Impact of US Jobs Report on Australian Currency

The value of the Australian dollar recently dropped to approximately $0.655. This change was largely influenced by a strong jobs report from the United States. In November, the US reported an increase in nonfarm payrolls by 199,000 jobs, which was more than the expected 180,000. Additionally, the unemployment rate in the US decreased slightly to 3.7%, and wages grew unexpectedly. This combination of factors has led to a boost in the US dollar (USD).

Why the Aussie Dollar Weakened

This weakening of the Australian dollar, often referred to as the “Aussie,” was also affected by decisions made by the Reserve Bank of Australia (RBA). The RBA decided to keep its policy rate steady at 4.35%. This decision was anticipated and is seen as a way for the RBA to take time and evaluate how previous interest rate increases are influencing the economy, particularly in terms of demand, inflation, and employment.

The RBA has expressed some uncertainty about future household spending. However, it has also noted that inflation is becoming more moderate and that there are signs of the job market becoming less tight.

Australia’s Economic Growth

Regarding Australia’s economic performance, there was a slight increase of 0.2% in the economy in the third quarter. This growth was less than the forecasted 0.4%, marking it as the slowest growth Australia has seen in a year.

Yen Falls as Dollar Strengthens, BOJ Policy in Focus

The value of the Japanese yen has recently seen a significant decline, falling beyond 145 against the US dollar. This change comes after a period of strength for the yen, which had reached a four-month peak. The shift is primarily due to the robustness of the US dollar, bolstered by unexpectedly strong job data from the United States. This information has altered perceptions, with many now doubting that the US Federal Reserve will reduce interest rates in the early part of 2024.

Furthermore, there’s been a decrease in expectations for interest rate increases by the Bank of Japan, especially as the bank’s monetary policy decision looms on the horizon. Just a week ago, the yen had experienced a surge, jumping by 3.5% to reach about 141.7 against the dollar. This increase was fueled by remarks from Bank of Japan Governor Kazuo Ueda, who hinted that the bank might end its negative interest-rate policy sooner than expected.

In a recent statement to the parliament, Governor Ueda mentioned the potential adjustments in short-term rates, dependent on the prevailing economic and financial circumstances. He indicated that the rates could shift from zero to 0.1%, and eventually to 0.25% or 0.50%. However, he also made it clear that Japan is yet to witness a sustainable increase in inflation that is driven by growth in wages.

