- Fed officials have softened their tone on the outlook for policy rates

- Money markets are betting the last rate Fed hike has been seen, with up to 100 basis points of cuts expected in 2024

- A possible policy pivot has seen cyclical assets classes jump in recent days, including the ASX and AUD/JPY

A far softer tone on the interest rate outlook from some Federal Reserve members has certainly left its mark, resulting in a solid rebound in beaten-up long bonds and long duration assets. Given the potential flow through to the real economy, cyclical plays such as the AUD and ASX 200 have also performed well, staging an abrupt about-face as US money markets pared rate hike bets for this year while adding to rate cut bets in 2024.

But given escalating geopolitical risks in the Middle East, the knowledge monetary policy works with significant lags and clear intent from the FOMC to keep policy sufficiently restrictive to defeat inflation, the latest bout of enthusiasm could easily be just another head-fake for traders like so many in the past.

Softer Fed tone stokes policy pivot hopes

Likely by design rather than coincidence, some of the Fed’s heavy-hitters have noticeably toned down the higher for longer rhetoric since last Friday’s payrolls report, pointing to tighter financial conditions, in part due to higher bond yields, as one factor that may diminish the need for them to continue lifting rates at the front end-end of the curve.

I say by design because this is not exactly “new” news with longer-dated yields surging in the wake of the FOMC September meeting where updated forecasts signaled rates were likely to increase again this year, with only 50 basis points of cuts seen in 2024. That tightened financial conditions, placing upward pressure on yields, corporate spreads and US dollar while placing downward pressure on stocks.

But some FOMC members clearly believe financial conditions have now tightened by more than enough. Just look at the key lines used by Fed speakers over the past few days.

Fed Vice Chair Philip Jefferson said they needed to “proceed carefully” with any further increases in the funds rate. “I will remain cognisant of the tightening in financial conditions through higher bond yields and will keep that in mind as I assess the future path of policy,” he said.

Speaking at the same event, known policy hawk Lorie Logan of the Dallas Fed said that "if long-term interest rates remain elevated because of higher term premiums, there may be less need to raise the fed funds rate”, echoing similar remarks from San Francisco Fed President Mary Daly late last week.

