I’ve been there plenty of times. I still have times when I feel as you do. It’s as if no matter what you do, even the opposite of what you normally do, gives a bad trade. You have to ride through it.All I can say is not to jump into trades and don’t force anything. There were a few trades I thought looked good today, but got stopped out. That’s what the stop loss is for. Maintaining a good risk reward and money management is what will save you. Even though I had a few losses today, I also had a few wins with 3:1 or better r&r keeping me ahead overall. Like I said, we have to trade the losers too. It’s planned for. Just like a restaurant that buys lemons for drinks or napkins knowing they are just given away for free, they know they will still come out on top in the long run. Keep staying positive.

Yeah, I still have a lot to learn, I basically forced myself to open a small live account because I figured the small amount of money that I will inevitably lose will teach me a lot about dealing with emotions during live trading. I have unsuccessfuly martingaled myself a couple of times and will probably switch back to my demo now after taking note of the way live trading feels.

I would also suggest a good trading plan too. It’s something everyone thinks they don’t need, is boring to create/read, and few people actually have one. However, a trading plan is your set of instructions basically that you can follow to success. It took me a while before I finally caved in and created my own. TMB posted a good checklist/rules to trade by that would probably go a long way to helping you out. I think it’s on page 71. It’s the rules of the trade. Before each trade, make sure you read through each line to ensure everything is as it should be. It’s a good start until you get a trading plan together and will help keep you from forcing trades or trading to overcome a series of losses.

Thanks that really helps a lot and links in with what I’ve discovered lately - “Shortcuts” are only fun for a little while but eventually you have to cave in, take a step back, and actually put your nose to the grindstone to learn to be successful.

The EJ broke 123 level and is currently in what I like to call “no mans land” I will not touch the pair until a bearish confirmation develops on 123.0 or 124.369 is reach and market direction is established and a reversal or continuation. AS a result, I will be switching pairs and currently I’m looking at the AUD/JPY:

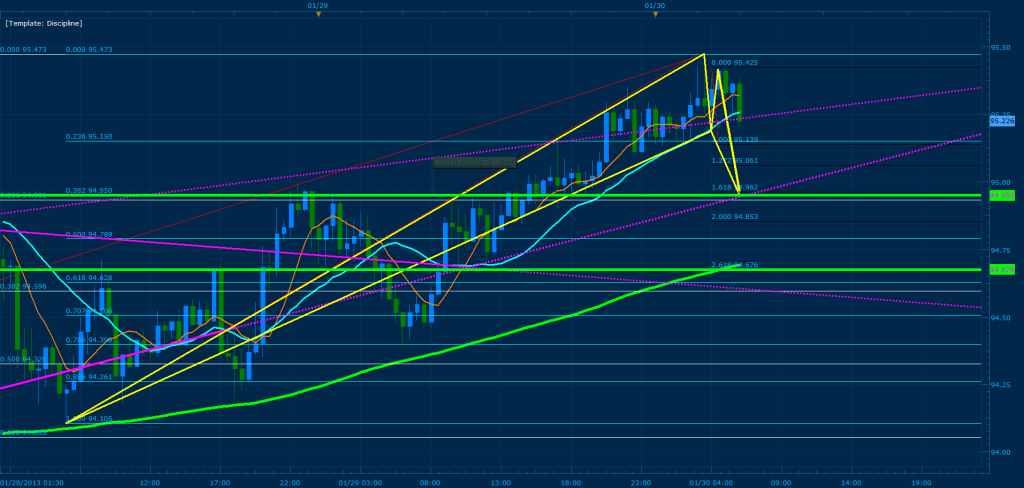

Bellow we have two bullish gartley patterns developing where 161% CD converges with the .382 of XA on the 30 min chart when using the most extreme point for X (when using the extreme MVA curve on the hourly, X is .236 [white fibs]). If this first convergence is broken, we can short price towards D where I expect it to reach 261% CD converging with the .618 of the 30 min XA (again we have convergence here with the higher XA of the hourly at the .382 [white fibs]). The green horizontal lines reflect my our entry points.

