What do you all think, does the USDCAD daily chart have a chance to form a bullish pin bar or does the top wick extend too far up?

How far you guys think euro gonna fall?

Any thought on this? anyone on it?

If that wick at the top wasn’t there I would be all over that!

The two other bounces from 1.9360 (GBP/NZD)were acompanied by PBs, that one looks like a brutal breakout.

However with such low R:R it worth a try.

Cheers.

It is not the greatest of Pinbars,however considering that August’s resistence turned into support makes it more reliable.

Cheers.

Hi Jinz - hows your week been ?

My take on these 2 crosses :

EURCAD ; Support now broken - will look for retest of new resistance then PA to get me back in Short

GBPNZD ; In solid range now and there was no PA signal to take a long off the low of the range. I will wait for a break now & either direction does not bother me at all. So long as it is a solid breakout with a retest and good PA signal.

Happy hunting next week. Enjoy the weekend buddy.

hi guys whats ur take on the gbp/aud setups looks potential though i dont like the colour of the pin besides that its resting on 1.54200 rn.av noted am learning alot by asking questions here

Hi Njokie,

I am following this forum a couple of days now and like it very much. You brought up the GBPAUD Daily chart and I like to give my opinion to that. I hope I am not stepping on somebodies feet.

I will atach my chart for my explanations.

I have market my S/R in purple. I guess your entry would be the green mark and your stop loss the red mark.

Now my problem would be the RR, because on my chart I have the next Resistance very close and on top of it my broker is charging me a 10 pip spread as you see on the left upper corner marked with the red arrow.

IMHO I would not take the trade, but in this forum are for sure smarter people which could explane that chart better.

Happy pippin!

andreasa

Njokie,

I also would not take this trade purely because the chart is respecting support and resistance at the moment.The question is do you wish to trade a range? If this is the case it is higher risk and you have to account for a much larger spread on this currency pair. Really you want to see a pullback or a Doji at an extreme of a move. Which way will it break?? Who knows? Have you looked at the fundamental news releases expected this week? Because it is so range bound I personally will keep it on my watchlist, I will then look for a break out in either direction, followed by a pullback towards the range and then a continuation pattern from the candles.

Best of luck

Hey guys this is the trade that i am going to enter tomorrow. There is a nice BEEB on aud/usd daily.

Its a no for me as

1-straight into resistance

2-buried in traffic

3-not as a swing low

Hello everyone,

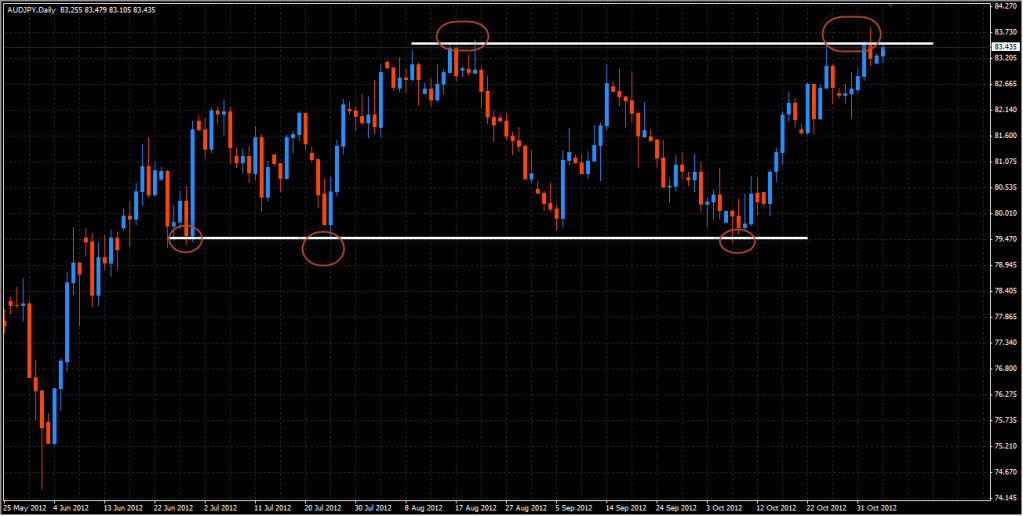

I was looking at this setup and thought it looked good…However I see possible trouble around the 82.80-90 level…Would that be enough to keep you veterans from taking such a trade? Anything else that would keep you OUT?!?

Hi,

IMHO, its’ a solid setup, and may well work out ( D1 has a pinbar )

My concerns (off the D1) are the recent higher highs+lows, and the trouble area around 82.70; will personally be watching this from the sidelines.

Cheers

Hi,

Another solid looking setup that may well work out.

Higher lows concern me here though; will be interesting to see how it plays out.

All the best!

Cheers

Does this mean you are staying out?

Yeah here’s the audjpy daily. Dudest why does it concern you with the higher highs and higher lows when it is in a range anyway?

With me it only have 2 point touch . Not enought to sure at the moment .

@ Next post : please post image help me . I can’t

A valid pin bar on the daily but If you ask me I would not trade this due to a strong support at 82.5 zone. Trade might reverse and go up. But you are right it is ranging and I will prefer to buy at the bottom of the range and let it go up since I feel like term trend is up.

Hallo Fil

I was actually looking at this as a trend reversal.

S1: price in downtrend found support

S2: price finally managed to break through the support ( clue for me: this is a key S/R )

A: price managed to turn around and break through resistance (former support).

Clue for me: If this resistance had held, down trend would still be in play.

But since now resistance was broken, this would now look to hold as NEW support ( i.e, trend reversal may be happening ).

(1) After breaking lower resistance, price found resistance at new high

(2) Price retrace back to old resistance ( S1/S2/A) and found new support and produced a Bullish Engulfing Bar => stages 1. and 2. of the ol’ 1-2-3 were complete.

(B) Take profit. Stage 3. complete.

IMHO, price may continue to range before breaking higher, or just break higher soon if there is enough bullish momentum.

Cheers!

Yes, personally staying out of both (AUDJPY, AUDUSD)

PS: i have no special knowledge, they may end up working out great.

So this is NOT trading advice, just my personal opinion.