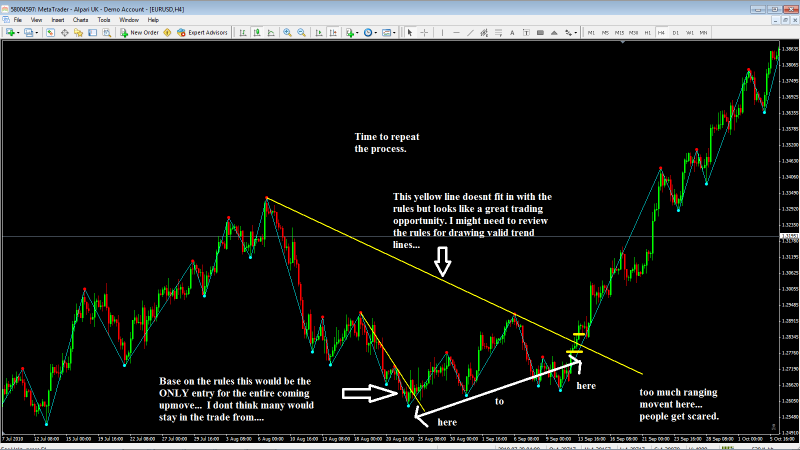

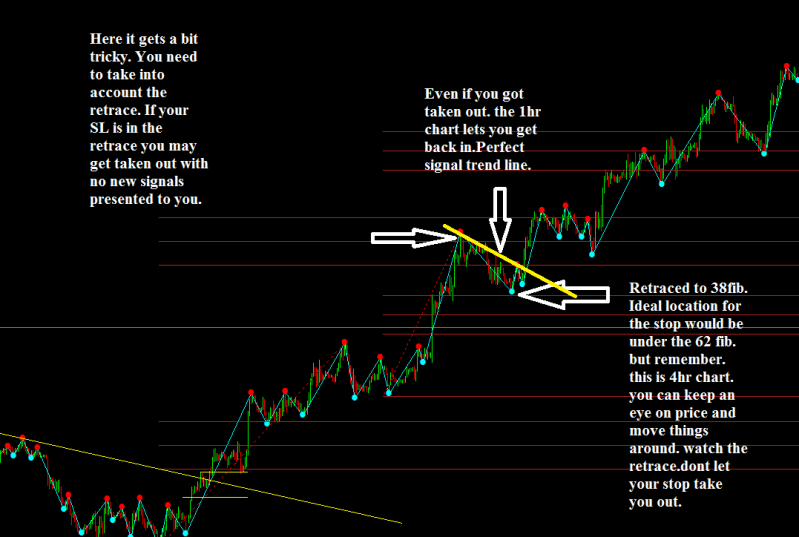

I know this all looks great in hind sight. But all we did was follow the trend line entry and use fibs…

Count it… That a hell of a profit… 5-10% a month. nah…

Nice thread, I just can’t work out where you are drawing your fib levels to. I am noticing that you start the 0.0 fib at a low point but im not sure where the 100 is.

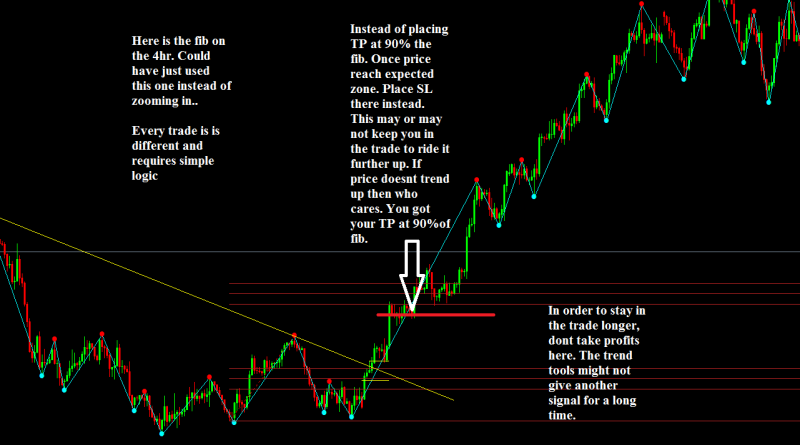

Its just each swing low to swing high. The 100 level doesnt show on my fib because theres no need. I dont need to show the 0 level really… just the 38,50,62 and 138,150 ,162

So when the trend line break formed on the above chart, where would you draw the fib lines?