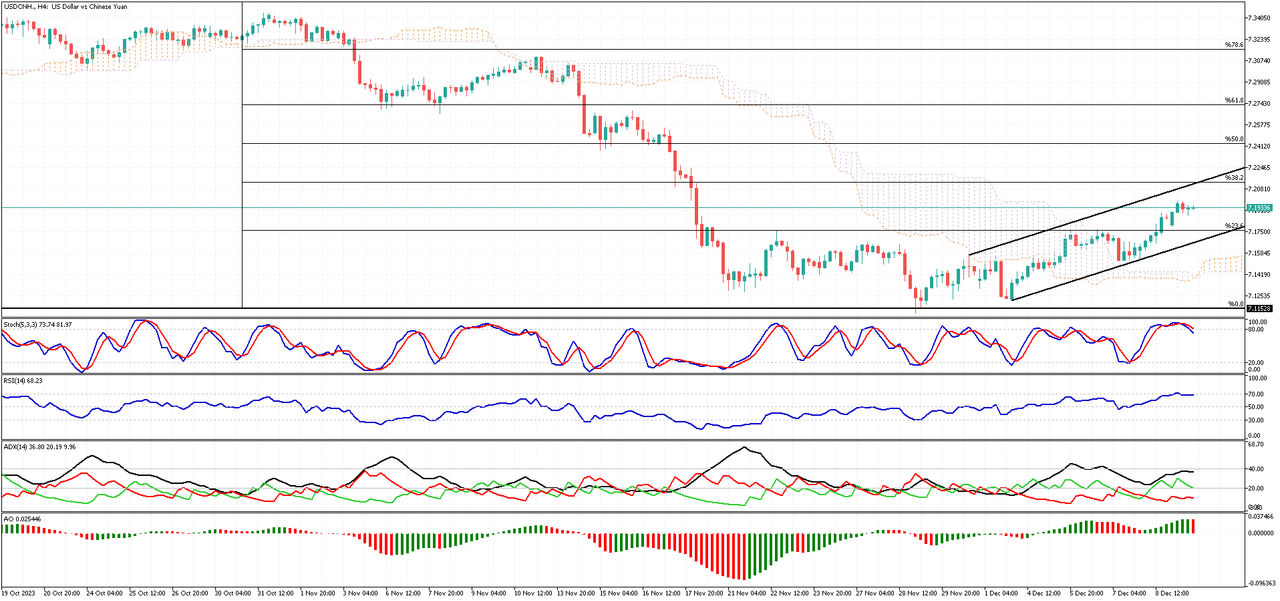

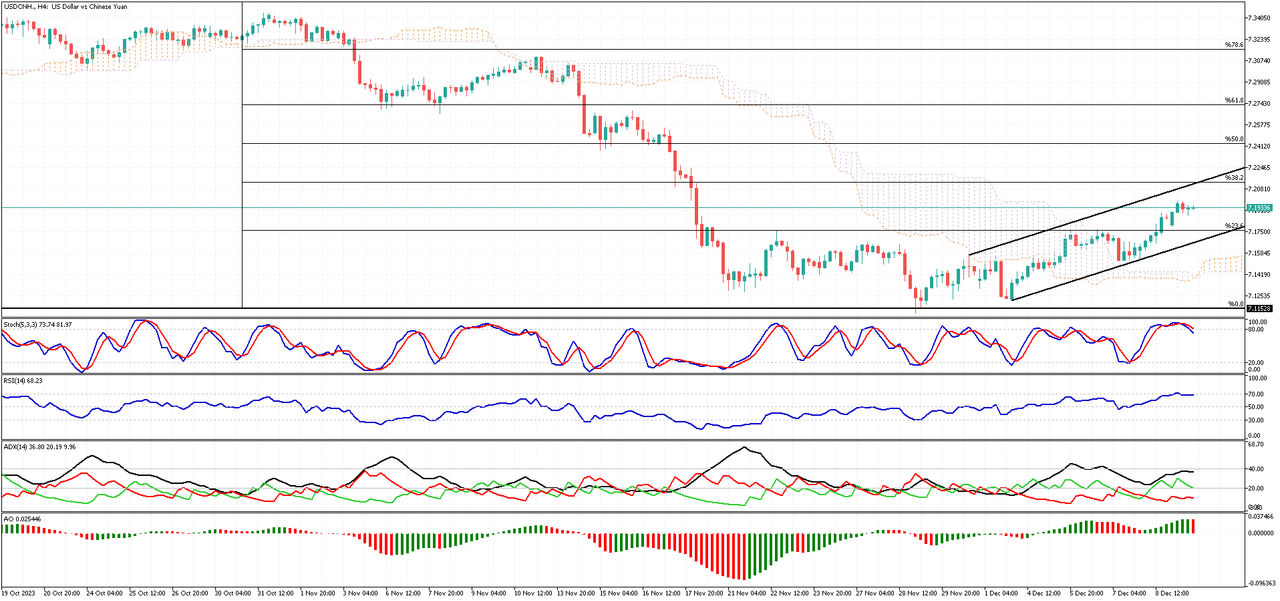

Analyzing the Recent Drop in Offshore Yuan Against the Dollar

The offshore yuan has recently experienced a notable decline, reaching around 7.20 against the US dollar. This represents its lowest level in three weeks. The primary reason for this drop is the ongoing deflationary pressures in China, indicating that the country’s economy is grappling with reduced domestic demand.

Economic Data and Its Implications

Recent statistics released over the weekend have highlighted this economic challenge. Consumer prices in China fell by 0.5% year-on-year in November, a more significant decrease than October’s 0.2% drop and below the expected 0.1% decline. Additionally, producer prices witnessed a 3% fall last month. This marks the 14th consecutive month of decline in the Producer Price Index (PPI) and is the most rapid drop since August.

