Major central banks may adjust their policy in the second half of 2025 as the Federal Reserve appears to be on track to reduce US interest rates.

By :David Song, Strategist

2025 2H Central Bank Outlook

Major central banks may adjust their policy in the second half of 2025 as the Federal Reserve appears to be on track to reduce US interest rates, while the European Central Bank (ECB) could be nearing the end of its rate-cutting cycle as ‘there was one Governing Council member who did not support the decision’ to lower the main refinancing rate to 2.15% in June.

North America

Federal Reserve

Keep in mind, the Federal Open Market Committee (FOMC) kept its benchmark interest rate at 4.25% to 4.50% in June as ‘increases in tariffs this year are likely to push up prices and weigh on economic activity,’ and the central bank may stick to the sidelines in the third quarter as the ongoing transition in fiscal policy clouds the outlook for the US economy.

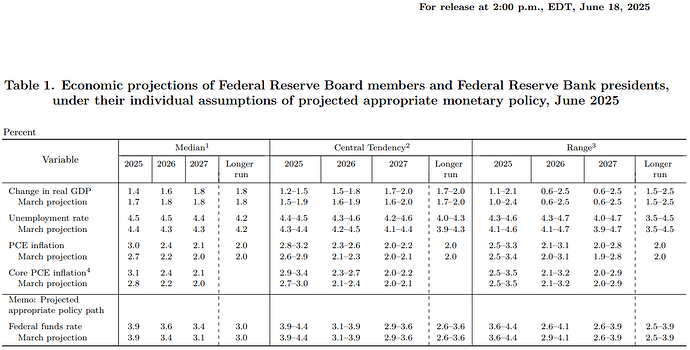

Source: FOMC

However, the update to the Fed’s Summary of Economic Projections (SEP) suggests the central bank will further unwind its restrictive policy in 2025 as the ‘median participant projects that the appropriate level of the federal funds rate will be 3.9 percent at the end of this year, the same as projected in March.’

In turn, the Fed may abandon its wait-and-see approach later this year especially as the Trump administration avoids a trade war, and the US Dollar may face headwinds over the coming months on the back of expectations for lower interest rates.

Europe

European Central Bank

Meanwhile, the European Central Bank (ECB) lowered Euro Area interest rates throughout the second quarter as ‘most measures of underlying inflation suggest that inflation will settle at around our two per cent medium-term target on a sustained basis,’ and the Governing Council may pursue an accommodative policy as ‘a further escalation in global trade tensions and associated uncertainties could lower euro area growth.’

In response, the ECB may push Euro Area interest rates below neutral as ‘falling energy prices and a stronger euro could put further downward pressure on inflation,’ but little signs of a recession may lead the Governing Council to alter the course for monetary policy as the President Christine Lagarde and Co. acknowledge that ‘rising government investment in defence and infrastructure will increasingly support growth over the medium term.’

As a result, the ECB may transition to a wait-and-see approach following the rate cuts from earlier this year, and developments coming out of Europe may heighten the appeal of the Euro amid the expansion in fiscal spending.

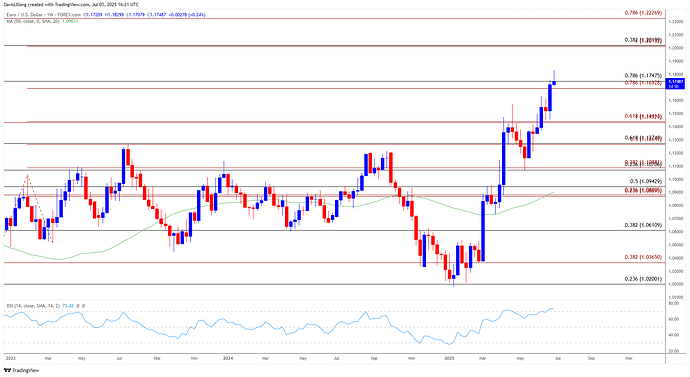

EUR/USD Weekly Chart

Source: TradingView

EUR/USD trades at its highest level since 2021 as it rallies to a fresh yearly high (1.1772) in the second quarter, with the rally in the exchange rate pushing the Relative Strength Index (RSI) on a weekly timeframe into overbought territory.