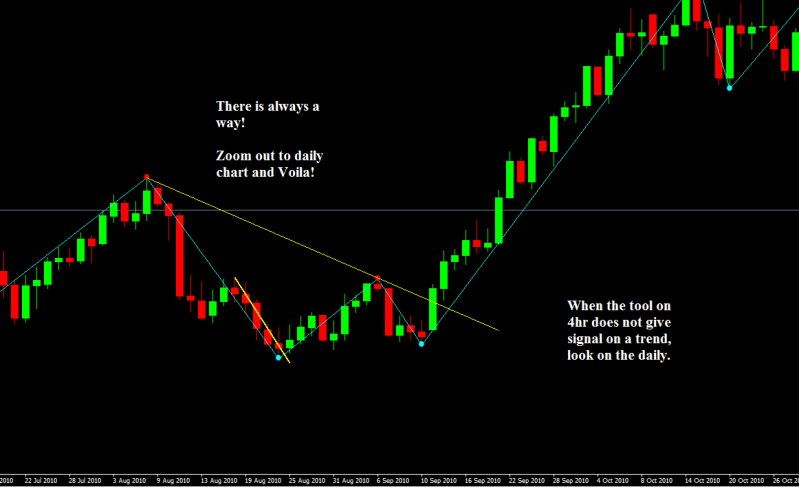

As you do not yet have a top you cannot draw a fib on that chart. You need to zoom out and look at price action to the left. Is there a swing low there? If there is then you place the 0 there and the 100 at the top on the chart above. The extended fibs will shows above where price will likely go. It not a science but FX never is. Its best guess. But as you can see from my example, it does work.

If there is no previous low on the left of that chart then I guess ur in a ranging market where fibs arent no good. Once your in a retrace on an uptrend the fib will be handy.

First off E, great tutorial, excellant job, I have a system, but had to check this one out because its well put together, and also has points of my system also.

38,50,62 ( price digits ) are very magical numbers, TO ME anyways… I even have a strat just for those numbers.

There are a few other things i use to conclude a put, and everything ties in very nicely. The R/R is awesome, if you let them ride, and you showed a pretty good TP goal, so it gives traders a sense of probable pips accumulation.

Again, Great JOb E,

Great Profits to Ya,

Loving this so far, planning to implement this indicator as part of my trading for the coming week.

After playing around with it and looking at previous weeks/months, this looks like it shows unfolding trends amazingly… I think i will be implementing this for more intraday rather than scalping as it seems to suit me better.

I like the idea of keeping it simple though, combining this with some of the other basic tools i have. I think most importantly, its keeping the charts clean - which i prefer…

Thanks for sharing, happy trading!

Thanks Epidot, I presume something like this is a good setup. Fib 0.0 is at the bottom of the down trend, fib 100 is at the top of the same down trend line and fib 161 is reached at the top of the new uptrend.

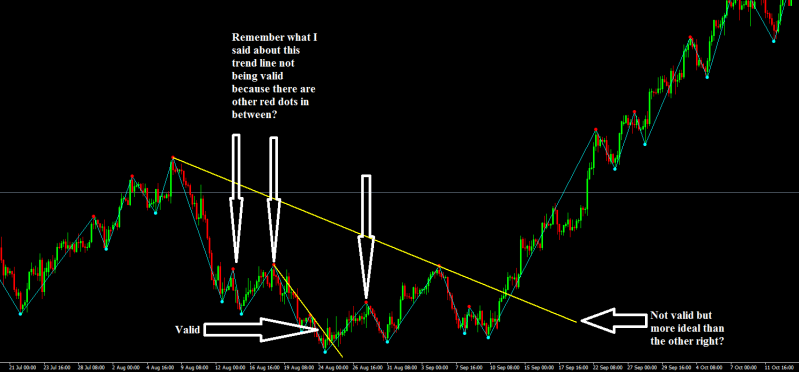

Thats right. You can see that price hit the extended fib near enough to the pip. But IMO you should remove the 0 ,23 and 100 fibs. It adds mess to the chart. we already no where 0 and 100 is and 23 isnt popular so much. Fibs only work because people assume they work. 38,50 and 62 and 138,150 and 162 is all you need.

thanks for the comments. This is real trading. No BS system where you jump in when the EA tells you. We know 95% of people lose… that is why. People dont like to use there brains.

