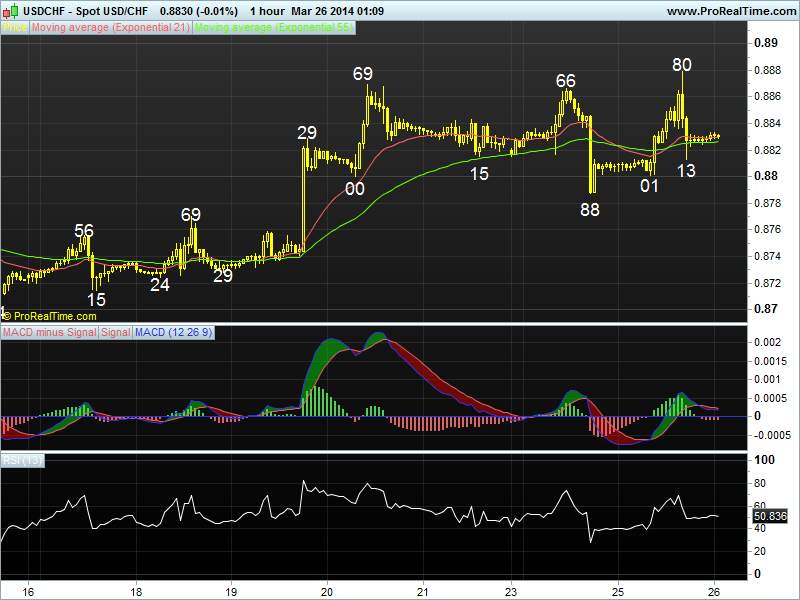

DAILY USD/CHF TECHNICAL OUTLOOK

Last Update At 26 Mar 2014 02:16GMT

Trend Daily Chart

Sideways ore

Daily Indicators

Turning up

21 HR EMA

0.8830

55 HR EMA

0.8827

Trend Hourly Chart

Sideways

Hourly Indicators

Neutral

13 HR RSI

53

14 HR DMI

+ve

Daily Analysis

Consolidation with downside bias

Resistance

0.8930 - Feb 26 high

0.8895 - Mar 05 high

0.8880 - Y’day’s high

Support

0.8788 - Mon’s low

0.8769 - Last Tue’s high, now sup

0.8729 - Last Wed’s Aust. low

. USD/CHF - 0.8845… The greenback swung fm gains to losses in choppy trading

on Tuesday. Despite rising steadily in Europe n a brief break above last week’s

high of 0.8869 to 0.8880 in NY due to weakness in eur/usd, intra-day rebound in

euro led to long liquidation in dlr n price retreated strongly to 0.8813.

. Despite dlr’s aforesaid rise to a 2-week high of 0.8880, as this lvl was

accompanied by prominent ‘bearish divergences’ on the hourly oscillators, subse-

quent decline to 0.8813 suggests recent erratic upmove fm Mar’s fresh 2-year

trough at 0.8698 has possibly made a temporary top there n 1-2 days of consolida

tion with downside bias is in store, breach of 0.8788 sup wud add credence to

this view, then further weakness to 0.8768 (61.8% r of 0.8698-0.8880) wud follow

, however, below 0.8733 (80.9% r) needed to signal correction is over n yield

re-test of 0.8698 later next week.

. In view of abv analysis, we’re turning short on dlr on intra-day recovery

in anticipation of initial weakness twd 0.8788 with stop abv said Tue’s high, as

break there wud risk marginal gain to 0.8890/95, however, loss of upward momen-

tum shud prevent strg gain today n daily res at 0.8930 shud remain intact.