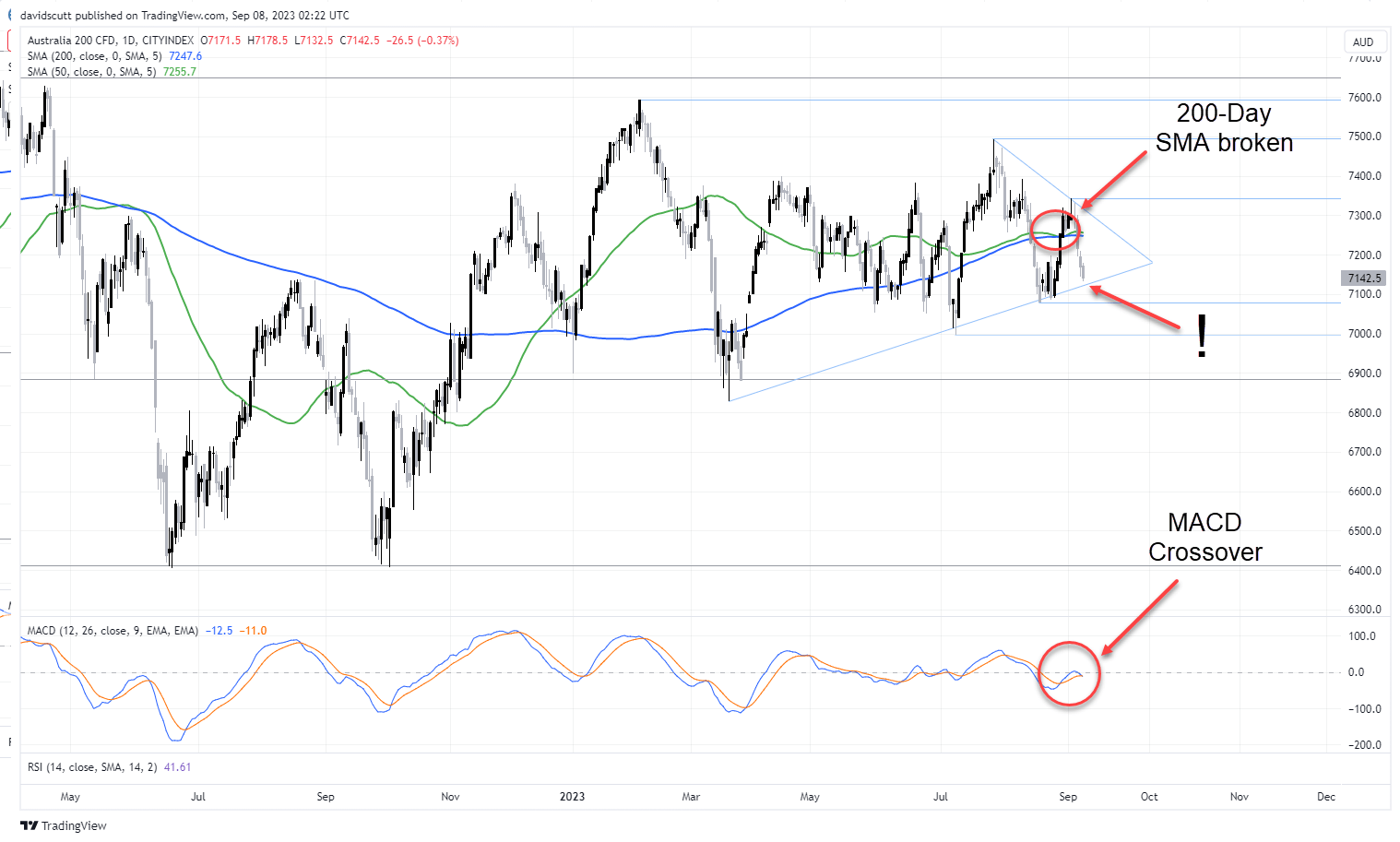

Bearish technical signals are mounting for Australian equities, pointing to the potential for additional downside beyond that already seen.

MACD crossover after 200-day moving average falls

Having sliced through the 200-day moving average like a hot knife through butter earlier this week, a MACD crossover below 0 has generated a further sell signal today. With momentum building on the downside, uptrend support that began in March is quickly coming into focus for traders. It’s located at 7120, not far off where the index is currently sitting.

Should we see a break of that level, 7080 and 7000 are the next two layers of support. Beyond that, 6885 – the 23.6% Fibonacci retracement of the pandemic low-high – is the next port of call on the downside.

Given how far the index has already fallen and that it’s a Friday, it would be nice to see a clean break of the uptrend before getting too confident about the trade. From a fundamental perspective, we’re also in the midst of dividend distribution season which could exacerbate downside depending on how the capital is deployed.