These figures are critical as they reflect the purchasing trends and production costs within the economy. Persistent deflationary pressures can indicate an economic slowdown, as falling prices often lead to decreased consumer spending and business investment.

Future Economic Indicators and External Influences

Investors are now turning their attention to upcoming economic data and the loan prime rate decisions from China’s central bank, which will provide further insights into the economic trajectory. Externally, the yuan is also feeling the impact of a globally strong US dollar. This strength is partly due to unexpectedly robust US jobs data, which suggests that the Federal Reserve might not reduce interest rates as soon as previously thought, in March 2024.

Impact on the Economy

This situation presents a mixed bag for China’s economy. On one hand, a weaker yuan can make Chinese exports more competitive on the global market. However, persistent deflation and reduced domestic demand can hinder economic growth and stability. Moreover, the interplay between domestic economic challenges and external pressures like the strong US dollar creates a complex environment for monetary policy decisions.

Wall Street Braces for Fed Meeting and CPI Data

On Monday, Wall Street’s primary indexes displayed a muted demeanor as investors’ focus turned to significant upcoming events: the Federal Reserve’s interest rate meeting and the U.S. inflation report, both due later in the week. The general market sentiment suggests that a halt in rate hikes is already factored into current prices. However, investors are vigilantly looking for clues about when the Fed might adjust interest rates in the upcoming year.

Inflation Data and Its Impact

The Consumer Price Index (CPI) report, scheduled for release just before the Fed meeting, is crucial as it provides insights into inflation trends. For November, it is anticipated that the headline inflation figures will show no significant change. Such data is vital as it influences the Federal Reserve’s decision-making regarding monetary policy, which in turn affects the economy’s overall health.

Individual Stock Movements

In the realm of individual stocks, Macy’s witnessed a 16% surge after an investor group proposed a $5.8 billion bid to privatize the department store chain. In parallel, health insurer Cigna’s shares climbed 14%. This increase came after the company decided against acquiring its competitor Humana and instead announced a massive $10 billion share repurchase program.

Index Performance and Economic Outlook

As for the broader market indices, the S&P 500 slightly declined by 0.1%, settling at 4,600 points. Meanwhile, the Dow Jones Industrial Average and the Nasdaq Composite showed minimal changes. This subdued activity follows a recent surge that had driven these indices to their highest points since early 2022.

Assessment of the Market Scenario

This cautious approach in the stock market reflects investor sensitivity to macroeconomic indicators and policy decisions. While individual stock movements like Macy’s and Cigna’s provide short-term trading opportunities, the broader market’s performance is more indicative of economic confidence. A stable or declining inflation rate can signal a healthier economic environment, potentially leading to more robust stock market performance in the long term.

Economic Forces Behind the Fluctuating Canadian Dollar

The Canadian dollar has seen a decline in value, reaching around 1.36 against the US dollar. This trend emerges as the strengthening of the US dollar counterbalances the positive effects of recovering oil prices.

Impact of US Economic Data

The US dollar’s strength was bolstered by a jobs report that surpassed expectations. This robust jobs data gives the Federal Reserve room to possibly delay any cuts in interest rates, which in turn supports the value of the US dollar. When the US dollar strengthens, it often leads to a relative depreciation of other currencies, like the Canadian dollar in this case.

Recovery in Oil Prices

Concurrently, there’s been a slight uptick in oil prices towards the end of the week. As a major oil exporter, Canada’s economy and the value of its currency, often referred to as the “loonie,” are influenced by changes in oil prices. The recent recovery in oil prices can potentially boost foreign exchange inflows into Canada, offering some support to the Canadian dollar.

Bank of Canada’s Stance

On the domestic front, the Bank of Canada has indicated a leaning towards increasing interest rates in the future. Governor Tiff Macklem has pointed out that the current economic climate, especially with inflation running significantly above the desired level, does not warrant loosening monetary policies.

Economic Implications

The interplay between the Canadian dollar’s value, oil prices, and monetary policy decisions is a complex one. A weaker Canadian dollar can make Canadian exports more competitive, potentially boosting sectors like manufacturing. However, it also means higher costs for imports, which could contribute to inflationary pressures.