The bullish momentum may persist as long as the RSI holds above 70, and a move above the 1.1690 (78.6% Fibonacci extension) to 1.1750 (78.6% Fibonacci retracement) zone may lead to a test of the September 2021 high (1.1909).

Next area of interest comes in around 1.2010 (100% Fibonacci extension) to 1.2020 (38.2% Fibonacci retracement), but EUR/USD may face a near-term correction if it struggles to test the September 2021 high (1.1909).

Lack of momentum to hold above the 1.1690 (78.6% Fibonacci extension) to 1.1750 (78.6% Fibonacci retracement) zone may push EUR/USD back toward the 1.1430 (100% Fibonacci extension) to 1.1440 (61.8% Fibonacci extension) region, with the next area of interest coming in around 1.1270 (50% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement).

Asia/Pacific

Bank of Japan

At the same time, the Bank of Japan (BoJ) stuck to the sidelines at its last meeting in June, with the board voting unanimously to keep its benchmark interest rate at 0.50%.

Nevertheless, the BoJ announced that its purchases of Japanese government bonds (JGBs) ‘will be cut down, in principle, by about 400 billion yen each calendar quarter until January-March 2026, and by about 200 billion yen each calendar quarter from April-June 2026,’ and it seems as though the central bank is in no rush to further normalize monetary policy as ‘underlying CPI inflation is likely to be sluggish, mainly due to the deceleration in the economy.’

With that said, the BoJ looks poised to stay hold in the third quarter as Japan still negotiate a trade deal with the Trump administration, and swings in the carry trade may continue to influence the Japanese Yen as Governor Kazuo Ueda and Co. remain reluctant to implement higher interest rates.

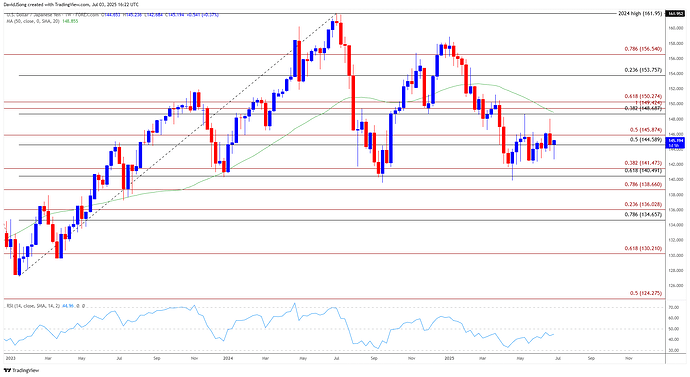

USD/JPY Weekly Chart

Source: TradingView

USD/JPY still trades within the 2024 range as it bounced back from a fresh yearly low (139.89) in April, and the exchange rate may continue to track sideways as amid the failed attempt to close below the 140.50 (61.8% Fibonacci retracement) to 141.50 (38.2% Fibonacci extension) region.

Need a move/close above the 148.70 (38.2% Fibonacci retracement) to 150.30 (61.8% Fibonacci extension) zone to bring the March high (151.31) on the radar, with the next area of interest coming in around 153.80 (23.6% Fibonacci retracement).

However, USD/JPY may no longer trade within last year’s range on a close below the 140.50 (61.8% Fibonacci retracement) to 141.50 (38.2% Fibonacci extension) region, with a move/close below 138.70 (78.6% Fibonacci extension) opening up the July 2023 low (137.24).

— Written by David Song, Senior Strategist

https://www.forex.com/en-us/news-and-analysis/2025-2h-central-bank-outlook/

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.