To start I am only focusing on EURUSD on the 4 hr. No reason it wont work on the 1hr or anything higher. I just don’t beleive in trading low TF due to noise and spikes…No matter what anyone tells you.no matter what system you have.Nothing can detect a spike or tell you what is random noise… “before its too late”

I truly believe that we need to be patient.This is the key the success. Why take a trade just because it looks good. Sure you can but what makes you think you wont fall into the 95% that fail…

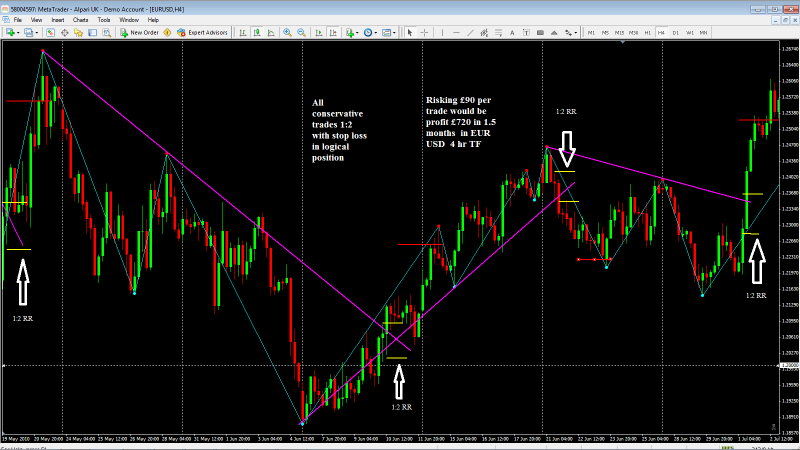

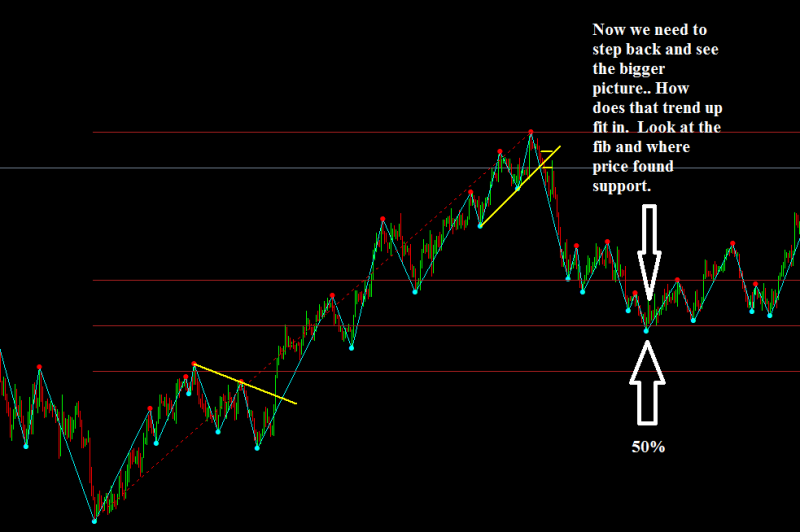

If we just be patient and wait for trading opportunities like the trade I demonstrated. Bounced off of resistance, made an impulsive move down throgh the fractal and had a tone of confluence for TP…then we can all be successful.

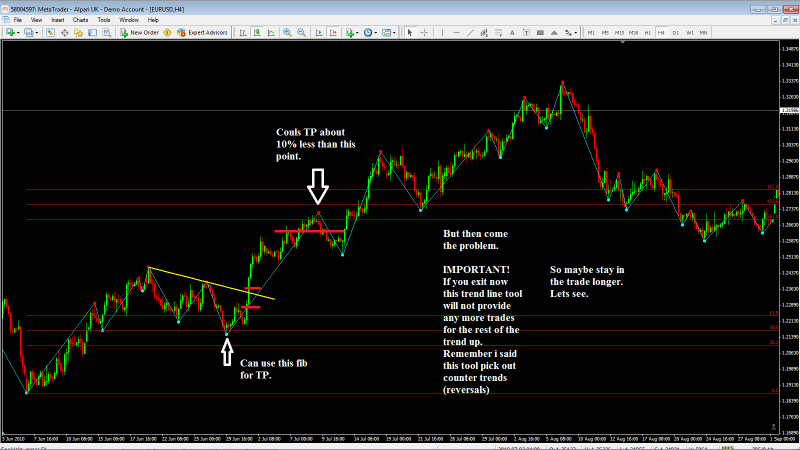

A key point to make is when to exit. Ask yourself, why exit now if the trend is likely to continue… look at that 15:1 RR. blimey. The move down could have easily been 3 trades which you may have won 1 lost 2.