Traders pile into bets on Fed rate cuts in 2024

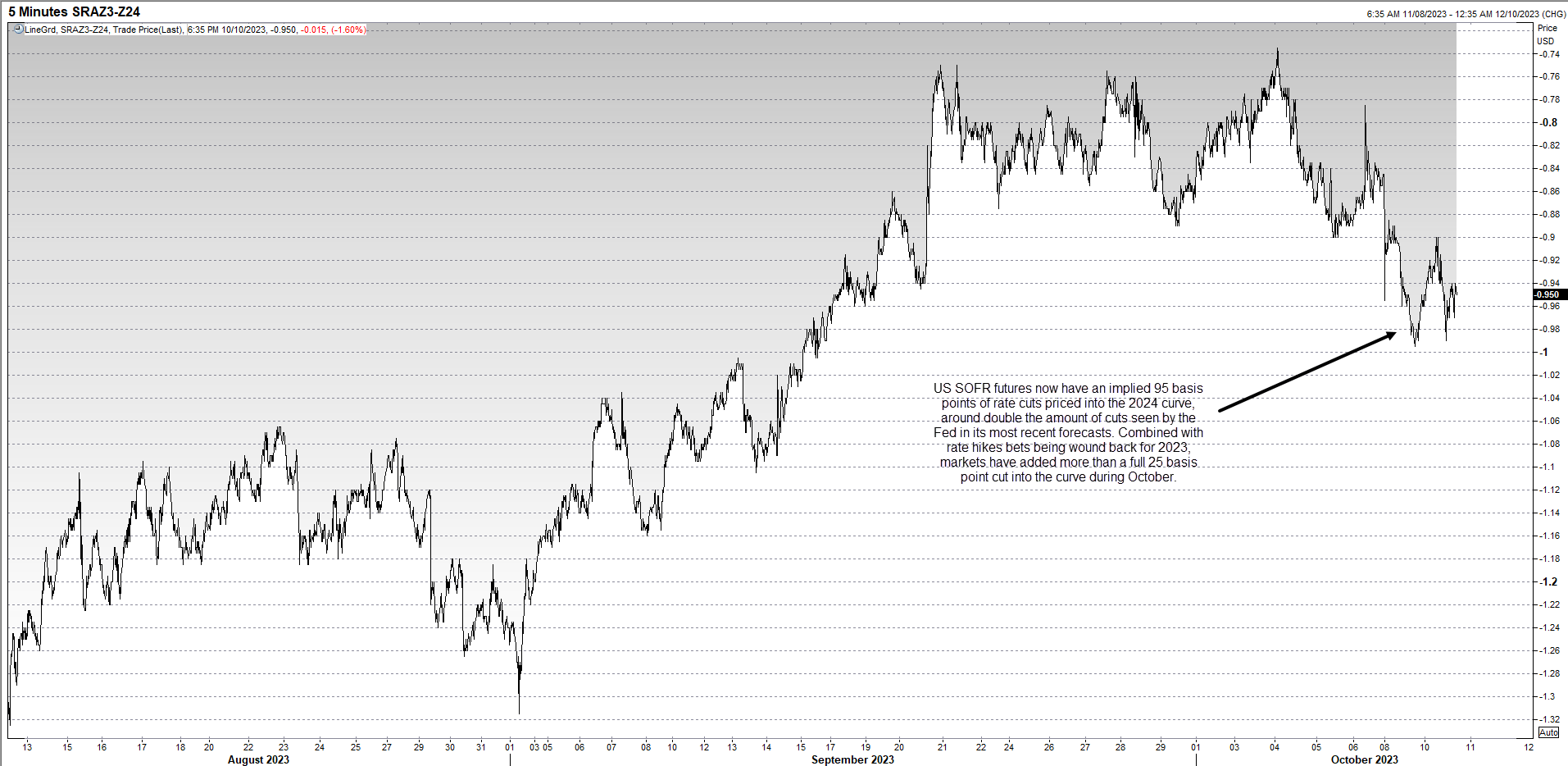

The market response has been swift to signs of a coordinated policy pivot. Not only have the odds of a further rate hike by the year-end been wound back to around 15%, the SOFR futures – a proxy for the Fed funds rate – now has close to 100 basis points of easing priced into the curve over 2024.

Source: Refinitiv

While some of that reflects what’s been happening in the Israel and the Gaza Strip, most has been driven by Fedspeak. And everyone knows markets like few things more than the sniff of rate hikes in the morning, as demonstrated by recent enthusiasm for most liquid asset classes.

Australia’s ASX 200 and AUD/JPY are two markets we’ll focus on given their dramatic U-shaped turn over the past week.

