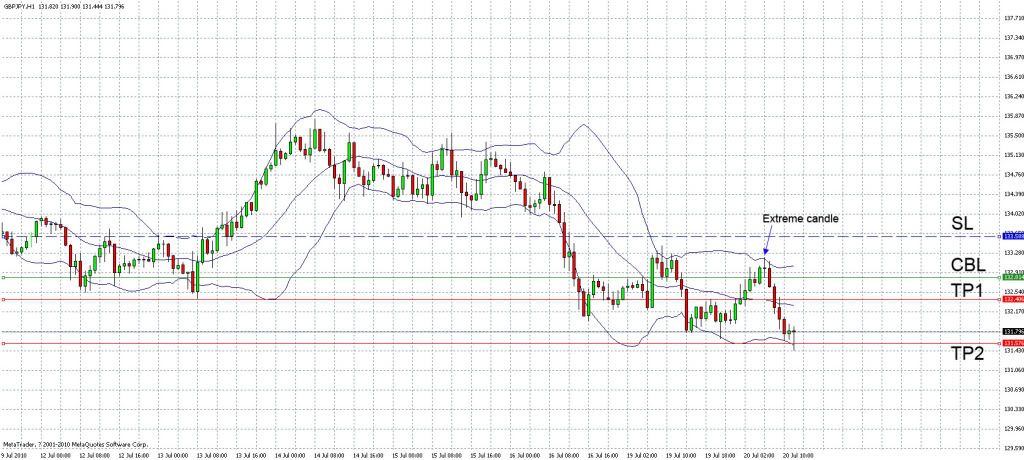

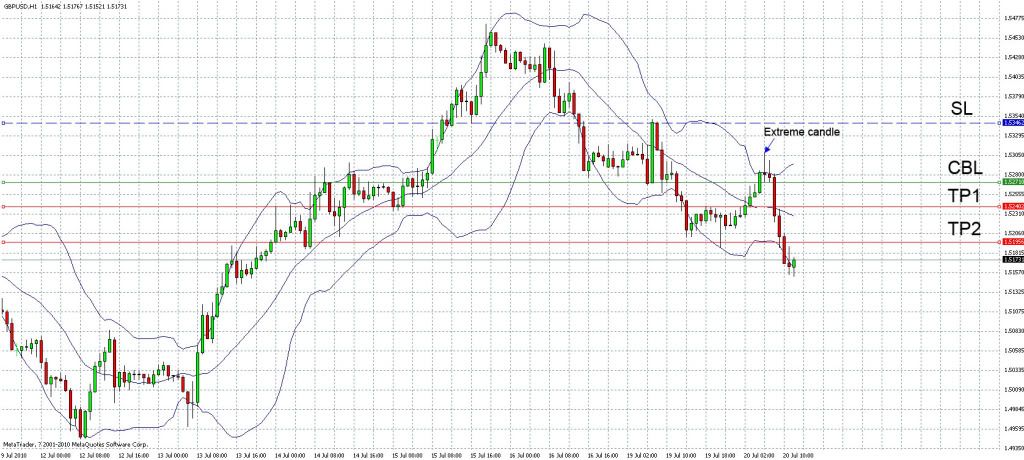

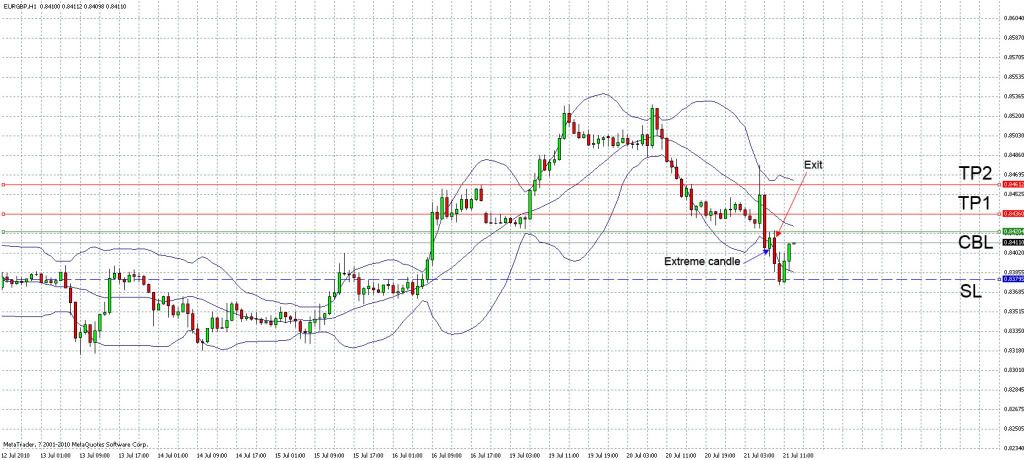

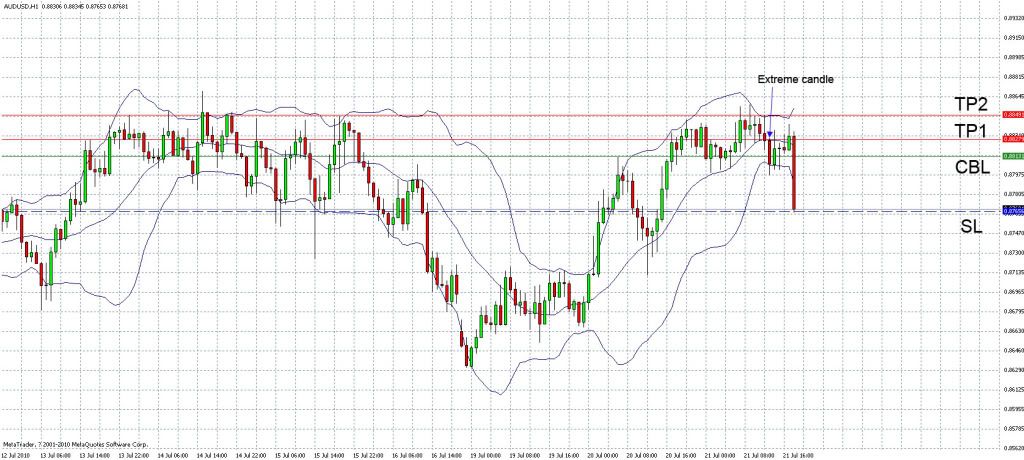

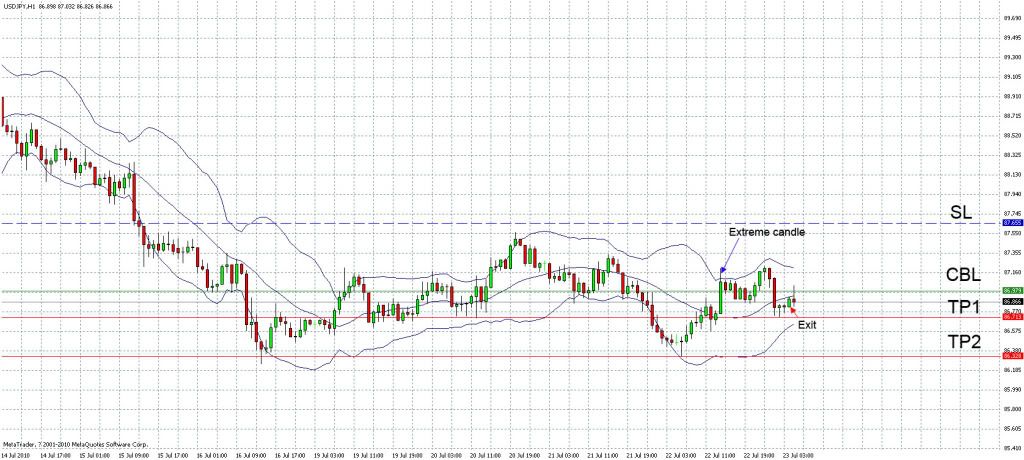

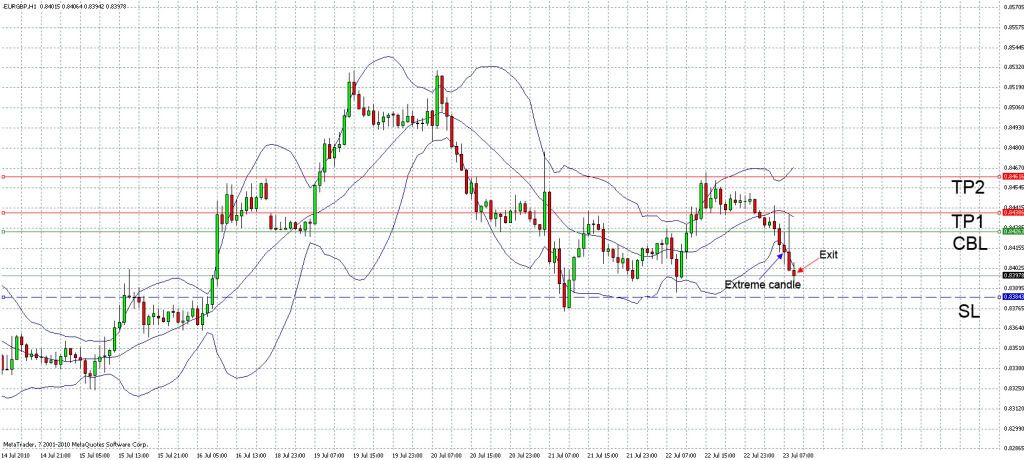

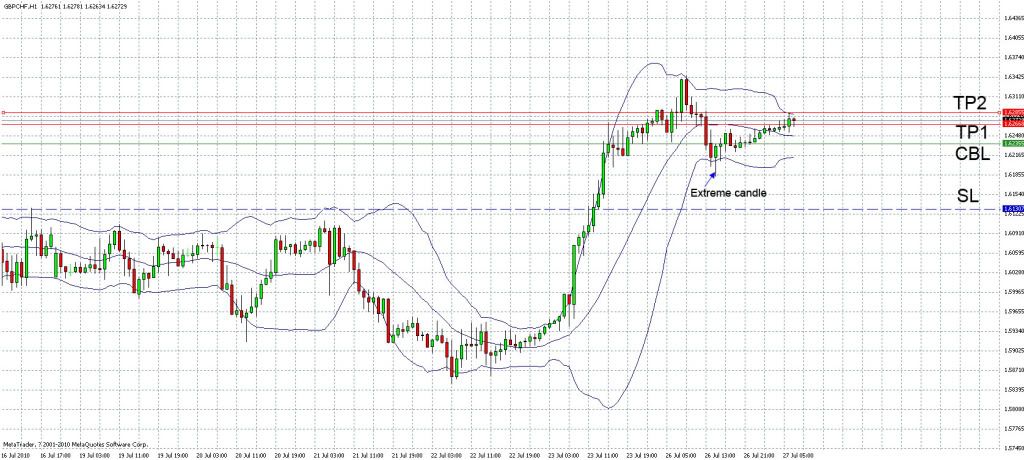

Entries will be made employing a system which uses an Orthodox Count Back Line method.

Only begin drawing the CBL from candles which touch the Outer Bollinger Band. If the CBL extends too close to the Middle Bollinger Band, then cut it in half. (I realise the definition of closeness to the middle BB is subjective since I’m only using 1 set of BB, I may look into incorporating the other in the future).

Bollinger Band bubbles and sausages will not be traded, until Point P has been reached, as they reduce the Win: Loss ratio. From my understanding, Point