Why shouldn’t you be trading on Fridays?

Short USD/CAD

High volume unable to break pivot or significantly pass the long term trend line.

I noticed supply coming in on the 1hr T/F. The 5min T/F was showing some resistance around 1.44488.

Leading up to that peak was one nice bar of volume that got my attention.

I actually entered the trade for a short at 1.44423 but I really should have waited for the

No Demand ( 2nd Vertical line).

I exited the trade for 31 Pips when it hits yesterdays support area and showed some stopping volume.

You little ripper!

Stephen

I only say that because throughout this thread people kept saying dont trade fridays its to volatile etc.

But I must say that I have really enjoyed trading today and learning. I was just happy that my analysis is getting better even though I have a long way too go. Everyday it`s getting easier. All that reading, watching you guys and chart time is starting to pay off.

Stephen

3rd trade for the night was the AUD/USD. I noticed supply coming in on the 1hr T/F with a nice long pin bar.

The 5min T/F showed some stopping volume

I entered the trade at 1.04984 for a short following the No Demand bars.

I exited the trade for 19 Pips when I saw the pin bar showing some buying coming back in and the associated volume.

There’s nothing particularly wrong with trading on a Friday so long as you’re conscious of what might be going on in the market. You’ll get more book squaring by participants as they sort out their week before the weekend. This’ll be magnified if it’s around month end naturally. But if you see a trade idea that stacks up and presents you with an entry, you can define your risk acceptably and there’s room to run in your trade then don’t be put off it just because it’s Friday.

Sames goes for opening two or more trades at once - if you have your overall account risk from your combined trades kept to a safe minimum there’s nothing wrong with it in my opinion.

Thanks for the advice PipBandit.

Much appreciated.

Regards

Stephen

Update:

Update:

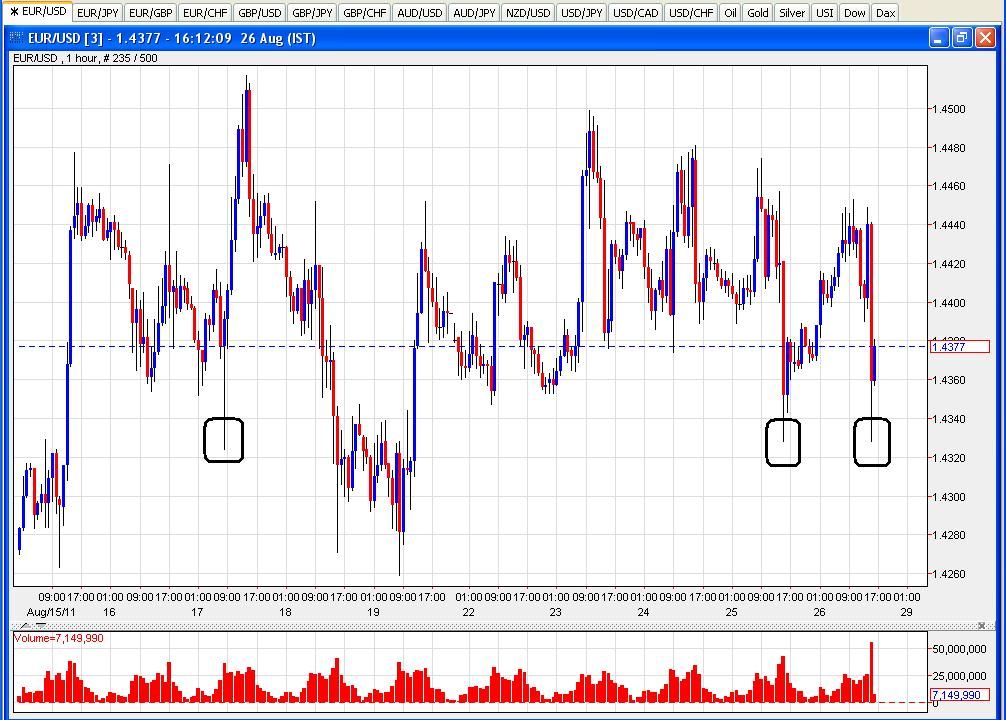

Well looks like we have a fairly identifiable marker for when the giant Panda has decided E/U has fallen enough and starts buying to keep it in it’s recent range over the past couple of week. I wouldn’t be looking to grab many pips past this point unless there’s something big driving the drop fundamentally (like maybe ECB cutting it’s interest rates soon). Looks to me like the play remains shorting in the 1.4450-1.45 area and going long in the 1.4330-50 area for next week.