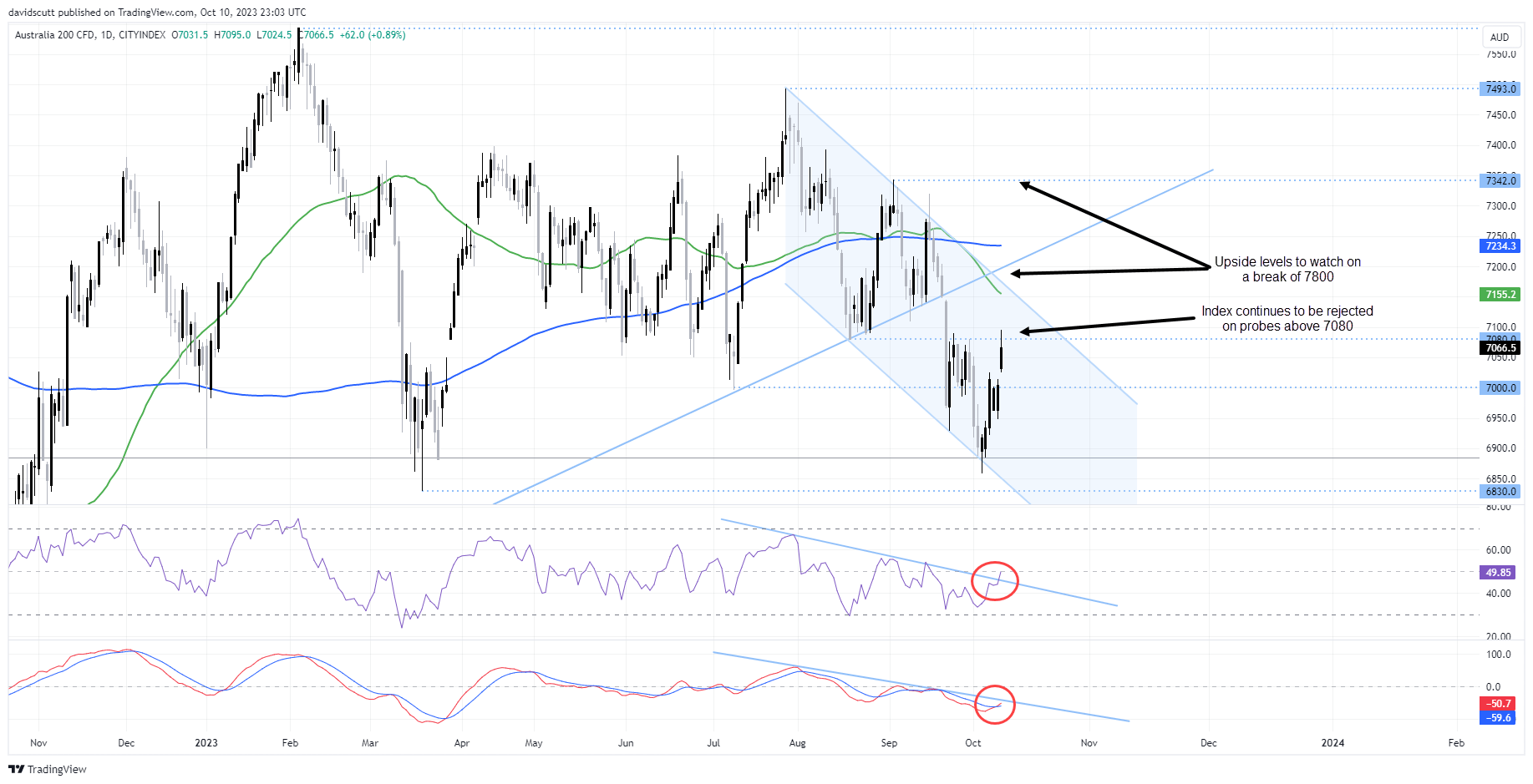

ASX 200: From zero to hero in the space of a week

Looking at Australia’s benchmark equity market, the XJO has triggered a raft of bullish indicators recently, assisted by a big rebound on the charts. It all kicked off a week ago when the index bounced strongly from channel support and 23.6% Fibonacci retracement level from the pandemic high-low, delivering a bullish hammer candle on the day. It’s been nothing but one-way traffic since, taking out resistance at 7000 before stalling at 7080, a level it struggled to overcome when the Fed was talking tough about the need for rates to remain higher for longer. But with RSI breaking out of its downtrend and MACD triggering a bullish crossover, the indicators suggest a growing risk the index may continue to push higher, especially with talk of further stimulus measures in China ahead of economic data from the nation later in the week. Wednesday may see some consolidation as traders await US CPI for September out on Thursday.

A break of 7080 will see channel resistance and former uptrend support around 7180 come into play, creating a key level for bulls to watch. Beyond there, 7342 would be the next upside target. Those looking for a continuation of upside could look to buy dips back towards 7000 with a stop-loss below for protection.

