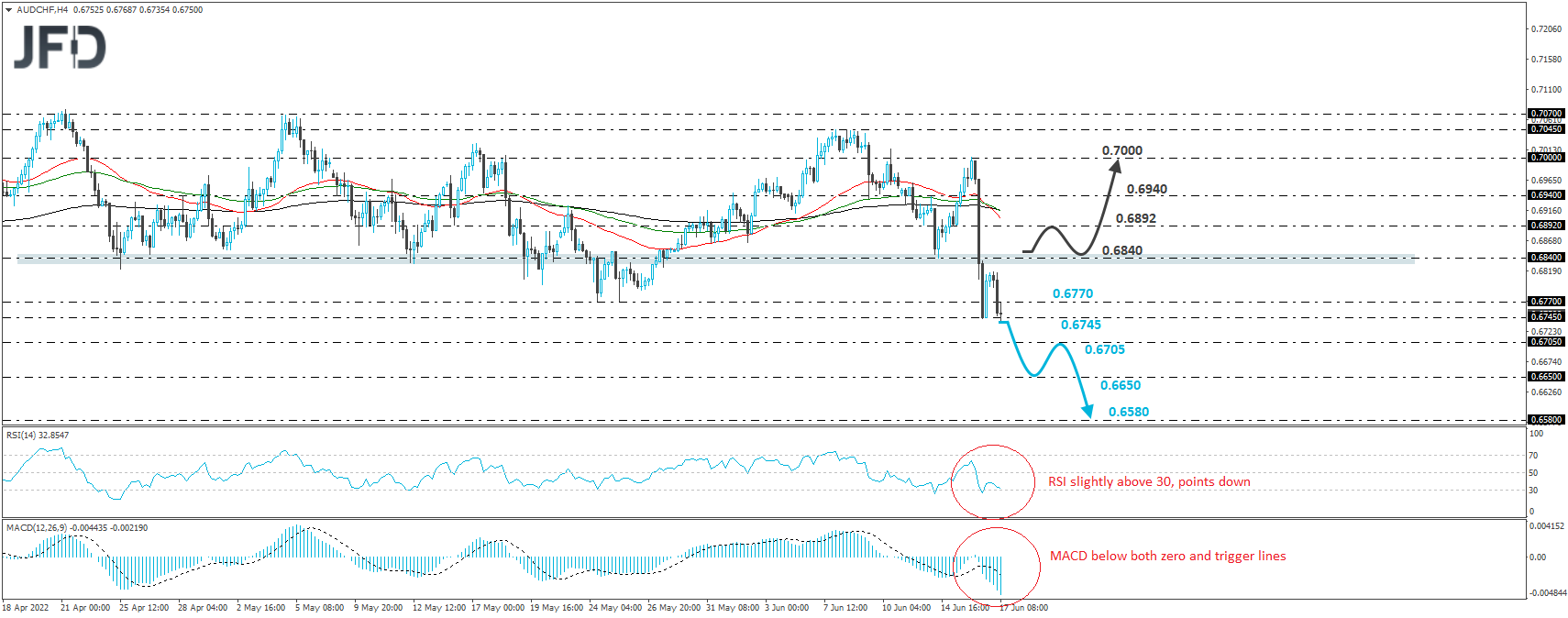

AUD/CHF fell sharply yesterday during the European morning after the SNB unexpectedly hiked rates by 50bps. This resulted in the break back below the 0.6840 zone, which had been acting as a key support since April 25th, with some small periods of exception. In any case, the tumble met support at 0.6745, and then the rate rebounded somewhat. However, the recovery remained limited below 0.6840, and another slide followed. In our view, this paints a negative short-term picture.

A clear and decisive break below 0.6745 would confirm a forthcoming lower low and may initially aim for the low of March 4th, at around 0.6705. A break lower could carry more bearish implications, perhaps targeting the 0.6650 hurdle, marked by the low of March 2nd. If the bears are not willing to stop there, then we may see them pushing towards the 0.6580 zone, marked by the low of February 24th.

Taking a look at our short-term oscillators, we see that the RSI turned down again and looks ready to fall back below its trigger line, while the MACD lies below both its zero and trigger lines. Both indicators detect strong downside speed and support the notion for further declines in this exchange rate.

In order to abandon the bearish case and start examining a decent recovery, we would like to see a clear break back above the key support zone of 0.6840. This could wake some bulls up and allow them to challenge the 0.6892 barrier, marked by the low of June 13th, the break of which could aim for the high of the day after, at around 0.6940. If that barrier is not able to halt the slide either, then we may experience extensions towards the round psychological figure of 0.7000, also marked near yesterday’s high.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.99% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.