The Bank of Canada’s potential interest rate hike can be seen as a response to control inflation. Higher interest rates can cool down an overheated economy, but they also run the risk of slowing down economic growth.

@SOLIDECN - could you respond to the questions so repeatedly asked of you in this thread ?

Ignoring them and producing irrelevant “information” that doiesn’t answer them won’t make them go away.

That approach really doesn’t speak at all well of your honesty or integrity.

People both here and in other forums are now increasingly pointing this out and my guess is that that process won’t stop until you show some honesty and integrity in your responses to what are totally legitimate, obvious and simple questions.

https://www.wikifx.com/en/dealer/3668502333.html

2 Likes

Analyzing the Recent Depreciation of the Mexican Peso

The Mexican peso has recently experienced a decline in value, now trading beyond the 17.4 mark against the US dollar. This level is close to the lowest it has been since the early days of November. This trend appears to be a reaction to the latest signs of disinflation in Mexico, which is influencing market expectations about the monetary policy stance of the Banco de México (Banxico), Mexico’s central bank.

A closer look at the economic data reveals some shifts. Mexico’s Producer Price Index (PPI), which measures the average changes in prices received by domestic producers for their output, increased by 1.20% year-on-year in November. This rate is a tad lower than the 1.30% seen in the previous month. Moreover, there was a month-over-month change, moving from a 0.5% increase in October to a 0.4% decrease in November.

In terms of core inflation, which is often used as a gauge for underlying long-term inflation trends in an economy, the numbers came in at 5.3% for November. This figure is lower than expected and represents a slowdown from the 5.5% recorded in the previous month.

Banxico’s Response

These developments are in line with recent comments from Banxico’s Governor Victoria Rodriguez Ceja and Deputy Governor Jonathan Heath. They have indicated that the central bank might ease its policies if the trend of disinflation continues, which could lessen the support for the Mexican peso.

Market Anticipation and Outlook

Traders and investors are now keenly awaiting the upcoming policy decisions from both the Federal Reserve and Banxico. The general expectation is that both will keep borrowing costs restrictive. However, there is some uncertainty regarding the tone and approach the officials will take moving forward.

Tuesday’s Triumph: FTSE 100 Soars, Marking a New High

On Tuesday, UK’s stock market witnessed a significant rebound. The FTSE 100 index, a key indicator, increased by 0.4%, reaching 7,570 points. This jump more than made up for the small loss experienced the day before, marking a near two-month high. The rise was largely driven by a recovery in stocks related to commodities. This shift in the market occurred as investors digested the latest UK labor report.

Interestingly, the unemployment rate has remained steady at 4.2% for five consecutive months. However, there’s a twist in the tale of wage growth. While still strong, it has seen its most considerable slowdown in almost two years. This development has led money markets to anticipate the Bank of England’s (BoE) first rate cut in June. However, there’s a general agreement that the BoE will likely follow the Federal Reserve’s lead in terms of timing.

On the corporate front, companies like Rio Tinto, Anglo American, and Antofagasta played a significant role. They each saw gains of over 1.5%, bouncing back from the previous day’s downturn. This recovery was supported by a resurgence in the prices of base and ferrous metals, following China’s recent sharp decline in inflation.

However, not all news was positive. Hargreaves Landsdown, a notable firm, experienced a sharp 8% decline in stock value. This drop came after the Financial Conduct Authority (FCA) raised concerns about the firm’s practice of paying interest on cash balances to customers.

The EURUSD Dilemma: Between Bullish Breakouts and Bearish Channels

The EURUSD pair experienced a surge in today’s trading session. It is now trading above the 50% level of the Fibonacci retracement tool. Simultaneously, the RSI indicator has flipped above the middle line, signaling a bullish trend. Despite this, the EURUSD pair remains within a bearish channel. For a bullish shift to be confirmed, bulls need to close and stabilize the price above the upper band of the flag. If they fail to do so, the bearish trend is likely to persist, particularly if the EURUSD price dips below the 50% Fibonacci level.