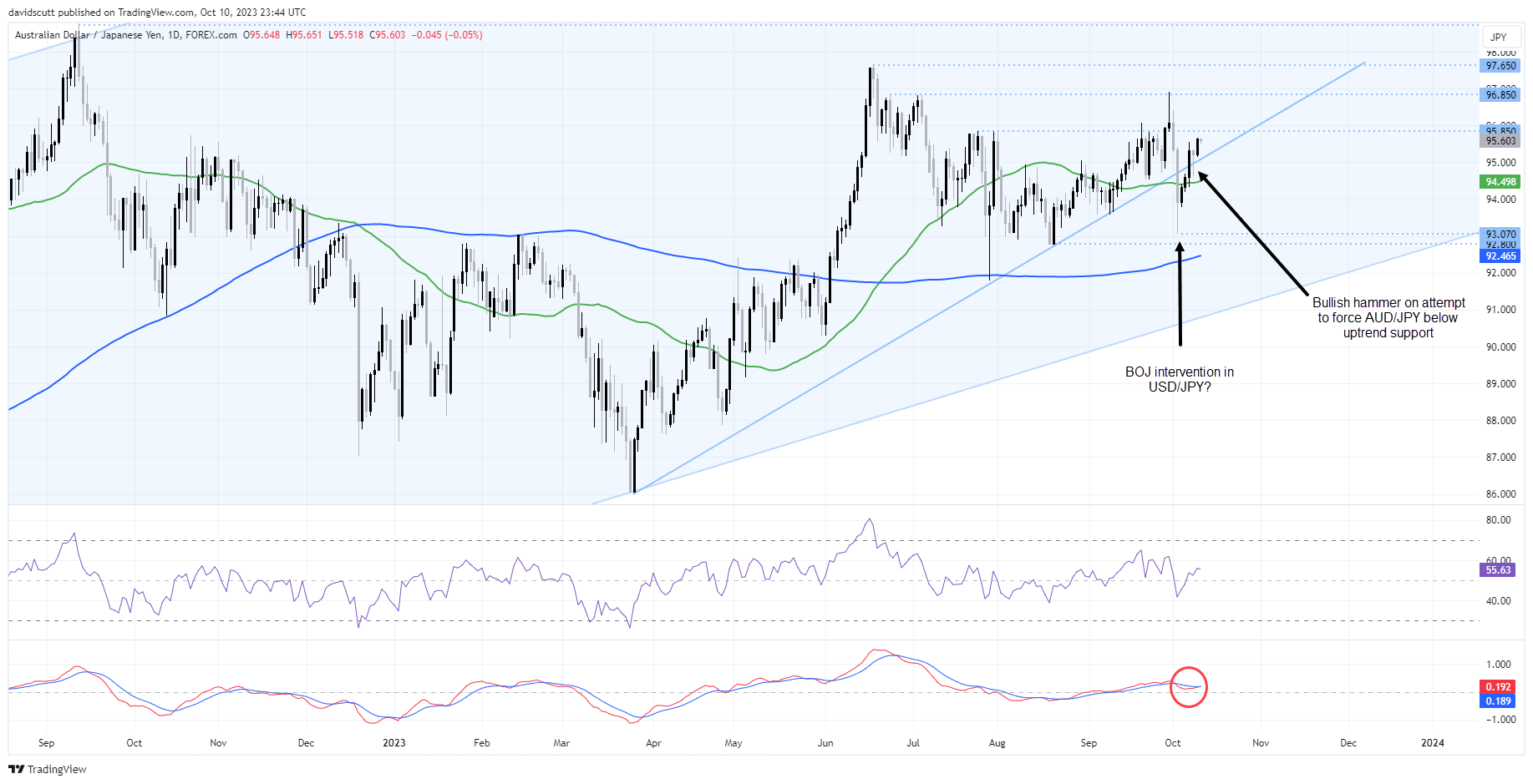

AUD/JPY: Reverts to trend after BOJ speedbump

Like the ASX 200, AUD/JPY has been another market to break long-term uptrend support only to snap back hard. I’ve annotated on the chart the day when USD/JPY tumbled hundreds of pips in the space of minutes on a venture above 150, generating speculation over whether the Bank of Japan (BOJ) had intervened. AUD/JPY was a major casualty, breaking its uptrend from earlier of the year. However, it’s bounced strongly ever since, finding renewed buying on attempts to force it back below the uptrend, suggesting we may be looking at a false break. The bullish hammer formed a few sessions ago only enhances that view.

Topside levels to watch include 95.85, 96.85 and 97.65, the 2023 YTD high. On the downside, dips below the uptrend have been bought recently, making a stop below the 50-day MA a decent location a logical location for potential long trades.

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.