P is the point where the retrace of Price Action hits the opposite Outer Bollinger Band from the Outer BB the PA was walking previously.

[U]Stops[/U]

A PCI stoploss is set at 1 candle length from the extreme candle’s high/low. For example, if the extreme candle has a length of 20pips from its high to its low, the SL will be set 20pips away from the extreme candle’s high/low, depending on the direction of the trade.

A “dynamic” stop-loss (credit to Trizzle for the idea) is used should the subsequent PA close between the high/low of the extreme candle and the PCI SL. To illustrate,

Eg. For a long trade,

Extreme candle low: 100.20

Extreme candle high: 100.40

CBL: 100.40

PCI stoploss: 100.00

Should the PA after entering the trade close between 100.20 and 100.00, the trade will be exited.

Trailing Stop: Upon hitting TP1 at the middle BB, move the stop-loss to the entry position (BREAK-EVEN). As PA moves towards TP2 at the outer BB, slowly adjust the SL to the middle BB (TP1) while monitoring the movements.

If you are stopped out INITIALLY, use the candle which stopped you out as criteria for another CBL entry. If however this second entry is stopped out as well, evaluate whether or not a Bollinger Band Bubble or Sausage has formed. If it has not formed, then feel free to enter once again. If it has formed, stay out of the trade until Point P has been reached.

[U]Exits[/U]

The Middle Bollinger Band will be the site of TP1.

The Outer Bollinger Band will be the site of TP2.

When initiating the trade, set the Take Profit target immediately at the present height of the desired target Bollinger Band.

EXIT ALL TRADES BY THE MARKET CLOSE ON FRIDAY!