In summary, the current trend of EURUSD is bearish. This trend could come to an end if the price crosses above the flag. However, if the price falls below the 50% level, the bearish trend is expected to continue. Under such circumstances, the next bearish target would be the 61.8% support level, potentially extending to the 78.6% level.

GBPUSD

The GBPUSD pair is currently trading below the Ichimoku cloud, indicating a potential continuation of the downtrend. If the bears manage to close and stabilize the price below the red bullish trendline, currently at 1.2539, this would further confirm the bearish momentum. In such a scenario, we could expect the downtrend to extend towards the 38.2% Fibonacci support level.

AUDUSD Rises, But Faces Ichimoku Cloud Challenge

Solid ECN – The AUDUSD currency pair has recently broken above its bearish channel. Accompanying this shift, the Awesome Oscillator is moving above the signal line, while the RSI (Relative Strength Index) remains above the median line. These indicators collectively suggest a bullish trend. However, it’s important to note that the pair is still trading below the Ichimoku cloud.

For the uptrend to gain momentum, it’s crucial for the bulls to secure and maintain the price above the Ichimoku cloud. Conversely, if the AUDUSD price falls below the 23.6% support level, it could signal a continuation of the downtrend.

@SOLIDECN - please reply to the questions asked in this thread ?

Ignoring them and/or producing irrelevant “information” that doiesn’t answer them won’t make them go away and doesn’t speak at all well of your honesty or integrity, as people both here and in other forums are now increasingly pointing out.

wikifx.com

wikifx.com

US Futures Gain Post-Inflation Data; Eyes on Fed’s Next Move

Solid ECN – After the release of US inflation data, stock futures in the US saw a modest rise on Tuesday. The major averages each grew by approximately 0.2%. This increase came as the inflation figures aligned closely with predictions. Notably, headline inflation eased to 3.1%, while the core rate remained steady at 4%, as anticipated. Additionally, the monthly core rate climbed to 0.3%, and the headline rate saw a 0.1% increase, slightly above the expected flat rate.

The Consumer Price Index (CPI) report has bolstered expectations that the Federal Reserve will hold interest rates steady in its upcoming decision. However, the focus is now shifting to the Fed’s plans for next year, particularly regarding when borrowing costs might start to decrease.

In corporate news, Oracle’s stock fell about 9% in premarket trading due to disappointing revenue figures. Moreover, Alphabet’s shares dipped roughly 0.9% after losing an antitrust lawsuit to Epic Games.

USDJPY Tests Crucial Support: Bearish Trends in Focus

The USDJPY currency pair recently climbed, approaching the 23.6% support level. This particular level coincides with the previously breached bullish flag pattern. Given that the pair is currently trading below the Ichimoku cloud, it suggests a bearish outlook. Consequently, it’s anticipated that the price may decline, targeting the 38.2% support level in the near future.