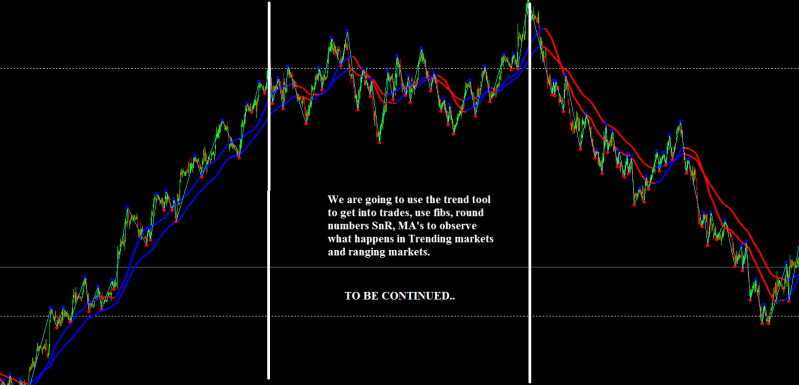

This system uses price action, fibs, SnR and “logic” along with the great fractal indicator which picks out counter trend moves “reversals” very very well.

The main point to make is to figure out when is best to get out the trade. If you can ride a trend all the way up then its far better than splitting it into multiple trades in which you might win some and lose some…

Hopefully these trades are helping us all see how price moves and when to enter and exit.

thanks

I wanted to implement a system similar to yours, but my personality didn’t quite fit holding for big gainers.

All in all, good stuff. Keep it up! :53:

Very nice thread, thanks for sharing. I think if you step back ( zoom out ) and think about the simple question " where does price want to go REALLY, despite all of the deceptive wicks and fake moves by the MM ? ", that it helps enormously.

Thanks for sharing, I`m subscribed !

BTW : what kind of moving averages do you use ? A trader friend of mine recommend the 60 sma or ema on the 4h, but then this of course looks different depending on your time zone and MT4 server time used. Others just have their 20 ema, or combos of 50 and 200 sma. Any comment very much appreciated.

Glad you like the thread. I came to the conclusion this sytem is great based on a excel spreadsheet I did. I took trades and saw how they played out based on diferent variables like where the SL is and TP, what MA’s I used.

I used 6 MA’s and the two that work at least on EUR USD are 50ema and 100sma. Price bounces of these amasingly well.

Odd that ur friend uses 60ema. Very close to my 50ema.

I’ll do some more trades today. Been at work all week and did a music gig last night. Not enough time to practice FX

This thread is us observing price action. Hopefully were all learning.

What have I learnt?

- Not to rely just on the 4hr chart. Need to utilize the daily and 1hr for signals also to get you back into trade and spot fibs the 4hr doesnt show.

2)Each trade is different. You cannot make money with a fixed rule system. (up trend from ranged market vs joining in an already formed uptrend)

We can see the step by step process here. Taking us higher and higher up the trend for more RR. I think this is key. Take as few trades as possible but get maximum profits. This up trend could have easily been multiple trades which half we may have lost!

This tool is great because as long as the trend line remains you need to try and stay in the trade bcos new signals may not show.It presents the perfect setups. So trying to get in a trade without it is dangerous. Imagin trying to run multiple trades all the way up for say 1:2 RR. Do we really think we will nail all of them for profits? You might come out the top of the trend with break even…

3)Need to use logic as a key tool in trading. (set the SL but watch out for the retrace) this kind of thing…

As im observing these trades I see they are not all so simple and can easily catch you out. Buy im not here to say this system is full proof. But to learn it enough so that it is full proof. Only because our experience will make it so. Not the system!

The great thing about this method is that is is kind of 50/50. The tool gives you the great trading opportunities and the rest is down to you!

And as I see it, this is the way to succeed. 95% lose at FX because they dont go 50/50… they do what there system tells them. There system is to robotic. But each and every trade is different. A robotic system cannot detect the difference. Im afraid we all have to use experience and logic for the other 50%.

Another great thing about this method is the potential for massive RR and with much fewer trades.

The trend toll gives us the ability to make small SL’s and the trade can go 1:5, 1:10, 1:20… if we do what were learning here… We have seen it in some of the trades right?

And if a trade doesnt run, no problem at most you will get stopped out so losing your initial investment or you may get stopped out on a retrace where you placed your SL at 90% the fib. You only need one of these 1:5 , 1:10 or 1:20 trades to come along for many of your losing trades to be meaningless…

I know it seem easy in hindsight but lets keep observing…