It all starts here, today, now. After a year of studying on and off in my spare time it is now time to start a trading journal. All trades both wins and losses will be documented here for reference.

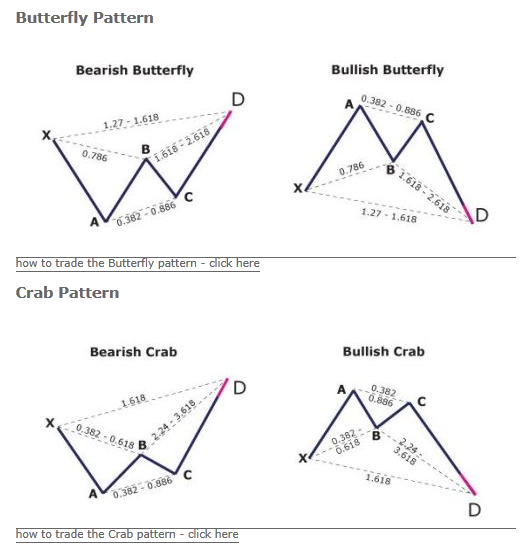

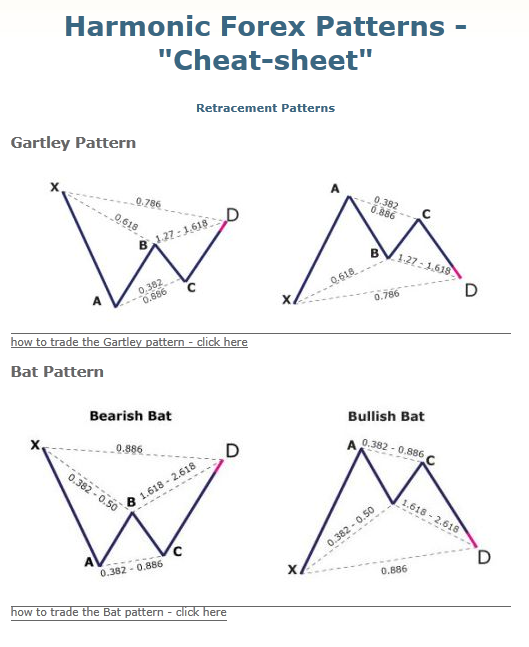

Strategy : Harmonic Trading

Description:

Harmonic Trading is a methodology that utilizes the recognition of specific price patterns and the alignment of exact Fibonacci ratios to determine highly probable reversal points in the financial markets. This methodology assumes that trading patterns or cycles, like many patterns and cycles in life, repeat themselves. The key is to identify these patterns, and to enter or to exit a position based upon a high degree of probability that the same historic price action will occur. Although these patterns are not 100% accurate, these situations have been historically proven. If these set-ups are identified correctly, it is possible to identify significant opportunities with a very limited risk.

Below are the 4 harmonic patterns you’ll see throughout this thread.

Along with patterns I use one indicator as defined below

Hurst Exponent:

In harmonic trading we use the Hurst Exponent as an estimate of predictability of a price data stream. It indicates if the price action is likely to have:-

Persistence - value 0.5 - 1 (i.e. whatever is happening now is likely to continue)

Anti-persistence - value 0 - 0.5 (i.e. whatever is happening now is likely to reverse)

Randomness - value around 0.5 (i.e. likely to go in any direction)

In Harmonic Trading, when the patterns identify possible reversal trades, the Hurst Exponent should ideally be between 0 and 0.5. (Note this is true regardless of a bullish or bearish trade). The lower and steeper the Hurst Exponent is, the better it is.

I use Hurst just as a filter to help me determine how heavy or light I should take the trade - not to influence if I take the trade or not.

Goals:

Trade a $2,300 demo account to $5,000.

Build confidence in my trading ability.

Define every step of a trade to almost mechanical execution.

Learn how tax is handled with spot forex in the usa.

Consistently win more then I lose.

Start trading live with confidence.

Helpful links:

30 pips a day keeps your money at bay Great source of harmonic trading information here at babypips.com.

At times I may post unrelated trade setups. This helps clear the mind, stay on track, among other things keep it fun.