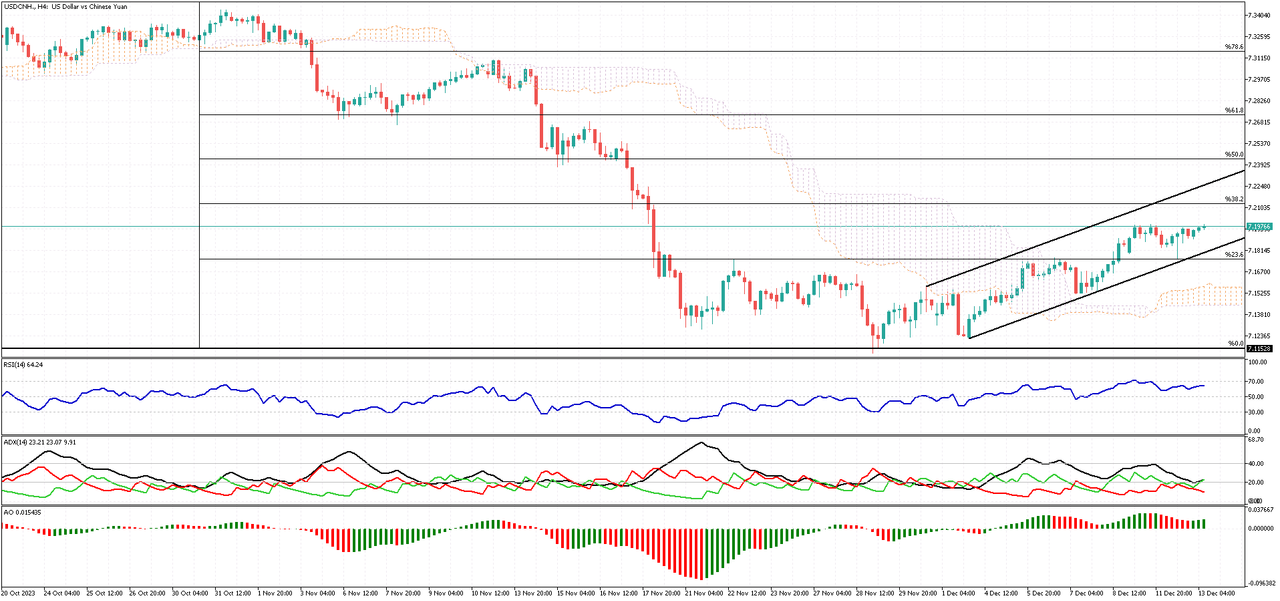

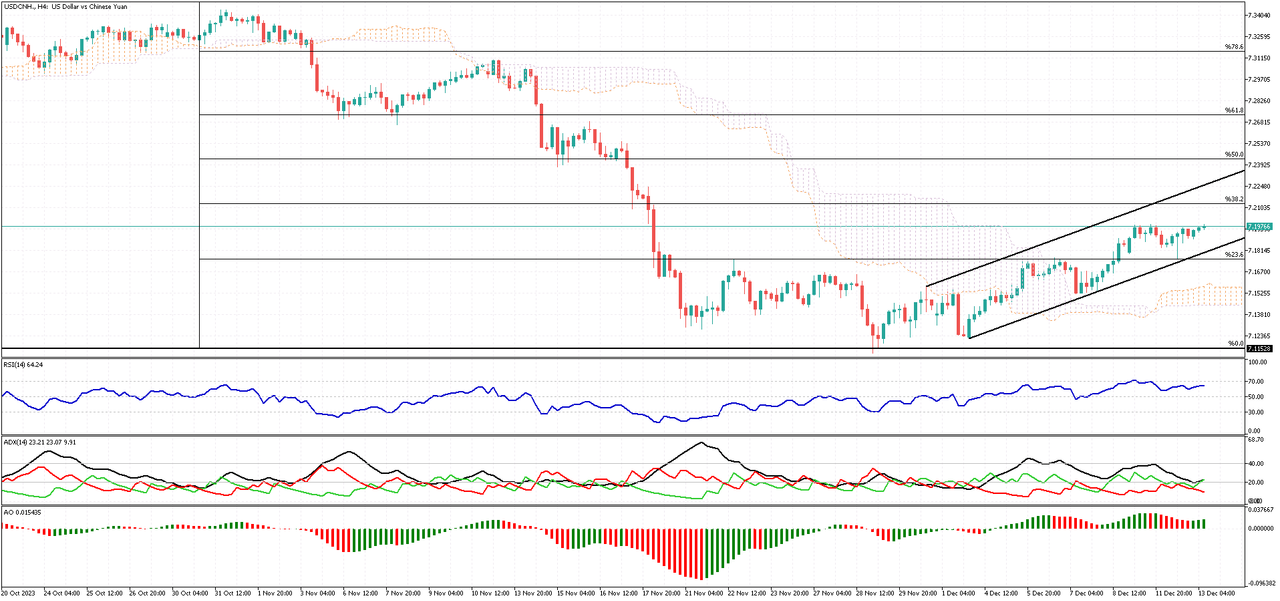

Understanding the Offshore Yuan’s Recent Dip

Recently, there has been a notable decrease in the value of the Chinese Yuan in international markets. Specifically, the offshore yuan’s value has dropped, approaching 7.2 against the US dollar. This change marks a significant low point for the currency, as it hasn’t been this low in over three weeks.