There are many Currency crosses to trade. Once I am confident I will using this indi and method to search for these very same high probability trades on various pairs. So even if you have to wait 2 weeks for a trade to show on the EURUSD who cares…there are other charts. Do not take trades on a single pair simply because you want to…

Bear in mind that this method works by detecting trend reversals.

So as the trade I demonstrated shows,a trend up hit RES and turned around into a down move.These are the profitable trades BUT as I said, need patients because waiting for reversals can take a while… You might want to try this on the 1 hour instead if you wish.

[B][U]This method works best in ranging markets[/U][/B].

When there is a long trend you will find very few trade opportunities are given by the indi. So there are two solutions.

- search a different pair

- zoom into a 1 hr chart from the 4hr in which more trade opportunites will arrise.

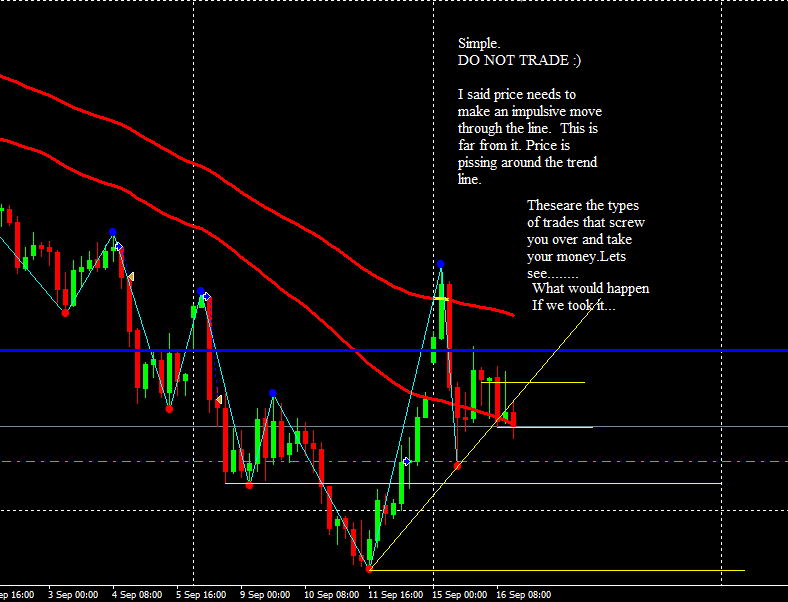

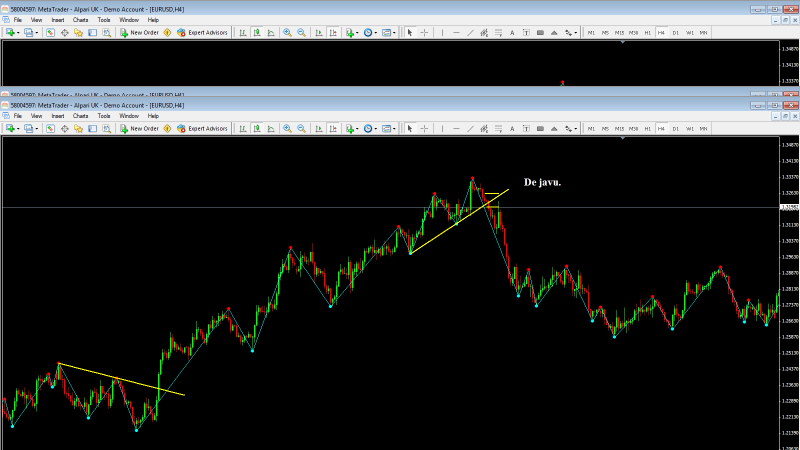

I will show the reasons why you cannot take every break of trend line,

I will show first which trade setups not to take.