Each setup should be an easy 30 pips  enjoy

enjoy

Do you mean the top green line you will short at and the bottom green line you will buy both for 30 pips each or you will attempt to buy on the top green line but if you get stopped out you’ll just reverse order to short for 30 pips and then buy at the bottom green line for 30?

I think he means the second option you explain.

If stopped out at first resistance, short to next D and buy there instead.

Closed my short orders at 123.350. Total loss 600 pips since i had tried to martingale myself out of there. But i reversed and bought twice as much on a long order, so now i’m close to break even again… Pheeew!

I think i will just stick with limit orders and predefined SL and TP for a while. Like Empowers i had 2 bad weeks now. As fast as i place an order the market shoots away in the wrong direction every time. Just gotta shake it off, refocus and start over.

By the way, TMB and cyanidez. Did you close your shorts on the EJ and when? My tactic didn’t work out at all trying to get out of the shorts i had.

Aaaand we have a perfect bounce off the 1.0 XA that missed my entry by 2 pips. Did not respect the fib level prior to that though. Hope you picked the right spot on your oval. That puppy dropped 90 pips.

Trading the market today is worse than riding a bull. I think i’ll call it a day.

Just got an enormours gap on the AUDJPY just jumping through my trade and hitting my SL within 1 second.

Same thing happened to me… Now waiting for confirmation of it closing under the 1.618 .382 convergence to then short down to 2.618 .618 convergence if it looks good. After that go long from that convergence if everything matches up… we will see…

can any of you post a picture of the aud/jpy, I’m on a mac with no platform at the moment at starbucks XD lol, but ill help out by checking out the image of current price if needed.

My post stated that I would exit if price broke 123.0

So it seems to have reversed without hitting the fibs, please note that my y axis is quite stretched out…

A H1 gartley is forming on the eur/chf. D point around 23463.

Sorry, would have helped out with a picture but i fell asleep on the couch. This cold i have is a nightmare and slowly killing me.

Yeah i know you did. Wrong question on my part. Let me rephrase the question. I’m just curious how you handle if the market moves against you with so many pips. Do you place a hedge order or do are you just letting it ride into a loss so to speak?

Are you using Tip to Tip for the XA? I see a lot of convergence at the 100% of the XA, including with the .5 of the monthly gartley.

wick to wick

If you don’t have a stop in place close to your entry, then place an emergency stop, usually like 100 pips, so you can still use visual stops but not get killed if things go wrong. In the end, own up to it and cut your losses. Stick to your plan and don’t try to recover with a desperate trade. Sometimes I may get stopped out of a trade a couple of times because it looks really good and I think maybe my stop was too close or I just needed to wait a little longer or something. My rule I have for myself is if I get stopped out three times on the same setup then I just stop trading. Whatever I think I’m seeing isn’t what really is or price is doing its own thing and I’m just giving money away.

Hey man,

My first position got stopped at BE, then I re-shorted, to only close it for +5 pips after shooting higher AGAIN and now I’m short again but this price action is not looking good and I’m down about 40 pips at this moment. A move above today’s high will stop me out… and I have a bad feeling that this might happen. As TMB said, price is in no man’s land at this point in time, floating around somewhere between the 127% and 161% extension.

I have, however, prepared for if this high holds and have some 30 pip profit buy setups lower down

Keep your chin up man, like my mentor always tells me, stick to your rules and plan. If you didn’t plan the trade, don’t trade it!  I realize it’s probably not a problem you’re having because you use limit orders which is great, but sometimes I just need to remind myself of this again. Forexpastor also summed it up very nicely.

I realize it’s probably not a problem you’re having because you use limit orders which is great, but sometimes I just need to remind myself of this again. Forexpastor also summed it up very nicely.

Take care guys,

Cheers

Today on Twitter I saw a very famous and successful trader guy who completely lost it because of the AUDUSD and he just shut it all down to refocus and come back tomorrow. Even perhaps next week?

Right now you remember what your balance used to be and that urge to make it back is incredibly strong. I know because I think we all still get moments like these. My friend, the markets are going to be here tomorrow, next week, next month. My recommendation would be to take a day or so. I personally have NEVER traded well after a day like you had just now, I just made it worse.

It’s not defeat, it’s coming back stronger!

Good luck.