Giant Panda - yes good that, LOL.

Look at the volume you have PB and forget about the news, you could’ve well grab 100 pips  The news just for the BB drives price down to fake the herd, gather SLs and trigger limit order for liquidity, it has nothing to do since it was well reserved and even went past the level before news. So the news here, have no impact what so ever, but to show the hand of BB to us

The news just for the BB drives price down to fake the herd, gather SLs and trigger limit order for liquidity, it has nothing to do since it was well reserved and even went past the level before news. So the news here, have no impact what so ever, but to show the hand of BB to us

The other reason I went long is rather statistical since for the last few weeks, it’s always bullish scenario on Friday and u know that BB often shows their hand on Friday

Short USD/CHF

Looks like distribution on the top end of Friday’s huge candle. On the daily chart we’re hitting the top of a trend line. On the 1 hour chart we have the highest volume of the day on a reversal candle on the daily trend line. Lastly, the 5 minute chart shows the highest volume at today’s high point, the test showed some shorting pressure with a low volume reversal off the pivot.

I took this short like 5 candles after the huge buying climax on H1. Unfortunetly it hit my tight stop loss. I’m thinking about going short again tho :26:

EDIT: I went short again and got stopped out for the second time today. :o … 0.6% loss for me… Can anyone explain why this textbook VSA Buying Climax didn’t work out?

Can you post the chart?

My first loss in weeks.

I still think a big short movement will occur, but the drawdown was too much and hit my SL.

This trade would have been better, but still would have experienced some drawdown. I didn’t see any sure-fire setups this session.

Shorting USD/CHF is a bit tricky at the moment - the SNB has all the bears running for the hills! The bears will be laying in wait for risk aversion to re-appear before they venture out in strength again while the SNB is still out walking around with that elephant gun of theirs would be my thinking.

There’s been a massive unwinding of the long CHF trades and now they’d like to give it another go no doubt now that the market isn’t so massively long anymore. But it needs the fundamentals to shift towards risk aversion before there’d be enough big money ready to step out and test the SNB’s resolve. The SNB can’t stand in the way of a stampede.

That’s right, I’m not applying vsa to chf and jpy pair anymore since they are influenced too much by intervention, rumors… Chf pair is a phenomenon of a large number of player unwinding their positions, plus someone think of there needs to have fundamental shift (chf overvalued) and also SL cascade for those who are short… which when combining generate powerful overflow. At the moment, it’s strong fundamental shift and there’re no signal of that about to change as of yet. But imo, eventually, it will all settled to its dominant trend.

Luiz, I took basically the same trade as Dodge. It was also first loss after 8 consecutive wins, so it wories me a bit. It sucks a ittle more because of my MM, because I increase position size after a win, so this loss took out a lot of my earlier profits :(.

Dodge, I can see that your SL is huge! How many pips was that? Where is your TP? And how much were you risking? I first thought you are trading a bit differently than me, but now I see you are taking the same trades I would. It just your charts look a lot different cause I like diferent colors :D.

PipBandit, I really hate combining VSA with fundamentals. It just seems unnecessary. All the fundamentals SHOULD be in the chart, otherwise VSA just doesn’t work. And it seems, as Luiz pointed out, that maybe we need to stay out swissy and UJ for couple months. I am already avoiding UJ, altho I noticed some crystal clear setups.

Stay out of Chf and Jpy imo, even Pete has tough time dealing with jpy pair, it’s just basically not following the exact pattern as EU did, so applying vsa to Jpy requires a bit of a difference imo.

Stick to EU, one pair and get the feel of it, we’ll see that its pattern just keep repeating, one pair is just enough.

It’s good to have SLs, when I first applied vsa, I have 20 consecutive wins  but then the following trade wiped me out because I’m too confident not even places SL. A painful experience.

but then the following trade wiped me out because I’m too confident not even places SL. A painful experience.