Details of the Policy Meeting

This decline occurred following a major policy meeting held by top Chinese officials. In this meeting, the officials discussed and set economic goals for the upcoming year. However, their announcements did not significantly encourage or uplift the market. One key point was the lack of a precise target for economic growth. Instead, the focus was on increasing domestic demand through a variety of fiscal and monetary policies.

The Economic Indicators

Investors are now keenly anticipating several important economic indicators from China. These include upcoming data on industrial production, retail sales, and unemployment figures. Additionally, there’s a heightened interest in the decisions regarding the medium-term lending rates by the People’s Bank of China, scheduled for the following week.

Recent Economic Data

Compounding the situation, recent economic data from China has shown some concerning trends. Consumer prices in the country decreased by 0.5% year-on-year in November, a more significant drop than the previous month and worse than what was predicted. Moreover, producer prices also fell by 3% last month. This decline has been ongoing for 14 months and is the most rapid since August.

Economic Implications

The Yuan’s depreciation could have mixed effects on the Chinese economy. On one hand, a weaker Yuan makes Chinese exports more competitive in global markets, potentially boosting export-driven sectors. However, it also indicates underlying concerns about the health of the domestic economy, particularly in terms of domestic demand and industrial productivity.

EURUSD Faces Key Fibonacci Resistance: What’s Next?

The EURUSD currency pair recently encountered the 38.2% Fibonacci resistance level. This significant resistance is further reinforced by the presence of the Ichimoku Cloud. As long as the EURUSD price remains below this 38.2% level, the bearish outlook continues to be relevant. Currently, if the bearish trend persists, the next objective for sellers could be the low experienced in December. Following that, the lower boundary of the established bearish channel could be the subsequent target.

GBPUSD’s Challenge with the Ichimoku Cloud: A Bearish Outlook

Solid ECN Blog – The GBPUSD currency pair recently faced a setback, unable to break through the Ichimoku cloud. Following this, it dropped back under the 23.6% Fibonacci level. When we look at the technical indicators, there’s a clear signal. The Relative Strength Index (RSI) is lingering below 50. Meanwhile, the Average Directional Index (ADX) suggests a weak trend, though its bearish line is rising above 20. Additionally, the Awesome Oscillator’s bars have switched to red, indicating a bearish trend. These indicators collectively point in one direction: they suggest that the downtrend for GBPUSD is likely to continue.

What’s Next for GBPUSD?

As long as GBPUSD remains below the Ichimoku cloud, we can expect the bearish trend to persist. The first target for this downward trend would be the 38.2% Fibonacci support level.

On the other hand, if the pair manages to rise above the Ichimoku cloud, it would invalidate the current bearish scenario.

Understanding the Bearish Signals in the AUDUSD Marke

Soldi ECN – The AUDUSD currency pair is currently trading below the Ichimoku cloud, indicating a potential shift from a bullish to a bearish trend. However, the pair has not yet fallen below the November high of 0.6525. This resistance led to a surge in the AUDUSD price, causing it to test the cloud for the second time this month. Presently, the pair is fluctuating within a bearish flag pattern, suggesting that a breach below the 0.6525 support level is probable. If this occurs, the next target for the bears could be the 161.8% Fibonacci support, followed by the lower band of the trading channel.

On the other hand, as long as the AUDUSD pair remains below the Ichimoku cloud, the overall trend is considered bearish. This suggests that traders should be cautious, as the market could continue to follow a downward trajectory.

USDCAD Tests Key Support Levels

Solid ECN - The USDCAD currency pair crossed above the Ichimoku cloud on November 12. Currently, it’s testing the cloud for support, a level that coincides with the broken bearish channel.

Technical indicators are hinting at a potential bearish trend. Yet, as long as the USDCAD pair trades above the bullish trendline (depicted in red), we can anticipate a price increase. If this trend continues, the next bullish goal might be the 50% level of the Fibonacci retracement tool.

On the flip side, should the USDCAD pair close and stabilize below the cloud, it would invalidate the bullish analysis. In such a case, the bears’ initial target could be the November low, marked at 1.34781.

Why do you lie to prospective account-holders about whether your company is regulated, and then ignore them completely when they ask for further details?