Antofagasta PLC Technical Analysis Summary

Below 1096

Sell Stop

Above 1197.75

Stop Loss

| Indicator | Signal |

|---|---|

| RSI | Neutral |

| MACD | Neutral |

| Donchian Channel | Neutral |

| MA(200) | Sell |

| Fractals | Sell |

| Parabolic SAR | Sell |

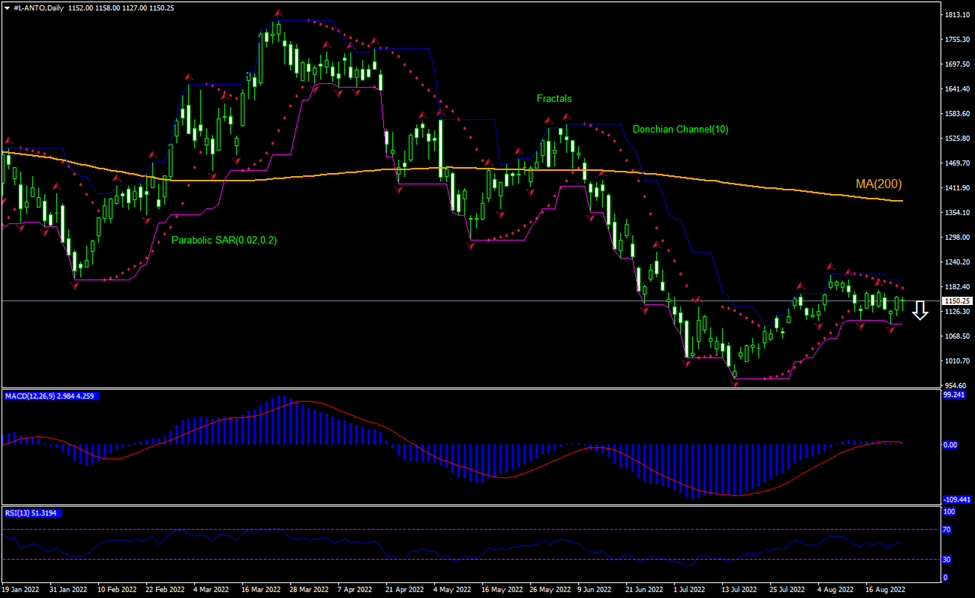

Antofagasta PLC Chart Analysis

Antofagasta PLC Technical Analysis

The technical analysis of the Antofagasta stock price chart in daily timeframe shows #L-ANTO, Daily is retracing down toward the two-year low it hit six weeks ago under the 200-day moving average MA(200). We believe the bearish momentum will continue after the price breaches below the lower boundary of the Donchian channel at 1096. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above the upper boundary of the Donchian channel at 1197.75. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (1197.75) without reaching the order (1096), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Stocks - Antofagasta PLC

Antofagasta stock rose after a report the company had sued the US government to revive its proposed Minnesota copper and nickel mine. Will the Antofagasta stock price continue rebounding?

Antofagasta plc is a Chilean publicly traded multinational mining company. Company’s market capitalization is at £11.31 billion. ANTOFAGASTA stock is trading at P/E Ratio (Trailing Twelve Months) of 15.09 currently. The company earned £6.41 billion revenue (ttm) and a Return on Assets (ttm) of 8.45% and a Return on Equity (ttm) of 14.95%. Antofagasta Plc’s Twin Metals subsidiary sued the US government on Monday to revive its proposed Minnesota copper and nickel mine. The company claims the lease cancellations in January by the US Department of the Interior were “arbitrary and capricious”. Twin Metals asked the US District Court in Washington to restore the leases, which were first granted in 1966 and have been passed between successor companies. No mining has taken place at the site. Restoration of leases may lead to copper and nickel mining which will be bullish for stock price. The stock price gained 2.8% on day after the news.