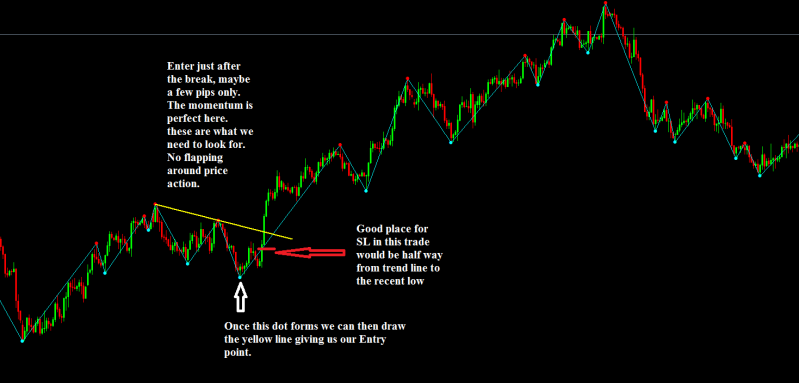

First of all understand HOW to draw the lines.

[B]Once a red or blue dot appears, you connect the previous 2 opposite dots.

Only once the dot appears you connect the previous 2.Do not connect them before because that last dot might move…

You need the trend line to have a nice angle. You do not want horizontal lines.This is why it works best in ranging markets.[/B]

On the swing Indi. You can set the number in the properties. The higher the number the less dots and the more significant the dot.

On the 4 hr I like to use 2. It provides just an extra few dots which are neccessary for getting the correct trend lines. If you use 3 or 4 there arent enough to give good signals.

While these decent setups may take quite some time to materialize… You can do this on the 1 hr TF. I probably cannot because I work full time. But remember you can search all currency pairs for the perfect setups…not just one.

Well I read the other guys thread and it looks like a good system but I’m with you in that I don’t like trading the 1m charts. Your modified system looks very promising, I’m gonna start trying it. I especially like that you can use the higher tfs as I’m also working full time. Great job on explaining it all too

Thanks. I think its good to make a thread like this.Not only for everyone but for me. Its not quite a trading log but these observed trades are captured step by step so we can all see how price moves, how to predict it and just how good or bad these fibs, sup res lines etc really are.

The problem with that 1m system is that they place the SL behind the last dot which in my opinion is a waste of potential money. Its very simple to explain. If you need to put the SL that far back then you clearly dont have beleif in the trade your taking.If price goes anywhere near your SL so far back where the previous dot is then you should never have been in the trade at all. Place the SL in the location just edging on being dangerous. If your taking the trade… you should trust it wont get hit. His trades are getting like 1:1 RR only bcos massive SL. I am tryin this method of putting the SL half way from the entry to the previous dot, which may well still be too big… we will see.

Makes sense. What close do you use, 5pm EST or midnight GMT? I spent a while getting round this but it makes a serious difference on 4H timeframes

And remember this is just 1 pair. Could be doing same thing with multiple others at the same time. Why not… its 4 hour TF so no rush. Just dont have to many trades at once to prevent margin call.

I use GMT +1 with Alpari UK. To be honest that is something I need to look into also. I heard you actually get an extra bar depending on what close you use. Ive been told its best to use the NY close.

hey so my first trade with this system was a winner!  now I’m a bit unsure as to what you do for S/L’s, at the moment I’ve just put it at 20 pips profit as right now i’m at around 60 pips profit. I obviously dont want to choke price but I dont want to lose the gains I’ve made.

now I’m a bit unsure as to what you do for S/L’s, at the moment I’ve just put it at 20 pips profit as right now i’m at around 60 pips profit. I obviously dont want to choke price but I dont want to lose the gains I’ve made.

btw the trade I made was a short of the GBP/USD as on the 4 hour charts there was a nice angled resistance and then since I had to go to sleep and I didnt want to put an oder without it being confirmed I figured that if it was gonna be a strong movement it’d have to break through pretty fast in 8 hours aka 2 bars, so I put a sell order around 30 pips below the resistance and sure enough it broke through pretty hard.

Good Job. Well take a look at the last screen shot I posted of the 4 possible trades. The SL is the most logical place on an trade by trade basis. Most the time its best just under the candle which is breaking through the line however if its too far away you can go half way from the trend line to the candle open. Or if the candle is really breaking through with momentum why not put it just before the trend line and get a potential huge RR…

the trick is to put it in a place where you think price COULD potentially go! depends if your aggresive or conservative in trading but think about it. Why put your SL in a stupidly safe place? if you think price might get near it even then… well youve probably already lost the trade and by having large stops, your lowering your RR to 1:1 alot.