Hey Darth

Yeah boy, the market is changing. I’ve had my eye on this all day, since NFP started.

Meaning, the USD had been on a bull run for a while now.

And the USD, on the lead up to the report (these past few days), was rising even more.

And it’s only in the last couple hours that now I’ve seen a MAJOR sentiment change. The USD is going down. And I think quite hard. But the thing of it is, is that it wasn’t a direct correlation to the jobs report. It just happened to be later on in the day (like right now) that the Dollar is tumbling.

I think today (NFP Friday) was a good catalyst for the move to happen, that’s all.

I think we got some serious risk-on going on. AUD, NZD, CAD all moving high. All else going down.

I think it would be a mistake to try to correlate what’s happening in the market to the NFP report. There’s so many things going on, you couldn’t possibly know exactly what all the reasons are.

Look. It is important to know why things are moving (if it’s possible to know all that).

But what’s more important is knowing that things are moving period. Prices are telling the story. And the analysts are trying to figure out why.

They don’t always get the reasons correct. But the market always does.

So just follow what’s going on in the market.

Check this out. Today, I took a snap shot of what the market was doing. I wanted to see some kind of progression, and where it was heading.

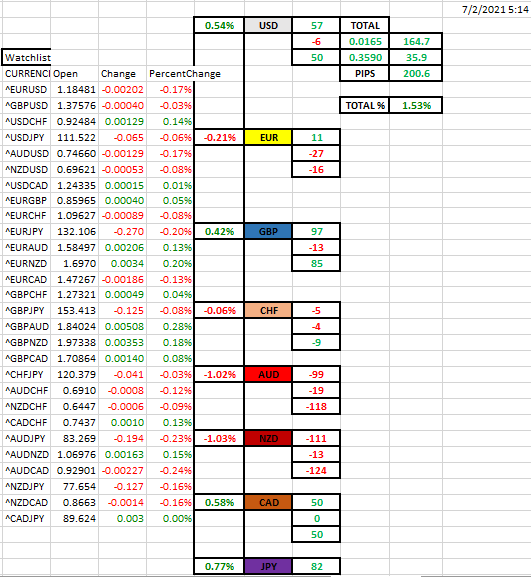

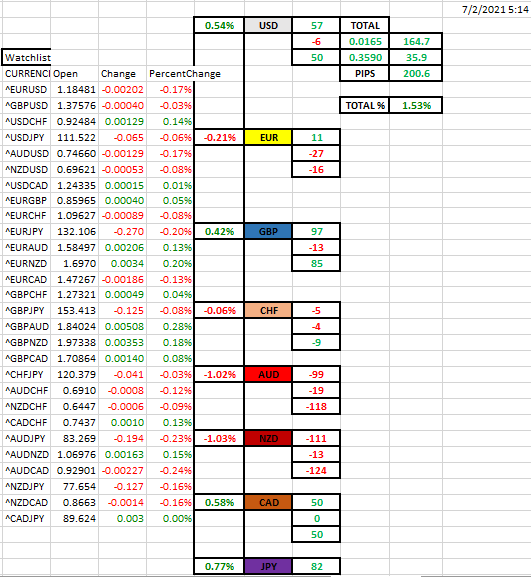

Just pay attention to the % in the middle. Going down. That’s how they are faring for the day. I got the time stamp on the top right corner. That’s 5am this morning. And NFP starts at 8:30am (well, this is 10 minutes late due to coming from Central Standard Time). But you should be able to see how the USD has been doing today. Right there it’s standing at .54% higher, for the day so far.

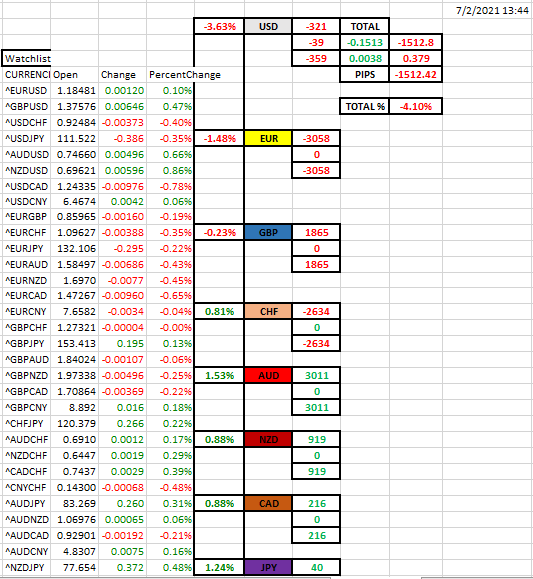

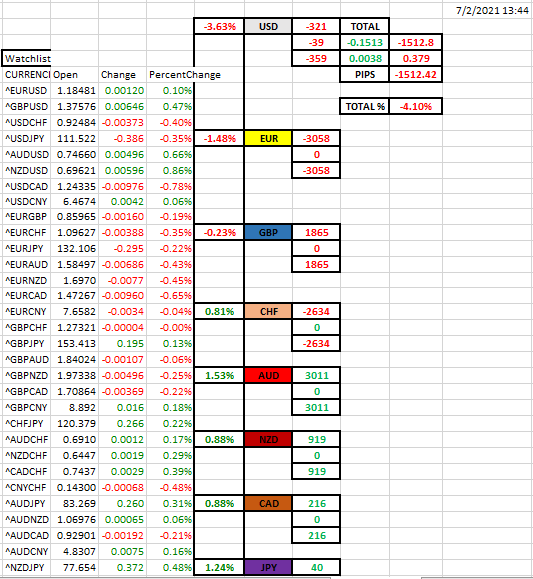

This is 2 hours after the report came out. The USD is only -1.62% on the day. That’s nothing. No changes are happening so far. Keep your eye on that.

And I just went and took the last pic now. This is the latest.

Ok. So. Looks like the bleeding stopped.

But you should be able to see that the USD did fall. And I also showed you that it wasn’t a direct result right after the report.

And btw…that % is nothing but all of the 7 USD pairs %'s added up together. It’s the sum total of all it’s parts. It gives you a birds eye view of what’s happening with the USD.

So, we have about one more hour before the market closes for the week.

It’ll probably get slow from here on out.

Well Darth…

Thanks for opening up the post. It’s interesting stuff.

And be careful of what you’re listening to (analysts). All they’re trying to do is explain what the market is doing. Well, when you have the market right at your finger tips, you should be able to see for yourself and make your own judgements.

I mean, does it matter anyway? What the reasons are?

Sure, it would be awesome to know. But as Matt tried to explain, and I agree, that sometimes there’s not always an answer to these questions.

What’s most important is to know that it is moving.

Well then, trade accordingly.

Mike